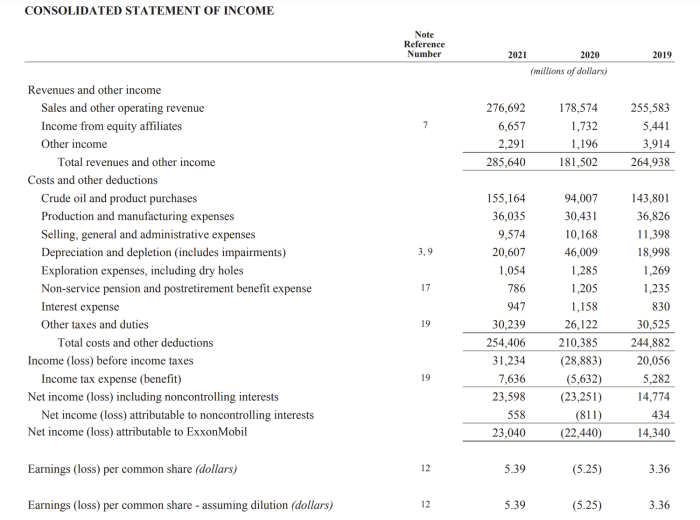

How To Read Financial Statements Like A Pro

How to Read Financial Statements Like a Pro unveils the secrets to understanding the language of finance. This comprehensive guide demystifies balance sheets, income statements, and cash flow statements, empowering you to analyze a company’s financial health with confidence. We’ll explore key ratios, profitability metrics, and forecasting techniques, transforming you from a financial novice into…