The Role Of Accounting In Economic Stability

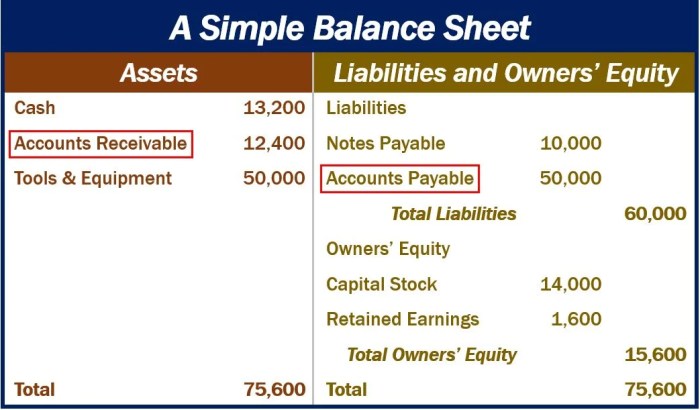

The Role of Accounting in Economic Stability is far more significant than simply recording transactions; it’s the bedrock upon which sound economic systems are built. From informing government policy to influencing investor confidence, accounting practices shape the very fabric of economic growth and stability. This exploration delves into the multifaceted ways accounting impacts macroeconomic trends,…