How To Prepare A Cash Flow Statement

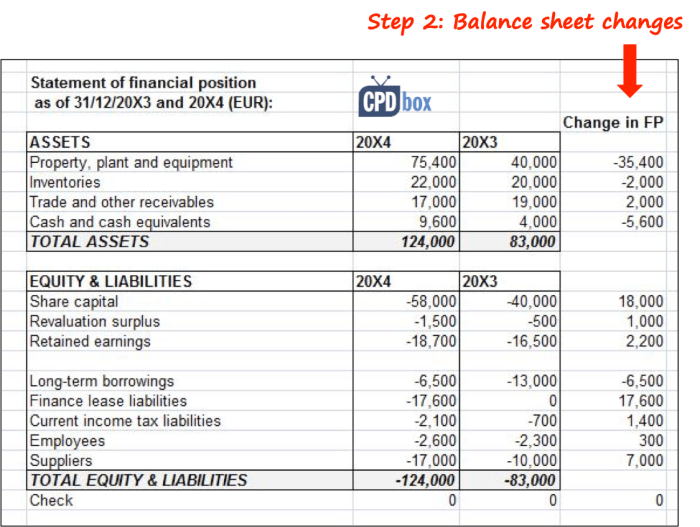

How to Prepare a Cash Flow Statement is a crucial skill for anyone involved in financial management. Understanding cash flow is essential for assessing a business’s financial health, making informed decisions, and securing future growth. This guide provides a comprehensive overview of the process, breaking down each step into manageable components, from understanding the statement’s…