How Standardizing Accounting Education Can Improve International Business Practices sets the stage for a compelling examination of global commerce. The current fragmented nature of accounting education creates significant challenges for multinational corporations and investors navigating diverse financial reporting standards. This disparity leads to inconsistencies, increased costs, and reduced transparency, hindering efficient cross-border transactions and investment. This exploration delves into the potential benefits of a standardized curriculum, analyzing the challenges and proposing solutions for a more unified and transparent global accounting landscape.

We will investigate the current state of global accounting education, highlighting variations in curricula and the inconsistencies in standards across major economies. This analysis will lay the groundwork for understanding the potential advantages of standardization, including improved financial reporting, reduced discrepancies, increased investor confidence, and the stimulation of foreign direct investment. Further, we will address the considerable challenges of implementing such a system, encompassing political, cultural, and economic considerations, and propose a phased approach to minimize disruption. The role of professional accounting bodies in fostering this standardization will also be explored, highlighting their crucial role in shaping the future of global accounting education.

The Current State of Accounting Education Globally: How Standardizing Accounting Education Can Improve International Business Practices

Accounting education, while aiming for a universal standard of financial reporting, currently exhibits significant variations across countries, impacting the efficiency and transparency of international business practices. These differences stem from a complex interplay of historical development, legal frameworks, and economic priorities. A standardized approach is crucial to fostering greater trust and reducing complexities in global commerce.

Variations in Accounting Curricula Across Countries

The content and structure of accounting curricula differ considerably worldwide. Some nations emphasize a more theoretical approach, focusing on accounting principles and standards, while others prioritize practical application and industry-specific skills. For example, curricula in the United States often include a strong focus on managerial accounting and financial analysis, reflecting the country’s market-driven economy. In contrast, some European countries may place more emphasis on auditing and regulatory compliance, reflecting their stronger tradition of government oversight. This divergence in educational priorities leads to inconsistencies in the knowledge and skill sets of accounting professionals across borders. The length of accounting programs also varies, with some countries offering shorter, more specialized programs, while others offer longer, more comprehensive ones. These variations ultimately affect the quality and consistency of accounting practices internationally.

Comparison of Accounting Standards in Major Economies

Three major economies – the United States, the European Union, and Japan – exemplify the global diversity in accounting standards. The United States primarily uses Generally Accepted Accounting Principles (GAAP), a rules-based system emphasizing detailed regulations. The European Union largely adheres to International Financial Reporting Standards (IFRS), a principles-based system that allows for more professional judgment. Japan utilizes a hybrid system, incorporating elements of both GAAP and IFRS, reflecting its unique economic and regulatory environment. These differences can lead to complexities in cross-border financial reporting and investment decisions. Companies operating in multiple jurisdictions often face the challenge of reconciling their financial statements under different accounting frameworks, incurring significant costs and potential for errors.

Weaknesses and Inconsistencies in Accounting Education Programs

Several weaknesses plague current accounting education programs globally. These inconsistencies hinder the development of a globally harmonized accounting profession and create challenges for international business. A lack of emphasis on international accounting standards in many curricula is a key concern. Furthermore, insufficient training in cross-cultural communication and ethical considerations in international business contexts is prevalent. Finally, limited access to high-quality accounting education in many developing countries exacerbates these issues.

Table of Weaknesses, Impacts, and Solutions

| Weakness | Impact on International Business | Proposed Solution | Country Examples |

|---|---|---|---|

| Insufficient training in IFRS | Difficulties in preparing consolidated financial statements for multinational corporations; increased audit costs; hinders cross-border investment. | Integrate IFRS training into core curricula; offer specialized IFRS certification programs. | United States, Japan |

| Lack of emphasis on cross-cultural communication | Misunderstandings in business negotiations; difficulties in building trust and rapport with international partners; increased risk of disputes. | Incorporate intercultural communication modules into accounting programs; offer training on international business etiquette. | Many developing nations |

| Limited access to quality accounting education | Shortage of qualified accountants in developing countries; hinders economic growth; increases the risk of financial fraud. | Invest in educational infrastructure; develop online learning platforms; offer scholarships and grants. | Many Sub-Saharan African countries, parts of South Asia |

| Insufficient focus on technology and data analytics | Inability to leverage technological advancements for improved efficiency and decision-making; increased risk of errors due to manual processes. | Integrate data analytics and accounting software training into curricula; emphasize the use of technology in auditing and financial reporting. | Many countries globally |

The Benefits of Standardized Accounting Education

Standardized accounting education offers significant advantages for international business, streamlining financial processes and fostering greater trust and transparency in global markets. A globally consistent approach to accounting principles and practices reduces ambiguity and complexity, leading to more efficient and effective operations for multinational corporations and investors alike.

Standardized accounting principles would dramatically improve cross-border financial reporting. Currently, the multitude of differing Generally Accepted Accounting Principles (GAAP) across nations creates significant challenges in comparing financial statements from different countries. This makes it difficult for investors to assess the true financial health of companies operating internationally, hindering investment decisions and potentially leading to inefficient capital allocation. A single, globally accepted set of standards would allow for easier and more accurate comparisons, fostering greater understanding and facilitating informed investment choices.

Reduced Accounting Discrepancies and Errors

The adoption of standardized accounting education would directly lead to a reduction in accounting discrepancies and errors. Inconsistent accounting practices often result in misinterpretations of financial data, leading to inaccurate valuations and potentially fraudulent activities. A unified curriculum focused on a single set of accounting principles would equip accountants globally with the same knowledge and skills, reducing the likelihood of errors stemming from differing interpretations of rules or methodologies. This would increase the reliability and comparability of financial statements, making it easier to identify and address inconsistencies. The improved accuracy would contribute to better decision-making by businesses, investors, and regulators.

Improved Investor Confidence and Increased Foreign Direct Investment

Greater transparency and comparability of financial information, resulting from standardized accounting practices, would significantly boost investor confidence. Investors are more likely to invest in companies and markets where they have confidence in the reliability and accuracy of the financial information provided. This increased investor confidence would naturally lead to a rise in foreign direct investment (FDI), stimulating economic growth in participating countries. For example, a company considering investing in a foreign market would be far more likely to proceed if the accounting practices were consistent with those of its home country, reducing the perceived risk and complexity of the investment. The ease of comparing financial performance across different markets would encourage more cross-border investment and mergers and acquisitions.

Industries Particularly Benefiting from Standardized Accounting Practices

The benefits of standardized accounting practices would be felt across numerous industries, but some would experience more pronounced advantages. Standardization would particularly benefit sectors with high levels of international activity and complex financial transactions.

- Multinational Corporations: These companies operate in multiple countries and currently face significant challenges in consolidating financial statements prepared under different accounting standards. Standardization would simplify this process, allowing for more efficient financial reporting and improved internal control.

- Financial Services: Banks, investment firms, and other financial institutions regularly deal with cross-border transactions and investments. Standardized accounting would enhance the transparency and reliability of financial information, reducing risk and improving efficiency in the financial markets.

- Technology Companies: The global nature of the technology sector makes consistent accounting practices crucial. Standardization would simplify the reporting of intellectual property, licensing agreements, and other complex transactions.

Challenges in Implementing Standardized Accounting Education

Implementing globally standardized accounting education, while offering significant benefits, faces considerable hurdles. The transition requires navigating complex political landscapes, diverse cultural norms, and varying economic realities. Successfully navigating these challenges necessitates a well-planned, phased approach that considers the unique circumstances of each participating nation.

Political and Cultural Barriers to Standardization

National sovereignty and differing regulatory frameworks present significant political barriers. Countries may be reluctant to cede control over their educational systems and accounting standards, fearing a loss of national identity or economic competitiveness. Cultural differences also play a role; teaching methodologies and preferred learning styles vary significantly across regions. For instance, a curriculum designed for a highly individualistic learning environment might be less effective in a collectivist culture. Furthermore, the entrenched interests of established accounting bodies and professional organizations can create resistance to change, potentially hindering the adoption of new standards. These vested interests often have significant political influence, making reform difficult.

Economic Implications of Transitioning to a Standardized System

The economic implications of transitioning to standardized accounting education are multifaceted and vary considerably across countries. Developed nations with robust accounting infrastructures might experience relatively smoother transitions, primarily facing costs associated with curriculum revisions and teacher training. However, developing countries might face more significant challenges, including the need for substantial investment in infrastructure, educational resources, and the retraining of accounting professionals. The initial costs could outweigh the benefits in the short term, potentially hindering economic growth. The potential for increased foreign investment and improved financial market integration should, however, be considered as long-term benefits. For example, a country with harmonized accounting standards might attract more foreign direct investment (FDI) due to increased transparency and investor confidence.

Cost-Benefit Analysis of Standardization Approaches

The choice between a single global standard and regional harmonization involves a trade-off between uniformity and adaptability. A single global standard offers maximum consistency but might not adequately address the unique needs and contexts of different regions. Regional harmonization, on the other hand, allows for greater flexibility but could lead to inconsistencies across regions. The costs associated with a single global standard are likely to be higher initially, encompassing significant investment in curriculum development, teacher training, and the translation of materials into multiple languages. Regional harmonization may be more cost-effective in the short term but might not offer the same level of global comparability. The benefits, however, such as enhanced investor confidence and reduced information asymmetry, are likely to outweigh the costs in the long run for both approaches.

Phased Implementation Plan for Standardized Accounting Education

A phased implementation approach can effectively mitigate the challenges of a sudden shift to standardization. Phase 1 would involve a thorough needs assessment, identifying the specific needs and challenges of each participating country. Phase 2 would focus on developing a flexible curriculum framework that incorporates regional variations while maintaining core global standards. This could involve creating modular curricula allowing countries to adapt specific modules to their local contexts. Phase 3 would entail pilot programs in selected countries to test the effectiveness of the curriculum and identify any necessary adjustments. Phase 4 would involve a gradual rollout of the standardized curriculum, starting with higher education institutions and gradually extending to secondary and professional development programs. Finally, Phase 5 would involve ongoing monitoring and evaluation to ensure the effectiveness of the standardized curriculum and to identify areas for further improvement. This phased approach allows for continuous adaptation and refinement, minimizing disruption and maximizing the chances of successful implementation.

Assessing the Impact of Standardized Education

Measuring the effectiveness of a standardized accounting education program on international business practices requires a multifaceted approach. It’s not enough to simply look at enrollment numbers; a thorough evaluation needs to consider the impact on financial reporting quality, the efficiency of business operations, and the overall competitiveness of firms. This assessment should incorporate both quantitative and qualitative data to provide a comprehensive understanding of the program’s success.

The effectiveness of standardized accounting education can be evaluated by analyzing its influence on various aspects of international business practices. A robust framework should consider both short-term and long-term effects, recognizing that the full impact may not be immediately apparent. This requires a longitudinal study design, tracking key indicators over an extended period. Furthermore, the evaluation needs to account for contextual factors that might influence the results, such as differences in national regulatory environments and the existing level of accounting expertise within participating countries.

Methods for Measuring the Effectiveness of Standardized Accounting Education

The effectiveness of a standardized accounting education program can be measured using a combination of quantitative and qualitative methods. Quantitative methods involve analyzing numerical data to assess changes in key performance indicators. Qualitative methods involve gathering and analyzing non-numerical data, such as interviews and focus groups, to understand the perspectives and experiences of stakeholders. Triangulation, the use of multiple methods to verify findings, enhances the validity and reliability of the assessment.

A Framework for Evaluating the Long-Term Impact on Financial Reporting Quality, How Standardizing Accounting Education Can Improve International Business Practices

A framework for evaluating the long-term impact of standardized accounting education on financial reporting quality should incorporate several key components. First, it should define clear benchmarks for assessing improvements in reporting quality, such as reduced instances of accounting errors or increased consistency in reporting practices across different countries. Second, it should establish a timeline for evaluating the impact, acknowledging that improvements may take time to materialize. Finally, it should incorporate mechanisms for monitoring and adjusting the program based on the evaluation findings. This iterative approach ensures the program remains responsive to evolving needs and challenges.

Key Performance Indicators (KPIs) for Assessing Success

Tracking key performance indicators (KPIs) is crucial for assessing the success of a standardized accounting education program. These indicators should reflect the program’s impact on both individual learners and the broader business environment. A comprehensive set of KPIs will provide a nuanced understanding of the program’s effectiveness and identify areas for improvement. The selection of KPIs should be guided by the specific goals and objectives of the program.

| KPI | Measurement Method |

|---|---|

| Number of graduates achieving professional accounting certifications | Tracking certification exam pass rates and number of certifications obtained by program graduates. |

| Consistency in financial reporting practices across countries | Comparing financial statements prepared by firms in different countries using standardized accounting principles. |

| Reduction in accounting errors and irregularities | Analyzing financial statement audits to identify the frequency and severity of accounting errors. |

| Improved investor confidence and reduced cost of capital | Analyzing stock market data and assessing the impact of improved financial reporting quality on investor sentiment and company valuations. |

| Increased efficiency of business operations | Measuring the time and resources required for financial reporting and compliance activities. |

| Enhanced comparability of financial statements | Assessing the ease with which investors and analysts can compare financial statements from different countries. |

The Role of Professional Accounting Bodies

Professional accounting bodies play a crucial role in fostering standardized accounting education globally. Their influence extends from setting global accounting standards to directly shaping curricula and credentialing programs, ultimately impacting the quality and consistency of accounting professionals worldwide. Their actions significantly contribute to the harmonization of international business practices.

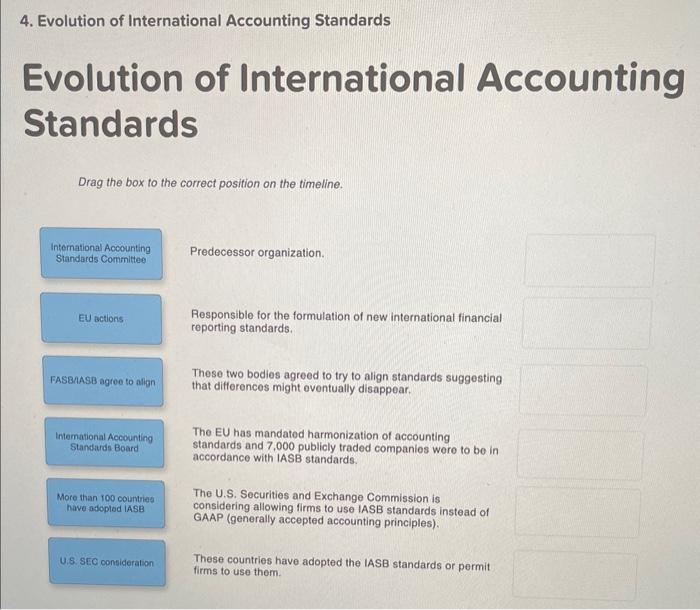

Professional accounting organizations, such as the International Accounting Standards Board (IASB), the Financial Accounting Standards Board (FASB), and the American Institute of Certified Public Accountants (AICPA), actively promote standardized accounting education through various initiatives. These initiatives aim to bridge the gap between differing national accounting practices and create a more unified global accounting landscape.

Best Practices in Promoting Global Accounting Standards

These organizations employ several best practices to achieve their goals. For example, the IASB, responsible for developing International Financial Reporting Standards (IFRS), offers extensive educational resources and training programs to help accountants and educators understand and implement IFRS. This includes online courses, workshops, and publications designed to facilitate the adoption of these standards across diverse educational settings and professional practices. The AICPA, similarly, provides continuing professional education (CPE) courses focused on IFRS, helping US-based accountants adapt to the increasing global demand for IFRS expertise. These bodies also actively engage in collaborative projects with other professional organizations and regulatory bodies worldwide, sharing best practices and promoting the consistent application of accounting standards.

Collaboration Among Professional Accounting Bodies

Increased collaboration between these organizations is paramount for greater harmonization. Joint initiatives, such as collaborative research projects investigating the effectiveness of different teaching methodologies or the development of shared curricula frameworks, could lead to more consistent and globally relevant accounting education. Regular conferences and forums that bring together representatives from different professional bodies provide platforms for dialogue and the sharing of best practices. This exchange of ideas and experiences helps identify areas where alignment is needed and fosters the development of common educational approaches. The mutual recognition of professional qualifications across borders is another significant area where collaboration can lead to substantial progress.

Potential Benefits of a Global Accreditation Body for Accounting Education

The creation of a global accreditation body for accounting education presents numerous advantages. Such a body could establish universally recognized standards for accounting education programs, ensuring consistent quality and comparability across different countries. This would enhance the mobility of accounting professionals globally and facilitate cross-border collaborations. A global accreditation body could also streamline the process of evaluating and recognizing accounting credentials, reducing the administrative burden on both educational institutions and individuals seeking international recognition. This increased efficiency and transparency would ultimately benefit both the accounting profession and international businesses relying on the expertise of qualified accountants. The credibility and trustworthiness of accounting qualifications would also increase, strengthening confidence in global financial markets. A standardized approach to accreditation would create a more efficient and transparent process for verifying the competence of accountants worldwide, fostering greater trust and reliability in international financial reporting.

Ultimate Conclusion

In conclusion, while the path towards standardizing accounting education presents significant challenges, the potential benefits for international business practices are undeniable. A unified approach to accounting education would foster greater transparency, reduce costs, and increase investor confidence, ultimately promoting a more efficient and robust global economy. By addressing the political, cultural, and economic hurdles through collaborative efforts and a phased implementation plan, a future where standardized accounting education empowers global business is achievable. The active participation of professional accounting bodies is paramount to ensuring the success of this crucial initiative.

Question Bank

What are the potential downsides of a completely standardized global accounting curriculum?

A completely standardized curriculum might not adequately address the unique accounting needs of specific industries or regions, potentially leading to oversimplification or a lack of contextual understanding.

How can cultural differences be addressed in a standardized accounting education program?

Cultural sensitivity can be integrated through case studies reflecting diverse business practices and ethical considerations, as well as incorporating culturally appropriate teaching methodologies.

Who would be responsible for enforcing a standardized global accounting curriculum?

A global accreditation body, potentially involving collaboration between existing professional accounting organizations, could play a significant role in setting and enforcing standards.

Find out further about the benefits of Why Every Business Needs a Strong Accounting Framework that can provide significant benefits.