The Challenges of Regulating Financial Technology (FinTech) Startups present a complex and evolving landscape. The rapid innovation within the FinTech sector, characterized by disruptive technologies and business models, constantly outpaces traditional regulatory frameworks. This creates significant uncertainty for both startups and regulators, necessitating a delicate balancing act between fostering innovation and ensuring consumer protection, market stability, and data security. This exploration delves into the multifaceted challenges inherent in governing this dynamic industry.

From navigating inconsistent regulatory landscapes across jurisdictions to addressing the unique data privacy and security risks associated with FinTech innovations, the regulatory hurdles are substantial. The potential for market dominance by established players and the need for international cooperation further complicate the picture. Understanding these challenges is crucial for fostering responsible growth and innovation within the FinTech ecosystem.

Regulatory Uncertainty and its Impact on Fintech Startups

The rapid evolution of financial technology (FinTech) presents significant challenges for regulators worldwide, creating an environment of uncertainty that significantly impacts the growth and stability of FinTech startups. This uncertainty stems from the inherent difficulty in applying existing regulatory frameworks designed for traditional financial institutions to the innovative and often disruptive business models employed by FinTech companies. The resulting regulatory gaps and inconsistencies create a complex and unpredictable landscape for these startups to navigate.

The evolving regulatory landscape poses numerous difficulties for FinTech companies. Adapting to rapidly changing regulations requires significant investment in legal expertise, compliance infrastructure, and ongoing monitoring of regulatory developments across multiple jurisdictions. This can be particularly burdensome for smaller startups with limited resources, potentially hindering their ability to compete with larger, more established players. The constant need to update business models and operational procedures to remain compliant adds considerable operational overhead and can divert resources from core innovation efforts.

Regulatory Inconsistencies Across Jurisdictions

Regulatory inconsistencies across different jurisdictions present a significant hurdle for FinTech startups aiming for international expansion. A solution that is compliant in one country may be illegal or heavily restricted in another, leading to increased complexity and costs associated with market entry. For example, regulations concerning data privacy, cryptocurrency trading, and the licensing of payment service providers vary considerably across countries, forcing FinTech companies to tailor their offerings and operational procedures to comply with each specific regulatory environment. This fragmentation can stifle innovation by creating barriers to entry and discouraging cross-border collaboration.

Comparative Analysis of Payment Regulations, The Challenges of Regulating Financial Technology (FinTech) Startups

The following table compares the regulatory frameworks of three countries – the United States, the United Kingdom, and Singapore – concerning payment services. These countries represent different approaches to regulating FinTech, offering a glimpse into the complexities faced by startups operating internationally.

| Country | Regulation Type | Key Provisions | Impact on Fintech Startups |

|---|---|---|---|

| United States | Patchwork of Federal and State Laws (e.g., Dodd-Frank Act, state money transmitter licenses) | Varying licensing requirements, data security standards, anti-money laundering (AML) and know-your-customer (KYC) regulations. | High compliance costs, difficulties navigating fragmented regulatory landscape, potential for inconsistent application across states. |

| United Kingdom | Payment Services Regulations 2017 (PSR) | Registration and authorization requirements for payment service providers, strong consumer protection measures, robust AML/KYC framework. | Clearer regulatory framework than the US, but still requires significant compliance efforts, particularly for authorization. |

| Singapore | Payment Services Act (PSA) | Licensing framework for payment service providers, emphasis on innovation and technology, robust AML/KYC regulations, focus on cybersecurity. | Generally considered a more FinTech-friendly regulatory environment, fostering innovation while maintaining strong consumer protections. |

Data Privacy and Security Concerns in Fintech

The rapid growth of financial technology (Fintech) has brought about unprecedented innovation in financial services, but it has also significantly increased the volume and sensitivity of personal data handled by these companies. This creates heightened risks related to data privacy and security, demanding robust regulatory frameworks and proactive security measures from Fintech startups. The interconnected nature of Fintech systems and the reliance on digital platforms exacerbate these challenges, requiring a comprehensive understanding of the risks and effective mitigation strategies.

Fintech companies often collect and process vast amounts of sensitive personal and financial data, including transaction histories, bank account details, biometric information, and location data. This data is a lucrative target for cybercriminals, making Fintech firms particularly vulnerable to data breaches, identity theft, and financial fraud. The consequences of such breaches can be severe, ranging from significant financial losses and reputational damage to legal penalties and erosion of customer trust.

Challenges of Complying with Data Protection Regulations

Meeting the requirements of international and national data protection regulations presents a significant hurdle for Fintech startups. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose stringent obligations on organizations handling personal data, including data minimization, purpose limitation, and user consent. These regulations require companies to implement robust data security measures, provide users with transparency about data processing activities, and establish mechanisms for data subject access requests and data deletion. Compliance can be complex and resource-intensive, especially for smaller Fintech startups with limited resources and expertise. The evolving nature of these regulations and the varying interpretations across jurisdictions further complicate the challenge. For example, navigating the differences between GDPR’s strict consent requirements and the CCPA’s opt-out model requires careful planning and adaptation.

Key Security Vulnerabilities in Common Fintech Applications and Services

Many common Fintech applications and services present specific security vulnerabilities. Mobile payment apps, for example, are susceptible to malware attacks that can steal user credentials or intercept transactions. Peer-to-peer (P2P) lending platforms can be targeted by fraudsters who create fake profiles to obtain loans or manipulate the platform’s algorithms. Insurtech platforms handling sensitive health or financial data are vulnerable to data breaches that could expose customers to identity theft or financial fraud. Furthermore, the use of third-party APIs and cloud-based services introduces additional security risks, as vulnerabilities in these systems can compromise the security of the Fintech platform itself. A lack of robust authentication mechanisms, inadequate encryption of data at rest and in transit, and insufficient employee training on cybersecurity best practices are all contributing factors to these vulnerabilities.

Hypothetical Data Breach Scenario and Regulatory Repercussions

Consider a hypothetical scenario where a Fintech startup specializing in providing personalized financial advice suffers a data breach due to a vulnerability in its cloud-based data storage system. The breach exposes the personal and financial data of thousands of customers, including their names, addresses, social security numbers, bank account details, and investment portfolios. The regulatory repercussions would be significant. Under GDPR, the startup would be obligated to notify the affected individuals and the relevant data protection authority within 72 hours of discovering the breach. Failure to do so could result in substantial fines. The startup would also be required to conduct a thorough investigation to determine the cause of the breach and implement corrective measures to prevent future incidents. In addition to regulatory fines, the startup would likely face civil lawsuits from affected individuals, reputational damage, and loss of customer trust, potentially leading to the business’s failure. The CCPA would impose similar notification and remediation requirements, and failure to comply could result in significant penalties. This scenario highlights the severe consequences of data breaches for Fintech startups and the importance of robust data security measures and compliance with data protection regulations.

Balancing Innovation and Consumer Protection: The Challenges Of Regulating Financial Technology (FinTech) Startups

The rapid growth of FinTech presents a significant challenge for regulators: fostering innovation while simultaneously safeguarding consumers. This delicate balance requires a nuanced approach, considering the unique characteristics of each FinTech sector and the potential risks involved. Different regulatory bodies employ varying strategies, leading to a diverse landscape of regulatory frameworks across the globe.

Different regulatory bodies employ diverse approaches to balancing innovation and consumer protection. Some prioritize a lighter-touch regulatory framework, emphasizing self-regulation and market-driven solutions, believing this approach encourages innovation and allows FinTechs to adapt quickly to evolving market needs. Others favor a more prescriptive approach, implementing strict rules and regulations to minimize consumer risks, potentially stifling innovation in the process. The European Union, for example, has adopted a relatively comprehensive regulatory approach with the PSD2 directive and the upcoming Digital Markets Act, emphasizing data protection and consumer rights. In contrast, the regulatory sandbox approach adopted by the UK’s Financial Conduct Authority (FCA) and the Monetary Authority of Singapore (MAS) prioritizes experimentation and learning through controlled environments, allowing FinTechs to test new products and services under regulatory supervision before full market launch.

Regulatory Sandbox Approaches and Their Impact

Regulatory sandboxes provide a controlled environment for FinTech startups to test innovative products and services under the supervision of regulatory bodies. This approach allows for experimentation and learning while mitigating potential risks to consumers. The UK’s FCA sandbox, for example, has supported the development of numerous innovative FinTech solutions, including those in the areas of open banking, peer-to-peer lending, and payments. The success of these sandboxes is often measured by the number of FinTechs participating, the level of innovation fostered, and the overall reduction in regulatory uncertainty. The MAS’s Fintech Regulatory Sandbox in Singapore has similarly facilitated the testing and launch of various innovative financial products and services, contributing to Singapore’s position as a leading FinTech hub. These successful initiatives demonstrate that a balanced approach, combining innovation with careful regulatory oversight, is achievable.

Ethical Considerations in AI-Powered Fintech Solutions

The increasing use of Artificial Intelligence (AI) in FinTech raises significant ethical considerations. AI algorithms used in areas such as credit scoring, fraud detection, and algorithmic trading can perpetuate existing biases, leading to unfair or discriminatory outcomes. For instance, if an AI algorithm is trained on historical data that reflects existing societal biases, it may inadvertently discriminate against certain demographic groups in its decision-making processes. Furthermore, the lack of transparency in some AI algorithms can make it difficult to understand how decisions are made, raising concerns about accountability and redress. Ensuring fairness, transparency, and accountability in AI-powered FinTech solutions is crucial for maintaining consumer trust and preventing harm. Robust ethical guidelines and regulatory frameworks are needed to address these concerns effectively.

Best Practices for Fintech Startups Prioritizing Consumer Protection

FinTech startups should prioritize consumer protection from the outset, integrating it into their business models and operations. This involves establishing robust data security protocols, implementing transparent and fair pricing practices, and providing clear and accessible information to consumers. Regular security audits, robust customer support channels, and proactive measures to detect and prevent fraud are also crucial. Furthermore, adopting ethical AI development principles and ensuring algorithmic transparency can build consumer trust and mitigate potential risks. A commitment to continuous improvement and adaptation to evolving regulatory requirements is essential for maintaining a strong consumer protection framework. By prioritizing consumer protection, FinTech startups can build trust, foster long-term sustainability, and contribute to a more inclusive and equitable financial system.

Competition and Market Dominance in the Fintech Sector

The rapid growth of the Fintech sector has raised significant concerns regarding competition and the potential for market dominance. Established financial institutions, with their extensive resources and existing customer bases, and large, rapidly expanding Fintech companies both possess the capacity to stifle competition and limit consumer choice. Understanding the dynamics of this competition and the challenges in regulating it is crucial for ensuring a fair and innovative financial landscape.

The potential for anti-competitive practices in the Fintech sector is multifaceted. Established players may leverage their existing infrastructure and market power to disadvantage smaller, innovative Fintech startups. This could manifest through predatory pricing, exclusive contracts with merchants, or the strategic acquisition of promising competitors before they can pose a significant threat. Large Fintech companies, once they achieve a dominant market position, could employ similar tactics to maintain their lead. The inherent network effects present in many Fintech services, such as payment platforms or social lending networks, further exacerbate this issue, creating a “winner-takes-most” dynamic.

Anti-Competitive Practices by Established Financial Institutions and Large Fintech Companies

Established financial institutions and large Fintech companies can engage in various anti-competitive practices. Predatory pricing, where a dominant firm temporarily lowers prices below cost to eliminate competition, is a classic example. Another tactic involves exclusive contracts with merchants, preventing them from working with competing Fintech firms. Finally, the acquisition of smaller, innovative competitors before they can gain significant market share prevents the emergence of genuine competition. For instance, a large bank might acquire a promising mobile payment startup to prevent it from challenging their existing payment systems. These practices limit consumer choice and innovation.

Challenges in Regulating Mergers and Acquisitions in the Fintech Sector

Regulating mergers and acquisitions (M&A) in the Fintech sector presents unique challenges. The rapid pace of innovation and the often-blurring lines between traditional finance and technology make it difficult for regulators to assess the competitive impact of these deals. Determining market definition in a rapidly evolving landscape is crucial yet complex. For example, is a mobile payment app competing only with other mobile payment apps, or does it also compete with traditional credit card networks? Further complicating the issue is the international nature of many Fintech companies, requiring coordination between multiple regulatory bodies. The valuation of Fintech companies, often based on future growth projections rather than current profitability, adds another layer of complexity to assessing the competitive implications of M&A activity.

Impact of Market Concentration on Financial Inclusion and Consumer Choice

High market concentration in the Fintech sector can negatively impact financial inclusion and consumer choice. When a few dominant players control a significant portion of the market, consumers may face limited options, higher prices, and less innovation. This is particularly concerning for underserved populations who may rely on Fintech solutions for access to essential financial services. For example, if a single company controls the dominant mobile payment platform, it could set fees that disproportionately affect low-income users. Moreover, a lack of competition can stifle innovation, as dominant firms may have less incentive to develop new products or services that benefit consumers.

Hypothetical Scenario: Regulatory Intervention in Mobile Payments

Imagine a scenario where a single mobile payment company, “PayAll,” achieves a near-monopoly in the market. They control over 90% of mobile payment transactions. This dominance allows them to impose high merchant fees, reducing the profitability of small businesses and potentially leading to higher prices for consumers. To prevent this, regulators could intervene by implementing regulations that promote interoperability between different mobile payment systems. This might involve mandating that PayAll’s system be compatible with other providers, preventing them from leveraging their market dominance to exclude competitors. Furthermore, regulators could impose restrictions on exclusive contracts between PayAll and merchants, ensuring that merchants have the freedom to choose alternative payment processors. This type of intervention would foster competition, protect consumers, and prevent the stifling of innovation in the mobile payment sector.

Cross-border Regulation and International Cooperation

The rapid expansion of FinTech across national borders presents significant regulatory challenges. The inherent nature of digital technologies transcends geographical limitations, making it difficult for individual countries to effectively regulate activities that originate or impact their citizens from outside their jurisdiction. This necessitates a nuanced approach that balances the need for consumer protection and financial stability with the fostering of innovation and competition in the global FinTech landscape.

The complexities of regulating cross-border FinTech activities stem from the diverse and often conflicting regulatory frameworks across different jurisdictions. A FinTech company operating internationally might face a patchwork of rules and regulations, each with its own interpretations and enforcement mechanisms. This regulatory fragmentation creates significant compliance burdens for businesses, potentially hindering their ability to scale and compete effectively. Furthermore, the speed of technological innovation often outpaces the capacity of regulators to adapt their frameworks, creating a persistent gap between regulatory requirements and the evolving FinTech landscape.

Challenges of Enforcing Regulations Across Different Jurisdictions

Enforcing regulations across borders presents a significant hurdle. Difficulties arise from issues such as differing legal systems, data localization requirements, and the absence of universally accepted enforcement mechanisms. For instance, obtaining evidence or seizing assets located in a foreign jurisdiction can be a protracted and complex legal process. Furthermore, jurisdictional disputes can arise when a FinTech company’s activities trigger regulatory scrutiny in multiple countries, potentially leading to conflicting demands and sanctions. The lack of clear cross-border cooperation mechanisms further exacerbates these enforcement challenges. The absence of a single, global regulatory body for FinTech contributes to this complexity. Effective enforcement requires international cooperation and a clear delineation of responsibilities among different regulatory authorities.

Importance of International Cooperation in Regulating Fintech

International cooperation is paramount to effectively regulate FinTech. A collaborative approach enables the establishment of common standards, facilitating a more level playing field for FinTech companies and promoting a more consistent and predictable regulatory environment. Shared information and intelligence-gathering between regulatory bodies can help identify and address emerging risks more efficiently. Joint enforcement actions can be undertaken to deter illicit activities and protect consumers. Examples of successful international cooperation include initiatives by organizations like the Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO) which work towards establishing common principles and standards for regulating FinTech. These collaborations are crucial for fostering trust and confidence in the global FinTech ecosystem.

Impact of Lack of Harmonization on Fintech Growth

The absence of harmonized regulatory frameworks significantly hinders FinTech growth. Inconsistencies in regulations create barriers to entry for FinTech companies, particularly smaller ones, that lack the resources to navigate complex and disparate legal landscapes. This regulatory fragmentation can also stifle innovation, as companies may choose to avoid international expansion due to the associated compliance costs and uncertainties. Ultimately, a lack of harmonization can lead to a less competitive and less innovative global FinTech sector, limiting the potential benefits of these technologies for consumers and the wider economy. The absence of a unified approach also creates opportunities for regulatory arbitrage, where companies seek out jurisdictions with more lenient regulations, potentially increasing systemic risks.

The Role of Technology in Regulatory Enforcement

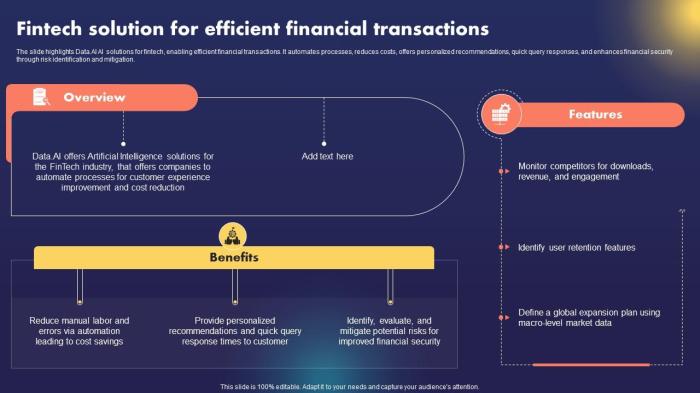

The rapid growth of FinTech necessitates a similarly rapid evolution in regulatory oversight. Traditional methods struggle to keep pace with the innovative and often globally dispersed nature of these businesses. Technology, however, offers a powerful toolset to enhance regulatory effectiveness, allowing for more efficient monitoring, analysis, and enforcement. This section explores how technology can improve regulatory processes and the associated challenges.

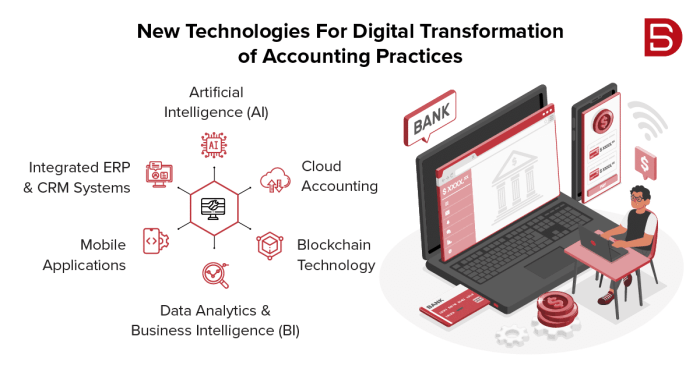

The application of technology to regulatory processes, often termed RegTech, is transforming how financial regulators operate. RegTech solutions leverage data analytics, artificial intelligence (AI), and machine learning (ML) to automate tasks, improve risk assessment, and enhance the detection of fraudulent activities. This allows regulators to focus their resources on more complex issues, improving both the speed and quality of their oversight.

Innovative Regulatory Technologies (RegTech) and Their Applications

RegTech encompasses a wide range of technologies designed to streamline regulatory compliance. For example, AI-powered systems can analyze vast datasets of financial transactions to identify suspicious patterns indicative of money laundering or fraud far more quickly and efficiently than human analysts. Similarly, Robotic Process Automation (RPA) can automate repetitive tasks like data entry and report generation, freeing up human resources for higher-level analysis and investigation. Blockchain technology, with its inherent transparency and immutability, can improve the traceability of transactions, making it easier to track funds and identify illicit activities. These technologies are not mutually exclusive; they can be integrated to create comprehensive regulatory solutions. For instance, an AI system might flag suspicious transactions, which are then investigated further using blockchain data to trace the flow of funds.

Challenges Associated with RegTech Implementation and Adoption

Despite the potential benefits, implementing and adopting RegTech solutions presents several challenges. The high initial investment costs can be a barrier for smaller regulatory bodies. Furthermore, integrating new technologies with existing legacy systems can be complex and time-consuming. Data security and privacy concerns are also paramount, particularly when dealing with sensitive financial information. Ensuring the accuracy and reliability of AI-driven systems is crucial, as errors could have significant consequences. Finally, the need for specialized expertise in both technology and finance creates a skills gap that must be addressed through training and recruitment.

Potential for Bias and Discrimination in AI-Driven Regulatory Enforcement

AI-powered RegTech systems are trained on historical data, which may reflect existing biases and inequalities. If this biased data is used to train an AI system for regulatory enforcement, the system may perpetuate or even amplify these biases, leading to unfair or discriminatory outcomes. For example, an AI system trained on data showing disproportionate loan defaults in certain demographics might unfairly flag loan applications from those demographics as higher risk, even if the applicants are otherwise creditworthy. Mitigating this risk requires careful data selection, algorithmic transparency, and ongoing monitoring of the AI system’s performance to identify and correct any biases. Regular audits and human oversight are essential to ensure fairness and prevent discriminatory practices.

Financial Inclusion and Fintech Regulation

Fintech’s potential to revolutionize financial services extends beyond efficiency gains; it offers a powerful tool for promoting financial inclusion, bringing essential services to underserved populations. However, the very technologies that promise greater access can also exacerbate existing inequalities if not carefully regulated. This section examines the multifaceted relationship between Fintech, financial inclusion, and the regulatory frameworks needed to ensure equitable access.

Fintech can both promote and hinder financial inclusion depending on its design and implementation. Mobile money platforms, for example, have demonstrably expanded access to financial services in many developing countries, allowing individuals without traditional bank accounts to participate in the formal economy. Conversely, the rapid pace of technological change and the complexity of some Fintech products can create barriers to entry for those lacking digital literacy or reliable internet access, thus potentially widening the financial inclusion gap. This highlights the critical need for a regulatory environment that both fosters innovation and safeguards against exclusion.

Regulatory Considerations for Equitable Access to Fintech Services

Ensuring equitable access requires a proactive regulatory approach that addresses affordability, accessibility, and digital literacy. Regulations should focus on promoting interoperability between different Fintech platforms to prevent fragmentation and ensure seamless transitions between services. Furthermore, clear and concise consumer protection guidelines, translated into multiple languages and presented in accessible formats, are crucial for empowering users to make informed decisions. Finally, regulatory bodies should actively encourage Fintech companies to develop products and services tailored to the specific needs of underserved communities, considering factors like language, literacy levels, and technological infrastructure. This might involve collaborating with community organizations and leveraging existing social networks for outreach and education.

Challenges of Regulating Fintech in Underserved Communities

Regulating Fintech in underserved communities presents unique challenges. These communities often lack the robust infrastructure and digital literacy needed to fully benefit from Fintech innovations. Furthermore, data privacy and security concerns are amplified in these contexts, where individuals may be more vulnerable to fraud and exploitation. The enforcement of regulations in remote or geographically dispersed areas also presents logistical hurdles. Finally, ensuring that regulatory frameworks are not overly burdensome or costly for Fintech companies serving these communities is vital to preventing them from being excluded from the market. A delicate balance must be struck between protecting consumers and fostering the growth of Fintech solutions that address their specific needs.

Policy Interventions to Enhance Financial Inclusion Through Fintech Regulation

Effective policy interventions are needed to harness Fintech’s potential for financial inclusion. These should include:

- Promoting digital literacy and financial education: Government-funded programs and public-private partnerships can play a crucial role in equipping individuals with the skills needed to navigate the digital financial landscape.

- Investing in digital infrastructure: Expanding broadband access and improving mobile network coverage are essential for ensuring equitable access to Fintech services, particularly in rural and underserved areas.

- Developing tailored regulatory frameworks: Regulations should be flexible enough to accommodate the specific needs and contexts of underserved communities, while still maintaining robust consumer protection measures.

- Encouraging the development of inclusive Fintech products: Incentivizing Fintech companies to design and offer products and services specifically tailored to the needs of low-income individuals and communities can significantly broaden financial access.

- Facilitating interoperability and data portability: Regulations should encourage seamless transitions between different Fintech platforms and ensure consumers can easily access and transfer their financial data.

- Strengthening consumer protection mechanisms: Clear and accessible consumer protection guidelines, coupled with effective enforcement mechanisms, are crucial for building trust and preventing exploitation.

- Supporting innovation through regulatory sandboxes: Regulatory sandboxes can provide a controlled environment for Fintech companies to test innovative products and services, allowing for experimentation and learning while mitigating risks.

Summary

In conclusion, the regulation of FinTech startups demands a proactive and adaptable approach. Successfully navigating the complexities requires a collaborative effort between regulators, FinTech companies, and other stakeholders. Embracing technological advancements in regulatory enforcement, fostering international cooperation, and prioritizing ethical considerations are essential for creating a regulatory environment that supports innovation while mitigating risks and ensuring consumer protection. The future of FinTech hinges on the ability to strike this crucial balance.

Question Bank

What are regulatory sandboxes, and how do they help FinTech startups?

Regulatory sandboxes are controlled environments where FinTech companies can test innovative products and services under regulatory supervision before full-scale launch, reducing risk and providing valuable feedback.

How does AI impact FinTech regulation?

AI presents both opportunities and challenges. It can enhance regulatory oversight through improved fraud detection and risk assessment, but also raises concerns about bias and algorithmic transparency.

What role does international cooperation play in FinTech regulation?

International cooperation is crucial for addressing cross-border activities and preventing regulatory arbitrage, ensuring consistent standards and fostering global FinTech growth.

What are the key ethical considerations in AI-powered FinTech?

Key ethical concerns include algorithmic bias, data privacy violations, lack of transparency, and potential for discriminatory outcomes.

For descriptions on additional topics like How to Improve Cash Flow with Better Accounting Practices, please visit the available How to Improve Cash Flow with Better Accounting Practices.