How to Calculate Profit Margins for Online Stores is crucial for the success of any e-commerce venture. Understanding your profit margins allows you to make informed decisions about pricing, inventory, and overall business strategy. This guide will walk you through calculating gross, operating, and net profit margins, providing clear formulas and examples to help you accurately assess your online store’s profitability and identify areas for improvement.

We’ll explore the different types of profit margins, examining the nuances of each calculation and how they reflect different aspects of your business’s financial health. From identifying your cost of goods sold (COGS) to accounting for operating expenses and taxes, we’ll cover all the essential steps. By the end, you’ll be equipped to not only calculate your profit margins but also use this information to optimize your pricing strategies and increase your overall profitability.

Understanding Profit Margin Basics

Profit margins are crucial metrics for any online store, providing insights into the profitability of your business. Understanding the different types of profit margins—gross, operating, and net—is essential for making informed business decisions and tracking your financial health. This section will clarify the calculation and interpretation of each.

Gross Profit Margin

Gross profit margin represents the profitability of your sales after deducting the direct costs of goods sold. It shows how efficiently you’re managing your inventory and production costs. A higher gross profit margin indicates greater efficiency in controlling direct costs.

The formula for calculating gross profit margin is: (Revenue – Cost of Goods Sold) / Revenue * 100%

For example, if an online store generates $10,000 in revenue and has a cost of goods sold of $4,000, the gross profit margin would be ($10,000 – $4,000) / $10,000 * 100% = 60%. This means that for every dollar of revenue, $0.60 is gross profit.

Operating Profit Margin

Operating profit margin goes beyond gross profit by factoring in operating expenses. These are the costs associated with running your online business, such as rent, salaries, marketing, and utilities. It provides a clearer picture of your operational efficiency.

The formula for calculating operating profit margin is: (Revenue – Cost of Goods Sold – Operating Expenses) / Revenue * 100%

Using the previous example, if the online store has operating expenses of $2,000, the operating profit margin would be ($10,000 – $4,000 – $2,000) / $10,000 * 100% = 40%. This indicates that 40% of each dollar of revenue remains after covering both direct costs and operating expenses.

Net Profit Margin

Net profit margin represents the overall profitability of your online store after all expenses, including taxes and interest, have been deducted. It’s the ultimate measure of your business’s success and efficiency.

The formula for calculating net profit margin is: (Net Profit / Revenue) * 100% where Net Profit = Revenue – Cost of Goods Sold – Operating Expenses – Taxes – Interest

Continuing with the example, if the online store has taxes and interest totaling $1,000, the net profit margin would be ($10,000 – $4,000 – $2,000 – $1,000) / $10,000 * 100% = 30%. This signifies that 30% of each dollar of revenue is pure profit after all expenses.

Profit Margin Comparison

| Profit Margin Type | Definition | Formula | Example Calculation (Revenue = $10,000, COGS = $4,000, Operating Expenses = $2,000, Taxes & Interest = $1,000) |

|---|---|---|---|

| Gross Profit Margin | Profitability after deducting direct costs of goods sold. | (Revenue – Cost of Goods Sold) / Revenue * 100% | ($10,000 – $4,000) / $10,000 * 100% = 60% |

| Operating Profit Margin | Profitability after deducting direct costs and operating expenses. | (Revenue – Cost of Goods Sold – Operating Expenses) / Revenue * 100% | ($10,000 – $4,000 – $2,000) / $10,000 * 100% = 40% |

| Net Profit Margin | Overall profitability after all expenses, including taxes and interest. | (Net Profit / Revenue) * 100% | ($10,000 – $4,000 – $2,000 – $1,000) / $10,000 * 100% = 30% |

Calculating Gross Profit Margin

Understanding your gross profit margin is crucial for the financial health of your online store. It reveals the profitability of your core business operations, showing how efficiently you’re converting your sales into profit before considering overhead costs like marketing and salaries. A strong gross profit margin indicates healthy pricing strategies and efficient inventory management.

Calculating your gross profit margin involves a straightforward formula, but accurately determining your cost of goods sold (COGS) is key. This involves more than just the initial purchase price of your products; it encompasses all direct costs associated with getting those products ready for sale to your customers.

Cost of Goods Sold (COGS) for E-commerce Businesses

The cost of goods sold (COGS) represents the direct costs attributable to producing the goods you sell. For an online store, this includes more than just the wholesale price. It’s a comprehensive figure encompassing all expenses directly tied to creating or acquiring the products sold. Failing to accurately account for all COGS elements can significantly skew your profit margin calculations, leading to flawed business decisions.

Examples of COGS for Different Online Store Types

The specific COGS components vary depending on your business model.

- Clothing Store: Wholesale cost of clothing, import duties (if applicable), shipping costs from the supplier to your warehouse, alterations or modifications to the clothing, and packaging materials.

- Electronics Store: Wholesale cost of electronics, import duties, shipping costs to your warehouse, any repair or testing costs before sale, and packaging.

- Digital Products Store: Costs associated with the creation of the digital product (e.g., software development costs, graphic design fees, writer fees), hosting fees directly related to delivering the product, and payment processing fees.

Step-by-Step Guide to Calculating Gross Profit Margin, How to Calculate Profit Margins for Online Stores

Accurately calculating your gross profit margin requires a systematic approach. This ensures consistency and avoids errors that can misrepresent your store’s financial performance.

- Calculate your revenue: This is the total amount of money generated from sales during a specific period (e.g., monthly or annually).

- Determine your cost of goods sold (COGS): This is the sum of all direct costs associated with producing or acquiring the goods sold during the same period as your revenue calculation. Be meticulous in this step, ensuring you include all relevant expenses.

- Calculate your gross profit: Subtract your COGS from your revenue. The result is your gross profit. This represents the profit generated before deducting operating expenses.

- Calculate your gross profit margin: Divide your gross profit by your revenue, then multiply the result by 100 to express it as a percentage. The formula is:

Gross Profit Margin = (Revenue – COGS) / Revenue * 100

Calculating Operating Profit Margin: How To Calculate Profit Margins For Online Stores

Operating profit margin provides a deeper dive into your online store’s profitability than gross profit margin. It reveals how efficiently you manage your business operations after accounting for both the cost of goods sold and operating expenses. A higher operating profit margin indicates better operational efficiency and stronger financial health.

Calculating operating profit margin involves subtracting your operating expenses from your gross profit. This metric offers a more comprehensive picture of your business’s profitability than gross profit margin alone, as it accounts for the overhead involved in running your online store. Understanding and improving your operating profit margin is crucial for sustainable growth.

Factors Influencing Operating Profit Margin

Several factors significantly impact an online store’s operating profit margin. These include pricing strategies, efficient inventory management, marketing campaign effectiveness, the cost of technology and software, and overall operational efficiency. For example, a store with a high customer acquisition cost might see a lower operating profit margin, even if its gross profit margin is healthy. Conversely, a store with effective marketing and low operational overhead can achieve a higher operating profit margin.

Key Operating Expenses for Online Stores

It’s crucial to accurately identify and account for all operating expenses when calculating your operating profit margin. Failing to do so can lead to inaccurate financial reporting and flawed business decisions.

- Salaries and Wages: This includes payments to employees involved in various aspects of the business, such as customer service, marketing, and fulfillment.

- Rent and Utilities: Costs associated with warehouse space, office space, and utilities like electricity and internet.

- Marketing and Advertising: Expenses related to attracting customers, including social media marketing, search engine optimization (), and paid advertising.

- Technology and Software: Costs associated with e-commerce platforms, website hosting, CRM software, and other digital tools.

- Shipping and Handling: Expenses related to packaging, shipping materials, and carrier fees.

- Customer Service: Costs associated with providing customer support, such as salaries for customer service representatives and the cost of live chat software.

- Office Supplies and Expenses: Costs of stationery, printing, and other general office supplies.

- Insurance: Costs for business insurance, such as liability and property insurance.

- Professional Fees: Costs for legal, accounting, and consulting services.

- Depreciation and Amortization: Accounting for the decrease in value of assets over time.

Operating Expenses Comparison: Subscription vs. Transactional Models

Operating expenses differ significantly between subscription-based and transactional online stores. Subscription-based businesses often have higher upfront costs in acquiring customers through marketing and potentially higher customer service costs, but recurring revenue provides greater predictability and stability. Transactional businesses, on the other hand, face fluctuating expenses tied directly to sales volume, such as higher shipping costs during peak seasons. Both models require careful management of operating expenses to maximize profitability. For example, a subscription box service might invest heavily in packaging and fulfillment automation to reduce per-unit costs, while a transactional retailer might focus on optimizing advertising spend for specific product launches.

Calculating Net Profit Margin

Net profit margin represents the ultimate profitability of your online store after all expenses, including taxes, are deducted from revenue. It provides a clear picture of your business’s overall financial health and efficiency. Understanding this metric is crucial for informed decision-making and long-term success.

Calculating net profit margin involves subtracting all expenses – including cost of goods sold, operating expenses, interest, and taxes – from your total revenue. The result is then divided by the total revenue, and multiplied by 100 to express it as a percentage. This final percentage indicates the proportion of each dollar of revenue that translates into profit.

Net Profit Margin Calculation

The formula for calculating net profit margin is straightforward:

Net Profit Margin = [(Revenue – Cost of Goods Sold – Operating Expenses – Interest – Taxes) / Revenue] x 100

Let’s illustrate this with an example. Suppose an online store generated $100,000 in revenue. Its cost of goods sold was $40,000, operating expenses totaled $20,000, interest expense was $5,000, and taxes amounted to $10,000. The net profit would be $100,000 – $40,000 – $20,000 – $5,000 – $10,000 = $25,000. The net profit margin would then be ($25,000 / $100,000) x 100 = 25%.

Types of Taxes Relevant to Online Businesses

Several types of taxes can impact an online business’s net profit margin. These vary depending on location and business structure. Common examples include:

- Sales Tax: Collected from customers on taxable goods and services, the amount varies by state/region.

- Income Tax: Levied on the business’s net income, the rate depends on the legal structure (sole proprietorship, LLC, corporation) and applicable tax brackets.

- Property Tax: If the business owns property (warehouse, office), this tax is based on the assessed value of the property.

- Payroll Tax: Applies if the business employs others, covering taxes like Social Security and Medicare.

- Use Tax: A tax on goods purchased from out-of-state vendors without sales tax and used within the state.

Accurate tax calculation and reporting are critical; errors can lead to significant financial penalties. Consulting with a tax professional is recommended.

Accounting for Interest Expenses and Other Non-Operating Expenses

Interest expenses, stemming from business loans or credit card debt, are subtracted from operating profit to arrive at net profit. Other non-operating expenses might include gains or losses from the sale of assets, or lawsuit settlements. These are considered outside the core operations of the business.

For example, if the online store in our previous example had an additional $2,000 in non-operating expenses (e.g., a loss from selling equipment), the net profit would decrease to $23,000, and the net profit margin would be 23%. Accurate accounting for these items is crucial for an accurate net profit margin calculation.

Relationship Between Gross, Operating, and Net Profit Margins

The following illustration demonstrates the hierarchical relationship:

Revenue

– Cost of Goods Sold = Gross Profit

– Operating Expenses = Operating Profit

– Interest & Taxes = Net Profit

This shows how each margin builds upon the previous one, with net profit margin representing the final, most comprehensive measure of profitability. A high net profit margin indicates strong overall financial health, while a low margin may suggest areas needing improvement in cost control or revenue generation.

Analyzing Profit Margins for Improvement

Understanding your profit margins isn’t just about crunching numbers; it’s about identifying areas for growth and profitability within your online store. Analyzing your margins allows you to pinpoint weaknesses and strategize for improvement, ultimately leading to a healthier bottom line. This section will explore practical strategies to enhance your gross, operating, and net profit margins.

Strategies for Improving Gross Profit Margin

A higher gross profit margin indicates greater efficiency in managing the cost of goods sold. Several key strategies can significantly improve this metric. Negotiating better terms with suppliers, for example, can directly reduce your cost of goods sold, thus boosting your gross profit margin. Similarly, optimizing your pricing strategy, factoring in both your costs and market competitiveness, is crucial. Carefully analyzing your pricing structure to identify areas for strategic price increases, while remaining competitive, is a key element of increasing gross profit. Another strategy involves reducing waste and improving inventory management. Implementing efficient inventory control systems can minimize losses due to spoilage, obsolescence, or theft.

Methods for Reducing Operating Expenses

Operating expenses, encompassing everything from marketing and advertising to salaries and rent, significantly impact your operating profit margin. Streamlining your operational processes is a primary way to reduce these costs. This could involve automating repetitive tasks, improving workflow efficiency, or outsourcing non-core functions. Negotiating lower shipping costs with carriers is another effective method. Exploring alternative shipping options or negotiating bulk discounts can yield substantial savings. Similarly, analyzing marketing spend and focusing on high-return channels can optimize advertising efficiency and reduce overall costs.

Key Performance Indicators (KPIs) for Profit Margin Tracking

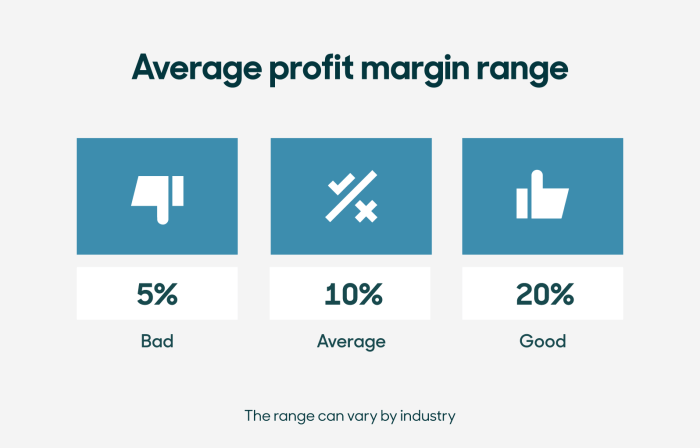

Regularly monitoring key performance indicators (KPIs) is essential for tracking profit margin performance and identifying areas needing attention. Some crucial KPIs include gross profit margin percentage, operating profit margin percentage, net profit margin percentage, cost of goods sold (COGS) as a percentage of revenue, and operating expenses as a percentage of revenue. Tracking these metrics over time provides valuable insights into trends and allows for proactive adjustments to your business strategies. Comparing your KPIs against industry benchmarks can further highlight areas for improvement.

Strategies to Improve Profit Margins

The following table Artikels potential strategies for improving each type of profit margin, along with an assessment of their potential impact and implementation difficulty.

| Profit Margin Type | Strategy | Potential Impact | Implementation Difficulty |

|---|---|---|---|

| Gross Profit Margin | Negotiate lower supplier prices | High | Medium |

| Gross Profit Margin | Optimize pricing strategy | High | Medium |

| Gross Profit Margin | Improve inventory management | Medium | Medium |

| Operating Profit Margin | Streamline operational processes | High | High |

| Operating Profit Margin | Negotiate lower shipping costs | Medium | Medium |

| Operating Profit Margin | Reduce marketing spend | Medium | Low |

| Net Profit Margin | Increase sales revenue | High | High |

| Net Profit Margin | Reduce taxes | Medium | High |

| Net Profit Margin | Improve financial management | Medium | Medium |

Profit Margin and Pricing Strategies

Profit margins are intrinsically linked to pricing strategies. Understanding this relationship is crucial for maximizing profitability and achieving sustainable business growth. The pricing strategy employed directly influences the revenue generated, which in turn impacts the final profit margin. Choosing the right strategy depends on various factors including market conditions, competition, and the unique value proposition of the product or service.

Cost-Plus Pricing and its Effect on Profit Margins

Cost-plus pricing is a straightforward method where a fixed percentage markup is added to the cost of goods sold (COGS) to determine the selling price. This approach ensures a guaranteed profit margin, provided the markup percentage is sufficient to cover all operating expenses and desired profit. However, it’s less responsive to market dynamics and customer perception of value. For example, if a product costs $10 to produce and a 50% markup is applied, the selling price becomes $15, resulting in a gross profit margin of 33.33%. A higher markup leads to a higher profit margin, but it could also price the product out of the market if competitors offer similar products at lower prices.

Value-Based Pricing and its Effect on Profit Margins

Value-based pricing focuses on the perceived value of the product or service to the customer. The price is set based on the benefits the customer receives, rather than simply the cost of production. This approach can command higher prices and achieve higher profit margins, but requires a strong understanding of customer needs and willingness to pay. For instance, a premium brand might charge a significantly higher price for a product similar to a competitor’s, justifying the premium through superior quality, brand reputation, or additional features. This higher price, even with higher COGS, can still lead to a higher profit margin if the demand remains strong enough.

Comparison of Pricing Strategies in Different Market Conditions

In competitive markets with many substitutes, cost-plus pricing might lead to lower profit margins if the markup is insufficient to compete on price. Value-based pricing can be more effective in such scenarios if the product offers unique features or perceived value that justifies a premium price. Conversely, in markets with limited competition or strong brand loyalty, cost-plus pricing can be more effective as it guarantees a certain profit level. Value-based pricing remains potent in these markets, allowing for premium pricing that reflects the product’s value proposition. During economic downturns, cost-plus pricing may be preferred for stability, while value-based pricing might require adjustments to reflect decreased customer purchasing power.

Impact of Pricing Strategies on Profit Margin

| Pricing Strategy | Description | Impact on Profit Margin | Market Suitability |

|---|---|---|---|

| Cost-Plus Pricing | Adding a fixed percentage markup to COGS | Guaranteed margin, but potentially lower if markup is too low | Suitable for stable markets with low competition |

| Value-Based Pricing | Setting price based on perceived customer value | Potentially higher margin, but requires strong understanding of customer needs and willingness to pay | Suitable for markets with differentiation opportunities and less price sensitivity |

| Competitive Pricing | Setting price based on competitor’s prices | Margin depends on competitor pricing and cost structure | Suitable for highly competitive markets |

| Penetration Pricing | Setting a low price to gain market share | Initially lower margin, but potential for higher margins as market share increases | Suitable for new product launches in large markets |

Summary

Mastering the calculation and analysis of profit margins is a cornerstone of successful online retail. By understanding the distinctions between gross, operating, and net profit margins, and by regularly tracking key performance indicators (KPIs), you can gain valuable insights into your business’s financial health. This knowledge empowers you to make data-driven decisions, optimize your pricing strategies, and ultimately, achieve greater profitability and sustainable growth in the competitive online marketplace. Remember to consistently review and adapt your strategies based on your evolving business needs and market conditions.

Query Resolution

What if I sell both physical and digital products? How do I calculate COGS?

Calculate COGS separately for physical and digital products. For physical goods, include costs like purchasing, shipping, and handling. For digital products, include development and distribution costs.

How often should I calculate my profit margins?

Ideally, calculate your profit margins monthly to track performance and identify trends. More frequent calculations (weekly) can be beneficial for businesses with rapid sales fluctuations.

What are some common mistakes businesses make when calculating profit margins?

Common mistakes include miscalculating COGS, overlooking operating expenses (like marketing or customer service), and failing to account for taxes properly.

How can I improve my net profit margin if it’s low?

Strategies include negotiating better supplier deals, increasing prices strategically, reducing operating expenses, and improving marketing efficiency to boost sales.

Remember to click How to Register for an EIN (Employer Identification Number) to understand more comprehensive aspects of the How to Register for an EIN (Employer Identification Number) topic.