How Hedge Funds and Private Equity Firms Navigate Accounting Regulations sets the stage for an exploration of the complex financial world these entities inhabit. These firms, managing billions in assets, face unique challenges in complying with a multifaceted regulatory landscape. This involves understanding and applying diverse accounting standards, navigating the intricacies of valuing often illiquid assets, and ensuring transparency in their financial reporting. The journey through these complexities reveals strategies employed for tax optimization, rigorous auditing procedures, and adaptation to evolving regulatory trends and technological advancements. This analysis delves into the intricacies of their accounting practices, offering insights into the strategies they employ to balance regulatory compliance with their unique investment strategies.

The regulatory environment for hedge funds and private equity firms is constantly evolving, demanding sophisticated financial reporting and risk management. This exploration will examine the key accounting standards, such as GAAP and IFRS, that govern their operations and how these standards impact their financial reporting. We will also explore the differences in regulatory scrutiny faced by hedge funds and private equity firms, the roles of key regulatory bodies, and the various valuation methodologies used for assets, including the implications of fair value accounting. Finally, we’ll examine the complexities of tax reporting, auditing procedures, and the emerging challenges and future trends shaping this dynamic field.

Understanding the Regulatory Landscape

Navigating the complex world of accounting for hedge funds and private equity firms requires a thorough understanding of the applicable regulatory framework. These entities, while distinct, face significant oversight designed to protect investors and maintain market integrity. The key accounting standards, regulatory bodies, and the variations in scrutiny across these investment vehicles are crucial elements in ensuring compliance.

Key Accounting Standards

Hedge funds and private equity firms primarily operate under Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS) internationally. However, the specific application of these standards can vary considerably depending on the fund’s structure and investment strategies. GAAP, developed by the Financial Accounting Standards Board (FASB), emphasizes a rules-based approach, while IFRS, established by the International Accounting Standards Board (IASB), leans towards a principles-based approach, offering more flexibility in certain situations. This difference in approach often leads to variations in financial reporting across jurisdictions. For example, the valuation of illiquid assets, a common feature in private equity portfolios, can be subject to different interpretations under GAAP and IFRS, impacting the reported net asset value (NAV).

Regulatory Scrutiny Differences

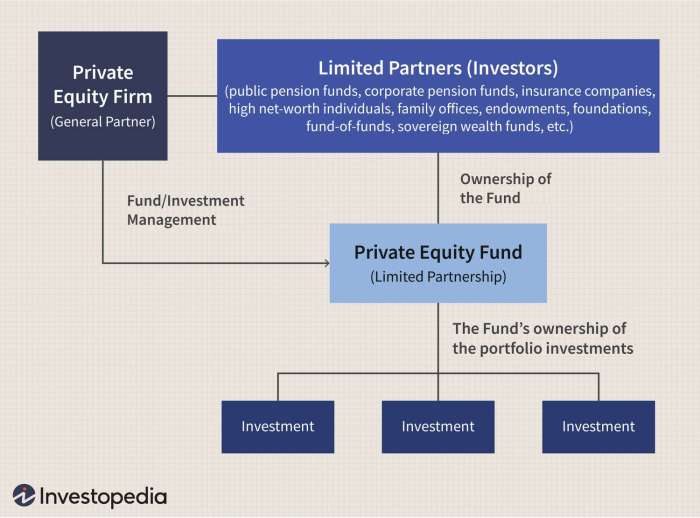

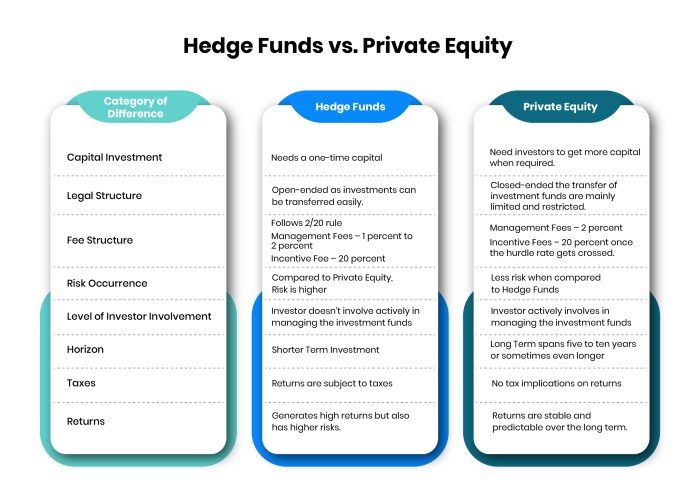

Hedge funds and private equity firms face different levels of regulatory scrutiny. Private equity firms, often structured as limited partnerships, are generally subject to less stringent reporting requirements than hedge funds. This is partly due to their longer-term investment horizons and less frequent trading activity. Hedge funds, on the other hand, due to their higher frequency trading and often complex investment strategies, are subject to more intensive regulatory oversight. The increased regulatory focus on hedge funds stems from their potential for rapid and significant market impact. This difference in scrutiny is reflected in the reporting requirements, frequency of audits, and the level of transparency demanded by regulatory bodies.

Roles of Regulatory Bodies

Several regulatory bodies play critical roles in overseeing hedge funds and private equity firms. In the United States, the Securities and Exchange Commission (SEC) is the primary regulator, enforcing securities laws and regulations. The SEC’s oversight includes registration requirements, periodic reporting, and anti-fraud provisions. In the United Kingdom, the Financial Conduct Authority (FCA) plays a similar role, ensuring market integrity and protecting investors. Other jurisdictions have their own regulatory bodies with comparable responsibilities, adapting their oversight to the specific characteristics of their financial markets. These bodies employ a variety of tools, including examinations, investigations, and enforcement actions, to maintain compliance and address any violations.

Accounting Treatments for Different Hedge Fund Strategies

The accounting treatment for hedge funds varies significantly depending on their investment strategies. For example, a long-short equity fund will account for its long and short positions separately, recognizing gains and losses accordingly. A fund employing arbitrage strategies might use different valuation methods depending on the nature of the arbitrage opportunity. Funds engaging in derivatives trading will need to adhere to specific accounting standards for derivatives, considering mark-to-market valuations and potential hedging relationships. The complexity of these strategies often requires specialized accounting expertise to ensure accurate and compliant financial reporting. Consistent and transparent accounting practices are critical for investors to accurately assess the fund’s performance and risk profile.

Valuation Challenges and Methods: How Hedge Funds And Private Equity Firms Navigate Accounting Regulations

Valuing the assets held by hedge funds and private equity firms presents unique challenges due to the often illiquid nature of their investments. Unlike publicly traded stocks, these assets lack readily available market prices, requiring sophisticated valuation methodologies and introducing significant subjectivity into financial reporting. This section explores the complexities involved in valuing these assets and the implications for reported financial performance.

Private equity firms frequently invest in illiquid assets such as privately held companies, real estate, and infrastructure projects. The lack of a continuous, active market for these assets makes determining their fair value a complex undertaking. This complexity is further compounded by factors such as the absence of comparable transactions, the inherent uncertainty surrounding future cash flows, and the potential for significant management discretion in the valuation process. These factors can lead to significant variations in valuation estimates across different firms and even within the same firm over time.

Valuation Methodologies and Their Implications

Several methodologies are employed to value illiquid assets, each with its own strengths, weaknesses, and implications for financial reporting. The choice of methodology often depends on the specific characteristics of the asset being valued, the availability of data, and the level of management judgment required. Common approaches include discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

Discounted Cash Flow (DCF) Analysis: This method projects future cash flows generated by the asset and discounts them back to their present value using a discount rate that reflects the risk associated with the investment. The accuracy of this method hinges critically on the reliability of the cash flow projections and the selection of the appropriate discount rate. Overly optimistic projections or an inappropriately low discount rate can lead to overvaluation.

Comparable Company Analysis: This approach involves comparing the valuation multiples (e.g., price-to-earnings ratio, enterprise value-to-EBITDA) of publicly traded companies with similar characteristics to the illiquid asset being valued. However, finding truly comparable companies can be difficult, and differences in financial leverage, growth prospects, and industry dynamics can lead to significant valuation discrepancies.

Precedent Transactions: This method relies on analyzing the prices paid for similar assets in past transactions. This approach is particularly useful when recent comparable transactions are available. However, the comparability of past transactions can be limited by differences in market conditions, transaction structures, and the specific circumstances surrounding each deal.

Impact of Fair Value Accounting

The adoption of fair value accounting under generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) has significantly impacted the reported performance of hedge funds and private equity firms. Fair value accounting requires assets to be reported at their current market value, which can fluctuate significantly for illiquid assets, leading to volatility in reported earnings and net asset value (NAV). This volatility can make it difficult for investors to assess the true underlying performance of these firms. Furthermore, the subjectivity inherent in valuing illiquid assets can create opportunities for earnings management, raising concerns about the reliability and transparency of financial reporting.

Hypothetical Valuation Scenario

Consider a private equity firm holding a diverse portfolio of assets. The following table illustrates the challenges in valuing this complex portfolio:

| Asset | Valuation Method | Potential Challenges |

|---|---|---|

| Privately held technology company | DCF analysis, comparable company analysis | Forecasting future cash flows, finding truly comparable public companies, estimating terminal value |

| Commercial real estate property | Comparable sales, income capitalization | Finding comparable properties in the same market, adjusting for differences in property characteristics, estimating vacancy rates and operating expenses |

| Infrastructure project (toll road) | DCF analysis, precedent transactions | Projecting traffic volume and toll rates, estimating operating and maintenance costs, finding comparable transactions |

| Venture capital investment in a start-up | Cost method, market multiples (if applicable) | Lack of readily available market data, difficulty in determining fair value until an exit event |

Transparency and Disclosure Requirements

Navigating the complex world of hedge fund and private equity regulation necessitates a thorough understanding of transparency and disclosure requirements. These requirements, dictated by a patchwork of national and international regulations, aim to balance investor protection with the need for these firms to maintain competitive advantages rooted in proprietary strategies and deal flow. The level of disclosure varies significantly depending on the fund’s structure and investor base.

Key disclosure requirements are often driven by the type of investor involved and the regulatory environment in which the fund operates. For example, funds registered with the Securities and Exchange Commission (SEC) in the United States face a higher level of scrutiny and disclosure compared to those operating solely within a private placement context. These requirements extend to a wide range of information, including fund performance, investment strategies, risk factors, fees, and the fund manager’s compensation structure.

Disclosure Requirements for Hedge Funds and Private Equity Firms

Specific disclosure requirements vary greatly based on jurisdiction and the type of fund. However, some common themes emerge. Regulatory bodies generally require periodic reporting on fund performance, including net asset value (NAV) calculations, which often involve complex valuation methodologies. Detailed breakdowns of fees and expenses are also mandated, along with disclosures regarding conflicts of interest, particularly those involving the fund manager’s personal investments or related party transactions. Further, information on the fund’s investment strategy and risk profile is typically required to ensure investors have a clear understanding of the potential for both returns and losses.

Reporting Structures and Confidentiality

Hedge funds and private equity firms employ various strategies to fulfill disclosure requirements while safeguarding confidential information. They often utilize customized reporting templates that meet regulatory standards while selectively omitting details that could compromise their competitive edge. For instance, a fund might disclose its overall investment strategy without revealing specific holdings or detailed transaction information. Aggregate data, rather than individual positions, is frequently used to meet disclosure obligations without jeopardizing sensitive market intelligence.

Furthermore, sophisticated data anonymization techniques can be employed to mask specific details within reports. This approach allows firms to meet disclosure mandates while preventing competitors from gaining insights into their proprietary trading strategies or deal pipelines. The use of blind pools, where investors commit capital without knowing the specific investments, is another strategy used to balance transparency with confidentiality, particularly in the early stages of a private equity fund’s life cycle.

Transparency in Publicly Traded vs. Privately Held Funds

A significant difference lies in the level of transparency expected from publicly traded versus privately held funds. Publicly traded funds, such as publicly traded REITs or business development companies (BDCs) that invest in private equity, are subject to far stricter disclosure rules and are required to file regular reports with regulatory bodies, such as the SEC in the U.S. These reports, including quarterly and annual filings, are publicly available and must adhere to strict accounting standards (e.g., GAAP). This level of public scrutiny enhances transparency and investor protection.

Learn about more about the process of How to Track Employee Work Hours for Payroll in the field.

Conversely, privately held funds enjoy a much higher degree of confidentiality. Their disclosure requirements are primarily dictated by the terms of their private placement memoranda (PPMs) and their investor agreements. While these agreements may contain significant disclosure obligations, the information is generally not publicly accessible, protecting the firm’s competitive advantage and preventing the disclosure of sensitive information that could impact its investment strategy.

Comparison of Disclosure Requirements

The following points highlight the key differences in disclosure requirements between publicly traded and privately held funds:

- Frequency of Reporting: Publicly traded funds are required to file regular reports (quarterly and annually), while privately held funds typically report less frequently, often annually or even less often, depending on investor agreements.

- Scope of Disclosure: Publicly traded funds must disclose significantly more information, including detailed financial statements, portfolio holdings, and risk factors, compared to privately held funds.

- Public Accessibility: Publicly traded fund disclosures are publicly available, while those of privately held funds are typically confidential and accessible only to investors.

- Regulatory Oversight: Publicly traded funds are subject to more stringent regulatory oversight and compliance requirements than privately held funds.

- Level of Detail: Publicly traded funds must provide far more detailed information about their investments and financial performance than privately held funds.

Tax Implications and Reporting

Tax reporting for hedge funds and private equity firms presents significant complexities due to the diverse investment vehicles employed, the structure of their compensation, and the intricacies of international tax laws. Understanding these complexities is crucial for ensuring compliance and optimizing tax efficiency. This section will delve into the specific tax considerations for these firms, focusing on carried interest, management fees, and tax optimization strategies.

Tax Reporting for Various Investment Vehicles

Hedge funds and private equity firms utilize a variety of investment vehicles, each with its own unique tax implications. These include partnerships (limited partnerships, general partnerships), limited liability companies (LLCs), corporations, and trusts. The choice of vehicle significantly impacts how profits, losses, and expenses are allocated and reported to tax authorities. For example, partnerships typically pass through profits and losses to their partners, who then report them on their individual tax returns, while corporations pay taxes on their profits at the corporate level before distributing dividends to shareholders. International investments further complicate matters, introducing issues of foreign tax credits, withholding taxes, and compliance with various jurisdictions’ tax regulations. Accurate reporting requires meticulous tracking of income and expenses across different jurisdictions and investment vehicles.

Tax Considerations for Carried Interest and Management Fees

Carried interest, a share of the profits earned by a private equity or hedge fund that is paid to its managers, is a particularly complex area. Tax authorities often scrutinize carried interest, with ongoing debates about its appropriate tax treatment. While traditionally taxed at capital gains rates, which are generally lower than ordinary income rates, there are ongoing legislative efforts to reclassify it as ordinary income. Management fees, on the other hand, are typically taxed as ordinary income for the fund managers. The timing of the recognition of income from both carried interest and management fees also has tax implications, influencing the overall tax liability. Proper accounting and documentation are vital to supporting the tax treatment claimed by the firms.

Tax Optimization Strategies

Within legal boundaries, hedge funds and private equity firms employ various strategies to minimize their tax liabilities. These strategies often involve sophisticated tax planning, leveraging tax deductions, credits, and exemptions allowed by law. Examples include utilizing tax-efficient investment structures, strategically timing capital gains and losses, and employing various tax shelters permitted under the law. However, it is crucial to emphasize that tax optimization must always be conducted in strict compliance with all applicable tax laws and regulations. Aggressive tax avoidance strategies can lead to significant penalties and legal repercussions.

Hypothetical Tax Scenario for a Private Equity Firm

Let’s consider a hypothetical private equity firm, “Apex Investments,” which made a successful investment in Company X.

| Item | Description | Amount | Tax Rate |

|---|---|---|---|

| Investment Gain | Profit from the sale of Company X shares | $10,000,000 | 20% (Capital Gains) |

| Management Fees | Fees earned for managing the investment | $500,000 | 35% (Ordinary Income) |

| Carried Interest | Share of profits allocated to managers | $2,000,000 | 20% (Capital Gains – Assumed) |

| Total Taxable Income | Sum of all taxable income | $12,500,000 | – |

| Total Tax Liability | (Investment Gain * Tax Rate) + (Management Fees * Tax Rate) + (Carried Interest * Tax Rate) | $2,000,000 + $175,000 + $400,000 = $2,575,000 | – |

This hypothetical scenario demonstrates a simplified calculation. Real-world tax calculations for private equity firms are far more intricate, considering various factors like depreciation, amortization, interest expenses, and potential tax credits. Furthermore, the tax rates used are illustrative and may vary depending on the jurisdiction and specific circumstances.

Auditing and Compliance Procedures

The auditing of hedge funds and private equity firms presents unique challenges due to the complexity of their investment strategies, the opacity of certain transactions, and the often illiquid nature of their assets. These audits require specialized expertise and a deep understanding of financial instruments and regulatory frameworks. Independent auditors play a crucial role in ensuring the integrity and reliability of financial reporting for these entities.

Auditing procedures for these firms typically involve a comprehensive review of their financial statements, investment portfolios, and operational processes. This process aims to provide reasonable assurance that the financial statements are presented fairly in all material respects in accordance with applicable accounting standards.

Independent Auditor’s Role in Ensuring Compliance

Independent auditors are responsible for providing an objective assessment of a hedge fund or private equity firm’s financial statements and internal controls. Their work includes verifying the accuracy of financial records, assessing the effectiveness of risk management strategies, and confirming compliance with relevant accounting regulations, such as generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), as well as specific regulations pertaining to investment management. The auditor’s opinion, expressed in an audit report, provides assurance to investors and regulators about the reliability of the financial information presented. A significant part of their role involves testing the design and operating effectiveness of internal controls.

Common Audit Focus Areas and Potential Risks, How Hedge Funds and Private Equity Firms Navigate Accounting Regulations

Auditors typically focus on several key areas when examining hedge funds and private equity firms. These include the valuation of illiquid assets, which often requires sophisticated modeling and judgment; the accuracy of performance reporting, including the calculation of management fees and carried interest; and the proper classification and disclosure of investments. Potential risks include errors in valuation methodologies leading to misstated net asset values (NAVs), inconsistencies in performance reporting, and inadequate disclosures of material risks. For example, misclassifying an investment could significantly impact the reported performance and risk profile of the fund. Another common risk area is the potential for fraud or manipulation in reporting performance or asset values.

Internal Controls and Accurate Financial Record Keeping

Robust internal controls are essential for hedge funds and private equity firms to maintain accurate financial records and ensure compliance with accounting regulations. These controls encompass a wide range of processes and procedures, including segregation of duties, authorization procedures, reconciliation of accounts, and regular independent reviews. Strong internal controls reduce the risk of errors, fraud, and non-compliance. For instance, a well-designed system for trade confirmation and settlement will minimize the risk of errors in calculating portfolio values. Regular reconciliations of bank statements and investment accounts are also crucial to detect discrepancies and potential irregularities. The effectiveness of these controls is regularly assessed by both management and external auditors.

Emerging Challenges and Future Trends

The evolving regulatory landscape, coupled with rapid technological advancements, presents significant challenges and opportunities for hedge funds and private equity firms. Navigating these changes requires proactive adaptation and a deep understanding of the implications for accounting, auditing, and compliance. This section will explore some key emerging challenges and future trends impacting these firms.

The increasing complexity of accounting standards and regulations, driven by factors such as globalization and financial crises, necessitates ongoing adaptation by hedge funds and private equity firms. New standards often require significant changes to internal processes, systems, and reporting methodologies, demanding substantial investment in both human capital and technology.

Impact of New Accounting Standards and Regulations

The adoption of new accounting standards, such as IFRS 17 (Insurance Contracts) for firms with insurance-linked investments, or evolving regulations concerning environmental, social, and governance (ESG) factors, presents significant challenges. For example, IFRS 17 necessitates a more complex valuation of insurance contracts, requiring specialized expertise and sophisticated systems. Similarly, increasing ESG reporting requirements demand the integration of ESG data into financial reporting, presenting challenges related to data collection, verification, and assurance. Failure to comply with these evolving standards can result in significant financial penalties and reputational damage.

Challenges from Increased Regulatory Scrutiny and Technological Advancements

Heightened regulatory scrutiny, driven by events such as the 2008 financial crisis and subsequent scandals, has led to increased oversight and stricter enforcement. This includes more frequent audits, enhanced data reporting requirements, and stricter penalties for non-compliance. Simultaneously, rapid technological advancements, such as the proliferation of big data and artificial intelligence, create both opportunities and challenges. While these technologies can enhance efficiency and improve risk management, they also introduce new complexities related to data security, algorithmic bias, and the need for specialized skills to manage and interpret complex datasets.

Implications of Increased Data Analytics and AI on Auditing and Compliance

The increased use of data analytics and AI in auditing and compliance is transforming the landscape. AI-powered tools can automate many aspects of the audit process, such as identifying anomalies and assessing risk more efficiently. However, the reliance on these technologies raises concerns about algorithmic bias, data security breaches, and the need for human oversight to ensure the accuracy and reliability of AI-driven insights. The development of robust governance frameworks and ethical guidelines for the use of AI in auditing and compliance is crucial to mitigate these risks. For example, a misconfigured AI algorithm could misidentify fraudulent activity, leading to incorrect conclusions and potentially harmful consequences.

Innovative Approaches to Adapting to Change

Hedge funds and private equity firms are adopting various innovative approaches to navigate the changing regulatory environment. This includes investing in advanced technology platforms for data management and reporting, enhancing internal controls and compliance programs, and recruiting specialized professionals with expertise in regulatory compliance and data analytics. Furthermore, many firms are collaborating with technology providers to develop customized solutions tailored to their specific needs. Some firms are also proactively engaging with regulators to gain a deeper understanding of upcoming changes and to contribute to the development of more effective and efficient regulatory frameworks. For instance, a firm might partner with a RegTech company to develop a system that automates regulatory reporting, reducing manual effort and improving accuracy.

Last Recap

Navigating the complex world of accounting regulations is paramount for the success and stability of hedge funds and private equity firms. This exploration has illuminated the intricate interplay between regulatory compliance, investment strategies, and financial reporting. From understanding the nuances of valuation methodologies for illiquid assets to mastering the complexities of tax reporting and adapting to evolving technological landscapes, these firms require a deep understanding of the accounting landscape. The future holds continued challenges, with increasing regulatory scrutiny and technological advancements demanding ongoing adaptation and innovation. By understanding these complexities, we gain valuable insights into the financial mechanisms that shape global markets and the crucial role of robust accounting practices in maintaining their integrity.

Detailed FAQs

What are the key differences between GAAP and IFRS in the context of hedge funds and private equity?

GAAP (Generally Accepted Accounting Principles) is primarily used in the US, while IFRS (International Financial Reporting Standards) is used internationally. Key differences lie in areas like revenue recognition, fair value accounting, and the level of detail required in financial reporting. These differences can significantly impact how these firms present their financial performance.

How do these firms manage the confidentiality of their investments while meeting disclosure requirements?

Firms utilize strategies like carefully structuring their reporting to meet minimum disclosure requirements without revealing sensitive competitive information. They often employ aggregation techniques and avoid granular detail about specific investments while still demonstrating compliance with regulatory demands.

What are some common audit challenges faced by auditors when examining hedge funds and private equity firms?

Common challenges include valuing illiquid assets, verifying complex derivative transactions, assessing the effectiveness of internal controls in a rapidly changing environment, and understanding the intricacies of various investment strategies.