How Global Tax Havens Affect Corporate Financial Statements is a critical issue impacting global finance. The use of tax havens by multinational corporations significantly alters the presentation of their financial health, often obscuring the true picture of profitability and financial stability. This manipulation of reported earnings raises concerns about transparency and fairness, impacting investors, governments, and the global economy as a whole. Understanding these mechanisms is crucial for navigating the complexities of international finance and promoting responsible corporate governance.

This exploration delves into the various methods employed to shift profits, the resulting distortions in key financial statement items, and the implications for stakeholders. We will examine the legal and regulatory frameworks surrounding tax havens, the role of auditors and regulatory bodies in oversight, and the broader economic and social consequences of this widespread practice. The goal is to provide a comprehensive overview, shedding light on the hidden complexities within corporate financial reporting.

Defining Global Tax Havens and Their Characteristics: How Global Tax Havens Affect Corporate Financial Statements

Global tax havens significantly impact corporate financial statements by offering opportunities to minimize tax liabilities. Understanding their characteristics is crucial for interpreting the financial health and transparency of multinational corporations. This section will define these jurisdictions, explore their enabling frameworks, and analyze the strategies corporations employ to leverage them.

A global tax haven is a country or territory that offers exceptionally low or zero tax rates, coupled with a lack of transparency and regulatory oversight. These jurisdictions actively attract foreign investment by offering significant tax advantages, often exceeding those available in other countries with stricter regulations. This creates an environment where companies can legally shift profits to reduce their overall tax burden, impacting their reported financial performance in ways that may not reflect their true economic activity.

Notice How Corporate Social Responsibility Affects Financial Reporting Standards for recommendations and other broad suggestions.

Defining Characteristics of Global Tax Havens

Tax havens are characterized by several key features. Low or no corporate income tax rates are paramount, often combined with minimal capital gains taxes, wealth taxes, and other levies. Additionally, these jurisdictions frequently lack robust information-sharing agreements with other countries, hindering tax authorities’ ability to track and audit cross-border transactions. Strict banking secrecy laws further enhance the opacity of financial activities, making it difficult to trace the ultimate beneficial owners of assets and companies. Finally, many tax havens offer sophisticated financial services, including shell companies and trusts, which facilitate complex tax planning strategies.

Examples of Tax Havens

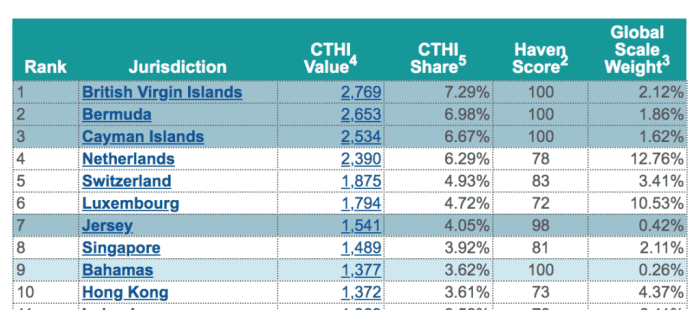

Several jurisdictions are commonly identified as tax havens. These include the British Virgin Islands, Cayman Islands, Bermuda, Luxembourg, the Netherlands, and certain states within the United States. It’s important to note that the designation of a jurisdiction as a tax haven is often contested and depends on the specific criteria used for assessment. The level of secrecy and the specific tax laws in effect continuously evolve, making the identification of a “tax haven” a complex and dynamic process.

Legal and Regulatory Frameworks Enabling Tax Haven Activity

The legal and regulatory frameworks of tax havens are specifically designed to attract foreign investment. These frameworks often include permissive incorporation laws, allowing for the easy establishment of shell companies with minimal disclosure requirements. Furthermore, many tax havens have limited or no requirements for substance, meaning that companies can register in these jurisdictions without having any significant physical presence or economic activity there. These weak regulatory structures contribute to the opacity and facilitate the movement of funds across borders with minimal scrutiny. Loopholes in international tax treaties, exploited through complex corporate structures, also play a significant role.

Corporate Tax Haven Strategies

Corporations employ various strategies to leverage tax havens. These include shifting profits to low-tax jurisdictions through transfer pricing manipulations, where the prices of goods and services exchanged between related companies are artificially inflated or deflated to reduce taxable income in high-tax countries. Another common strategy is the use of holding companies, which are established in tax havens to hold assets and receive income from subsidiaries in other countries, allowing for the deferral or reduction of tax liabilities. Furthermore, corporations may utilize complex financial instruments and structured transactions to obscure the flow of funds and minimize their tax exposure. The choice of strategy often depends on the specific corporate structure, the nature of the business, and the legal expertise available.

Mechanisms for Shifting Profits to Tax Havens

Corporations employ various sophisticated strategies to minimize their global tax burden. These methods often involve shifting profits from high-tax jurisdictions to low-tax or no-tax jurisdictions, commonly known as tax havens. This practice raises ethical and legal concerns, as it deprives governments of much-needed revenue. Understanding these mechanisms is crucial for analyzing the true financial picture of multinational corporations.

Profit shifting is achieved through a range of techniques, primarily revolving around manipulating the pricing of goods and services exchanged between related entities in different countries. This manipulation, known as transfer pricing, allows companies to artificially inflate expenses in high-tax countries and reduce taxable income, while simultaneously inflating profits in low-tax jurisdictions. Other methods involve the strategic use of intangible assets like patents and trademarks, and the exploitation of legal loopholes in international tax treaties.

Transfer Pricing Manipulation

Transfer pricing is the setting of prices for goods, services, and intangible assets exchanged between related entities within a multinational corporate group. In legitimate transactions, transfer prices should reflect arm’s length prices – that is, the prices that would be agreed upon between unrelated parties in a comparable transaction. However, corporations often manipulate transfer prices to shift profits. For instance, a multinational corporation might sell its products to a subsidiary in a tax haven at a significantly low price, thus reducing its taxable income in its home country while increasing the profits of the subsidiary in the tax haven. This artificially inflates the expenses in the high-tax country and reduces taxable income there.

Intangible Assets and Profit Shifting

Intangible assets, such as patents, trademarks, copyrights, and brand names, play a significant role in profit shifting schemes. These assets often generate substantial profits, and their valuation is subjective and open to manipulation. A company can shift profits by assigning a high value to intangible assets held by a subsidiary in a tax haven, thus increasing the profits reported by that subsidiary and reducing the profits reported in higher-tax jurisdictions. This is because the royalties paid to the tax haven subsidiary for the use of these assets are tax-deductible expenses in the high-tax country.

Hypothetical Scenario: Multinational Corporation Tax Optimization

Let’s consider a hypothetical scenario involving “GlobalTech,” a multinational technology company headquartered in the US. GlobalTech holds valuable patents for its software. To reduce its US tax burden, GlobalTech establishes a subsidiary in a tax haven like Bermuda. GlobalTech then licenses its patents to the Bermuda subsidiary for a significantly high royalty fee. This artificially inflates the Bermuda subsidiary’s profits, reducing GlobalTech’s US taxable income and shifting profits to the low-tax jurisdiction. The royalty payments are deducted from GlobalTech’s US income, lowering its taxable base. The Bermuda subsidiary then pays minimal taxes due to the tax haven’s favorable tax laws.

Methods of Profit Shifting to Tax Havens

| Method | Description | Impact on Financial Statements | Example |

|---|---|---|---|

| Transfer Pricing Manipulation | Artificially inflating expenses in high-tax countries and reducing taxable income by manipulating the prices of goods and services exchanged between related entities. | Lower reported profits in high-tax jurisdictions; higher reported profits in low-tax jurisdictions. | A US-based company sells its products to a subsidiary in a tax haven at a significantly lower price than the market value. |

| Intangible Asset Exploitation | Assigning high values to intangible assets held by subsidiaries in tax havens to increase their profits and reduce profits in higher-tax jurisdictions. | Lower reported profits in high-tax jurisdictions; higher reported profits in low-tax jurisdictions; increased royalty expenses in high-tax jurisdictions. | A pharmaceutical company licenses its patented drug to a subsidiary in a tax haven for a high royalty fee. |

| Debt Shifting | Borrowing money from a subsidiary in a tax haven to generate tax-deductible interest expenses in a high-tax jurisdiction. | Lower reported profits in high-tax jurisdictions due to increased interest expense. | A company borrows money from its subsidiary in a tax haven at a high-interest rate. |

| Thin Capitalization | Using excessive debt financing in a high-tax jurisdiction to reduce taxable income. | Lower reported profits in high-tax jurisdictions due to increased interest expense. | A company finances its operations primarily through debt from related parties in a tax haven. |

Impact on Key Financial Statement Items

Tax haven activity significantly impacts several key line items in a corporation’s financial statements, ultimately affecting its reported profitability and financial health. The primary mechanism is the artificial reduction of taxable income through profit shifting, leading to lower income tax expenses and potentially influencing other balance sheet and income statement accounts. Understanding these effects is crucial for accurately interpreting a company’s financial performance.

The most notable impact is on income tax expense. By shifting profits to low- or no-tax jurisdictions, companies reduce their overall tax liability reported in their income statement. This artificially inflates reported net income, presenting a misleading picture of true profitability. This manipulation also influences deferred tax assets and liabilities, as the timing of tax payments is altered, creating complexities in the balance sheet. Furthermore, increased retained earnings result from the higher reported net income, potentially affecting shareholder distributions and future investment capacity.

Income Tax Expense Reduction

The most direct impact of tax haven utilization is a reduction in income tax expense. A company operating in multiple jurisdictions can strategically allocate profits to subsidiaries in tax havens, minimizing its global tax burden. This lower tax expense directly increases net income, improving the company’s reported profitability. For example, a company with $100 million in pre-tax income might report a $20 million tax expense if operating solely in a high-tax jurisdiction. However, by shifting a portion of its profits to a tax haven, it might reduce its reported tax expense to $10 million, doubling its reported net income. This difference significantly impacts key financial ratios such as return on assets (ROA) and return on equity (ROE), making the company appear more profitable than it might be in reality.

Impact on Deferred Tax Assets and Liabilities

The use of tax havens also complicates a company’s deferred tax assets and liabilities. Deferred tax assets arise when a company has paid more taxes than it currently owes, while deferred tax liabilities arise when it has paid less. Profit shifting can create temporary differences between the company’s financial reporting and its tax reporting, leading to changes in these balances. For instance, accelerated depreciation for tax purposes in a high-tax jurisdiction but straight-line depreciation for financial reporting purposes would generate a deferred tax liability. Conversely, utilizing tax havens might create deferred tax assets if the company anticipates future tax benefits in higher-tax jurisdictions. The complexity of these adjustments makes analyzing the financial statements more challenging and requires careful scrutiny of the notes to the financial statements.

Comparative Illustration of Income Statements

To illustrate the impact, consider two identical companies, Company A and Company B. Both have $100 million in revenue and $60 million in operating expenses. Company A utilizes a tax haven, while Company B does not. Assume a 25% tax rate in Company B’s jurisdiction.

| Line Item | Company A (Using Tax Haven) | Company B (No Tax Haven) |

|---|---|---|

| Revenue | $100,000,000 | $100,000,000 |

| Operating Expenses | $60,000,000 | $60,000,000 |

| Pre-tax Income | $40,000,000 | $40,000,000 |

| Income Tax Expense | $5,000,000 (12.5% effective rate due to tax haven) | $10,000,000 (25% tax rate) |

| Net Income | $35,000,000 | $30,000,000 |

The difference in net income, solely due to tax haven utilization, highlights the significant impact on reported profitability. Company A’s higher net income would lead to higher retained earnings and potentially influence various financial ratios, creating a distorted view of its actual financial performance compared to Company B. Note that this is a simplified illustration; real-world scenarios often involve more complex tax structures and jurisdictions.

Disclosure Requirements and Transparency

International accounting standards and national regulations concerning the disclosure of tax haven activities are complex and vary significantly, impacting the transparency of multinational corporations’ financial reporting. The lack of consistent global standards often leads to inconsistencies and difficulties in accurately assessing a company’s true financial position and tax obligations.

The current international accounting standard, IFRS 12, addresses the disclosure of interests in other entities, including those located in tax havens. However, the standard’s effectiveness depends heavily on the quality and detail of the information provided by companies, which can be influenced by national laws and enforcement. Many jurisdictions have implemented their own specific rules and regulations regarding tax haven disclosures, adding to the complexity of navigating this area.

Variations in Disclosure Requirements Across Jurisdictions, How Global Tax Havens Affect Corporate Financial Statements

Significant differences exist in the level of detail required for tax haven disclosures across various jurisdictions. Some countries mandate extensive reporting on the nature of the tax haven entity, its financial activities, and the tax implications, while others only require minimal disclosures, leaving significant room for ambiguity. For example, the European Union has implemented stricter disclosure requirements for tax-related information compared to some countries in other regions, leading to discrepancies in the transparency of multinational corporate financial statements. This variability makes international comparisons challenging and can hinder effective cross-border tax enforcement.

Challenges in Ensuring Transparency

Several key challenges hinder transparency in the use of tax havens by multinational corporations. One significant obstacle is the inherent complexity of global tax structures. The intricate web of subsidiaries, shell companies, and complex financial instruments often obscures the actual location of profits and the effective tax rate. Furthermore, the lack of standardized definitions for “tax havens” makes it difficult to consistently identify and report on these entities. The varying levels of enforcement across different jurisdictions further complicate the issue, allowing some companies to exploit loopholes and avoid full disclosure. The lack of effective international cooperation in sharing tax information also contributes to a lack of transparency.

Inconsistencies in Disclosure Regulations and Misleading Reporting

Inconsistencies in disclosure regulations can directly lead to misleading financial reporting. Companies might selectively disclose information in jurisdictions with weaker regulations, potentially understating their effective tax rate or masking the true extent of their tax haven activities. This lack of uniformity allows for “creative accounting,” where companies manipulate their financial statements to present a more favorable picture to investors and stakeholders. For example, a company might report minimal income from a tax haven subsidiary, even if substantial profits are being channeled through that entity, thus misleading investors about the company’s true profitability and tax burden. This can create an uneven playing field for businesses that operate transparently and comply with stricter regulations.

The Role of Auditors and Regulatory Bodies

Auditors and regulatory bodies play crucial roles in mitigating the risks associated with corporate use of tax havens. Their actions, while not always perfectly effective, are vital for maintaining financial statement transparency and preventing the erosion of tax bases. The effectiveness of their oversight varies depending on the resources available, the sophistication of tax avoidance schemes, and the political will to enforce regulations.

Auditors’ Responsibilities in Detecting Tax Haven-Related Issues

Auditors have a responsibility to identify and report potential tax haven-related issues within a company’s financial statements. This involves a thorough review of the company’s transactions, particularly those involving related parties or jurisdictions known for low tax rates or lax regulatory environments. They should scrutinize intercompany transactions, transfer pricing arrangements, and the overall structure of the company’s international operations to detect any indications of profit shifting. A key aspect of this process is assessing the substance of the company’s operations in each jurisdiction, ensuring that reported profits align with the actual economic activity conducted. Failure to adequately investigate such matters could lead to qualified audit opinions or even legal repercussions for the auditing firm. Modern auditing standards increasingly emphasize the importance of considering tax risks and related disclosures.

Regulatory Bodies’ Oversight and Enforcement

Regulatory bodies, such as tax authorities and financial regulators, are responsible for overseeing the use of tax havens and enforcing disclosure requirements. Their responsibilities include developing and implementing regulations aimed at preventing tax avoidance, conducting investigations into suspected tax haven activity, and imposing penalties on companies found to be engaging in such practices. These bodies utilize various tools to achieve this, including information sharing agreements with other countries, enhanced data analytics to detect unusual patterns in financial flows, and stricter enforcement of existing regulations. The effectiveness of these bodies hinges on their resources, their level of independence, and the political environment in which they operate. Lack of international cooperation can significantly hamper efforts to combat cross-border tax avoidance.

Effectiveness of Different Regulatory Approaches

Different countries and international organizations have adopted varying approaches to address tax haven activity. Some jurisdictions have implemented stricter rules on transfer pricing, while others have focused on enhancing information sharing and transparency. The effectiveness of these approaches varies. For instance, information-sharing agreements can be very effective when countries actively cooperate and share data effectively. However, their effectiveness is diminished when jurisdictions lack the political will or resources to act on the information received. Similarly, stricter transfer pricing rules can be effective in deterring profit shifting, but their success depends on the ability of tax authorities to effectively monitor and enforce them. Countries with strong regulatory frameworks and robust enforcement mechanisms tend to be more successful in curbing tax haven activity.

Examples of Successful Interventions

Several cases demonstrate the success of auditors and regulatory bodies in identifying and addressing tax haven-related issues. For example, the investigation into the LuxLeaks scandal, which revealed how Luxembourg granted favorable tax rulings to multinational corporations, led to increased scrutiny of tax rulings and greater transparency in the tax practices of both corporations and governments. Furthermore, various high-profile cases involving multinational companies have resulted in significant penalties and settlements due to aggressive tax planning involving tax havens. These cases highlight the importance of robust auditing practices and strong regulatory oversight in curbing the use of tax havens and ensuring corporate financial statement accuracy. The ongoing efforts by the OECD to promote tax transparency and cooperation among countries are also contributing to a more effective global response to tax havens.

Economic and Social Consequences

The widespread use of corporate tax havens carries significant economic and social ramifications, extending far beyond the immediate financial benefits accrued by corporations. These practices create a ripple effect impacting national economies, government services, and ultimately, the well-being of citizens. Understanding these consequences is crucial for formulating effective policies to mitigate the negative impacts.

The economic consequences of tax havens are multifaceted and often detrimental to the global economy. The most immediate impact is a reduction in government revenue. This loss of tax revenue directly affects the ability of governments to fund essential public services such as healthcare, education, and infrastructure. Furthermore, the erosion of the tax base can lead to increased pressure on other taxpayers to compensate for the shortfall, potentially leading to regressive tax policies. Beyond the direct revenue loss, tax havens can also distort competition, as companies based in tax havens often have a significant cost advantage over those operating in countries with higher tax rates. This can lead to a “race to the bottom,” where countries continuously lower their corporate tax rates to attract businesses, ultimately reducing overall tax revenue globally. This ultimately weakens the capacity of governments to invest in sustainable economic growth and development.

Reduced Government Revenue and Public Service Provision

The diminished tax revenue resulting from the use of tax havens directly impacts the funding available for essential public services. For example, a country might experience cuts to education budgets, leading to under-resourced schools and a less skilled workforce. Similarly, reduced healthcare funding can result in longer waiting times, limited access to specialist care, and an overall decline in public health. Infrastructure projects, such as road maintenance and public transportation improvements, may also suffer due to a lack of funding. These cuts affect the quality of life for citizens and hinder long-term economic development. This is particularly pronounced in developing countries, where a significant portion of government revenue is already limited.

Negative Consequences for Various Stakeholders

The negative consequences of tax havens are widely distributed across various stakeholders. Understanding these impacts is critical for developing effective strategies to address this issue.

- Governments: Reduced tax revenue, hindering the funding of public services and economic development initiatives. Increased pressure to lower corporate tax rates, potentially leading to a “race to the bottom.” Loss of control over tax policy and economic sovereignty.

- Taxpayers: Increased tax burden to compensate for revenue lost due to corporate tax avoidance. Reduced access to quality public services due to budget cuts. A sense of unfairness and inequality as corporations avoid paying their fair share.

- Businesses: Increased competition from companies using tax havens, potentially leading to lower profits and job losses in countries with higher tax rates. Reputational damage associated with using tax havens, potentially impacting investor confidence and consumer trust.

Closing Summary

In conclusion, the utilization of global tax havens presents a significant challenge to the accuracy and transparency of corporate financial statements. The intricate methods used to shift profits distort key financial metrics, hindering a clear understanding of a company’s true financial performance. While international regulations and auditing practices aim to address these issues, inconsistencies and loopholes remain. Ultimately, fostering greater transparency and accountability in corporate tax practices is crucial for maintaining a level playing field and ensuring a healthy global economy. Further research and stricter enforcement are necessary to mitigate the negative economic and social consequences associated with tax havens.

General Inquiries

What are some common types of tax haven strategies?

Common strategies include transfer pricing manipulation (artificially inflating costs in high-tax jurisdictions and lowering them in low-tax ones), using shell companies in tax havens to hold assets or intellectual property, and employing complex debt financing structures.

How do tax havens impact a company’s credit rating?

While not directly impacting credit ratings, the use of tax havens can raise concerns about financial transparency and risk, potentially leading to a lower credit rating if it signals questionable accounting practices or a higher overall risk profile.

Are there any ethical considerations related to using tax havens?

Yes, ethical concerns arise around fairness and equity. Using tax havens to avoid paying taxes deprives governments of revenue needed for public services, potentially exacerbating social inequalities. It can also be seen as a breach of corporate social responsibility.