How to Manage Business Debt Effectively is crucial for long-term business success. Navigating the complexities of business debt can feel overwhelming, but understanding the various types of debt, from loans and credit cards to lines of credit, is the first step towards financial health. This guide will equip you with practical strategies to develop a comprehensive debt management plan, explore effective debt reduction methods, and ultimately prevent future debt accumulation. We’ll delve into budgeting, debt prioritization, negotiation techniques, and the potential benefits of seeking professional financial advice.

Successfully managing business debt requires a proactive and strategic approach. This involves not only understanding your current financial situation but also developing a forward-thinking plan that addresses both immediate concerns and long-term financial goals. We will explore various methods for reducing debt, improving cash flow, and establishing sustainable financial practices to ensure your business remains financially stable and resilient.

Understanding Your Business Debt

Managing business debt effectively requires a clear understanding of your financial obligations. Ignoring or misunderstanding your debt can lead to serious financial problems, impacting your business’s growth and even its survival. This section will Artikel the key aspects of understanding your business’s debt profile to help you make informed decisions.

Types of Business Debt

Businesses utilize various types of debt to fund operations and growth. Understanding the characteristics of each is crucial for effective management. Common types include:

- Term Loans: These are typically fixed-amount loans with a predetermined repayment schedule and interest rate. They often have longer repayment terms than other forms of debt.

- Lines of Credit: These provide access to a pre-approved amount of funds that can be borrowed and repaid multiple times within a specific period. Interest is typically only charged on the borrowed amount.

- Credit Cards: Business credit cards offer revolving credit, allowing for repeated borrowing and repayment. However, they usually come with higher interest rates than term loans or lines of credit.

- Merchant Cash Advances: These are short-term loans based on future credit card sales. They often involve higher fees than traditional loans.

Interest Rates and Repayment Terms

Interest rates and repayment terms are critical factors influencing the overall cost of your debt. Higher interest rates mean greater expense over the life of the loan. Shorter repayment terms lead to higher monthly payments but lower overall interest costs. Understanding these variables for each debt type allows for accurate budgeting and strategic repayment planning. For example, a small business taking out a $50,000 term loan at 8% interest over 5 years will pay significantly more in interest than the same loan at 6% interest. Similarly, a 10-year repayment term will result in lower monthly payments but higher overall interest paid compared to a 5-year term.

Consolidating Multiple Debts

Managing multiple debts can be complex. Consolidating debt involves combining several smaller debts into a single, larger loan. This can simplify repayment, potentially lower monthly payments (depending on the interest rate of the consolidation loan), and improve your credit score over time. However, it’s important to secure a lower interest rate on the consolidated loan than your average current interest rate to truly benefit.

A step-by-step guide to debt consolidation:

- Assess your debts: List all your debts, including balances, interest rates, and minimum payments.

- Check your credit score: A good credit score improves your chances of securing favorable terms on a consolidation loan.

- Shop around for lenders: Compare interest rates, fees, and repayment terms from different lenders.

- Apply for a consolidation loan: Once you’ve found a suitable lender, submit your application.

- Pay off your existing debts: Once the consolidation loan is approved, use the funds to pay off your existing debts.

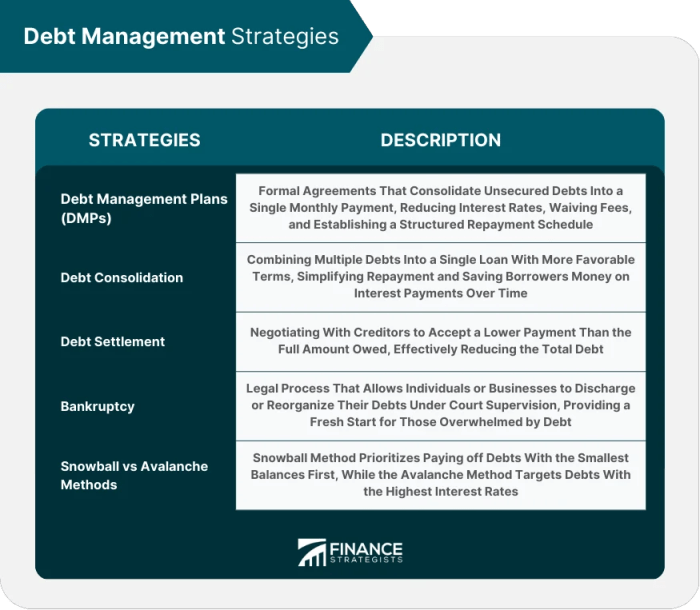

Debt Management Strategies Comparison

| Strategy | Pros | Cons | Suitable For |

|---|---|---|---|

| Debt Consolidation | Simplified repayment, potentially lower monthly payments, improved credit score | May extend repayment period, potentially higher overall interest if not secured at a lower interest rate | Businesses with multiple debts and good credit |

| Debt Snowball | Motivational, pays off smaller debts quickly | May take longer to pay off total debt, higher interest paid overall | Businesses motivated by quick wins, prioritizing psychological payoff |

| Debt Avalanche | Pays off debt faster, minimizes total interest paid | Can be less motivating initially, requires discipline | Businesses prioritizing minimizing interest costs |

| Negotiating with Creditors | Potential for reduced payments or interest rates | May negatively impact credit score, requires strong negotiation skills | Businesses facing immediate financial hardship |

Developing a Debt Management Plan

Effectively managing business debt requires a structured approach. A well-defined debt management plan is crucial for navigating financial challenges and ensuring long-term business sustainability. This involves creating a realistic budget, prioritizing debts, and exploring options like debt consolidation or interest rate negotiation.

Creating a comprehensive debt management plan begins with a thorough understanding of your financial situation. This involves meticulously tracking all income and expenses, accurately assessing your debt obligations, and projecting future cash flows. This allows for informed decision-making and the development of a realistic repayment strategy.

Realistic Budget Creation

A realistic budget is the cornerstone of any effective debt management plan. It involves meticulously listing all sources of income, including sales revenue, investments, and loans. Simultaneously, all expenses must be accounted for, categorized, and prioritized. This includes operational costs (rent, utilities, salaries), debt payments (principal and interest), marketing and advertising, and other necessary expenditures. The difference between total income and total expenses reveals your net cash flow, which is crucial for determining your debt repayment capacity. For example, a business with consistent monthly revenue of $10,000 and monthly expenses of $7,000 has a net cash flow of $3,000, which can be allocated towards debt repayment. This detailed budget allows for a clear visualization of your financial standing and helps in determining the affordability of different debt repayment strategies.

Prioritizing High-Interest Debts

Prioritizing high-interest debts is a key strategy for minimizing overall interest payments and accelerating debt reduction. High-interest debts, such as credit card debt or short-term loans, accrue interest rapidly, increasing the total amount owed over time. Focusing repayment efforts on these debts first, even with smaller payments, can significantly reduce the overall interest burden. This approach, often referred to as the “avalanche method,” prioritizes debts based on their interest rate, regardless of the balance. For instance, if a business has two loans, one with a 15% interest rate and another with a 5% interest rate, the avalanche method dictates focusing on the 15% loan first, even if the 5% loan has a larger balance. This strategy minimizes the long-term cost of debt.

Debt Consolidation Loans

Debt consolidation involves combining multiple debts into a single loan with potentially more favorable terms. The benefits can include simplified payment schedules, lower monthly payments (though the total repayment amount might be higher), and potentially a lower interest rate. However, drawbacks exist. Consolidation loans often require good credit, and the total interest paid over the life of the loan might be higher than with some original debts if the interest rate isn’t significantly lower. Furthermore, consolidating debts might lengthen the repayment period, delaying the complete elimination of debt. Carefully weigh the pros and cons and compare offers from different lenders before opting for debt consolidation. A business with several small high-interest loans might benefit from consolidating them into a single lower-interest loan, simplifying their financial management and potentially reducing their monthly payments.

Negotiating Lower Interest Rates

Negotiating lower interest rates with creditors can significantly reduce the overall cost of debt. This involves contacting creditors and explaining your financial situation, demonstrating your commitment to repayment, and proposing a revised payment plan with a lower interest rate. Successful negotiation often requires a strong track record of timely payments and a clear plan for future repayment. Businesses with a history of responsible debt management are more likely to succeed in negotiating favorable terms. For example, a business consistently paying its loan installments on time could negotiate a lower interest rate by highlighting its responsible financial behavior and offering to extend the loan term slightly.

Exploring Debt Reduction Strategies

Effectively reducing business debt requires a strategic approach. Understanding various debt reduction methods and implementing income-boosting strategies are crucial for achieving financial health. This section will explore different strategies, emphasizing practical application and resource identification.

Debt Reduction Methodologies: Debt Snowball vs. Debt Avalanche

The choice between the debt snowball and debt avalanche methods depends on individual preferences and psychological factors. The debt snowball method prioritizes paying off the smallest debt first, regardless of interest rate, to build momentum and motivation. The debt avalanche method, conversely, focuses on paying off the debt with the highest interest rate first, minimizing overall interest paid.

Debt Snowball Method: This method provides a psychological boost by quickly eliminating smaller debts. The feeling of accomplishment from paying off smaller debts can encourage continued effort. However, it might result in paying more interest overall compared to the avalanche method.

Debt Avalanche Method: This method is mathematically more efficient, saving money on interest in the long run. However, the initial progress may seem slower, potentially impacting motivation if the largest debt is significantly large.

Example: Imagine two debts: a $1,000 loan at 5% interest and a $5,000 loan at 10% interest. The snowball method would tackle the $1,000 loan first, while the avalanche method would prioritize the $5,000 loan due to its higher interest rate. While the snowball might offer a quicker sense of achievement, the avalanche would save money on interest payments in the long run.

Increasing Income to Accelerate Debt Repayment

Increasing income provides more funds to allocate towards debt repayment, significantly accelerating the process. Several strategies can be implemented to achieve this.

Strategies for increasing income include seeking a higher-paying job or a promotion, taking on a part-time job or freelance work, selling unused assets, renting out unused space (like a spare room or office), and exploring new revenue streams aligned with the business’s capabilities. For example, a bakery could offer online ordering and delivery services to reach a wider customer base.

Example: A small business owner working 40 hours a week at their primary job could dedicate 10 additional hours weekly to freelance consulting, generating an extra income stream. This additional income can be directly applied to debt reduction, significantly shortening the repayment period.

Learn about more about the process of Common Accounting Errors That Can Hurt Your Business in the field.

Resources for Financial Assistance and Counseling

Several resources offer financial assistance and counseling to businesses struggling with debt.

These resources can provide valuable guidance, support, and potentially financial aid. Such resources include the Small Business Administration (SBA), non-profit credit counseling agencies, and local community development financial institutions (CDFIs). These organizations often offer workshops, seminars, and one-on-one consultations to help businesses navigate their financial challenges.

- Small Business Administration (SBA): Offers various loan programs and resources to help small businesses.

- Non-profit credit counseling agencies: Provide debt management plans and financial education.

- Local Community Development Financial Institutions (CDFIs): Offer financial products and services tailored to underserved communities.

Tracking Progress and Adjusting the Debt Management Plan

Regularly tracking progress and making necessary adjustments is essential for effective debt management.

A simple spreadsheet or budgeting software can be used to monitor debt balances, interest payments, and monthly payments. This allows for visualizing progress and identifying areas needing adjustment. If unexpected expenses arise or income fluctuates, the debt management plan should be reviewed and modified to ensure it remains feasible and effective. For instance, if a significant unexpected repair is needed, the plan might require temporarily reducing payments on some debts while prioritizing the urgent expense.

Example: A monthly review of the debt repayment plan allows for adjustments based on actual income and expenses. If a month shows a surplus, that surplus can be allocated to accelerate debt repayment. Conversely, if expenses exceed projections, the plan may require minor adjustments to ensure continued progress without jeopardizing the business’s operations.

Preventing Future Debt Accumulation

Successfully managing existing business debt is crucial, but equally important is preventing future debt accumulation. Proactive strategies focusing on cash flow, robust financial planning, and regular reviews are essential for long-term financial health and sustainability. This section Artikels practical steps to achieve this.

Effective cash flow management and forecasting are the cornerstones of preventing future debt. Understanding your income and expenses, identifying trends, and accurately predicting future cash inflows and outflows allows for informed decision-making and prevents unexpected shortfalls that might lead to borrowing.

Cash Flow Management and Forecasting

Accurate cash flow forecasting involves projecting future income and expenses. This projection should consider seasonal variations, anticipated sales, and known upcoming expenses like rent, salaries, and supplier payments. Tools like spreadsheets or dedicated financial software can assist in creating detailed cash flow projections. For example, a seasonal business might anticipate higher sales during the holiday season and adjust inventory and staffing accordingly to optimize cash flow. Regularly comparing the projected cash flow against the actual figures helps identify discrepancies and allows for timely adjustments to the budget. This proactive approach helps avoid unexpected cash shortages that might force the business to take on debt.

Creating a Robust Financial Plan

A comprehensive financial plan provides a roadmap for the business’s financial future. This plan should include detailed projections for revenue, expenses, and profitability over a specific period, typically three to five years. It should also Artikel strategies for achieving financial goals, such as increasing market share, expanding operations, or improving profitability. A well-defined financial plan will consider various scenarios, including worst-case scenarios, and Artikel contingency plans to manage potential risks. For instance, a plan might include provisions for unexpected economic downturns or supply chain disruptions. This proactive planning minimizes the reliance on debt to cover unforeseen circumstances.

Regular Financial Reviews and Adjustments

Regular financial reviews are vital for identifying potential problems early and making necessary adjustments. Monthly reviews allow for timely detection of variances from the budget and enable proactive intervention. Quarterly reviews offer a broader perspective, enabling evaluation of progress toward long-term financial goals. Annual reviews provide an opportunity for a comprehensive assessment of the business’s financial health and to adjust the financial plan based on performance and market changes. For example, if sales are consistently lower than projected, the business can review its marketing strategies, pricing, or product offerings to improve revenue.

Best Practices for Responsible Business Spending, How to Manage Business Debt Effectively

Implementing responsible spending habits is paramount to preventing future debt. This involves careful consideration of all expenditures and prioritizing essential business needs.

- Prioritize essential expenses: Focus spending on critical areas such as production, marketing, and employee salaries.

- Negotiate favorable terms with suppliers: Seek discounts or extended payment terms to improve cash flow.

- Track expenses meticulously: Utilize accounting software to monitor all spending and identify areas for potential savings.

- Avoid unnecessary purchases: Carefully evaluate the return on investment for all purchases before committing to them.

- Explore cost-effective alternatives: Consider cheaper alternatives for supplies, services, and equipment whenever possible.

- Implement a robust budgeting system: Create and adhere to a detailed budget to control spending and prevent overspending.

Seeking Professional Help

Navigating complex business debt can be overwhelming, and seeking professional guidance is often a crucial step towards effective management and resolution. Financial advisors and debt counselors offer specialized expertise and support, providing valuable insights and strategies tailored to your specific circumstances. Early intervention is key to preventing the situation from escalating and limiting the potential negative impacts on your business.

Financial advisors and debt counselors play distinct but complementary roles in debt management. Financial advisors provide a broader perspective on your overall financial health, offering advice on budgeting, investment strategies, and long-term financial planning, often incorporating debt management as part of a comprehensive plan. Debt counselors, on the other hand, specialize in developing and implementing strategies specifically for debt reduction, negotiation with creditors, and exploring debt relief options. They often provide more hands-on support in navigating the complexities of debt repayment.

The Role of Financial Advisors and Debt Counselors

Financial advisors offer a holistic approach, considering your business’s financial situation within a larger context. They can help you create a comprehensive financial plan that includes strategies for debt reduction alongside other financial goals, such as saving and investment. Debt counselors, conversely, focus intensely on your debt, providing personalized strategies for repayment or exploring debt relief options such as debt consolidation, debt settlement, or even bankruptcy if necessary. The choice between these professionals often depends on the complexity of your financial situation and your specific needs. A business owner facing significant debt may benefit from consulting both a financial advisor and a debt counselor for a comprehensive approach.

Questions to Ask When Seeking Professional Financial Advice

Before engaging a financial advisor or debt counselor, it’s essential to gather relevant information and clarify expectations. A clear understanding of their services, fees, and experience will ensure a productive working relationship.

- What is your experience working with businesses facing similar debt situations?

- What specific debt management strategies do you recommend, and why are they appropriate for my situation?

- What are your fees, and how are they structured?

- What is your success rate in helping businesses resolve their debt?

- Can you provide references from past clients?

- What are the potential risks and downsides of each strategy you propose?

- What is your communication process, and how often will we meet or communicate?

Benefits of Early Intervention

Seeking professional help early in the debt management process offers several significant advantages. Early intervention allows for the implementation of proactive strategies before the debt burden becomes unmanageable. This can minimize the long-term financial impact, preserve business creditworthiness, and reduce the stress associated with overwhelming debt. A timely intervention often prevents more drastic measures like bankruptcy, allowing for a smoother and more controlled path towards financial recovery. For example, a business that addresses debt issues early might negotiate favorable repayment terms with creditors, avoiding costly legal fees and potential business closure.

Debt Relief Options

Several debt relief options are available to businesses facing significant financial challenges. These options vary in their complexity, legal implications, and long-term consequences.

- Debt Consolidation: Combining multiple debts into a single loan with potentially lower interest rates or more manageable monthly payments.

- Debt Settlement: Negotiating with creditors to settle debts for a reduced amount, often less than the total owed. This can negatively impact credit scores.

- Debt Management Plans (DMPs): Working with a credit counseling agency to create a plan to repay debts over an extended period, often with reduced interest rates.

- Bankruptcy: A legal process that can discharge certain debts, but it has significant long-term consequences for business credit and may result in the loss of assets.

Illustrating Effective Debt Management

Successfully managing business debt requires a proactive and strategic approach. This involves understanding your financial situation, creating a realistic plan, and consistently monitoring progress. The following example demonstrates how a hypothetical business effectively reduced its debt using a debt snowball method.

Let’s consider “Green Thumb Gardens,” a small landscaping business. At the start of the year, they owed a total of $50,000 in debt, distributed as follows: $10,000 on a high-interest credit card (20% APR), $20,000 on a small business loan (8% APR), and $20,000 on equipment financing (6% APR).

Debt Snowball Method in Action

Green Thumb Gardens decided to utilize the debt snowball method, focusing on paying off the smallest debt first, regardless of interest rate. This approach provides psychological motivation by generating early wins and building momentum. They prioritized the credit card debt due to its high interest rate and relatively small balance.

They allocated additional funds from their monthly cash flow, resulting in a $1,500 monthly payment towards the credit card. Within seven months, the credit card debt was fully paid. They then redirected that $1,500 monthly payment towards the equipment financing, accelerating its repayment. Once the equipment financing was settled, the remaining funds were allocated to the small business loan.

Visual Representation of Debt Repayment

Imagine a bar graph. The horizontal axis represents time, divided into months, spanning over two years. The vertical axis represents the total debt amount, starting at $50,000. The graph displays three bars, each representing one of the debt types. Initially, the credit card debt bar is the shortest, followed by the equipment financing, and finally, the small business loan, the longest bar. As months progress, the credit card bar rapidly shrinks to zero within seven months. Then, the equipment financing bar begins to decrease, followed by the small business loan bar. By the end of the two-year period, all three bars reach zero, indicating that all debts have been successfully repaid. The graph visually demonstrates the snowball effect, with the reduction in one debt freeing up funds to tackle the next, leading to a faster overall debt reduction.

Financial Details

The following table illustrates the approximate monthly payments and repayment timelines for each debt:

| Debt Type | Initial Balance | Monthly Payment | Repayment Time |

|---|---|---|---|

| Credit Card | $10,000 | $1,500 | 7 months |

| Equipment Financing | $20,000 | $2,500 (including the previous $1,500) | 8 months |

| Small Business Loan | $20,000 | $4,000 (including the previous $2,500) | 5 months |

Note: These figures are simplified for illustrative purposes and do not include interest calculations. Actual repayment times and amounts may vary based on interest rates and payment schedules.

Last Word: How To Manage Business Debt Effectively

Effectively managing business debt is an ongoing process that demands vigilance and strategic planning. By understanding your debt landscape, creating a realistic budget, and employing suitable debt reduction strategies, you can significantly improve your business’s financial health. Remember, seeking professional guidance when needed can prove invaluable in navigating complex financial situations. With proactive management and a commitment to responsible financial practices, your business can overcome debt challenges and achieve sustainable financial success.

Common Queries

What are the signs I need help managing business debt?

Consistent late payments, difficulty meeting monthly obligations, relying heavily on credit cards for operational expenses, and a declining credit score are all warning signs.

Can I negotiate with creditors on my own?

Yes, but it requires careful preparation and strong communication skills. Clearly articulate your financial situation and propose a realistic repayment plan.

What’s the difference between debt snowball and debt avalanche methods?

The debt snowball prioritizes paying off the smallest debts first for motivational purposes, while the debt avalanche focuses on paying off the highest-interest debts first to save money.

What are some ways to increase business income to pay down debt faster?

Explore options like raising prices strategically, increasing sales volume, cutting unnecessary expenses, seeking additional funding, or diversifying revenue streams.