How to Prepare a Cash Flow Statement is a crucial skill for anyone involved in financial management. Understanding cash flow is essential for assessing a business’s financial health, making informed decisions, and securing future growth. This guide provides a comprehensive overview of the process, breaking down each step into manageable components, from understanding the statement’s purpose to analyzing the final results. We will explore the three main sections—operating, investing, and financing activities—and demonstrate how to prepare a cash flow statement using both direct and indirect methods. The goal is to equip you with the knowledge and tools to confidently interpret and utilize this vital financial document.

We will cover essential concepts like cash inflows and outflows, reconciling the statement with the balance sheet, and interpreting key ratios and metrics to gain valuable insights into a company’s financial performance. Through practical examples and clear explanations, this guide aims to demystify the process of preparing a cash flow statement, making it accessible to a wide range of users, from students to seasoned professionals.

Understanding Cash Flow Statements

A cash flow statement is a crucial financial statement that provides insights into the movement of cash both into and out of a business over a specific period. Unlike the income statement, which uses accrual accounting, the cash flow statement focuses solely on actual cash transactions. Understanding cash flow is vital for assessing a company’s liquidity, solvency, and overall financial health. It helps investors, creditors, and management make informed decisions about the future of the business.

The Three Main Sections of a Cash Flow Statement

The cash flow statement is divided into three primary sections, each reflecting different aspects of a company’s cash activities: operating activities, investing activities, and financing activities. These sections provide a comprehensive picture of where cash is coming from and where it’s being used.

Operating Activities

Operating activities represent the cash inflows and outflows related to a company’s core business operations. This section focuses on the cash generated from or used in the day-to-day running of the business.

Examples of cash inflows from operating activities include:

- Cash received from customers for goods or services sold.

- Cash received from interest earned on investments.

- Cash received from rent or royalties.

Examples of cash outflows from operating activities include:

- Cash paid to suppliers for goods and services.

- Cash paid to employees for salaries and wages.

- Cash paid for rent, utilities, and other operating expenses.

Investing Activities

Investing activities pertain to the cash flows associated with acquiring or disposing of long-term assets. These assets are typically used in the business’s operations and are expected to provide benefits over a period longer than one year.

Examples of cash inflows from investing activities include:

- Cash received from the sale of property, plant, and equipment (PP&E).

- Cash received from the sale of investments.

Examples of cash outflows from investing activities include:

- Cash paid for the purchase of property, plant, and equipment (PP&E).

- Cash paid for the purchase of investments.

Financing Activities

Financing activities encompass the cash flows related to how a company raises and repays capital. This section reflects the sources of funding for the business and how that funding is managed.

Examples of cash inflows from financing activities include:

- Cash received from issuing stocks or bonds.

- Cash received from loans.

Examples of cash outflows from financing activities include:

- Cash paid for repurchasing company stock.

- Cash paid for dividend payments to shareholders.

- Cash paid to repay debt (loans).

A Simple Cash Flow Statement Template, How to Prepare a Cash Flow Statement

The following table provides a basic template for a cash flow statement. Remember that actual statements are typically more detailed.

| Activity | Cash Inflow | Cash Outflow | Net Cash Flow |

|---|---|---|---|

| Operating Activities | |||

| Investing Activities | |||

| Financing Activities | |||

| Net Increase/Decrease in Cash | |||

| Beginning Cash Balance | |||

| Ending Cash Balance |

Preparing the Operating Activities Section

The operating activities section of the cash flow statement is crucial because it shows how much cash the business generated or used from its core operations. Understanding this section is vital for assessing a company’s profitability and its ability to generate cash from its day-to-day activities. There are two primary methods for preparing this section: the direct method and the indirect method.

Direct Method of Preparing the Operating Activities Section

The direct method calculates net cash flow from operating activities by directly adding up all cash inflows and subtracting all cash outflows related to operations. This involves reviewing actual cash receipts and payments from transactions like sales, purchases, salaries, and taxes. While providing a clear picture of actual cash flows, it requires detailed records of cash transactions, which many companies don’t maintain.

Indirect Method of Preparing the Operating Activities Section

The indirect method starts with net income from the income statement and adjusts it to reflect cash flows. Non-cash items, such as depreciation and changes in working capital accounts (accounts receivable, inventory, accounts payable), are added or subtracted to arrive at net cash flow from operating activities. This method is more commonly used because it leverages readily available accounting data.

Comparison of Direct and Indirect Methods

The direct method offers a more transparent view of actual cash flows, but it is more time-consuming and data-intensive. The indirect method is easier and faster to prepare, utilizing existing accounting records, but it can be less transparent as it relies on adjustments to net income. Many users prefer the direct method for its clarity, while others find the indirect method more practical.

Examples of Calculating Net Cash Flow from Operating Activities

Let’s illustrate with a simplified example. Suppose Company A reported net income of $100,000. Using the indirect method, we would adjust this figure. If depreciation was $10,000 (added back as it’s a non-cash expense), accounts receivable increased by $5,000 (subtracted as it represents cash not yet collected), and accounts payable increased by $2,000 (added as it represents a delay in cash payments), the net cash flow from operating activities would be: $100,000 + $10,000 – $5,000 + $2,000 = $107,000.

Under the direct method, we would sum up all cash inflows (e.g., cash sales) and subtract all cash outflows (e.g., cash payments for salaries, rent). This would require detailed cash transaction records to arrive at the net cash flow from operating activities. The resulting figure might differ slightly from the indirect method due to timing differences in recording transactions.

Step-by-Step Guide to Preparing the Operating Activities Section Using the Indirect Method

A step-by-step guide to preparing the operating activities section using the indirect method involves the following:

1. Start with Net Income: Begin with the net income figure from the company’s income statement.

2. Adjust for Non-Cash Items: Add back non-cash expenses such as depreciation, amortization, and depletion. These are expenses that reduce net income but don’t involve cash outflows.

3. Account for Changes in Working Capital: Analyze changes in current assets and liabilities. Increases in current assets (e.g., accounts receivable, inventory) generally reduce cash flow, while increases in current liabilities (e.g., accounts payable) generally increase cash flow. Decreases have the opposite effect.

4. Calculate Net Cash Flow from Operating Activities: After making all the necessary adjustments, the final result is the net cash flow from operating activities. This figure represents the cash generated or used by the company’s core business operations.

Net Cash Flow from Operating Activities = Net Income + Depreciation + (Decrease in Current Assets) – (Increase in Current Assets) + (Increase in Current Liabilities) – (Decrease in Current Liabilities)

Preparing the Investing Activities Section

The investing activities section of the cash flow statement focuses on changes in long-term assets. Understanding this section provides crucial insights into a company’s capital expenditures and investments, revealing its growth strategy and long-term financial health. It shows how a company uses its resources to generate future returns.

The investing activities section reflects cash inflows and outflows related to the acquisition and disposal of long-term assets. These assets are typically used in the business’s operations and are expected to provide benefits over several years. Positive cash flows indicate investments are generating returns, while negative flows may signify expansion or capital improvements.

Common Investing Activities and Their Impact on Cash Flow

Investing activities primarily involve the purchase and sale of long-term assets. The purchase of these assets represents a cash outflow, reducing the company’s cash balance. Conversely, the sale of these assets results in a cash inflow, increasing the company’s cash balance. Understanding these opposing forces is critical for interpreting the overall financial picture.

Examples of Cash Inflows and Outflows from Investing Activities

| Activity | Cash Flow Effect | Example |

|---|---|---|

| Purchase of Property, Plant, and Equipment (PP&E) | Cash Outflow | A company spends $1 million to buy a new factory building. |

| Sale of Property, Plant, and Equipment (PP&E) | Cash Inflow | A company sells an old delivery truck for $50,000. |

| Purchase of Investments (e.g., stocks, bonds) | Cash Outflow | A company invests $200,000 in the bonds of another company. |

| Sale of Investments (e.g., stocks, bonds) | Cash Inflow | A company sells its holdings of a particular stock for $150,000, generating a profit. |

| Acquisition of another company | Cash Outflow | A company purchases a smaller competitor for $5 million. |

| Loan to another company | Cash Outflow | A company provides a $1 million loan to a subsidiary. |

| Collection of a loan | Cash Inflow | A company receives repayment of a loan, plus interest. |

Calculating Net Cash Flow from Investing Activities

The net cash flow from investing activities is calculated by summing all cash inflows and outflows related to investing activities. A positive net cash flow indicates more cash was generated from investing activities than was used, while a negative net cash flow indicates the opposite.

Net Cash Flow from Investing Activities = Total Cash Inflows – Total Cash Outflows

For example, if a company had total cash inflows of $100,000 and total cash outflows of $150,000 from investing activities, the net cash flow from investing activities would be -$50,000. This signifies a net cash outflow from investing activities during the period.

Preparing the Financing Activities Section

The financing activities section of the cash flow statement details how a company raises and uses capital. It reflects changes in the company’s long-term liabilities and equity, providing insights into its financial structure and its ability to fund operations and growth. Understanding this section is crucial for assessing a company’s financial health and its long-term sustainability.

This section focuses on cash flows related to financing sources, such as debt and equity, and how the company manages these sources. It includes both cash inflows (money coming into the company) and outflows (money leaving the company). Analyzing these flows helps investors and creditors understand the company’s reliance on debt, its ability to repay obligations, and its overall financial flexibility.

Common Financing Activities and Their Impact on Cash Flow

Financing activities primarily involve obtaining and repaying long-term capital. Issuing debt, such as bonds or loans, brings in cash, increasing the company’s financial resources. Conversely, repaying debt decreases the company’s cash balance. Issuing equity (e.g., selling shares) also increases cash, while repurchasing shares or paying dividends reduces it. The net effect of these activities on cash flow significantly impacts a company’s liquidity and financial position. For example, a company might issue bonds to fund a major expansion project, resulting in a significant cash inflow. Conversely, a company facing financial difficulties might reduce its debt by repaying loans, leading to a cash outflow.

Examples of Cash Inflows and Outflows from Financing Activities

Several transactions affect the financing activities section. Issuing bonds or taking out loans results in a cash inflow, recorded as a positive value. Conversely, repaying loan principal or buying back company stock represents a cash outflow, recorded as a negative value. Paying dividends to shareholders also leads to a cash outflow. Receiving proceeds from issuing common stock leads to a cash inflow. Consider a company that issues $10 million in bonds. This would be recorded as a $10 million cash inflow in the financing activities section. If the same company then repays $5 million in loan principal, this would be a $5 million cash outflow. Finally, if the company pays $1 million in dividends, this would represent a further $1 million cash outflow.

Calculating Net Cash Flow from Financing Activities

The net cash flow from financing activities is calculated by summing all cash inflows and outflows related to financing activities. Cash inflows are added, and cash outflows are subtracted. The result shows the overall net increase or decrease in cash from financing activities during the reporting period. A positive net cash flow indicates that the company generated more cash from financing activities than it used, while a negative net cash flow indicates the opposite. For example, if a company had $10 million in cash inflows and $6 million in cash outflows from financing activities, the net cash flow from financing activities would be $4 million. This positive net cash flow suggests the company strengthened its financial position during the period.

Steps in Preparing the Financing Activities Section

Preparing this section involves a methodical approach. First, identify all financing-related transactions during the reporting period. This includes issuing debt, repaying debt, issuing equity, repurchasing equity, and paying dividends. Second, determine the cash inflow or outflow associated with each transaction. Third, sum all cash inflows and subtract all cash outflows. The resulting figure is the net cash flow from financing activities. Finally, present this figure in the cash flow statement, clearly labeled.

- Identify all financing transactions.

- Determine the cash impact (inflow or outflow) of each transaction.

- Sum all cash inflows and subtract all cash outflows.

- Report the net cash flow from financing activities.

Reconciling the Cash Flow Statement

Reconciling the cash flow statement is a crucial step in ensuring the accuracy and reliability of a company’s financial reporting. This process verifies that the cash flow statement accurately reflects the changes in a company’s cash balance over a specific period. A properly reconciled statement provides a clear picture of the company’s liquidity and financial health.

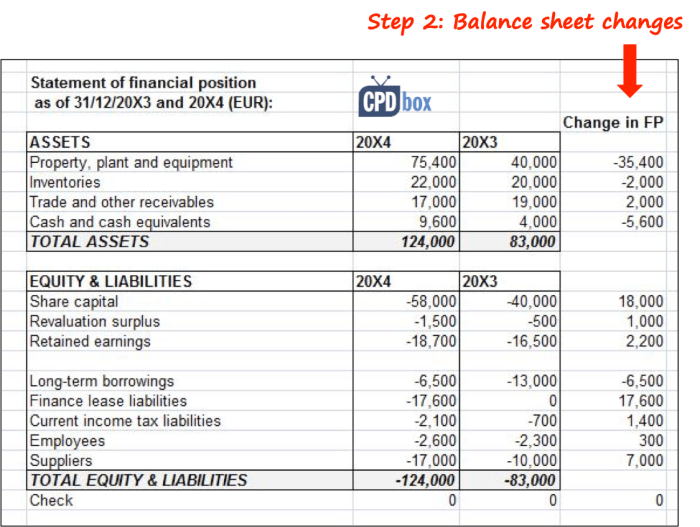

The importance of reconciling the cash flow statement with the balance sheet stems from the fundamental accounting equation: Assets = Liabilities + Equity. The cash balance reported on the balance sheet should directly correspond to the net change in cash shown on the cash flow statement. Discrepancies indicate errors in either statement, potentially impacting critical financial decisions.

Reconciling Beginning and Ending Cash Balances

The reconciliation process begins with comparing the beginning cash balance reported on the balance sheet to the ending cash balance shown on the cash flow statement. This comparison should account for all cash inflows and outflows recorded during the period. The starting point is the beginning cash balance as per the balance sheet. We then add all cash inflows from operating, investing, and financing activities as detailed in the cash flow statement. Finally, subtracting all cash outflows from these same activities should result in a figure that exactly matches the ending cash balance reported on the balance sheet.

Identifying and Correcting Discrepancies

Discrepancies between the ending cash balance per the cash flow statement and the ending cash balance per the balance sheet necessitate a thorough investigation. Common causes include errors in recording transactions, omissions, or misclassifications of cash flows. For example, a bank deposit might be recorded in the accounting system but not reflected in the cash flow statement. Conversely, a cash outflow might be wrongly categorized under the wrong activity section. The process of identification involves reviewing each transaction meticulously, cross-referencing it with supporting documentation like bank statements and accounting records. Correction involves adjusting the relevant entries in the cash flow statement and the general ledger to ensure consistency.

Reconciliation Process Illustration

Let’s imagine a simplified scenario. The beginning cash balance on the balance sheet is $10,000. The cash flow statement shows net cash inflows from operating activities of $5,000, net cash outflows from investing activities of $2,000, and net cash inflows from financing activities of $1,000. Therefore, the ending cash balance *as per the cash flow statement* is calculated as: $10,000 (Beginning Balance) + $5,000 (Operating) – $2,000 (Investing) + $1,000 (Financing) = $14,000. Now, if the ending cash balance on the balance sheet is also $14,000, the reconciliation is successful. However, if the balance sheet shows $13,500, a discrepancy of $500 exists. This requires a detailed review of all transactions to locate the $500 difference. This might involve checking for unrecorded bank charges, discrepancies in the timing of transactions, or errors in recording cash receipts or payments. Once the error is identified, it’s corrected in the relevant accounts and the cash flow statement is adjusted accordingly.

Analyzing Cash Flow Statements

Analyzing a cash flow statement provides crucial insights into a company’s liquidity, solvency, and overall financial health. Unlike the accrual-based income statement, the cash flow statement focuses on the actual cash inflows and outflows, offering a clearer picture of a company’s ability to meet its short-term and long-term obligations. Effective analysis involves examining key ratios, metrics, and trends to understand the sources and uses of cash.

Key Ratios and Metrics for Cash Flow Statement Analysis

Several key ratios and metrics derived from the cash flow statement help assess a company’s financial performance and prospects. These metrics provide a more comprehensive view than relying solely on profitability figures. Analyzing these ratios in conjunction with other financial statements enhances the accuracy of the overall financial assessment.

| Ratio | Formula | Interpretation |

|---|---|---|

| Cash Flow to Sales Ratio | Operating Cash Flow / Net Sales | Indicates the efficiency of converting sales into cash. A higher ratio suggests better cash management. |

| Cash Flow to Debt Ratio | Operating Cash Flow / Total Debt | Measures the ability to repay debt using operating cash flow. A higher ratio indicates stronger debt servicing capacity. |

| Free Cash Flow to Firm Value Ratio | Free Cash Flow / Firm Value (Market Cap + Net Debt) | Shows the proportion of firm value generated by free cash flow. A higher ratio is generally favorable. |

| Cash Flow Coverage Ratio | (Operating Cash Flow + Depreciation & Amortization) / Total Debt | Measures the ability to cover debt obligations with cash flow from operations and non-cash charges. A higher ratio is better. |

Free Cash Flow and its Implications for a Business

Free cash flow (FCF) represents the cash a company generates after accounting for capital expenditures (CAPEX) necessary for maintaining or expanding its operations. It’s a critical indicator of a company’s financial health and its ability to reward investors through dividends, share buybacks, or debt reduction. A consistently high FCF suggests strong financial strength and growth potential. Conversely, consistently low or negative FCF can indicate financial distress.

Free Cash Flow = Operating Cash Flow – Capital Expenditures

For example, a company with high FCF might choose to invest in research and development, acquire other businesses, or return capital to shareholders. A company with low or negative FCF might need to secure additional financing or reduce its capital expenditures.

Interpreting Cash Flow Statement Data to Assess Financial Health

Analyzing cash flow statement data requires a holistic approach, considering the trends in operating, investing, and financing activities over time. For instance, a consistent increase in operating cash flow suggests improving operational efficiency and profitability. Conversely, a significant decrease might indicate declining sales or rising costs. A large outflow in investing activities could signal significant capital investments, while a large inflow might suggest asset sales. Finally, examining financing activities reveals how a company is funding its operations, including debt issuance, equity financing, and dividend payments.

Consider a hypothetical scenario: Company A consistently shows increasing operating cash flow, while Company B experiences declining operating cash flow despite reporting strong net income. This suggests that Company A’s earnings are more sustainable and its cash management is more efficient than Company B’s, even if Company B’s reported net income is higher. This discrepancy highlights the importance of analyzing cash flow data in addition to other financial statements.

Ending Remarks: How To Prepare A Cash Flow Statement

Mastering the preparation and analysis of a cash flow statement empowers you to make data-driven decisions and gain a deeper understanding of your financial position. By effectively tracking cash inflows and outflows, you can identify areas for improvement, optimize resource allocation, and ultimately enhance your business’s financial stability and success. Remember that consistent monitoring and analysis of your cash flow statement are key to maintaining a healthy financial outlook. This guide serves as a foundation for building this essential skill, encouraging continuous learning and adaptation to the ever-evolving financial landscape.

Quick FAQs

What is the difference between a cash flow statement and an income statement?

An income statement shows profitability over a period, while a cash flow statement shows the actual movement of cash during that same period. The income statement uses accrual accounting, while the cash flow statement focuses on actual cash receipts and payments.

Why is it important to reconcile the cash flow statement with the balance sheet?

Reconciliation ensures accuracy and consistency between the cash flow statement and the balance sheet. It helps identify any discrepancies and allows for correction of errors, enhancing the reliability of the financial statements.

Can I use a spreadsheet program to prepare a cash flow statement?

Yes, spreadsheet software like Microsoft Excel or Google Sheets provides excellent tools for organizing and calculating the data needed for a cash flow statement.

What are some common mistakes to avoid when preparing a cash flow statement?

Common mistakes include misclassifying cash flows, overlooking non-cash transactions, and inaccurate calculations. Careful attention to detail and a clear understanding of the accounting principles are crucial.

Understand how the union of The Influence of Cultural Differences on International Accounting Ethics can improve efficiency and productivity.