The Role Of Transfer Pricing In Multinational Corporate Taxation

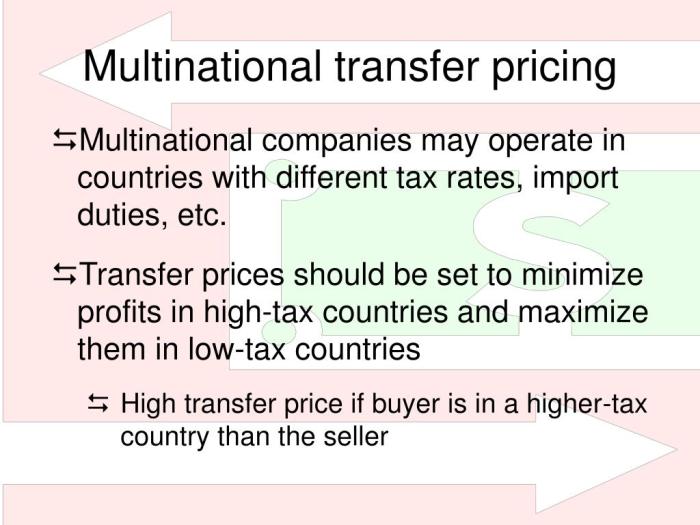

The Role of Transfer Pricing in Multinational Corporate Taxation is a critical area impacting global businesses. Understanding how multinational corporations price internal transactions significantly influences their tax liabilities across various jurisdictions. This involves navigating complex regulations, applying various pricing methods, and meticulously documenting transactions to minimize audit risks and ensure compliance. The stakes are high,…