The Relationship Between Accounting and Corporate Governance is a crucial interplay shaping the ethical and financial landscape of businesses. Accurate accounting practices are the bedrock of transparent governance, providing stakeholders with the information necessary to make informed decisions. Conversely, flawed accounting can mask unethical behavior, leading to financial instability and reputational damage. This exploration delves into the intricate connection between these two vital aspects of corporate operations, examining their impact on stakeholder trust, regulatory compliance, and overall business success.

This analysis will explore the role of accounting in maintaining good corporate governance, the importance of internal controls and audits, and the implications of both successful and failed financial reporting. We will consider the perspectives of various stakeholders, from investors and creditors to employees and the wider community, highlighting the far-reaching consequences of accounting irregularities and their impact on corporate reputation and long-term sustainability.

The Role of Accounting in Corporate Governance

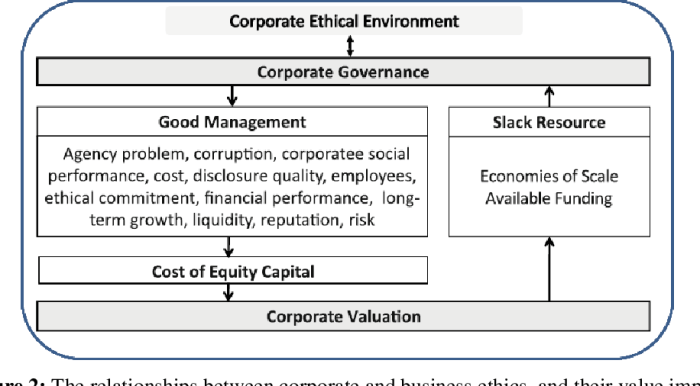

Effective corporate governance relies heavily on robust and transparent accounting practices. The accuracy and reliability of financial reporting directly impact stakeholder confidence, investor decisions, and the overall health of an organization. Without a strong accounting foundation, the mechanisms of good governance – including oversight, accountability, and ethical conduct – are significantly weakened.

Accurate and Transparent Financial Reporting: A Cornerstone of Good Corporate Governance, The Relationship Between Accounting and Corporate Governance

Accurate and transparent financial reporting is paramount for maintaining good corporate governance. It provides stakeholders with a clear and unbiased view of a company’s financial position, performance, and cash flows. This transparency fosters trust, allowing investors and other stakeholders to make informed decisions. Omissions, misrepresentations, or manipulations of financial information erode this trust, potentially leading to significant financial losses, reputational damage, and legal repercussions. For example, a company consistently underreporting its liabilities creates a false impression of financial strength, misleading investors and potentially leading to poor investment choices. Conversely, open and honest reporting, even during periods of financial difficulty, demonstrates accountability and builds long-term credibility.

The Influence of Accounting Standards and Regulations on Corporate Governance Practices

Accounting standards and regulations, such as those issued by the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB), significantly influence corporate governance practices. These standards provide a framework for consistent and comparable financial reporting, reducing the potential for manipulation and enhancing transparency. Regulations such as the Sarbanes-Oxley Act (SOX) in the United States aim to strengthen corporate governance by increasing accountability and enhancing the independence of auditing processes. Compliance with these standards and regulations is crucial for maintaining a strong corporate governance structure and demonstrating a commitment to ethical accounting practices. Failure to comply can result in substantial penalties and damage to a company’s reputation.

Stakeholder Use of Accounting Information to Assess Corporate Governance Effectiveness

Stakeholders, including investors, creditors, employees, and the public, utilize accounting information to evaluate the effectiveness of a company’s corporate governance. Investors analyze financial statements to assess a company’s profitability, solvency, and risk profile, all of which are indicators of effective governance. Creditors use accounting information to assess creditworthiness and the likelihood of loan repayment. Employees rely on financial information to evaluate the company’s financial stability and job security. The public also uses this information to gauge a company’s social responsibility and ethical behavior. For instance, consistent and accurate reporting of environmental, social, and governance (ESG) factors demonstrates a commitment to responsible business practices, influencing stakeholder perception and investor decisions.

Hypothetical Scenario: Accounting Irregularities Leading to Poor Corporate Governance

Imagine a publicly traded company, “Alpha Corp,” consistently understates its expenses and overstates its revenues to meet investor expectations. This accounting irregularity, driven by pressure from management to achieve ambitious financial targets, leads to a false perception of the company’s financial health. Internal controls are weak, and the audit committee is ineffective, failing to detect the irregularities. Eventually, the fraud is uncovered, resulting in a significant drop in the company’s stock price, loss of investor confidence, and legal investigations. This scenario highlights how accounting irregularities, coupled with weak corporate governance mechanisms, can lead to substantial financial and reputational damage.

Comparative Analysis of Accounting Practices and Corporate Governance

Let’s compare two publicly traded companies: “Company A,” known for its strong corporate governance and ethical accounting practices, and “Company B,” which has a history of accounting scandals and weak governance. Company A consistently adheres to high accounting standards, maintains robust internal controls, and has an independent and active audit committee. Its financial statements are transparent and reliable, reflecting its commitment to ethical conduct. In contrast, Company B has a history of accounting irregularities, weak internal controls, and a lack of transparency in its financial reporting. This difference in accounting practices directly reflects their contrasting corporate governance reputations, impacting investor confidence and long-term sustainability. Company A enjoys higher investor trust and a stronger market valuation compared to Company B.

Internal Controls and Corporate Governance

Strong internal controls are fundamental to effective corporate governance. They provide a framework for managing risks, ensuring compliance, and promoting the reliability of financial reporting. A robust system of internal controls fosters trust among stakeholders, enhances operational efficiency, and ultimately contributes to the long-term success and sustainability of an organization.

The Interplay of Strong Internal Controls and Effective Corporate Governance

Effective corporate governance relies heavily on a system of strong internal controls. These controls act as safeguards against fraud, errors, and inefficiencies, directly impacting the accuracy and reliability of financial reporting. When internal controls are weak, the risk of material misstatements in financial statements increases, eroding investor confidence and potentially leading to regulatory penalties. Conversely, robust internal controls provide assurance to stakeholders that the organization is managed responsibly and ethically, strengthening the overall governance framework. This assurance is crucial for attracting investment, maintaining a positive reputation, and achieving sustainable growth. For example, a company with strong internal controls regarding procurement processes is less likely to experience fraudulent activities related to vendor selection and payments, directly supporting good governance principles of transparency and accountability.

The Internal Audit Function’s Contribution to Financial Reporting Integrity and Corporate Governance

The internal audit function plays a vital role in bolstering the integrity of financial reporting and strengthening corporate governance. Independent of operational management, internal auditors assess the effectiveness of internal controls, identify weaknesses, and recommend improvements. Their work provides objective assurance to the board of directors and senior management on the reliability of financial information and the effectiveness of risk management processes. Through regular audits and reviews, internal auditors help ensure compliance with relevant regulations and internal policies, contributing to a culture of accountability and transparency. For instance, an internal audit might identify a weakness in the segregation of duties within the accounts payable department, leading to recommendations for process improvements to mitigate the risk of fraudulent payments. This proactive approach directly enhances corporate governance by reducing operational risks and improving the quality of financial reporting.

Key Internal Control Weaknesses that Undermine Corporate Governance

Several internal control weaknesses can significantly undermine corporate governance. These include inadequate segregation of duties, a lack of proper authorization procedures, insufficient oversight of key processes, and the absence of robust monitoring mechanisms. Poor documentation of internal controls, inadequate employee training, and a lack of management commitment to internal control effectiveness are also major contributing factors. For example, a lack of segregation of duties, where one individual handles both authorization and payment processing, creates an opportunity for fraud. Similarly, inadequate oversight of financial transactions can lead to errors and misstatements, undermining the reliability of financial reporting and damaging the organization’s reputation.

Best Practices for Designing and Implementing Effective Internal Controls to Support Corporate Governance

Designing and implementing effective internal controls requires a comprehensive and systematic approach. Best practices include clearly defining roles and responsibilities, establishing robust authorization procedures, implementing strong segregation of duties, and regularly monitoring and reviewing the effectiveness of controls. Regular employee training on internal control procedures and ethical conduct is also crucial. Furthermore, establishing a strong tone at the top, where senior management actively champions the importance of internal controls, is essential for fostering a culture of compliance and accountability. Regular risk assessments should be conducted to identify potential vulnerabilities and adjust controls accordingly. Finally, using technology to enhance control effectiveness, such as implementing automated transaction processing and real-time monitoring systems, can significantly improve efficiency and accuracy.

Comparison of Internal Control Frameworks and Their Impact on Corporate Governance

| Framework | Key Features | Impact on Corporate Governance | Example of Application |

|---|---|---|---|

| COSO Framework | Control environment, risk assessment, control activities, information and communication, monitoring activities | Provides a comprehensive framework for designing and implementing effective internal controls, enhancing risk management and promoting transparency and accountability. | Used by many publicly traded companies to improve their internal control systems. |

| COBIT Framework | Focuses on IT governance and management, aligning IT with business objectives | Ensures that IT systems support business objectives and are managed effectively, reducing IT-related risks and improving operational efficiency. | Used by organizations to manage their IT risks and ensure that their IT systems are secure and reliable. |

| ISO 27001 | Focuses on information security management systems | Ensures the confidentiality, integrity, and availability of information assets, protecting sensitive data and mitigating reputational risks. | Used by organizations to demonstrate their commitment to information security and comply with relevant regulations. |

| Internal Control – Integrated Framework (ICIF) | Developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) | Provides a comprehensive framework for internal control, encompassing all aspects of the organization. | Provides guidance for organizations to design and implement internal control systems that are effective in preventing and detecting fraud and errors. |

The Auditor’s Role in Corporate Governance

External auditors play a vital role in ensuring the integrity of financial reporting and, consequently, the effectiveness of corporate governance. Their work provides an independent assessment of a company’s financial health, offering crucial assurance to investors and other stakeholders. This independent verification is a cornerstone of trust in the capital markets.

Auditor Responsibilities in Ensuring Financial Statement Accuracy and Reliability

External auditors are responsible for conducting independent audits of a company’s financial statements in accordance with generally accepted auditing standards (GAAS). This involves examining evidence supporting the financial information presented, assessing the company’s internal control systems, and issuing an audit opinion on the fairness and reliability of the statements. The accuracy and reliability of these statements are directly tied to the effectiveness of corporate governance, as they provide the foundation for informed decision-making by investors, creditors, and other stakeholders. A clean audit opinion signifies that the financial statements fairly present the company’s financial position, results of operations, and cash flows, thereby bolstering investor confidence and promoting good corporate governance. Conversely, a qualified or adverse opinion raises serious concerns about the integrity of the financial reporting process and can significantly impact a company’s reputation and access to capital.

Auditor Independence and its Importance

Maintaining auditor independence is paramount to the integrity of the audit process and the overall effectiveness of corporate governance. Independence ensures that the auditor’s judgment is not compromised by any relationship or influence from the company being audited. This independence allows auditors to objectively evaluate the financial information and identify any potential misstatements or irregularities without fear of reprisal. Regulatory bodies, such as the Public Company Accounting Oversight Board (PCAOB) in the United States, establish strict rules and regulations to safeguard auditor independence, including restrictions on non-audit services provided to audit clients and requirements for rotation of audit partners. Compromised independence erodes trust in the audit process, undermines the credibility of financial statements, and weakens corporate governance.

Implications of Audit Failures on Corporate Governance

Audit failures, where auditors fail to detect or report material misstatements in financial statements, can have severe consequences for corporate governance. These failures can lead to investor losses, reputational damage to the company, regulatory penalties, and even legal action against the company and the auditors themselves. The Enron and WorldCom scandals are prime examples of how audit failures can contribute to major corporate governance failures, leading to significant financial losses and a loss of public trust. These events underscored the importance of strong regulatory oversight and the need for robust auditor independence and professional skepticism.

Comparison of Internal and External Auditors’ Roles in Corporate Governance

While both internal and external auditors contribute to good corporate governance, their roles and responsibilities differ significantly. Internal auditors provide independent assurance on the effectiveness of the company’s internal control systems and other operational processes, reporting to management and the audit committee. External auditors, on the other hand, provide independent assurance on the fairness and reliability of the company’s financial statements, reporting to the shareholders. Internal audits often focus on operational efficiency and risk management, while external audits concentrate on the financial reporting process and the accuracy of the financial statements. The combined efforts of both types of auditors strengthen the overall corporate governance framework.

Examples of Auditor Oversight Preventing or Detecting Corporate Governance Failures

In numerous instances, diligent auditor oversight has played a crucial role in preventing or detecting corporate governance failures. For example, thorough audits have uncovered instances of fraudulent financial reporting, enabling timely remediation and preventing significant financial losses. Similarly, auditors’ identification of weaknesses in internal controls has prompted companies to implement improvements, strengthening their corporate governance structure and reducing the risk of future failures. While not always publicized, the preventative work of auditors is a silent guardian of corporate governance, preventing many potential scandals from ever coming to light.

Financial Reporting and Stakeholder Accountability

Effective financial reporting is the cornerstone of strong corporate governance, fostering trust and confidence among stakeholders. It provides a transparent view into a company’s financial health, operational performance, and risk management strategies, enabling informed decision-making by investors, creditors, employees, and the wider public. This transparency is crucial for maintaining the integrity of the capital markets and promoting sustainable economic growth.

Effective Financial Reporting and Stakeholder Trust

High-quality financial reporting, prepared in accordance with relevant accounting standards (like IFRS or GAAP), builds stakeholder trust by demonstrating accountability and adherence to best practices. Accurate and reliable financial statements allow stakeholders to assess the company’s financial position, profitability, and cash flows, leading to more informed investment decisions and reduced uncertainty. Conversely, inaccurate or misleading financial reporting can severely damage a company’s reputation, leading to loss of investor confidence, decreased market value, and potential legal repercussions. For example, the Enron scandal highlighted the devastating consequences of fraudulent financial reporting on stakeholder trust and market stability.

Transparency and Disclosure in Enhancing Corporate Governance

Transparency and full disclosure are paramount in enhancing corporate governance. Open communication regarding financial performance, risk factors, and corporate social responsibility initiatives fosters trust and accountability. Companies should proactively disclose material information in a timely and accessible manner, including details about their business model, strategy, governance structure, and environmental, social, and governance (ESG) performance. This commitment to transparency helps to mitigate information asymmetry between management and stakeholders, promoting fairer and more efficient capital markets. A good example of increased transparency is the growing adoption of integrated reporting, which combines financial and non-financial information to provide a holistic view of a company’s performance and sustainability.

Materiality Assessments and Financial Reporting Scope

Materiality assessments are crucial in determining the scope and quality of financial reporting. Material information is defined as any information that could reasonably be expected to influence the decisions of stakeholders. A thorough materiality assessment ensures that the financial statements focus on the most relevant information for stakeholders, avoiding unnecessary detail while ensuring that all significant aspects of the company’s financial performance and position are adequately disclosed. This process helps to improve the efficiency and effectiveness of financial reporting, enhancing its value for stakeholders. For example, a company in the renewable energy sector might consider its carbon emissions a material factor, requiring detailed disclosure in its financial reports.

Best Practices in Financial Reporting for Good Corporate Governance

Several best practices promote good corporate governance through robust financial reporting. These include:

- Adherence to relevant accounting standards and regulations.

- Independent audit by a reputable firm.

- Establishment of a strong internal control system.

- Regular review and improvement of financial reporting processes.

- Proactive communication with stakeholders regarding financial performance and risks.

- Implementation of a whistleblower protection program to encourage reporting of potential irregularities.

These practices ensure the accuracy, reliability, and transparency of financial reporting, fostering stakeholder trust and confidence in the company’s governance.

Key Elements of a Comprehensive Financial Reporting System

A comprehensive financial reporting system supporting strong corporate governance incorporates several key elements:

- A robust internal control framework to ensure the accuracy and reliability of financial data.

- Clear lines of responsibility and accountability for financial reporting.

- Regular and independent audits to verify the integrity of financial statements.

- Transparent and timely disclosure of financial information to stakeholders.

- A process for identifying and assessing material risks and uncertainties.

- Mechanisms for addressing stakeholder concerns and feedback.

- Ongoing monitoring and improvement of financial reporting processes.

These elements work together to create a system that is accurate, reliable, transparent, and accountable, promoting strong corporate governance and building stakeholder trust.

Corporate Governance Failures and Accounting Irregularities

Accounting scandals serve as stark reminders of the crucial link between robust corporate governance and reliable financial reporting. When governance mechanisms fail, the door opens for accounting irregularities, ultimately harming stakeholders and eroding public trust. This section explores the interconnectedness of these failures and their far-reaching consequences.

Accounting Scandals Exposing Governance Weaknesses

Accounting scandals often reveal significant weaknesses in a company’s corporate governance structure. For instance, a lack of independent oversight from the board of directors, insufficient internal controls, and a culture that prioritizes short-term profits over ethical conduct can all contribute to fraudulent accounting practices. The Enron scandal, for example, highlighted the dangers of a weak board failing to adequately challenge management’s aggressive accounting practices. Similarly, WorldCom’s accounting irregularities exposed the inadequacy of internal controls and the lack of accountability within the organization. These failures demonstrate how a flawed governance framework can create an environment conducive to accounting fraud.

Consequences of Accounting Irregularities on Stakeholder Relationships and Corporate Reputation

The consequences of accounting irregularities extend far beyond the immediate financial impact on the company. Stakeholders, including investors, employees, creditors, and customers, suffer significant losses. Investor confidence plummets, leading to decreased stock prices and difficulty in securing future financing. Employees may lose their jobs, and creditors may face significant financial difficulties. Furthermore, the company’s reputation is severely tarnished, impacting its ability to attract and retain talent, customers, and business partners. The long-term effects on a company’s sustainability can be devastating, often leading to bankruptcy or protracted legal battles.

Factors Contributing to Accounting Irregularities and Corporate Governance Failures

Several common factors often contribute to both accounting irregularities and corporate governance failures. These include a lack of ethical leadership, weak internal controls, inadequate board oversight, excessive pressure to meet financial targets, and a culture that tolerates or encourages unethical behavior. Furthermore, complex accounting standards and regulations can create opportunities for manipulation, particularly when coupled with insufficient internal auditing and a lack of transparency. A lack of independence amongst auditors, as seen in some high-profile cases, further exacerbates these problems.

Case Study: The Interconnectedness of Accounting Practices and Corporate Governance Effectiveness

Consider a hypothetical company, “InnovateTech,” experiencing rapid growth but lacking a robust corporate governance structure. The board of directors is largely comprised of individuals with close ties to the CEO, limiting independent oversight. Internal controls are weak, allowing for unchecked spending and questionable accounting practices. Driven by the pressure to maintain high stock prices, management manipulates earnings through aggressive revenue recognition and the underreporting of expenses. This eventually leads to an accounting scandal, exposing the weaknesses in InnovateTech’s governance and resulting in significant financial losses for investors, job losses for employees, and irreparable damage to the company’s reputation. This case study illustrates how ineffective governance directly facilitates accounting irregularities and their devastating consequences.

Regulatory Responses to Accounting Scandals and Their Impact on Corporate Governance Practices

Major accounting scandals, such as Enron and WorldCom, prompted significant regulatory reforms aimed at strengthening corporate governance and improving financial reporting. The Sarbanes-Oxley Act of 2002 (SOX) in the United States, for example, introduced stricter regulations on corporate governance, including enhanced auditor independence, improved internal controls, and increased corporate accountability. Similar reforms have been implemented globally, emphasizing the importance of independent boards, effective internal audit functions, and transparent financial reporting. These regulatory responses, while not foolproof, have significantly enhanced corporate governance practices and reduced the incidence of major accounting scandals.

Outcome Summary: The Relationship Between Accounting And Corporate Governance

In conclusion, the relationship between accounting and corporate governance is symbiotic and undeniably crucial. Strong, transparent accounting practices are essential for effective corporate governance, fostering trust among stakeholders and ensuring the long-term viability of organizations. Conversely, weaknesses in accounting systems and practices can severely undermine corporate governance, leading to significant financial and reputational risks. A robust understanding of this interconnectedness is paramount for both businesses and regulators seeking to promote ethical and sustainable corporate practices.

User Queries

What is the role of a whistleblower in improving corporate governance?

Whistleblowers play a vital role in exposing accounting irregularities and corporate misconduct. Their actions can trigger internal investigations and regulatory scrutiny, leading to improved corporate governance practices and accountability.

How do international accounting standards influence corporate governance globally?

International standards like IFRS aim to harmonize accounting practices across borders, promoting transparency and comparability. This contributes to improved corporate governance globally by increasing investor confidence and facilitating cross-border investments.

What are some common consequences of poor corporate governance?

Consequences can include loss of investor confidence, decreased stock value, legal penalties, reputational damage, and ultimately, business failure.

Browse the implementation of Employee Benefits Accounting Guide in real-world situations to understand its applications.