How to Read Financial Statements Like a Pro unveils the secrets to understanding the language of finance. This comprehensive guide demystifies balance sheets, income statements, and cash flow statements, empowering you to analyze a company’s financial health with confidence. We’ll explore key ratios, profitability metrics, and forecasting techniques, transforming you from a financial novice into a seasoned interpreter of corporate performance.

From identifying liquidity and solvency issues to predicting future trends, you’ll learn to navigate the complexities of financial reports. This journey will equip you with the skills to make informed investment decisions, assess business viability, and confidently evaluate financial data in any context. We’ll cover everything from the fundamental principles to advanced analysis techniques, ensuring you grasp the intricacies of financial statement analysis.

Understanding the Basics of Financial Statements

Financial statements are the cornerstone of understanding a company’s financial health. They provide a structured overview of a company’s performance, position, and cash flows, allowing investors, creditors, and management to make informed decisions. Mastering their interpretation is crucial for anyone seeking to navigate the world of finance.

The Balance Sheet

The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity. Assets represent what a company owns (cash, accounts receivable, property, plant, and equipment), liabilities represent what a company owes (accounts payable, loans), and equity represents the owners’ stake in the company (retained earnings, common stock). Analyzing the balance sheet reveals a company’s financial structure and its ability to meet its short-term and long-term obligations. For example, a high debt-to-equity ratio might indicate a higher financial risk.

The Income Statement

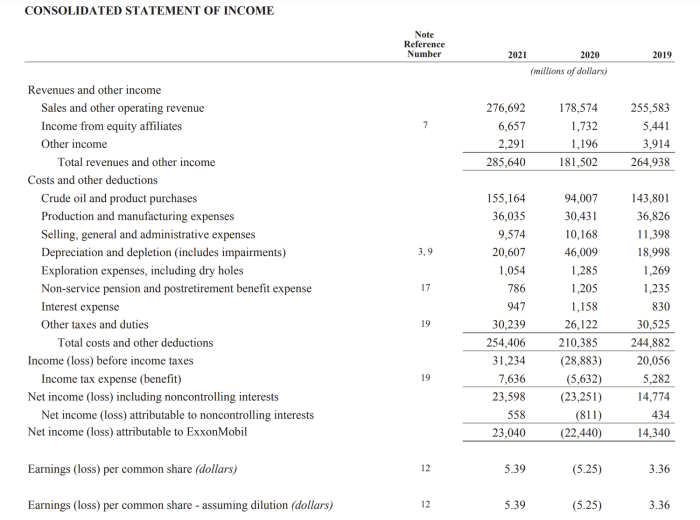

The income statement, also known as the profit and loss (P&L) statement, summarizes a company’s revenues and expenses over a specific period. It shows the company’s profitability by calculating net income (or net loss). Key components include revenues (sales), cost of goods sold (COGS), operating expenses (salaries, rent), and other income and expenses. Analyzing the income statement helps assess a company’s profitability trends, operational efficiency, and pricing strategies. A consistently declining gross profit margin, for example, could signal issues with cost control or pricing pressure.

The Cash Flow Statement

The cash flow statement tracks the movement of cash both into and out of a company over a specific period. It categorizes cash flows into three main activities: operating activities (cash from core business operations), investing activities (cash from buying or selling assets), and financing activities (cash from debt, equity, or dividends). This statement provides insights into a company’s liquidity and its ability to generate cash. Analyzing cash flow reveals if a company is generating sufficient cash to cover its expenses, reinvest in its business, and repay its debts. A consistently negative cash flow from operations, despite positive net income, might suggest issues with accounts receivable collection or inventory management.

Relationships Between Financial Statements

The three core financial statements are interconnected. Net income from the income statement flows into retained earnings on the balance sheet. Cash flows from the cash flow statement impact the cash balance on the balance sheet. Changes in balance sheet accounts (like accounts receivable or inventory) are reflected in the cash flow statement. Understanding these interrelationships provides a holistic view of a company’s financial performance and health. For instance, a significant increase in accounts receivable on the balance sheet could indicate slower collections, which would then negatively affect the cash flow from operations.

Industry-Specific Differences in Financial Statement Presentation

Different industries have unique characteristics that affect how their financial statements are presented. For example, a manufacturing company will have significant investments in property, plant, and equipment (PP&E) reflected on its balance sheet, while a technology company might have more intangible assets like intellectual property. A retail company’s income statement will heavily emphasize cost of goods sold, while a service-based company will focus on operating expenses. These differences highlight the importance of industry-specific benchmarks and comparisons when analyzing financial statements.

Comparison of Financial Statements

| Statement | Purpose | Key Metrics | Primary Users |

|---|---|---|---|

| Balance Sheet | Shows a company’s financial position at a specific point in time. | Current Ratio, Debt-to-Equity Ratio, Working Capital | Investors, Creditors, Management |

| Income Statement | Summarizes a company’s revenues and expenses over a period of time. | Gross Profit Margin, Net Profit Margin, Return on Equity (ROE) | Investors, Analysts, Management |

| Cash Flow Statement | Tracks the movement of cash into and out of a company over a period of time. | Free Cash Flow, Operating Cash Flow, Cash Ratio | Investors, Creditors, Management |

Analyzing the Balance Sheet

The balance sheet, a snapshot of a company’s financial position at a specific point in time, provides crucial insights into its liquidity, solvency, and overall financial health. Analyzing this statement allows investors and creditors to assess a company’s ability to meet its short-term and long-term obligations. Understanding the interplay between assets, liabilities, and equity is fundamental to a comprehensive financial analysis.

Liquidity and Solvency Evaluation

Liquidity refers to a company’s ability to meet its short-term obligations, while solvency reflects its ability to meet its long-term obligations. Several ratios derived from the balance sheet help assess these aspects. For instance, the current ratio (Current Assets / Current Liabilities) indicates the extent to which current assets can cover current liabilities. A higher ratio suggests stronger liquidity. The quick ratio ( (Current Assets – Inventory) / Current Liabilities) offers a more conservative measure, excluding less liquid inventory. Solvency is often assessed using the debt-to-equity ratio (Total Debt / Total Equity), revealing the proportion of financing from debt versus equity. A high ratio suggests higher financial risk. Furthermore, the times interest earned ratio (EBIT / Interest Expense) measures the company’s ability to cover its interest payments.

Working Capital and its Components

Working capital, calculated as Current Assets minus Current Liabilities, represents the funds available for a company’s day-to-day operations. Its components—current assets (cash, accounts receivable, inventory) and current liabilities (accounts payable, short-term debt)—directly influence a company’s operational efficiency and short-term financial flexibility. Sufficient working capital is vital for smooth operations, ensuring the company can meet its immediate obligations and take advantage of business opportunities. Insufficient working capital can lead to operational disruptions and financial distress. For example, a company with high inventory levels might face liquidity issues if it cannot convert that inventory into cash quickly enough.

Significance of Different Asset and Liability Types

Different types of assets and liabilities carry varying degrees of liquidity and risk. Current assets, readily convertible to cash within a year, include cash, accounts receivable, and inventory. Non-current assets, such as property, plant, and equipment (PP&E), represent long-term investments. Similarly, current liabilities, due within a year, include accounts payable and short-term debt, while non-current liabilities encompass long-term debt and deferred revenue. Understanding the composition of these assets and liabilities is crucial for evaluating a company’s financial strength and risk profile. For instance, a high proportion of intangible assets might signal high growth potential but also increased uncertainty. A large amount of long-term debt might indicate a high level of financial leverage and associated risk.

Key Balance Sheet Ratios and Interpretations

| Ratio | Formula | Interpretation | Example |

|---|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures short-term liquidity; higher is generally better. | A current ratio of 2.0 suggests the company has twice the current assets to cover its current liabilities. |

| Quick Ratio | (Current Assets – Inventory) / Current Liabilities | A more conservative measure of liquidity, excluding inventory. | A quick ratio of 1.5 indicates a strong ability to meet short-term obligations even without liquidating inventory. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Indicates the proportion of financing from debt; higher ratios suggest higher financial risk. | A debt-to-equity ratio of 0.5 means that for every $1 of equity, the company has $0.5 of debt. |

| Times Interest Earned | EBIT / Interest Expense | Measures the company’s ability to cover interest payments; higher is better. | A times interest earned ratio of 5.0 suggests the company’s earnings are five times its interest expense. |

Deciphering the Income Statement

The income statement, also known as the profit and loss (P&L) statement, provides a snapshot of a company’s financial performance over a specific period, typically a quarter or a year. Unlike the balance sheet, which shows a company’s financial position at a single point in time, the income statement tracks revenues, expenses, and ultimately, profitability. Understanding how to interpret this statement is crucial for assessing a company’s financial health and its potential for future growth.

Key Profitability Ratios

Profitability ratios are essential tools for evaluating a company’s ability to generate profits from its operations. These ratios provide a standardized way to compare a company’s performance across different periods and against its competitors. Several key ratios offer valuable insights.

- Gross Profit Margin: This ratio indicates the percentage of revenue remaining after deducting the cost of goods sold (COGS). It’s calculated as:

Gross Profit Margin = (Revenue – COGS) / Revenue * 100%

A higher gross profit margin suggests efficient cost management in production or procurement.

- Operating Profit Margin: This ratio measures profitability after considering both COGS and operating expenses (such as salaries, rent, and utilities). It’s calculated as:

Operating Profit Margin = Operating Income / Revenue * 100%

A higher operating profit margin signifies effective management of overall operations.

- Net Profit Margin: This is the ultimate measure of profitability, representing the percentage of revenue remaining after all expenses, including taxes and interest, are deducted. It’s calculated as:

Net Profit Margin = Net Income / Revenue * 100%

A higher net profit margin indicates strong overall financial performance.

Analyzing Revenue Growth and Cost Structures

Analyzing revenue growth and cost structures is vital for understanding a company’s profitability trends. Consistent revenue growth indicates strong market demand and effective sales strategies. However, merely increasing revenue isn’t sufficient; it’s equally important to manage costs effectively.

For example, a company might experience rapid revenue growth but simultaneously see its profit margins shrink due to escalating operating expenses. Analyzing the relationship between revenue growth and cost increases (e.g., fixed costs versus variable costs) helps determine whether the growth is sustainable and profitable. A company with a high proportion of fixed costs might struggle to maintain profitability during economic downturns, while a company with a high proportion of variable costs may be more flexible and adaptable.

Income Statement Formats

While the core elements remain consistent, income statements can be presented in slightly different formats. The single-step format simply lists all revenues and then all expenses, resulting in a net income figure. The multi-step format breaks down revenues and expenses into various categories, providing a more detailed view of profitability at different operational stages (e.g., gross profit, operating income, and net income). The choice of format doesn’t alter the underlying financial data but affects the presentation and ease of interpretation. A multi-step format generally offers more granular insights.

Analyzing Gross Profit Margin, Operating Profit Margin, and Net Profit Margin

Let’s illustrate the analysis of these margins with a hypothetical example. Company A has revenue of $1,000,000, COGS of $400,000, operating expenses of $200,000, and net income of $200,000.

Its Gross Profit Margin is ($1,000,000 – $400,000) / $1,000,000 * 100% = 60%. Its Operating Profit Margin is ($1,000,000 – $400,000 – $200,000) / $1,000,000 * 100% = 40%. Finally, its Net Profit Margin is $200,000 / $1,000,000 * 100% = 20%. This shows a healthy gross profit margin, suggesting efficient cost management in production. The operating profit margin indicates a significant portion of revenue is consumed by operating expenses. The lower net profit margin, compared to the gross and operating margins, points towards significant interest and tax expenses. Comparing these margins across different periods or against competitors provides a more comprehensive understanding of the company’s performance and financial health.

Mastering the Cash Flow Statement: How To Read Financial Statements Like A Pro

The cash flow statement provides a crucial insight into a company’s liquidity and financial health, offering a different perspective than the balance sheet and income statement. Unlike accrual accounting used in the income statement, the cash flow statement focuses solely on the actual cash inflows and outflows during a specific period. Understanding this statement is essential for assessing a company’s ability to meet its short-term obligations, fund its operations, and invest in future growth.

The Three Sections of the Cash Flow Statement

The cash flow statement is divided into three primary sections: operating activities, investing activities, and financing activities. These sections provide a comprehensive overview of where a company’s cash is coming from and where it’s going. Analyzing each section individually, and then collectively, paints a complete picture of the company’s cash management.

Analyzing Cash Flow from Operations

Cash flow from operations reflects the cash generated from a company’s core business activities. A strong positive cash flow from operations indicates a healthy and profitable business capable of self-sustaining operations. Conversely, consistently negative operating cash flow raises significant concerns about the company’s ability to remain solvent. Analyzing this section involves examining the specific sources and uses of cash related to sales, purchases, and operating expenses. For example, a high increase in accounts receivable could indicate slow collections, impacting the operating cash flow negatively despite strong sales. Similarly, a significant decrease in accounts payable could signal strained supplier relationships or difficulties in managing working capital.

Methods for Assessing a Company’s Ability to Generate Cash

Several key ratios and metrics can be used to assess a company’s cash-generating capabilities. The operating cash flow to revenue ratio, for example, shows the percentage of revenue converted into cash. A higher ratio generally suggests better cash management and operational efficiency. Another important metric is the operating cash flow to current liabilities ratio, which indicates the company’s ability to cover its short-term debts with operating cash flow. Analyzing these ratios in conjunction with the trend analysis of operating cash flow over several periods provides a holistic view of the company’s cash generation capacity. For instance, a company consistently showing an increasing operating cash flow to revenue ratio over the past five years suggests improving efficiency and profitability.

Analyzing Free Cash Flow and its Importance in Valuation

Free cash flow (FCF) represents the cash available to a company after covering all operating expenses and capital expenditures. It is a crucial metric for valuing a company, as it reflects the cash available for distribution to shareholders, debt repayment, or reinvestment in the business.

A step-by-step guide to analyzing free cash flow:

1. Calculate Operating Cash Flow: This is typically found directly on the cash flow statement.

2. Determine Capital Expenditures (CAPEX): This information is usually found on the cash flow statement or in the company’s notes to the financial statements. CAPEX represents investments in property, plant, and equipment.

3. Calculate Free Cash Flow (FCF): The formula is:

FCF = Operating Cash Flow – Capital Expenditures

4. Analyze the Trend: Examine the FCF over several years to identify trends and patterns. A consistently increasing FCF suggests a healthy and growing business.

5. Compare to Peers: Compare the company’s FCF to its competitors to assess its relative performance and valuation.

6. Valuation Implications: FCF is a key input in various valuation models, such as the discounted cash flow (DCF) analysis. A higher FCF generally leads to a higher valuation. For example, a company with a consistently high FCF might command a higher stock price than a company with low or inconsistent FCF, even if their net income is similar. This is because FCF directly reflects the company’s ability to generate cash, which is ultimately what investors seek.

Ratio Analysis and Key Performance Indicators (KPIs)

Ratio analysis is a crucial tool for investors and financial analysts to assess a company’s financial health and performance. By examining the relationships between different line items on the financial statements, we can gain valuable insights into a company’s liquidity, solvency, profitability, and efficiency. These insights allow for a more informed assessment of the company’s past performance and future potential. Understanding these ratios is essential for making sound investment decisions.

Liquidity Ratios, How to Read Financial Statements Like a Pro

Liquidity ratios measure a company’s ability to meet its short-term obligations. These ratios are particularly important for creditors and suppliers who need to assess the likelihood of timely payments. A company with strong liquidity is less likely to experience financial distress.

Key liquidity ratios include the Current Ratio and the Quick Ratio. The Current Ratio is calculated by dividing current assets by current liabilities:

Current Ratio = Current Assets / Current Liabilities

. A higher current ratio generally indicates better liquidity. The Quick Ratio, also known as the Acid-Test Ratio, is a more stringent measure, excluding inventory from current assets:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

. This provides a more conservative view of a company’s immediate ability to meet its short-term obligations.

Explore the different advantages of How to Improve Business Cash Flow with Smart Accounting that can change the way you view this issue.

Solvency Ratios

Solvency ratios gauge a company’s ability to meet its long-term obligations. These ratios provide insights into the company’s financial leverage and its capacity to withstand economic downturns. Investors use solvency ratios to assess the risk associated with lending to or investing in a company.

A common solvency ratio is the Debt-to-Equity Ratio, which measures the proportion of a company’s financing that comes from debt versus equity:

Debt-to-Equity Ratio = Total Debt / Total Equity

. A high debt-to-equity ratio indicates higher financial risk, as the company relies heavily on debt financing. Another important ratio is the Times Interest Earned ratio, which assesses a company’s ability to cover its interest expenses with its earnings:

Times Interest Earned = Earnings Before Interest and Taxes (EBIT) / Interest Expense

. A higher ratio indicates better ability to service its debt.

Profitability Ratios

Profitability ratios reveal how effectively a company generates profits from its operations. These ratios are critical for investors evaluating the return on their investment and assessing the overall financial health of the business. Analyzing profitability ratios alongside other metrics provides a comprehensive understanding of a company’s performance.

Examples of profitability ratios include Gross Profit Margin, which measures the profitability of sales after deducting the cost of goods sold:

Gross Profit Margin = (Revenue – Cost of Goods Sold) / Revenue

. Net Profit Margin shows the percentage of revenue remaining as profit after all expenses are deducted:

Net Profit Margin = Net Income / Revenue

. Return on Equity (ROE) measures the return generated on shareholders’ investments:

Return on Equity (ROE) = Net Income / Shareholder Equity

. A higher ROE generally indicates better management of shareholder investments.

Efficiency Ratios

Efficiency ratios, also known as activity ratios, assess how effectively a company manages its assets and liabilities. These ratios help investors understand how efficiently a company utilizes its resources to generate sales and profits. Improving efficiency often leads to enhanced profitability and a stronger financial position.

Examples of efficiency ratios include Inventory Turnover, which measures how many times a company sells and replaces its inventory during a period:

Inventory Turnover = Cost of Goods Sold / Average Inventory

. A higher turnover suggests efficient inventory management. Days Sales Outstanding (DSO) indicates the average number of days it takes a company to collect payment from its customers:

Days Sales Outstanding (DSO) = (Accounts Receivable / Revenue) * Number of Days in Period

. A lower DSO indicates efficient credit and collection processes.

Key Financial Ratios Summary

The following table summarizes key financial ratios and their formulas. Remember that these ratios should be analyzed in context and compared to industry averages and historical trends for a comprehensive assessment.

| Ratio Category | Ratio Name | Formula | Interpretation |

|---|---|---|---|

| Liquidity | Current Ratio | Current Assets / Current Liabilities | Higher is better, indicates ability to meet short-term obligations. |

| Liquidity | Quick Ratio | (Current Assets – Inventory) / Current Liabilities | Higher is better, more conservative measure of short-term liquidity. |

| Solvency | Debt-to-Equity Ratio | Total Debt / Total Equity | Lower is better, indicates lower financial risk. |

| Solvency | Times Interest Earned | EBIT / Interest Expense | Higher is better, indicates ability to cover interest expenses. |

| Profitability | Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Higher is better, indicates profitability of sales. |

| Profitability | Net Profit Margin | Net Income / Revenue | Higher is better, indicates overall profitability. |

| Profitability | Return on Equity (ROE) | Net Income / Shareholder Equity | Higher is better, indicates return on shareholder investment. |

| Efficiency | Inventory Turnover | Cost of Goods Sold / Average Inventory | Higher is better, indicates efficient inventory management. |

| Efficiency | Days Sales Outstanding (DSO) | (Accounts Receivable / Revenue) * Number of Days in Period | Lower is better, indicates efficient credit and collection. |

Financial Statement Trends and Forecasting

Analyzing trends and forecasting future performance are crucial skills for anyone aiming to master financial statement analysis. By understanding historical patterns and applying appropriate forecasting techniques, you can gain valuable insights into a company’s financial health and potential future success. This involves examining historical data, incorporating industry benchmarks, and considering macroeconomic factors.

Analyzing trends in financial statements involves comparing figures across multiple periods to identify patterns and potential issues. This longitudinal view reveals growth rates, profitability changes, and shifts in financial structure, providing a more comprehensive picture than a single snapshot in time. For example, a consistent decline in gross profit margin over several years might indicate pricing pressure or rising input costs, requiring further investigation. Similarly, an upward trend in accounts receivable could suggest problems with collections or a loosening of credit policies.

Trend Analysis Techniques

Trend analysis can be conducted using various methods, including percentage change calculations, graphical representations (like line charts), and regression analysis. Percentage change calculations highlight the rate of growth or decline in key financial metrics. Graphical representations visually illustrate these trends, making them easier to identify and interpret. Regression analysis, a more sophisticated statistical technique, can identify the relationship between variables and predict future values based on historical data. For example, plotting revenue figures over five years on a line chart clearly demonstrates revenue growth or decline. Calculating the percentage change in revenue year-over-year provides a quantitative measure of that growth.

Forecasting Future Financial Performance

Forecasting involves projecting future financial performance based on historical data, industry trends, and management expectations. Several methods exist, ranging from simple percentage growth assumptions to complex econometric models. Simple methods, such as applying a consistent growth rate to past revenue, are suitable for stable businesses with predictable growth. More complex models incorporate multiple factors and can provide more accurate projections, but require more data and expertise. A common approach involves using a combination of historical data and management projections. For example, a company might forecast next year’s sales based on historical sales growth and anticipated market share changes.

The Importance of Industry Benchmarks and Economic Conditions

Industry benchmarks provide a comparative perspective on a company’s financial performance. Comparing a company’s key ratios (such as profitability margins or debt-to-equity ratios) to its industry peers helps to identify areas of relative strength or weakness. Economic conditions significantly influence a company’s performance. Recessions can reduce demand, while periods of economic expansion can boost sales. Therefore, incorporating macroeconomic factors (like interest rates, inflation, and unemployment) into financial forecasts is essential for accuracy. For instance, a company in the construction industry might experience reduced profitability during a recession due to decreased construction activity.

Creating a Simple Financial Model

A simple financial model can be created using a spreadsheet program. This model might project future revenue, expenses, and profits based on historical data and assumptions about future growth rates. For example, a simple model could project revenue growth at a consistent rate, project cost of goods sold as a percentage of revenue, and estimate operating expenses based on historical trends. The model then calculates projected net income and cash flow. This model should include sensitivity analysis to understand how changes in key assumptions affect the projected results. For instance, varying the assumed revenue growth rate by plus or minus 5% would illustrate the impact on projected profitability.

Interpreting Financial Statement Footnotes and Disclosures

Financial statement footnotes and disclosures are often overlooked, yet they provide crucial context and detail that significantly impact the interpretation of the main financial statements. A thorough review is essential for a complete and accurate understanding of a company’s financial health and performance. Ignoring these supplemental details can lead to misinterpretations and flawed investment decisions.

The information contained within footnotes expands upon the summarized data presented in the balance sheet, income statement, and cash flow statement. These disclosures clarify accounting methods used, provide details on significant transactions, and reveal potential risks and uncertainties. This additional information is vital for a comprehensive analysis, allowing for a more nuanced understanding of a company’s financial position and future prospects.

Significant Accounting Policies and Their Impact

Accounting policies dictate how a company records and reports its financial transactions. The choice of accounting methods can materially affect the reported figures. For example, the method used for inventory valuation (FIFO, LIFO, weighted-average cost) directly influences the cost of goods sold and ultimately, net income. Similarly, the depreciation method selected for fixed assets impacts the reported net income and asset values over time. Footnotes clearly Artikel the specific accounting policies adopted by the company, enabling analysts to assess the impact of these choices on the reported financial data. A company choosing accelerated depreciation, for instance, will report lower net income in the early years of an asset’s life compared to using straight-line depreciation. This impacts tax liabilities and reported profitability.

Examples of Common Accounting Methods and Their Implications

Several common accounting methods significantly influence financial statement interpretation. The choice of revenue recognition method, for example, determines when revenue is recorded. Using the accrual basis of accounting, revenue is recognized when earned, regardless of when cash is received. In contrast, the cash basis recognizes revenue only when cash is received. This difference can significantly impact the reported revenue figures, particularly for companies with significant credit sales. Another crucial area is the treatment of intangible assets. The method used to amortize or write down these assets directly impacts the reported profitability and net asset value. A company choosing a shorter amortization period for its intangible assets will report lower net income in the short term, but a higher net income in the long term, compared to a company using a longer period.

Understanding Debt Covenants and Contingencies

Footnotes often disclose details about debt covenants, which are agreements between a company and its lenders that stipulate certain financial ratios or performance metrics that must be maintained. Failure to meet these covenants can trigger default and have severe consequences. Furthermore, footnotes detail contingencies, which are potential future events that could significantly affect the company’s financial position. These might include pending lawsuits, environmental liabilities, or potential losses from guarantees. Understanding these disclosures is critical for assessing the company’s risk profile. For example, a company facing a significant lawsuit might disclose this in the footnotes, providing an estimate of the potential liability. This information allows investors to adjust their assessment of the company’s financial strength accordingly.

Analyzing Related Party Transactions

Related party transactions involve transactions between a company and its affiliates, subsidiaries, or key executives. These transactions can be complex and may not always be conducted at arm’s length. Footnotes provide details on the nature and value of these transactions, allowing analysts to assess whether they are beneficial or detrimental to the company. For instance, a transaction with a related party that appears to be unusually favorable might raise concerns about potential conflicts of interest. These disclosures help investors evaluate the independence and objectivity of the company’s financial reporting.

Visualizing Financial Data

Effective visualization is crucial for understanding complex financial information. Transforming raw numbers into clear, concise visuals allows for quicker identification of trends, patterns, and anomalies, ultimately improving decision-making. This section will guide you through creating impactful charts and graphs to represent financial data, highlighting key techniques and best practices.

Chart and Graph Selection for Financial Data

The choice of chart or graph depends heavily on the type of data being presented and the message you wish to convey. For instance, line charts are ideal for showcasing trends over time, such as revenue growth or expense fluctuations. Bar charts are effective for comparing discrete data points, like comparing sales across different product lines or regions. Pie charts effectively illustrate proportions, such as the breakdown of assets or liabilities. Scatter plots are useful for identifying correlations between two variables, for example, the relationship between marketing spend and sales revenue. Choosing the right chart type significantly enhances the clarity and impact of your visualization.

Creating Visualizations to Highlight Key Trends and Insights

To effectively highlight key trends and insights, focus on simplicity and clarity. Avoid cluttering charts with excessive data points or labels. Use clear and concise titles and axis labels. Employ consistent color schemes and fonts to maintain visual coherence. Highlight significant data points or trends using annotations or callouts. For example, if showcasing a period of significant revenue growth, use a different color or highlight that section of the line chart to draw attention to it. Consider using trend lines to emphasize long-term patterns and projections.

Effective Data Visualization Techniques for Financial Statements

Several techniques enhance the effectiveness of visualizing financial statement data. For instance, when visualizing the balance sheet, a stacked bar chart can effectively show the proportion of assets, liabilities, and equity over time. For the income statement, a line chart illustrating revenue and expenses side-by-side clearly displays profitability trends. For the cash flow statement, a waterfall chart can visually represent the changes in cash balance over a period, highlighting inflows and outflows. Using color-coding to differentiate positive and negative cash flows further enhances understanding. Furthermore, combining multiple visualizations to show the interconnectedness of different financial statements provides a holistic view of the company’s financial health. For example, a dashboard could show a line chart of revenue growth alongside a bar chart comparing key profitability ratios.

Step-by-Step Guide to Creating a Visually Appealing and Informative Dashboard

Creating a financial dashboard involves a structured approach.

- Define Objectives: Clearly Artikel the key performance indicators (KPIs) you want to track and the insights you aim to gain. This will guide your chart selection and data organization.

- Data Collection and Preparation: Gather the necessary financial data from the statements and other relevant sources. Clean and organize the data to ensure accuracy and consistency.

- Chart Selection and Design: Choose appropriate chart types for each KPI, considering the type of data and the message to be conveyed. Maintain a consistent visual style across all charts.

- Dashboard Layout and Organization: Arrange the charts logically, ensuring a clear flow of information. Use whitespace effectively to avoid cluttering the dashboard. Consider grouping related KPIs together.

- Interactive Elements (Optional): Incorporate interactive elements like dropdowns or filters to allow users to explore the data in more detail. This can be particularly useful for larger datasets.

- Testing and Refinement: Test the dashboard with users to gather feedback and identify areas for improvement. Refine the design and layout based on the feedback received.

For example, a well-designed dashboard might include a line chart showing revenue growth over the past five years, a bar chart comparing gross profit margins across different product lines, and a key ratio analysis table summarizing liquidity, profitability, and solvency metrics. The dashboard should provide a comprehensive overview of the company’s financial performance at a glance.

Summary

Mastering financial statement analysis is a powerful skill, unlocking a deeper understanding of business performance and investment opportunities. By applying the techniques and insights presented in this guide, you’ll be able to confidently assess a company’s financial health, identify potential risks and rewards, and make data-driven decisions. Whether you’re an investor, entrepreneur, or simply curious about the world of finance, this knowledge will provide you with a significant competitive advantage. Embrace the power of financial literacy and embark on a journey towards financial proficiency.

FAQ Explained

What is the difference between accrual and cash accounting?

Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when cash changes hands. Cash accounting recognizes revenue and expenses only when cash is received or paid.

How do I interpret a negative cash flow from operations?

A negative cash flow from operations doesn’t automatically indicate a problem. It could be due to factors like significant capital expenditures or changes in working capital. Further investigation is needed to determine the underlying cause.

What are some common red flags to watch for in financial statements?

Red flags include rapidly increasing debt levels, declining profitability margins, inconsistent revenue growth, and significant discrepancies between reported figures and industry averages.

Where can I find financial statements for publicly traded companies?

Publicly traded companies typically file their financial statements with the Securities and Exchange Commission (SEC) and make them available on their investor relations websites.