The Evolution of Global Accounting Practices Over the Decades sets the stage for this exploration, offering a journey through the fascinating transformation of global accounting. From the disparate methods of the pre-1950s era to the increasingly standardized practices of today, we will examine the key events, challenges, and innovations that have shaped the modern accounting landscape. This analysis will delve into the impact of industrialization, globalization, technological advancements, and regulatory responses on the development of global accounting standards and practices.

We will explore how differing regional approaches converged (or sometimes clashed) to create the international framework we know today. The role of influential organizations, landmark accounting scandals, and the ongoing pursuit of harmonization will be central to our discussion. By examining case studies and considering future trends, we aim to provide a comprehensive overview of this dynamic and ever-evolving field.

Early Accounting Practices (Pre-1950s)

Before the mid-20th century, global accounting practices were significantly less standardized than they are today. Methods varied considerably across regions, often reflecting the prevailing economic systems and levels of industrialization. While basic bookkeeping existed for centuries, the formalization and professionalization of accounting were still in their relatively early stages.

Early accounting practices were largely driven by the need to track financial transactions for individual businesses and governments. The development of double-entry bookkeeping, attributed to Luca Pacioli in the late 15th century, provided a foundational framework, but its implementation and application varied widely. The lack of universally accepted standards led to inconsistencies in reporting and made comparisons between entities challenging.

Regional Variations in Accounting Systems

Pre-1950s accounting systems showed considerable regional differences. In Europe, particularly in countries with established commercial centers like the Netherlands and England, more sophisticated accounting practices developed earlier. These often incorporated elements of financial reporting geared toward investors and creditors. North American accounting practices, while influenced by European models, evolved alongside the rapid growth of the American economy, focusing on aspects relevant to the expansion of businesses and the emergence of large corporations. Asian accounting systems, conversely, were often more closely tied to the specific needs of individual businesses and family-owned enterprises, with less emphasis on standardized external reporting. These differences reflected diverse legal, regulatory, and cultural environments.

The Impact of the Industrial Revolution

The Industrial Revolution profoundly impacted the evolution of accounting practices. The rise of large-scale manufacturing, complex supply chains, and the need for significant capital investment demanded more sophisticated accounting methods. Businesses required systems to track large volumes of transactions, manage inventories effectively, and assess profitability across various production lines. This spurred the development of cost accounting techniques, designed to analyze and control production costs, a crucial element for businesses competing in increasingly competitive markets. The growth of joint-stock companies and the increasing importance of capital markets further fueled the demand for more reliable and transparent financial reporting.

Evolution of Key Accounting Standards (Pre-1950s)

| Period | Region | Key Development | Impact |

|---|---|---|---|

| Late 15th – 18th Centuries | Europe (Italy, Netherlands, England) | Development and wider adoption of double-entry bookkeeping | Improved accuracy of financial record-keeping; foundation for future advancements |

| 19th Century | North America & Europe | Emergence of cost accounting techniques | Enabled better control over production costs and improved managerial decision-making |

| Early 20th Century | Various | Growth of professional accounting bodies and the development of early accounting standards (though not yet globally harmonized) | Increased credibility and standardization within specific jurisdictions |

| 1930s-1940s | US | The Securities and Exchange Commission (SEC) is established, leading to increased regulation of financial reporting for publicly traded companies. | Enhanced transparency and investor protection in the US capital markets. |

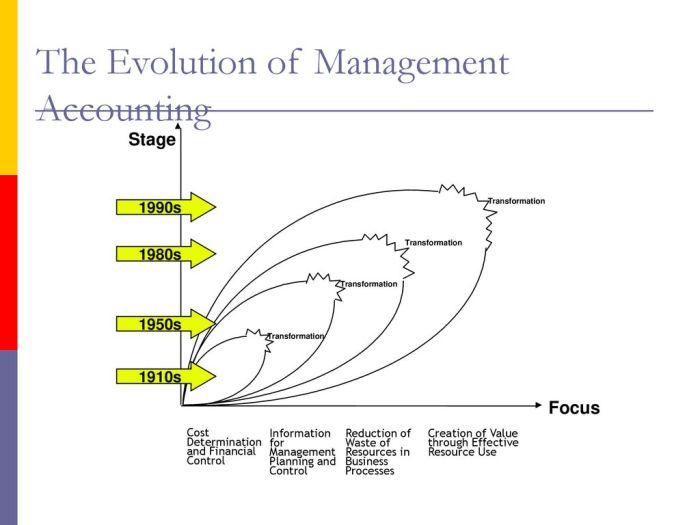

The Rise of Standardized Accounting (1950s-1980s)

The post-World War II era witnessed a burgeoning global economy, characterized by increased cross-border trade and investment. This rapid globalization exposed the limitations of diverse and often incompatible national accounting standards. The need for greater transparency and comparability in financial reporting became increasingly apparent, laying the groundwork for the development of international accounting standards.

The growth of multinational corporations played a significant role in pushing for standardized accounting practices. These companies operated across multiple jurisdictions, each with its own unique accounting rules. This created complexities in consolidating financial statements, comparing performance across subsidiaries, and attracting international investment. The lack of uniformity hindered efficient capital allocation and increased the costs of international business transactions.

Emergence of International Accounting Standards Organizations

The need for standardized accounting practices led to the formation of international organizations dedicated to harmonizing accounting standards. A key player was the International Accounting Standards Committee (IASC), established in 1973. The IASC aimed to develop a common set of accounting standards that could be adopted globally, thereby improving the comparability and transparency of financial statements. This early initiative represented a crucial step towards international accounting harmonization, though the process was fraught with challenges. Later, the IASC evolved into the International Accounting Standards Board (IASB) in 2001, further solidifying the global push for standardized accounting.

Factors Driving the Need for Greater Standardization

Several factors converged to create a compelling case for greater standardization in accounting practices. Beyond the challenges faced by multinational corporations, the growth of international capital markets fueled the demand for comparable financial information. Investors needed reliable and consistent data to make informed decisions about investments across borders. Furthermore, increased cross-border auditing practices highlighted the inconsistencies and complexities arising from differing national accounting standards. The desire for greater investor confidence and reduced information asymmetry significantly contributed to the movement towards standardization.

Early Attempts at International Accounting Harmonization

Early attempts at harmonization primarily focused on developing a common framework for accounting principles. The IASC, in its early years, issued a series of International Accounting Standards (IASs). These standards addressed key areas such as financial statement presentation, inventory valuation, and depreciation. While these early IASs represented a significant step towards greater uniformity, their adoption was not universal, and significant differences in interpretation and implementation persisted across countries. The process was slow and complex, involving extensive negotiations and compromises among diverse national accounting traditions.

Challenges in Achieving Global Consensus

Achieving global consensus on accounting standards proved to be a formidable challenge. National differences in accounting practices, often deeply rooted in cultural, legal, and economic contexts, created significant obstacles. Different countries had varying levels of economic development, regulatory frameworks, and accounting expertise, making it difficult to reach a universal agreement on a single set of standards. Furthermore, the influence of powerful national accounting bodies and lobbying efforts from various stakeholders often slowed down the harmonization process. The sheer complexity of accounting itself, with its nuanced rules and interpretations, added another layer of difficulty.

Globalization and its Impact (1990s-2000s)

The 1990s and 2000s witnessed a dramatic acceleration in globalization, profoundly impacting accounting practices worldwide. Increased cross-border transactions, the rise of multinational corporations (MNCs), and the interconnectedness of global markets created a pressing need for greater consistency and comparability in financial reporting. This period saw a significant shift away from nationally-specific accounting standards towards a more harmonized, international framework.

The increasing complexity of international business transactions necessitated a move towards standardized accounting practices. Inconsistencies in national accounting standards hampered cross-border investment and created difficulties in comparing the financial performance of companies operating in different jurisdictions. This led to a growing demand for a globally accepted set of accounting standards that would enhance transparency, comparability, and trust in financial markets.

Key Events Accelerating the Adoption of International Accounting Standards

The push for international accounting standards gained considerable momentum during this period. Several key events and developments played a crucial role in fostering the widespread adoption of International Financial Reporting Standards (IFRS). These included the increasing influence of international organizations, the growing recognition of the limitations of national standards in a globalized economy, and the efforts of standard-setting bodies to develop a comprehensive and globally accepted framework.

- Formation of the International Accounting Standards Committee (IASC) in 1973: While not directly within the 1990s-2000s timeframe, the IASC laid the groundwork for future developments. Its initial efforts to harmonize accounting standards across nations paved the way for the later creation of the IASB.

- Establishment of the International Accounting Standards Board (IASB) in 2001: The IASB replaced the IASC, inheriting its mandate to develop and promote the adoption of IFRS. This marked a significant step towards global accounting standardization.

- Increased Endorsement by National Regulators: Throughout the 1990s and 2000s, many national regulatory bodies began endorsing or mandating the use of IFRS, either partially or fully, significantly accelerating its global adoption.

- Growing Pressure from Investors and Stakeholders: International investors increasingly demanded greater transparency and comparability in financial reporting, pushing for the adoption of a single set of high-quality global accounting standards.

Accounting Practices of Multinational Corporations: Before and After IFRS Adoption

Before the widespread adoption of IFRS, multinational corporations often faced the challenge of complying with multiple sets of national accounting standards, leading to increased costs and complexities in financial reporting. Consolidated financial statements were difficult to prepare and compare due to the inconsistencies in accounting treatments. The lack of comparability also made it difficult for investors to assess the true financial health and performance of these corporations.

After the adoption of IFRS, MNCs experienced a greater degree of consistency in their financial reporting. The use of a single set of global standards simplified the preparation of consolidated financial statements and facilitated cross-border comparisons. This improved transparency and comparability enhanced investor confidence and reduced information asymmetry. While challenges remained in the implementation and interpretation of IFRS, the overall impact was a significant improvement in the quality and consistency of financial reporting for MNCs.

Timeline of Significant Milestones in Global Accounting Standards (1990s-2000s)

The evolution of global accounting standards during this period was a dynamic process, marked by several significant milestones:

- Mid-1990s: Increased calls for international accounting standards driven by the growth of cross-border investments and the limitations of national standards.

- 1998: The IASC issues IAS 32, “Financial Instruments: Disclosure and Presentation,” a crucial step in addressing the complexities of financial instruments.

- 2001: The International Accounting Standards Board (IASB) is formed, replacing the IASC.

- 2002: The European Union mandates the use of IFRS for listed companies, a landmark decision that significantly accelerated the global adoption of IFRS.

- 2005 onwards: Many other countries and regions begin adopting IFRS, either fully or partially, marking a significant shift towards global accounting harmonization.

The 21st Century and Beyond: The Evolution Of Global Accounting Practices Over The Decades

The 21st century has witnessed a dramatic transformation of global accounting practices, driven primarily by technological advancements and the emergence of new economic models. The increasing interconnectedness of global markets, coupled with rapid technological change, has presented both opportunities and unprecedented challenges for the accounting profession. This section will explore the key influences shaping the future of global accounting.

Technological Influence on Accounting Practices

The proliferation of sophisticated software, cloud computing, and data analytics has revolutionized accounting processes. Automation has streamlined routine tasks such as data entry and reconciliation, freeing up accountants to focus on higher-value activities like analysis and strategic decision-making. Real-time data processing allows for more accurate and timely financial reporting, improving the efficiency and effectiveness of financial management. Furthermore, the use of artificial intelligence (AI) and machine learning (ML) is increasingly being explored to detect anomalies, predict financial trends, and enhance audit procedures. For example, AI-powered systems can analyze vast datasets to identify potential fraud risks far more efficiently than traditional methods. This shift towards data-driven insights is fundamentally changing the skillset required of accountants, emphasizing the need for proficiency in data analysis and technological literacy.

Challenges Posed by Digital Assets and the Sharing Economy

The rise of digital assets, such as cryptocurrencies and non-fungible tokens (NFTs), and the growth of the sharing economy (e.g., Uber, Airbnb) have created significant accounting challenges. The volatile nature of cryptocurrencies necessitates the development of robust accounting standards to accurately reflect their value on balance sheets. Similarly, the decentralized and often intangible nature of assets in the sharing economy requires new approaches to valuation and revenue recognition. Consider the case of a company using a blockchain-based system for tracking inventory. The traditional inventory accounting methods may not be entirely suitable in this context, requiring the development of new procedures to accurately reflect the value and movement of assets within the blockchain ecosystem. These new economic models demand a flexible and adaptive accounting framework capable of addressing the unique characteristics of digital and intangible assets.

Harmonization and Convergence of Accounting Standards

The ongoing efforts towards greater harmonization and convergence of accounting standards, primarily led by the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB), are crucial for facilitating cross-border investments and enhancing global financial transparency. While significant progress has been made, complete convergence remains a long-term goal. The challenges lie in navigating differing national accounting traditions and regulatory frameworks. For example, the differences in how lease accounting is treated under different national standards highlight the complexities involved in achieving global harmonization. However, the increasing pressure for greater transparency and comparability in financial reporting will continue to drive these efforts forward. The ultimate goal is a single set of high-quality global accounting standards, fostering greater trust and efficiency in international capital markets.

A Hypothetical Scenario: Global Accounting in 2033

By 2033, imagine a world where AI-powered auditing systems are commonplace, significantly reducing the risk of financial fraud and improving the accuracy of financial statements. Blockchain technology is widely used for secure and transparent transaction recording, simplifying accounting processes across industries. Global accounting standards are largely harmonized, resulting in increased comparability and reduced complexity for multinational corporations. Accountants are highly specialized professionals, possessing advanced skills in data analytics, AI, and blockchain technology, playing a critical role in advising businesses on navigating the complex landscape of the digital economy. A major accounting firm might utilize AI to analyze real-time financial data from various sources, instantly identifying potential risks and opportunities for their clients, offering proactive advice and enhancing their decision-making process. This illustrates a future where accounting is not just about recording transactions, but about providing strategic insights and driving business growth in an increasingly complex and interconnected global economy.

Case Studies

This section examines specific instances illustrating the evolution of global accounting practices and their impact on corporate financial reporting. We will analyze how changes in accounting standards have affected a company’s financial statements and the key lessons learned from these experiences. The examples provided are intended to highlight the complexities and challenges faced by companies navigating the increasingly interconnected global financial landscape.

Enron’s Collapse and the Need for Enhanced Transparency

Enron’s spectacular collapse in 2001 serves as a stark reminder of the potential consequences of inadequate accounting practices and a lack of transparency. The company employed a complex web of Special Purpose Entities (SPEs) to hide massive debts and inflate its profits, ultimately misleading investors and leading to significant financial losses. Enron’s accounting practices, which exploited loopholes in existing U.S. Generally Accepted Accounting Principles (GAAP), highlight the need for more robust and transparent accounting standards. The scandal prompted significant reforms in corporate governance and accounting regulations, including the Sarbanes-Oxley Act of 2002 in the United States. This legislation strengthened corporate responsibility and oversight, mandating stricter accounting standards and greater transparency in financial reporting. Enron’s case demonstrates the devastating impact that opaque accounting practices can have on a company’s reputation, investor confidence, and the broader economy.

Comparative Analysis: Treatment of Intangible Assets Under GAAP and IFRS

Consider the accounting treatment of research and development (R&D) expenses. Under U.S. GAAP, R&D costs are generally expensed as incurred, reflecting a conservative approach. This means that the costs are immediately deducted from the income statement, reducing reported profits. However, under International Financial Reporting Standards (IFRS), companies can capitalize certain R&D expenditures if specific criteria are met, such as demonstrating the technical feasibility of the project and the intention to complete the project and use or sell the resulting asset. This allows companies to defer the recognition of R&D expenses, potentially increasing reported profits in the short term. The differing treatments reflect fundamental differences in the philosophical approaches of GAAP and IFRS. GAAP prioritizes conservatism, while IFRS aims for a more fair presentation of the company’s financial position. A company reporting under IFRS might show higher assets and potentially higher profits in the short term, compared to a company using GAAP for the same R&D expenditure. The long-term implications however, are comparable.

Adoption of IFRS by a Publicly Traded Company: Impact on Financial Statements

The adoption of IFRS by a publicly traded company can significantly impact its financial statements. For instance, consider a company that previously used U.S. GAAP and transitioned to IFRS. The change might lead to adjustments in the valuation of assets, liabilities, and equity. For example, the adoption of IFRS might necessitate revaluation of property, plant, and equipment (PP&E) to fair value, which could lead to a significant increase or decrease in reported asset values. Similarly, changes in accounting policies related to revenue recognition or inventory valuation could affect the company’s income statement and cash flow statement. This transition can result in complexities in comparing financial statements across different periods. Investors and analysts must carefully consider these adjustments when evaluating a company’s financial performance after its adoption of IFRS.

Key Lessons Learned, The Evolution of Global Accounting Practices Over the Decades

The following points summarize key lessons from these case studies:

- Transparency and robust internal controls are crucial for maintaining investor confidence and preventing financial scandals.

- Differences in accounting standards can significantly impact a company’s reported financial performance, requiring careful consideration and comparison.

- The adoption of IFRS can lead to significant changes in a company’s financial statements, necessitating careful analysis and understanding of the underlying accounting policies.

- Global accounting convergence aims to improve comparability and transparency but requires careful management of the transition process.

The Role of Regulation and Enforcement

The evolution of global accounting practices is inextricably linked to the development and enforcement of regulations. Without robust regulatory frameworks and consistent enforcement, the integrity of financial reporting would be severely compromised, leading to market instability and a loss of investor confidence. The interplay between regulatory bodies, accounting scandals, and ethical considerations has shaped the landscape of modern accounting.

Regulatory bodies play a crucial role in establishing and maintaining globally consistent accounting standards. Organizations like the International Accounting Standards Board (IASB) and national accounting standard-setters work to create a framework that promotes transparency, comparability, and accountability in financial reporting. These standards provide a baseline for how companies prepare and present their financial statements, allowing investors and other stakeholders to make informed decisions. National regulators, in turn, adapt and enforce these international standards within their own jurisdictions, often adding specific requirements to address unique local circumstances. The effectiveness of these standards relies heavily on the ability of regulatory bodies to monitor compliance and impose penalties for violations.

Regulatory Bodies and Global Accounting Standards

The IASB’s International Financial Reporting Standards (IFRS) have become a significant force in harmonizing accounting practices worldwide. However, the adoption and enforcement of IFRS vary across countries. Some countries have fully adopted IFRS, while others have adopted modified versions or continue to rely on their own national standards. This uneven adoption creates challenges in achieving true global comparability. The role of national regulatory bodies in interpreting and applying IFRS is therefore critical in ensuring consistent application across different jurisdictions. Furthermore, ongoing efforts to improve and update IFRS reflect the dynamic nature of the global economy and the need for continuous adaptation to new accounting challenges. For example, the increasing complexity of financial instruments necessitates ongoing adjustments to IFRS to ensure accurate and comprehensive reporting.

Impact of Accounting Scandals on Accounting Regulations

Major accounting scandals, such as Enron and WorldCom, have profoundly impacted the development of accounting regulations. These high-profile cases exposed significant weaknesses in existing regulations and corporate governance structures. The resulting fallout led to increased scrutiny of accounting practices and a heightened demand for greater transparency and accountability. The Sarbanes-Oxley Act (SOX) in the United States, enacted in response to Enron and WorldCom, is a prime example of legislative action aimed at strengthening corporate governance and improving the accuracy of financial reporting. SOX introduced stricter regulations on corporate responsibility, internal controls, and auditor independence, setting a precedent for stricter regulatory frameworks globally. Subsequent scandals have further reinforced the need for continuous improvements in accounting regulations and enforcement.

Challenges in Enforcing Global Accounting Standards

Enforcing global accounting standards presents several significant challenges. The sheer diversity of accounting practices across countries, coupled with differences in legal systems and enforcement capabilities, makes consistent implementation difficult. The complexity of IFRS itself can also lead to inconsistencies in interpretation and application, even within the same jurisdiction. Moreover, the resources available to regulatory bodies often vary considerably, making effective enforcement uneven across different countries. This disparity in resources can lead to a “race to the bottom,” where companies may seek jurisdictions with weaker enforcement to avoid stricter regulations. Cross-border investigations and enforcement actions also present logistical and jurisdictional hurdles, requiring international cooperation and coordination.

Ethics and Corporate Governance in Maintaining Financial Reporting Integrity

Ethical conduct and strong corporate governance are essential for maintaining the integrity of financial reporting. A culture of ethical behavior within organizations fosters a commitment to transparency and accountability, reducing the likelihood of accounting irregularities. Effective corporate governance mechanisms, including independent boards of directors, robust internal controls, and a strong audit function, provide checks and balances to prevent fraudulent activities and ensure accurate financial reporting. These elements are vital not only for complying with regulations but also for building trust with investors and other stakeholders. Companies with strong ethical cultures and robust governance structures are better positioned to withstand pressure to manipulate financial information, thus contributing to the overall stability and integrity of the global financial system.

Ending Remarks

In conclusion, the evolution of global accounting practices reveals a compelling narrative of adaptation, standardization, and ongoing challenges. From the localized systems of the past to the increasingly interconnected world of today, the journey has been marked by both progress and setbacks. The ongoing influence of technology, the persistent need for ethical considerations, and the ever-present pressure for greater transparency and harmonization ensure that the evolution of global accounting practices remains a dynamic and vital area of study, shaping the financial health of nations and businesses alike. The future undoubtedly holds further developments as the world continues to evolve.

FAQs

What are some examples of early accounting scandals that influenced regulatory changes?

Examples include the Equity Funding scandal of the 1970s and the Enron and WorldCom scandals of the early 2000s. These events highlighted weaknesses in existing accounting regulations and led to significant reforms aimed at improving corporate governance and financial reporting transparency.

How has technology impacted the auditing process?

Technology has significantly improved the efficiency and effectiveness of auditing. Data analytics tools allow auditors to analyze vast datasets, identify anomalies, and assess risks more effectively. Automation of tasks reduces manual effort and improves accuracy.

What are the major challenges in enforcing global accounting standards?

Challenges include ensuring consistent application across diverse jurisdictions with varying legal and cultural contexts, overcoming resistance to change from stakeholders, and addressing the complexities of enforcing standards for multinational corporations with operations in multiple countries.

Remember to click Dropshipping Accounting for Beginners to understand more comprehensive aspects of the Dropshipping Accounting for Beginners topic.