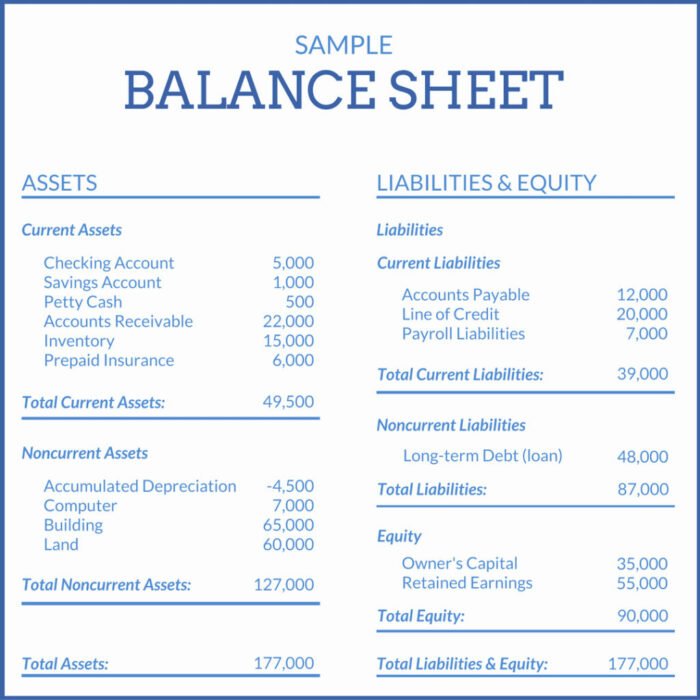

Income Statement Vs Balance Sheet Key Differences

Income Statement vs Balance Sheet Key Differences: Understanding the core distinctions between these two fundamental financial statements is crucial for anyone seeking to analyze a company’s financial health. While both provide vital insights, they offer different perspectives, one focusing on profitability over a period, the other on a snapshot of financial position at a specific…