How to Track Online Sales Tax for E-commerce is a crucial aspect of running a successful online business. Navigating the complexities of state sales tax laws, nexus requirements, and tax software can seem daunting, but understanding the fundamentals empowers e-commerce entrepreneurs to manage their tax obligations effectively and avoid costly penalties. This guide provides a comprehensive overview of the key considerations for tracking online sales tax, from understanding sales tax nexus to streamlining compliance procedures. We’ll explore practical strategies and resources to help you navigate this essential aspect of your business.

Successfully managing online sales tax involves a multifaceted approach. It begins with clearly defining your sales tax nexus—the connection between your business and a state that gives that state the right to collect sales taxes from you. This involves understanding both physical presence and economic nexus, which are determined by factors like your business’s location, the number of transactions you conduct within a state, and the total revenue generated from sales in that state. Once you understand your nexus, you can accurately identify taxable products and services, accounting for varying tax rates and exemptions across different states. Effective use of sales tax software and meticulous record-keeping are essential for compliance and accurate reporting.

Understanding Sales Tax Nexus for E-commerce

Navigating the complexities of sales tax for online businesses can be challenging, particularly understanding the concept of sales tax nexus. This crucial concept determines whether an online retailer is required to collect and remit sales tax in a particular state. Failing to comply with nexus rules can result in significant financial penalties.

Sales Tax Nexus: Definition and Implications

Sales tax nexus refers to the connection between a business and a state that requires the business to collect and remit sales taxes on sales made to customers in that state. The existence of nexus triggers the obligation to register with the state’s tax authority, collect sales tax at the point of sale, and file and remit sales tax returns regularly. The absence of nexus means a business is not required to collect sales tax in that state, although the customer may still owe use tax. This can significantly impact profitability and operational efficiency, making a clear understanding of nexus essential.

Factors Establishing Sales Tax Nexus

Several factors can establish sales tax nexus, and these vary by state. Historically, physical presence was the primary determinant. However, the Supreme Court’s decision in *South Dakota v. Wayfair, Inc.* (2018) significantly altered the landscape, introducing the concept of economic nexus.

Physical Presence Nexus vs. Economic Nexus

Traditionally, physical presence nexus meant a business had to have a physical presence in a state—such as a warehouse, office, or employee—to be required to collect sales tax there. This is still a factor in many states. Economic nexus, established by *Wayfair*, considers a business’s economic activity within a state. This typically involves exceeding a certain threshold of sales or number of transactions within a state during a specific period. The thresholds vary considerably from state to state. A business might have economic nexus in a state even without a physical presence, if it meets the specified sales or transaction thresholds.

Examples of Nexus and Non-Nexus Situations

A business with a warehouse in California would have physical presence nexus and therefore be required to collect California sales tax. Conversely, a business operating solely online and making $100,000 in sales to customers in Nevada (assuming Nevada’s threshold is $100,000) would have economic nexus and be required to collect Nevada sales tax, even without a physical presence in Nevada. A business with minimal sales in a particular state, below that state’s economic nexus threshold, would generally not have nexus in that state.

Sales Tax Nexus Rules for Five States

| State | Physical Presence Nexus | Economic Nexus (Sales Threshold) | Economic Nexus (Transaction Threshold) |

|---|---|---|---|

| California | Yes | $100,000 | 200 transactions |

| Florida | Yes | $100,000 | 200 transactions |

| New York | Yes | $100,000 | 200 transactions |

| Texas | Yes | $500,000 | 200 transactions |

| Washington | Yes | $100,000 | 200 transactions |

Identifying Taxable Products and Services

Navigating the complexities of sales tax for e-commerce businesses requires a thorough understanding of which products and services are subject to taxation. This varies significantly depending on the state and even the locality within a state. This section will clarify the identification of taxable goods and services, highlight common exceptions and exemptions, and explain the discrepancies in tax rates across different jurisdictions.

The types of products and services subject to sales tax are generally broad, encompassing most tangible personal property sold at retail. However, states frequently define specific exceptions and exemptions. Furthermore, the sales tax rate applied can fluctuate considerably based on location. This variation stems from differences in state and local tax policies, aiming to fund public services and infrastructure within each jurisdiction.

Sales Tax Rates Across States and Localities

Sales tax rates differ significantly across states and even within states, due to varying state and local tax structures. Some states have no sales tax at all, while others impose relatively high rates. For instance, some states may levy a base state sales tax, with individual counties or cities adding their own local sales tax, resulting in a combined rate. This combined rate can easily reach 10% or more in certain areas, whereas other regions may only have a 4% or 5% rate. This necessitates a thorough understanding of the specific rates applicable to each location where a business operates. Failure to comply with these varying rates can result in significant penalties and back taxes.

Product Categories and Sales Tax Implications

Understanding the sales tax implications for different product categories is crucial for accurate tax calculation and compliance. The following list Artikels common product categories and their typical sales tax treatment. Note that specific rules and exceptions can vary significantly by state.

It is important to note that the taxability of a product can depend on its intended use. For example, clothing might be tax-exempt when purchased for charitable purposes but taxable for personal use. Similarly, certain building materials may be tax-exempt for new construction but taxable for repairs.

Discover more by delving into Cash Flow Statement Explained further.

- Clothing and Apparel: Generally taxable, but some states offer exemptions for certain types of clothing (e.g., children’s clothing, diapers). Taxability can also vary based on price thresholds.

- Food and Groceries: Usually exempt, although prepared foods or meals from restaurants are typically taxable.

- Prescription Drugs: Usually exempt, but over-the-counter medications are generally taxable.

- Software: Often taxable, although some states have specific rules for downloadable software or software as a service (SaaS).

- Digital Goods: Taxability varies significantly by state; some states tax digital downloads like ebooks or music, while others do not.

- Services: The taxability of services is highly dependent on the state. Some states tax specific services like car repairs or haircuts, while others do not tax services at all.

Examples of Products with Varying Tax Rates, How to Track Online Sales Tax for E-commerce

Consider the example of a book. In a state with a 6% sales tax and no specific exemptions for books, a $20 book would be subject to $1.20 in sales tax. However, if the same book is sold in a state with a 0% sales tax, no sales tax would be collected. Similarly, some states may offer tax exemptions for certain types of books, such as educational textbooks, reducing or eliminating the tax liability. A different scenario might involve a state that taxes prepared food. A $10 sandwich from a restaurant would be taxable, but a $10 bag of groceries (excluding prepared foods) might be exempt.

Utilizing Sales Tax Software and Automation

Managing sales tax for an e-commerce business can be complex, involving numerous state and local regulations. Manually tracking and calculating taxes is time-consuming and prone to errors, potentially leading to penalties and audits. Sales tax software offers a streamlined solution, automating many aspects of tax compliance and reducing the risk of costly mistakes. This section will explore the benefits of using such software, compare various options, and guide you through the setup and usage process.

Benefits of Sales Tax Software

Sales tax software offers numerous advantages for e-commerce businesses of all sizes. These tools automate the calculation of sales tax based on location, product type, and applicable tax rates. This automation saves significant time and resources, allowing businesses to focus on other aspects of their operations. Furthermore, accurate tax calculations minimize the risk of penalties and audits from tax authorities. The software often integrates with accounting and e-commerce platforms, creating a seamless workflow and reducing manual data entry. Features such as tax rate updates, reporting, and filing capabilities further streamline the tax compliance process. Finally, many solutions provide support and resources to help businesses navigate complex sales tax regulations.

Comparison of Sales Tax Software Options

Several software options cater to e-commerce businesses’ sales tax needs. These range from simple solutions suitable for small businesses to comprehensive platforms designed for large enterprises with complex tax requirements. Key features to consider include tax rate calculation accuracy, integration capabilities with existing systems (e.g., Shopify, WooCommerce, QuickBooks), reporting and filing functionalities, customer support, and pricing. Pricing models vary, often based on transaction volume, features, and the number of users. Some solutions offer a free plan with limited features, while others operate on a subscription basis with different tiers offering varying levels of functionality.

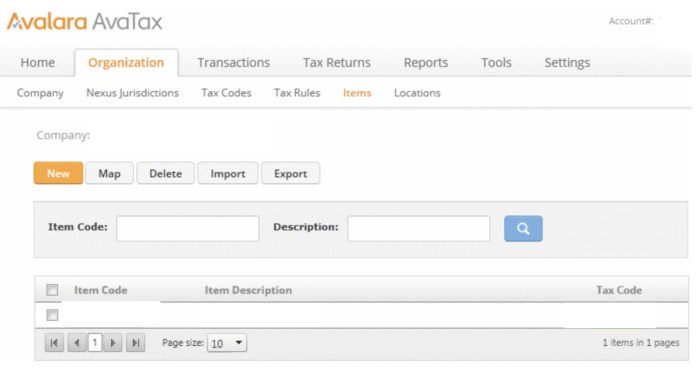

Setting Up and Configuring Sales Tax Software

The setup process typically involves creating an account, providing business information (e.g., tax ID, address, and business type), and connecting the software to your e-commerce platform and accounting system. You’ll need to input your products and services, specifying their taxability in different jurisdictions. The software will then automatically determine the applicable tax rates based on the customer’s shipping address and your product configurations. Many platforms provide detailed setup guides and tutorials to assist users through the process. Regular updates and maintenance are essential to ensure the software remains accurate and compliant with changing tax laws.

Calculating and Remitting Taxes Using Sales Tax Software

Once configured, the software automatically calculates sales tax at the point of sale. This information is typically integrated into your accounting system, simplifying the process of generating tax reports. At the end of each tax period (usually monthly or quarterly), the software generates reports detailing the taxes collected and owed to each jurisdiction. These reports can be used to prepare and file your sales tax returns electronically or manually, depending on the requirements of your jurisdiction and the software’s capabilities. The software often facilitates the remittance process by providing tools to directly pay taxes to the relevant authorities.

Comparison of Three Sales Tax Software Solutions

| Feature | Software A (Example: Avalara) | Software B (Example: TaxJar) | Software C (Example: Vertex) |

|---|---|---|---|

| Pricing | Subscription based, tiered pricing | Subscription based, tiered pricing | Subscription based, enterprise-level pricing |

| Integration | Integrates with major e-commerce platforms and accounting software | Integrates with major e-commerce platforms and accounting software | Integrates with major e-commerce platforms and accounting software, custom integrations available |

| Reporting & Filing | Automated reporting and filing for multiple states | Automated reporting and filing for multiple states | Automated reporting and filing for multiple states and countries |

| Customer Support | Phone, email, and online resources | Email and online resources | Dedicated account manager and comprehensive support |

Managing Sales Tax Records and Reporting: How To Track Online Sales Tax For E-commerce

Maintaining meticulous sales tax records is crucial for e-commerce businesses. Accurate record-keeping ensures compliance with tax laws, prevents penalties and audits, and facilitates efficient tax preparation. Failing to maintain proper records can lead to significant financial repercussions, including back taxes, interest, and potential legal action. A well-organized system simplifies the process and minimizes the risk of errors.

Types of Sales Tax Records

Accurate sales tax record-keeping involves maintaining a comprehensive collection of documents that detail all aspects of your sales transactions. These records serve as evidence of your tax liability and are essential for successful audits. Missing or incomplete records can result in penalties and disputes with tax authorities.

- Sales invoices: These should include the date of sale, invoice number, description of goods or services, quantity sold, selling price, sales tax charged, and customer information (name and address).

- Sales receipts: Similar to invoices, receipts should document the transaction details, including the date, amount, and sales tax collected.

- Purchase orders: These are crucial for tracking purchases of goods that might be subject to sales tax, especially if you’re claiming input tax credits.

- Bank statements: Bank statements help verify deposits and payments related to sales and purchases.

- Sales tax returns: These are the official forms submitted to the relevant tax authorities, showing the calculated tax liability for a specific period.

- Tax exemption certificates: If you sell to tax-exempt entities, keep copies of their certificates to support your claims.

Proper Record-Keeping Practices

Consistent and organized record-keeping is essential for accurate sales tax reporting. Implementing standardized practices helps minimize errors and simplifies the process of preparing tax returns. A well-defined system reduces the time and effort required during tax season, allowing you to focus on other aspects of your business.

- Use a dedicated accounting system: Software specifically designed for e-commerce accounting automates many tasks, reducing the risk of human error.

- Number all documents sequentially: This ensures that no transaction is missed and makes it easier to track down specific records.

- Maintain a clear audit trail: All transactions should be easily traceable from source documents to the final tax return.

- Regularly reconcile records: Compare your accounting records with bank statements to ensure accuracy and identify any discrepancies promptly.

- Store records securely: Keep both physical and digital copies of your records in a safe and accessible location, preferably using cloud storage for backups.

Methods for Organizing and Storing Sales Tax Records

Effective organization is key to efficient sales tax record management. Choosing a suitable method depends on your business size and complexity, but a consistent approach is vital for accurate reporting and smooth audits. Consider a combination of digital and physical storage for optimal security and accessibility.

- Cloud-based accounting software: Many platforms offer automated tax calculations, reporting, and secure storage.

- Spreadsheet software: Spreadsheets can be used for simple record-keeping, but they require manual data entry and lack the automation features of dedicated accounting software.

- Physical filing system: A well-organized physical filing cabinet can be used for storing paper documents, but this method is less efficient and more prone to errors.

- Hybrid approach: Combining digital and physical storage allows for both secure backup and easy access to important documents.

Sample Sales Tax Record-Keeping System

A robust system incorporates both digital and physical components. A suggested approach involves using cloud-based accounting software for daily transactions and storing physical copies of key documents in a well-organized filing cabinet. This ensures data security and easy access to information.

Digital System: Utilize accounting software (e.g., Xero, QuickBooks Online) to record all sales and purchases, automatically calculate sales tax, and generate reports. Regularly back up your data to a secure cloud storage service.

Physical Filing System: Maintain a physical file for each tax year, organizing documents chronologically. Include a separate folder for tax exemption certificates and other crucial documents. Consider using color-coded folders for easy identification.

Navigating State Sales Tax Laws and Regulations

Successfully navigating the complex landscape of state sales tax laws is crucial for e-commerce businesses to maintain compliance and avoid potential penalties. Understanding the nuances of each state’s regulations, from registration to reporting, is essential for smooth operations. This section will Artikel key resources and procedures to help you effectively manage your sales tax obligations across multiple states.

State Sales Tax Law Resources

Several resources provide access to individual state sales tax laws and regulations. The most reliable source is usually the state’s department of revenue website. These websites typically offer detailed information on tax rates, taxable items, and filing requirements. Additionally, the Federation of Tax Administrators (FTA) website provides a centralized directory of state tax agencies, facilitating easier access to relevant information. Many commercial tax compliance services also offer summaries and interpretations of state sales tax laws, but it’s always advisable to verify information with the official state sources.

Sales Tax Permit Registration Procedures

Registering for sales tax permits is a state-specific process. Generally, you’ll need to complete an application form, provide business information (including EIN or SSN), and potentially pay a registration fee. The application process can vary significantly by state; some may require online applications, while others may necessitate paper submissions. It’s crucial to contact the relevant state’s tax agency to determine the exact procedures and required documentation. Failure to register in states where you have nexus can lead to significant penalties. For example, in California, the process involves an online application through the California Department of Tax and Fee Administration (CDTFA) website, requiring information such as your business’s legal structure, address, and principal business activity.

Sales Tax Return Filing and Payment Procedures

Filing sales tax returns and remitting payments typically involve online portals provided by each state’s tax agency. The frequency of filing varies by state (monthly, quarterly, or annually), and deadlines must be strictly adhered to. Each state’s portal usually provides instructions, forms, and payment options. Accurate record-keeping is vital for preparing accurate returns. Failure to file or pay on time will likely result in penalties and interest charges. For example, New York State uses a system where businesses can file and pay electronically through their online portal, requiring a detailed breakdown of sales and tax collected.

Common Sales Tax Compliance Issues and Solutions

Common compliance issues include miscalculating tax rates, incorrectly identifying taxable items, and failing to register in states where nexus exists. Miscalculating tax rates can result from using outdated information or failing to account for local tax rates. Incorrectly identifying taxable items often stems from a lack of understanding of state-specific exemptions and rules. Failure to register in states where nexus exists is a serious issue, often leading to significant back taxes and penalties. Solutions include regularly updating tax rate information, utilizing tax compliance software, and seeking professional advice when needed. Proactive measures like regularly reviewing state tax laws and seeking professional assistance can prevent many compliance issues.

Penalties for Non-Compliance

Penalties for non-compliance with state sales tax laws vary widely but generally include interest charges on unpaid taxes, late filing penalties, and potentially legal action. The severity of penalties often depends on the nature and extent of the non-compliance. For instance, intentionally evading taxes can result in far more severe penalties than unintentional errors. These penalties can significantly impact a business’s financial stability. For example, a consistent failure to file in multiple states could result in substantial penalties and legal repercussions, potentially impacting credit ratings and business operations.

Understanding Sales Tax Thresholds and Exemptions

Navigating the complexities of sales tax for e-commerce businesses often involves understanding critical thresholds and exemptions. These factors significantly impact your registration requirements and ultimately, your tax liability. Failure to properly understand these aspects can lead to penalties and legal issues. This section clarifies these crucial elements.

Sales Tax Thresholds and Registration Requirements

Each state establishes a sales tax threshold, representing the amount of sales within that state that triggers the requirement for e-commerce businesses to register and collect sales tax. These thresholds vary considerably. For example, some states may require registration if your business makes even a single dollar of sales within their borders, while others might have thresholds in the tens or even hundreds of thousands of dollars. It’s crucial to consult each state’s specific Department of Revenue website to determine its threshold. Failing to register when required can result in significant penalties. These thresholds are not static; they may be adjusted periodically by the respective state governments. Businesses should actively monitor these changes to maintain compliance.

Types of Sales Tax Exemptions

Several categories of sales are typically exempt from sales tax. These exemptions aim to alleviate the tax burden on specific goods or services deemed essential or socially beneficial. Common exemptions include those for groceries, prescription medications, and certain educational materials. However, the specific goods and services exempt vary widely by state. Some states might offer exemptions for agricultural products or specific manufacturing equipment. Understanding which products or services your business offers that fall under these exemptions is vital for accurate tax calculation and reporting.

Examples of Sales Tax Exemptions

A bookstore selling textbooks to a university might qualify for a sales tax exemption on those sales, depending on the state’s regulations. Similarly, a company selling medical supplies to a hospital could benefit from exemptions. A farmer selling produce directly to consumers at a farmers market might also be exempt from sales tax in certain states. However, it’s essential to note that the specifics of these exemptions are highly state-dependent and can be complex, necessitating careful review of each state’s regulations.

State-by-State Variations in Sales Tax Thresholds and Exemptions

The landscape of sales tax thresholds and exemptions differs significantly across states. Some states may have relatively high thresholds and limited exemptions, while others may have lower thresholds and a broader range of exemptions. For instance, State A might have a $100,000 annual sales threshold and only exempt groceries, while State B might have a $50,000 threshold and exempt both groceries and prescription medications. This variation necessitates a meticulous state-by-state approach to compliance. There is no single, universal standard.

Determining Sales Tax Applicability: A Flowchart

The following flowchart illustrates the decision-making process for determining sales tax applicability:

[Imagine a flowchart here. The flowchart would start with “Sale Made?” Yes leads to “Nexus Established?” Yes leads to “Exemption Applies?” Yes leads to “No Sales Tax,” No leads to “Sales Tax Applies.” No to “Sale Made?” leads to “No Sales Tax.” Each decision point would have arrows leading to the appropriate next step. The flowchart would visually represent the steps a business should take to determine whether sales tax applies to a particular transaction.]

Strategies for Streamlining Sales Tax Compliance

Managing sales tax for an e-commerce business can feel overwhelming, especially as you expand into new states. However, implementing effective strategies can significantly simplify the process, reduce risks, and ultimately save you time and money. This section Artikels practical approaches to streamline your sales tax compliance and minimize potential issues.

Centralized Sales Tax Management

A crucial step in streamlining sales tax compliance is establishing a centralized system for managing all your sales tax-related data. This could involve using dedicated sales tax software (discussed earlier) or implementing robust accounting procedures that clearly separate sales tax liabilities by state. A centralized system ensures accuracy, prevents errors caused by disparate data sources, and simplifies reporting. For example, instead of relying on spreadsheets for each state, a centralized system provides a single, easily accessible source of truth for all sales tax information.

Automated Sales Tax Calculations

Integrating automated sales tax calculations directly into your e-commerce platform is a game-changer. This eliminates manual calculations, reducing the risk of human error and saving valuable time. Many e-commerce platforms offer built-in integrations with sales tax software or APIs that automatically calculate and apply the correct tax rate based on the customer’s shipping address. This ensures accurate tax collection at the point of sale, preventing discrepancies and potential penalties. For example, if a customer is in a state with a 6% sales tax and purchases a $100 item, the system automatically adds $6 in tax to the order total.

Regular Sales Tax Audits and Reviews

Proactive measures are key to minimizing the risk of sales tax audits. Regular internal audits of your sales tax records help identify and correct any inconsistencies or errors before they become major problems. This includes verifying the accuracy of tax rates, reviewing exemption certificates, and ensuring proper record-keeping. Regular reviews of your sales tax procedures can also reveal areas for improvement and highlight potential vulnerabilities. For example, a quarterly internal review could compare your calculated tax liabilities against actual tax payments to identify discrepancies.

Effective Multi-State Sales Tax Management

Expanding into multiple states significantly increases the complexity of sales tax compliance. However, effective strategies can help manage this complexity. This includes using sales tax software that supports multi-state calculations, maintaining detailed records for each state, and staying updated on individual state regulations. Consider creating a state-by-state compliance calendar to track deadlines for filing and paying taxes. For instance, a calendar could remind you of the due date for filing your sales tax return in California, which might differ from the due date in New York.

Sales Tax Compliance Checklist

A comprehensive checklist ensures all aspects of sales tax compliance are addressed consistently. This checklist should include steps such as:

- Regularly update your sales tax nexus information.

- Verify the accuracy of tax rates applied to each sale.

- Properly file and pay sales tax returns on time.

- Maintain detailed records of all sales, including customer addresses and tax rates.

- Obtain and maintain exemption certificates for eligible customers.

- Conduct regular internal audits of sales tax procedures.

- Stay informed about changes in state sales tax laws and regulations.

Using a checklist helps create a standardized process, minimizing the chance of overlooking crucial steps in the compliance process. This structured approach contributes to a more efficient and accurate system.

Final Review

Mastering online sales tax compliance is a journey, not a destination. By understanding the core principles of sales tax nexus, accurately identifying taxable items, leveraging the power of sales tax software, and diligently maintaining records, e-commerce businesses can build a strong foundation for long-term success. Remember to regularly review state sales tax laws and regulations, and consider seeking professional advice when facing complex scenarios. Proactive compliance not only avoids penalties but also fosters a trustworthy relationship with your customers and the authorities, ensuring your business thrives in the ever-evolving landscape of e-commerce.

Essential Questionnaire

What happens if I don’t register for sales tax in a state where I have nexus?

Failure to register can result in significant penalties, including back taxes, interest, and potential legal action.

Can I deduct sales taxes paid on business purchases?

Generally, yes, sales taxes paid on purchases for business purposes are often deductible as a business expense.

How often do I need to file sales tax returns?

Filing frequency varies by state; it’s usually monthly, quarterly, or annually.

What if I make a mistake on my sales tax return?

Most states allow for amended returns to correct errors. Contact the relevant state tax agency for guidance.