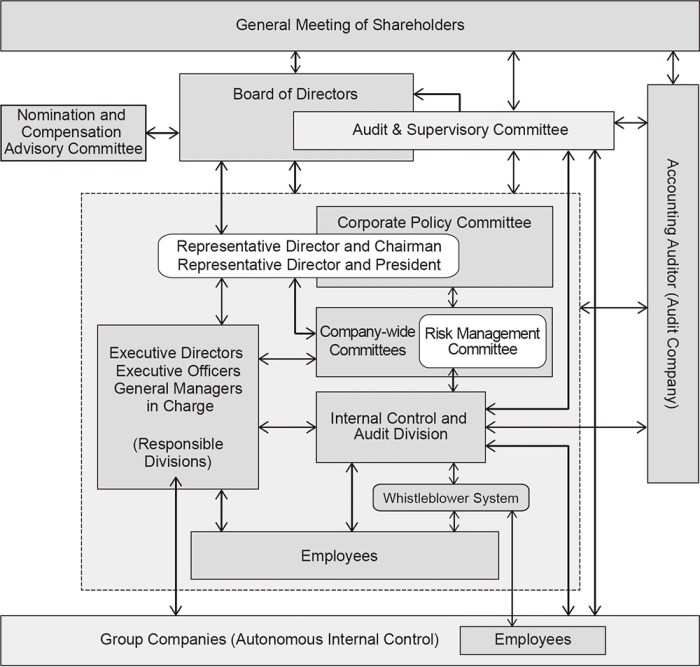

The Role Of Accounting In Corporate Governance

The Role of Accounting in Corporate Governance is paramount to ensuring ethical and transparent business practices. This crucial function extends far beyond simply recording financial transactions; it underpins the very foundation of trust and accountability within a corporation. From setting robust internal controls to fostering transparent financial reporting, accounting plays a vital role in safeguarding…

:max_bytes(150000):strip_icc()/accounting-valuation.asp_Final-f441df548f6444ca9db23e01b7ea9efe.png?w=700)