Navigating The Complexities Of Payroll Processing

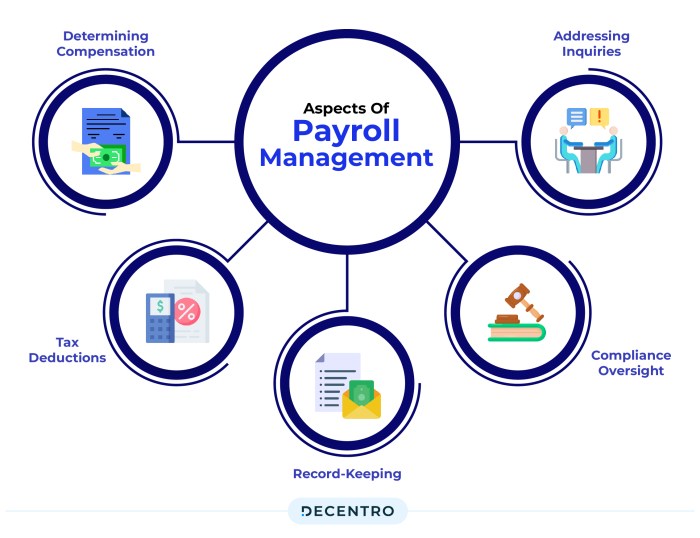

Navigating the Complexities of Payroll Processing can feel like traversing a labyrinthine maze, but understanding its intricacies is crucial for any business, regardless of size. From mastering fundamental payroll calculations to navigating intricate tax regulations and leveraging technology for efficiency, the journey requires careful planning and execution. This exploration will illuminate the path, offering insights…