The Role of Accounting in Monitoring Corporate Climate Disclosures is increasingly crucial. As regulatory pressure mounts for transparent climate-related reporting, the accounting profession plays a vital role in verifying the accuracy and reliability of corporate disclosures. This involves navigating complex frameworks like the TCFD and GRI, assessing the financial implications of climate risks and opportunities, and integrating climate data into existing financial reporting structures. The challenges are significant, encompassing data quality, estimation uncertainties, and the need for innovative technological solutions, but the impact on corporate accountability and sustainable investing is undeniable.

This examination delves into the multifaceted responsibilities of accountants in this evolving landscape, exploring best practices, addressing key challenges, and offering insights into the future of climate disclosure monitoring within the accounting profession. We will analyze how accountants verify climate-related data, account for the financial impacts of climate change, and integrate this crucial information into comprehensive financial reports. The use of technology to streamline this process and the ongoing adaptation to evolving regulatory requirements will also be key discussion points.

Introduction

The increasing awareness of climate change and its far-reaching consequences has spurred significant global action, placing considerable pressure on corporations to demonstrate their environmental responsibility. This pressure manifests in the form of intensified regulatory scrutiny and growing stakeholder expectations, leading to a surge in the demand for transparent and reliable climate-related disclosures. The accounting profession plays a crucial role in ensuring the accuracy, consistency, and comparability of this information.

The regulatory landscape surrounding climate disclosures is rapidly evolving. Governments worldwide are implementing mandates and guidelines requiring companies to report on their environmental impact, driven by the need to inform investment decisions, promote accountability, and facilitate the transition to a low-carbon economy. This regulatory push is not uniform across jurisdictions, but the overall trend is undeniably toward greater transparency and standardized reporting.

Climate Disclosure Frameworks and Standards

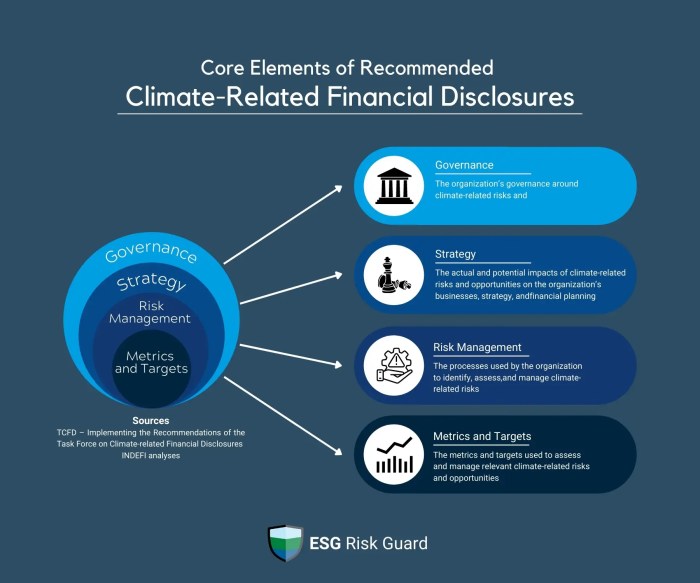

Several frameworks and standards have emerged to guide companies in their climate disclosures, offering varying levels of detail and specificity. The Task Force on Climate-related Financial Disclosures (TCFD), for example, recommends a consistent framework for climate-related financial risk reporting, focusing on governance, strategy, risk management, and metrics and targets. The Global Reporting Initiative (GRI) provides a comprehensive sustainability reporting framework, encompassing a wide range of environmental, social, and governance (ESG) issues, including climate change. Similarly, the Sustainability Accounting Standards Board (SASB) offers industry-specific standards for material sustainability issues, including climate-related risks and opportunities. These frameworks, while not always perfectly aligned, offer a common language and structure for climate disclosures, facilitating comparability and improving the quality of information available to investors and other stakeholders.

Types of Climate-Related Data

Companies are increasingly required to report a diverse range of climate-related data, reflecting the multifaceted nature of climate change impacts. This data often includes greenhouse gas (GHG) emissions, both direct (Scope 1) and indirect (Scope 2 and 3), energy consumption, water usage, waste generation, and the company’s climate-related risks and opportunities. For example, Scope 1 emissions encompass direct emissions from owned or controlled sources, such as company vehicles or on-site energy generation. Scope 2 emissions cover indirect emissions from purchased energy, while Scope 3 emissions encompass all other indirect emissions in the company’s value chain, including those from suppliers and customers. Beyond emissions data, companies may also be required to disclose information on their climate-related strategies, including targets for emissions reductions, renewable energy adoption, and adaptation measures. Furthermore, companies are expected to report on the financial implications of climate change, including potential impacts on revenue, expenses, and assets. For instance, a company might disclose the potential financial losses associated with extreme weather events or the costs of transitioning to a low-carbon business model. The specific data points required will vary depending on the applicable regulatory framework and the company’s industry.

The Accountant’s Role in Verification and Assurance

Accountants play a crucial role in ensuring the credibility and reliability of corporate climate-related disclosures. Their expertise in financial reporting and auditing provides a critical lens through which to assess the accuracy and completeness of the information presented, ultimately building trust in the market and fostering responsible environmental stewardship. This involves not only verifying the numerical data but also evaluating the underlying methodologies and assumptions used in generating climate-related metrics.

Accountants’ responsibilities extend beyond simply checking numbers; they must also assess the quality and reliability of the data itself. This requires a deep understanding of the specific metrics being reported, the methodologies used to calculate them, and the potential sources of error or bias. The verification process must be rigorous, transparent, and demonstrably independent to ensure the integrity of the resulting assurance.

Verification of Climate-Related Disclosures

The verification process for climate-related disclosures mirrors, to a degree, traditional financial statement audits. However, the unique challenges posed by the inherent uncertainty and complexity of climate data necessitate a more nuanced approach. Accountants must critically evaluate the data sources, ensuring their reliability and relevance. This includes scrutinizing methodologies used for greenhouse gas (GHG) emissions calculations, examining the completeness of data collection across the organization’s value chain, and assessing the accuracy of estimations related to future climate impacts. They should also consider the potential for material misstatements arising from errors in data input, processing, or interpretation. A key aspect is determining whether the company’s disclosures align with established reporting frameworks, such as the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

Best Practices for Ensuring Data Integrity

To ensure the integrity of climate data, accountants should adhere to several best practices. This includes implementing robust internal controls over data collection and reporting processes. Companies should maintain comprehensive documentation of their methodologies, assumptions, and data sources. Regular independent reviews and audits of climate-related information should be conducted. Furthermore, leveraging technology, such as data analytics tools, can enhance the efficiency and accuracy of data processing and analysis. Finally, continuous professional development is crucial for accountants to stay abreast of evolving climate-related reporting standards and best practices.

Challenges in Auditing Climate-Related Information

Auditing climate-related information presents unique challenges compared to traditional financial statement audits. Data quality can be inconsistent, particularly for Scope 3 emissions, which often rely on estimations and indirect data sources. Uncertainty is inherent in predicting future climate impacts, making it difficult to provide absolute assurance. The lack of universally standardized reporting frameworks can also hinder comparability and consistency across companies. Additionally, the expertise required to effectively audit climate-related information may not be readily available within all accounting firms. Addressing these challenges requires a collaborative approach, involving experts in climate science, data analytics, and accounting.

Hypothetical Audit Plan for Climate-Related Disclosures

A hypothetical audit plan for a company’s climate-related disclosures would include several key areas of focus. First, a thorough review of the company’s GHG emissions inventory, verifying the completeness and accuracy of Scope 1, 2, and 3 emissions data. This includes examining the methodologies used for calculating emissions, the data sources employed, and the underlying assumptions made. Second, an assessment of the company’s climate-related risks and opportunities, evaluating the adequacy of its risk management processes and the reliability of its projections of future climate impacts. Third, a review of the company’s climate-related targets and strategies, determining whether they are aligned with the company’s overall business strategy and its commitment to reducing its environmental footprint. Finally, a comprehensive review of the company’s climate-related disclosures, ensuring their accuracy, completeness, and consistency with relevant reporting frameworks. This would involve testing the disclosures against underlying data and assessing their clarity and understandability. The plan should also account for the significant role of external assurance providers in validating the company’s claims. This verification process should provide stakeholders with confidence that the company’s disclosures are accurate and reliable.

Accounting for Climate-Related Risks and Opportunities

Companies are increasingly recognizing the significant financial implications of climate change, necessitating the integration of climate-related factors into their accounting practices. This involves assessing both physical risks, such as extreme weather events and sea-level rise, and transition risks, stemming from policy changes, technological advancements, and evolving market preferences towards sustainability. Accurate accounting for these factors is crucial for providing stakeholders with a comprehensive understanding of a company’s financial position and future prospects.

Methods for Incorporating Climate-Related Factors

Several accounting methods are employed to incorporate climate-related factors into financial statements. These methods vary in their complexity and the degree of certainty they offer, reflecting the inherent uncertainties associated with climate change projections. The choice of method depends on factors such as the company’s industry, the availability of data, and the level of sophistication of its internal risk management processes. Some common approaches include scenario analysis, sensitivity analysis, and the use of probabilistic models. These methods are often used in conjunction with traditional accounting techniques to provide a more holistic view of the company’s financial health.

Advantages and Disadvantages of Accounting Approaches

Scenario analysis, for example, involves projecting financial performance under different climate scenarios (e.g., a low-carbon transition versus a high-carbon scenario). This approach allows companies to assess the potential impact of various climate-related outcomes on their profitability and cash flows. While this offers valuable insights into potential risks and opportunities, it is inherently subjective and reliant on the quality of the underlying assumptions. Sensitivity analysis, on the other hand, focuses on the impact of changes in specific variables (e.g., carbon price, regulatory changes) on the company’s financial performance. This approach is less complex than scenario analysis but may not capture the full range of climate-related risks and opportunities. Probabilistic models offer a more sophisticated approach, using statistical methods to quantify the likelihood of different outcomes and their associated financial impacts. However, these models require significant data and expertise.

Financial Implications of Climate Scenarios

The following table illustrates the potential financial implications of different climate scenarios for a hypothetical energy company, “PowerGen,” over a ten-year period. These figures are illustrative and based on simplified assumptions. Actual impacts would vary depending on numerous factors including the company’s specific operations, location, and adaptation strategies.

| Scenario | Revenue (Millions) | Operating Costs (Millions) | Net Income (Millions) |

|---|---|---|---|

| High-Carbon (Status Quo) | 1500 | 1200 | 300 |

| Moderate-Carbon (Partial Transition) | 1400 | 1100 | 300 |

| Low-Carbon (Rapid Transition) | 1200 | 900 | 300 |

| Severe Climate Impacts | 1000 | 1300 | -300 |

Integrating Climate Data into Financial Reporting

Integrating climate-related data into financial reporting is crucial for providing a complete and accurate picture of a company’s financial health and long-term sustainability. This involves not only disclosing climate-related risks and opportunities but also demonstrating how these factors impact the company’s financial performance and future prospects. This requires a robust approach to data collection, analysis, and presentation within the established framework of financial reporting standards.

The integration of climate data necessitates a shift in how financial reports are structured and interpreted. Existing frameworks, such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), offer opportunities for incorporating climate-related information. This can be achieved through enhanced disclosures in the notes to the financial statements, supplementary information, or even the incorporation of climate-related metrics directly into the financial statements themselves, where appropriate and feasible. The key is to present the information in a clear, concise, and consistent manner that allows investors and other stakeholders to understand the materiality of climate-related factors on the company’s financial position, performance, and cash flows.

Climate Data Integration within Financial Statements

A company can integrate climate-related data into its financial statements by providing detailed disclosures in the notes to the financial statements. This could include a dedicated section outlining the company’s climate-related risks and opportunities, including the potential financial impacts of climate change, such as physical risks from extreme weather events and transition risks from policy changes or technological advancements. Quantitative data, such as estimated costs associated with climate change adaptation or potential revenue losses due to carbon pricing, should be included wherever possible and reliably measurable. Qualitative disclosures might explain the company’s strategy for managing climate-related risks and seizing climate-related opportunities. This section should clearly link the disclosed information to the company’s overall financial performance and strategic objectives. For instance, if a company is investing heavily in renewable energy, the financial implications of this investment (capital expenditure, operating expenses, and projected future revenues) could be clearly detailed.

Sample Section of a Financial Report Incorporating Climate Disclosures

The following is a hypothetical example of a section from a company’s financial report incorporating climate disclosures:

Note X: Climate-Related Financial Risks and Opportunities

Our business is exposed to climate-related risks, primarily physical risks related to extreme weather events, and transition risks associated with the global shift towards a low-carbon economy. We have identified potential physical risks including increased frequency and intensity of storms which could disrupt operations and damage our facilities. Our estimated cost for adapting to these physical risks over the next five years is $10 million. Transition risks include potential carbon pricing schemes and increasing demand for sustainable products. We estimate that the implementation of a carbon tax could result in an increase in our operating costs of $5 million annually. However, we also see opportunities in the transition to a low-carbon economy. Our investment in renewable energy projects is expected to generate additional revenue of $2 million annually within the next three years. Our strategy to mitigate climate-related risks and seize opportunities includes investing in climate resilience measures, transitioning to renewable energy sources, and developing sustainable products. We regularly assess and update our climate-related risk and opportunity assessment, integrating these findings into our overall business strategy and financial planning. This information is regularly reviewed by our Board of Directors.

Improved Transparency and Comprehensiveness of Financial Reports

The inclusion of climate-related data significantly enhances the transparency and comprehensiveness of financial reports. By providing a more holistic view of the company’s financial performance, including the impacts of climate change, investors and other stakeholders gain a clearer understanding of the company’s long-term sustainability and resilience. This improved transparency allows for better informed investment decisions, facilitates greater accountability, and fosters increased trust between the company and its stakeholders. The inclusion of both quantitative and qualitative data provides a richer understanding of the company’s climate-related performance, enabling a more nuanced assessment of its financial health and future prospects than would be possible with traditional financial reporting alone. Moreover, consistent and comparable climate-related disclosures across industries can contribute to a more efficient and transparent capital market.

The Use of Technology in Climate Disclosure Monitoring

Technology plays a crucial role in enhancing the efficiency and accuracy of climate disclosure monitoring. The sheer volume and complexity of data involved in assessing a company’s environmental impact necessitate automated and sophisticated analytical tools. Effective technology integration streamlines the process, allowing for quicker identification of inconsistencies and potential risks, ultimately leading to more reliable and comprehensive climate disclosures.

The application of technology improves the overall process by automating data collection, analysis, and reporting. This leads to a reduction in manual effort, decreased chances of human error, and ultimately, more reliable information. Furthermore, advanced analytical techniques enabled by technology can reveal hidden patterns and correlations within climate-related data, providing a more nuanced understanding of a company’s environmental performance.

Data Collection and Management Technologies

Several technologies facilitate the efficient collection and management of climate-related data. These tools are essential for compiling the diverse range of information required for comprehensive climate disclosures. This includes data from various sources, both internal and external, often requiring integration from different systems.

- Data Integration Platforms: These platforms consolidate data from disparate sources, such as energy consumption meters, supply chain databases, and carbon accounting software. This centralized approach simplifies data management and reduces inconsistencies.

- Automated Data Extraction Tools: These tools can automatically extract relevant climate-related data from various documents, including energy bills, emissions reports, and sustainability reports. This significantly reduces manual data entry and associated errors.

- Geographic Information Systems (GIS): GIS software allows for the visualization and analysis of spatially referenced climate data, such as greenhouse gas emissions mapped to specific locations. This provides valuable insights into emission hotspots and facilitates more targeted mitigation strategies.

Data Analysis and Reporting Technologies

Once data is collected, advanced analytical techniques are necessary to extract meaningful insights and prepare comprehensive reports. The application of these technologies ensures a more thorough and accurate assessment of climate-related risks and opportunities.

- Machine Learning (ML) and Artificial Intelligence (AI): ML and AI algorithms can identify patterns and anomalies in climate data that might be missed by manual analysis. They can also be used to predict future emissions based on historical trends and company-specific factors. For example, an AI model could predict future energy consumption based on past usage and planned expansion.

- Data Visualization Tools: These tools transform complex data sets into easily understandable charts, graphs, and maps, enabling more effective communication of climate-related information to stakeholders. Interactive dashboards can showcase key performance indicators (KPIs) and trends over time, providing a clear picture of a company’s environmental progress.

- Scenario Analysis Software: This software allows companies to model the potential financial impacts of different climate scenarios, such as a 2°C or 4°C increase in global temperature. This assists in assessing the resilience of their business model to climate change.

Benefits and Limitations of Technology in Climate Disclosure Monitoring

The benefits of technology are significant, improving both the efficiency and reliability of climate disclosure monitoring. However, limitations exist and need to be acknowledged.

- Benefits: Improved data accuracy, reduced manual effort, enhanced analysis capabilities, improved transparency, better stakeholder communication, and more effective risk management.

- Limitations: High initial investment costs, requirement for specialized expertise, potential for data bias, and reliance on data quality and availability. For example, the accuracy of AI predictions depends heavily on the quality and completeness of the training data.

Future Trends and Challenges

The landscape of corporate climate disclosures is rapidly evolving, driven by increasing regulatory scrutiny, investor demand for transparency, and the growing urgency of addressing climate change. This evolution presents both opportunities and challenges for accountants, requiring them to adapt their skills and methodologies to meet the demands of a more complex and data-intensive reporting environment. The following sections explore key emerging trends and the challenges they pose.

Emerging trends in corporate climate disclosures significantly impact accounting practices. Increased standardization and the development of robust frameworks, such as the Sustainability Accounting Standards Board (SASB) standards and the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, are driving more consistent and comparable reporting. However, this also necessitates greater accounting expertise in interpreting and applying these frameworks to diverse business contexts. Furthermore, the integration of climate-related data into mainstream financial reporting is gaining momentum, blurring the lines between traditional financial accounting and sustainability reporting. This necessitates a broader skillset for accountants, bridging the gap between financial and environmental data analysis.

Increased Data Complexity and Verification Challenges

The volume and complexity of data required for comprehensive climate disclosures are increasing exponentially. Companies are now expected to report not only on direct emissions (Scope 1) but also on indirect emissions from energy consumption (Scope 2) and their value chain (Scope 3). Verifying the accuracy and reliability of Scope 3 emissions data, in particular, presents a significant challenge due to the involvement of numerous third-party suppliers and complex supply chains. Accountants need to develop new methodologies and tools to assess the credibility and completeness of this data, potentially involving advanced data analytics and collaboration with external specialists. For instance, a company manufacturing clothing might need to verify emissions from cotton farming across multiple countries, requiring significant data gathering and validation efforts.

Adapting to Evolving Regulatory Frameworks, The Role of Accounting in Monitoring Corporate Climate Disclosures

Governments worldwide are implementing increasingly stringent regulations regarding climate-related disclosures. The EU’s Corporate Sustainability Reporting Directive (CSRD), for example, mandates extensive climate-related disclosures for a wide range of companies, including detailed information on climate risks, transition plans, and environmental performance indicators. Accountants will need to stay abreast of these evolving regulations and ensure their clients’ disclosures comply with all relevant requirements. Failure to comply can lead to significant financial penalties and reputational damage. Furthermore, the harmonization of global reporting standards remains a work in progress, presenting challenges for multinational companies operating across jurisdictions with different regulatory landscapes.

Developing New Skills and Technologies

Addressing the challenges of future climate disclosures requires accountants to acquire new skills and leverage advanced technologies. This includes proficiency in data analytics, sustainability metrics, and climate-related risk assessment. The use of technology, such as blockchain for supply chain transparency and artificial intelligence for data analysis, can significantly enhance the efficiency and accuracy of climate disclosure monitoring. Investment in training and development programs is crucial to equip accountants with the necessary competencies to navigate the evolving regulatory landscape and meet the demands of more sophisticated climate reporting. For example, training in carbon accounting methodologies and the use of specialized software for climate data analysis would be beneficial.

Ending Remarks: The Role Of Accounting In Monitoring Corporate Climate Disclosures

In conclusion, the role of accounting in monitoring corporate climate disclosures is not merely a compliance exercise; it is a critical component of building trust and fostering responsible corporate behavior. Accountants are uniquely positioned to bridge the gap between environmental stewardship and financial reporting, ensuring that climate-related risks and opportunities are accurately reflected in a company’s financial picture. As both regulatory frameworks and technological capabilities continue to evolve, the accounting profession must remain agile and adaptable, playing a crucial role in driving transparency and accountability in the fight against climate change.

Question & Answer Hub

What are the potential legal ramifications for companies that fail to accurately disclose climate-related information?

Companies may face fines, lawsuits, reputational damage, and difficulty securing investments if they fail to meet disclosure requirements or if their disclosures are found to be inaccurate or misleading. The specific penalties vary by jurisdiction and the severity of the infraction.

How can accountants develop the necessary expertise to effectively audit climate-related disclosures?

Accountants can enhance their expertise through professional development courses, certifications (e.g., Sustainability Accounting Standards Board certifications), and participation in industry events focused on climate-related financial reporting. Staying updated on relevant regulations and best practices is also crucial.

What are some examples of technology used in climate disclosure monitoring?

Examples include data analytics platforms for analyzing environmental data, blockchain technology for enhancing data transparency and traceability, and AI-powered tools for automating data collection and analysis.

For descriptions on additional topics like QuickBooks vs Xero Which is Better?, please visit the available QuickBooks vs Xero Which is Better?.