The Accounting Challenges Of Mergers Between Public And Private Companies

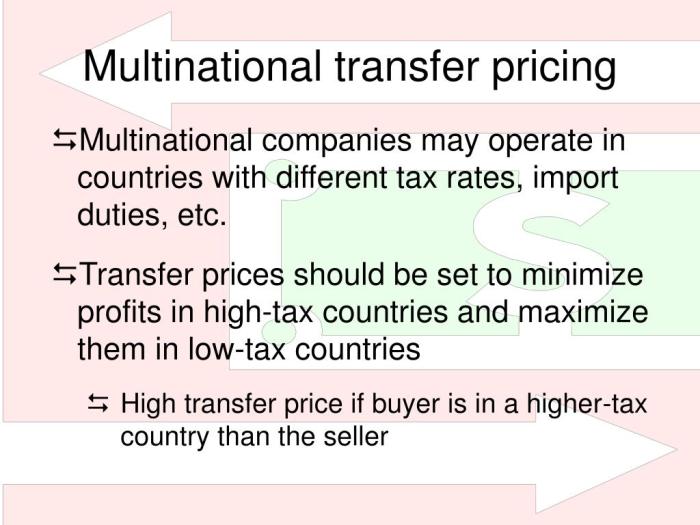

The Accounting Challenges of Mergers Between Public and Private Companies present a unique set of complexities. Merging entities with differing accounting standards, valuation methods, and internal control systems necessitates careful planning and execution. This process requires navigating discrepancies in financial reporting, tax implications, and data management, all while ensuring compliance with relevant regulations. Successfully integrating…