How Financial Transparency Affects International Investment is a critical consideration in today’s globalized economy. The degree of openness and accountability in financial reporting significantly influences the decisions of both foreign direct investors (FDI) and portfolio investors. This analysis explores the multifaceted relationship between financial transparency and international capital flows, examining how varying levels of transparency across nations impact investment decisions, risk assessment, and ultimately, economic growth. We will delve into the roles of international organizations, technological advancements, and the harmonization of global standards in shaping a more transparent and efficient international investment landscape.

This exploration will cover various aspects, including the definition of financial transparency in an international context, its impact on different investment types (FDI and portfolio investments), its role in risk mitigation, and the potential of technology to enhance transparency. We will also discuss the importance of international cooperation and the harmonization of standards to create a more level playing field for global investment.

Defining Financial Transparency in International Investment

Financial transparency is crucial for fostering trust and attracting international investment. It involves the open and readily available dissemination of accurate financial information, allowing investors to make informed decisions and assess risks effectively. A lack of transparency, conversely, can lead to capital flight, increased investment costs, and hindered economic growth.

Dimensions of Financial Transparency in International Investment

Financial transparency in international investment encompasses several key dimensions. Accounting standards provide a common framework for recording and reporting financial data, ensuring comparability across different jurisdictions. Disclosure requirements mandate the release of specific financial information to the public and investors, promoting accountability and reducing information asymmetry. Robust regulatory frameworks, including enforcement mechanisms, are essential to ensure compliance with accounting standards and disclosure requirements. These elements work together to create a transparent and predictable investment environment.

Comparative Levels of Financial Transparency Across Countries and Regions

Significant variations exist in the levels of financial transparency across different countries and regions. Developed economies generally exhibit higher levels of transparency due to more established regulatory frameworks, stronger enforcement mechanisms, and a greater emphasis on corporate governance. Emerging markets, however, often face challenges in implementing and enforcing robust transparency standards, sometimes due to limited resources, capacity constraints, or a lack of political will. This disparity can influence investment flows, with investors often preferring jurisdictions with higher transparency levels. Regional differences are also evident, with some regions showing a greater commitment to transparency initiatives than others. For example, the European Union has implemented comprehensive regulations to enhance financial transparency, while other regions may lag behind.

The Role of International Organizations in Promoting Financial Transparency

International organizations such as the International Monetary Fund (IMF) and the World Bank play a vital role in promoting financial transparency globally. They provide technical assistance and capacity building to developing countries to help them improve their accounting standards, disclosure requirements, and regulatory frameworks. They also conduct research and analysis to identify best practices and promote the adoption of international standards. Furthermore, these organizations often incorporate financial transparency criteria into their lending and investment decisions, incentivizing countries to adopt greater transparency. Their influence helps to establish a global baseline for financial reporting and regulation.

Comparison of Financial Transparency Regulations in Three Major Economies

| Country | Accounting Standards | Disclosure Requirements | Regulatory Enforcement |

|---|---|---|---|

| United States | Generally Accepted Accounting Principles (GAAP) | Extensive disclosure requirements for publicly traded companies, regulated by the Securities and Exchange Commission (SEC). | Robust enforcement by the SEC, with significant penalties for non-compliance. |

| China | Chinese Accounting Standards (CAS), increasingly converging with IFRS. | Disclosure requirements are evolving, with a growing emphasis on transparency, though enforcement remains a challenge. | Enforcement mechanisms are improving, but inconsistencies and limitations remain. |

| European Union | International Financial Reporting Standards (IFRS) adopted widely. | Comprehensive disclosure requirements under various directives, including the Transparency Directive and Market Abuse Regulation (MAR). | Enforcement varies across member states, but generally strong oversight by national regulatory bodies. |

Impact of Transparency on Foreign Direct Investment (FDI)

Increased financial transparency significantly influences the flow of Foreign Direct Investment (FDI). A strong correlation exists between transparent financial reporting and increased FDI inflows, while opaque practices often deter investment. This section explores this relationship, providing examples and illustrating the impact on investor confidence.

Increased financial transparency fosters greater confidence among foreign investors, leading to higher FDI inflows. Transparent financial reporting allows investors to accurately assess the risks and potential returns associated with an investment, reducing uncertainty and encouraging capital flows. Conversely, a lack of transparency creates an environment of uncertainty, making it difficult for investors to evaluate risks, potentially deterring investment. This can manifest in various ways, from hesitancy to invest in emerging markets with weak regulatory frameworks to a reluctance to engage in business deals where financial information is incomplete or unreliable.

Transparent Financial Reporting Attracts FDI

Countries with robust accounting standards, effective auditing practices, and readily available financial information tend to attract more FDI. Investors are more likely to commit capital when they can confidently assess a company’s financial health and track its performance over time. For instance, countries in the European Union, known for their stringent financial regulations and transparency requirements, generally attract significant FDI. Conversely, countries with weak regulatory frameworks and a history of financial scandals may experience lower FDI inflows as investors perceive higher risks. The availability of reliable, independently audited financial statements acts as a powerful signal to investors, demonstrating a commitment to good governance and reducing information asymmetry. This predictability and reduced uncertainty are crucial factors driving investment decisions.

Opaque Financial Practices Deter FDI

Opaque financial practices, including weak accounting standards, lack of independent audits, and limited access to financial information, significantly hinder FDI inflows. Investors are hesitant to commit capital in environments where they cannot adequately assess the risks associated with their investment. This is particularly true in developing countries where corruption or weak governance may lead to a lack of transparency in financial reporting. For example, instances of accounting fraud or undisclosed liabilities can severely damage investor confidence and lead to capital flight. The resulting uncertainty increases the perceived risk, leading to higher required returns and potentially deterring investment altogether. The absence of transparent financial information creates information asymmetry, giving an advantage to insiders and potentially exposing investors to greater risks.

Hypothetical Scenario: Improved Transparency Leading to Increased FDI

Imagine a developing country, let’s call it “Atheria,” with significant untapped potential but a history of opaque financial practices. Currently, Atheria experiences limited FDI due to investor concerns about corruption and unreliable financial reporting. However, if Atheria implements comprehensive reforms, including strengthening its accounting standards, establishing an independent auditing body, and improving access to financial information through a publicly accessible database, it can dramatically change its investment landscape. This improved transparency would signal to foreign investors a commitment to good governance and reduce the perceived risk. As a result, Atheria could attract significant FDI, leading to economic growth, job creation, and improved living standards. This hypothetical scenario is based on numerous real-world examples where countries have successfully attracted FDI by improving their financial transparency. For example, several East Asian economies have witnessed significant FDI growth after implementing robust regulatory frameworks and improving the quality of financial reporting.

Transparency and Portfolio Investment

Portfolio investment, encompassing stocks and bonds, is significantly influenced by the level of financial transparency in a market. Investors, whether individuals or large institutions, rely on readily available and reliable information to make informed decisions, minimizing risk and maximizing returns. A lack of transparency introduces uncertainty, potentially deterring investment and increasing volatility.

Financial transparency affects portfolio investment decisions by shaping investor perception of risk and return. When companies and governments are open about their financial health, including accounting practices, regulatory compliance, and economic conditions, investors feel more confident in their investment choices. Conversely, opaque financial systems can lead to higher perceived risk, demanding higher returns to compensate for the uncertainty, or even deterring investment altogether.

Information Needs of Portfolio Investors

Portfolio investors require a comprehensive understanding of a company’s or country’s financial standing before committing capital. This need extends beyond basic financial statements. Investors seek clarity on accounting methodologies, regulatory compliance, corporate governance structures, and the overall macroeconomic environment. Access to timely and accurate information is crucial for assessing potential risks and opportunities. For example, consistent and transparent reporting on earnings, debt levels, and cash flow provides a clearer picture of a company’s financial health, allowing investors to evaluate its long-term sustainability. Similarly, transparent government reporting on economic indicators and fiscal policies allows investors to better gauge the overall stability of a country’s investment climate.

Information Requirements: Long-Term vs. Short-Term Investors

Long-term and short-term portfolio investors have differing information requirements, shaped by their investment horizons. Long-term investors, such as pension funds, prioritize information related to a company’s long-term strategic plans, sustainable business models, and management quality. They are less concerned with short-term fluctuations and more focused on the fundamental strength and future prospects of the investment. Short-term investors, on the other hand, are primarily concerned with immediate market trends and short-term financial performance. Their information needs center around timely financial updates, market sentiment indicators, and factors that might impact the short-term price movements of securities. For instance, a long-term investor might focus on a company’s research and development spending, while a short-term investor might concentrate on quarterly earnings reports and analyst forecasts.

Best Practices for Attracting Portfolio Investment

Companies seeking to attract portfolio investment through enhanced financial transparency should adopt the following best practices:

Implementing these best practices helps build trust and confidence among investors, leading to improved access to capital and lower borrowing costs. Ultimately, increased transparency benefits both companies and investors by fostering a more efficient and stable investment environment.

Check what professionals state about The Role of Accounting in Sustainable Development and ESG Reporting and its benefits for the industry.

- Publish comprehensive and timely financial reports adhering to internationally recognized accounting standards (e.g., IFRS).

- Maintain robust internal controls and audit processes to ensure the accuracy and reliability of financial information.

- Disclose all material risks and uncertainties that could affect the company’s financial performance.

- Provide clear and concise explanations of the company’s business strategy and operational performance.

- Engage proactively with investors and analysts, providing opportunities for Q&A sessions and open communication.

- Maintain a transparent and ethical corporate governance structure, ensuring accountability and oversight.

- Regularly communicate with investors on significant events and developments that could impact the company’s financial performance.

Transparency and Risk Mitigation

Transparent financial reporting plays a crucial role in mitigating the inherent risks associated with international investment. By providing readily available and reliable information about a company’s financial health, operations, and governance, transparency reduces uncertainty and allows investors to make more informed decisions, ultimately lowering their risk exposure. This is particularly important in international contexts where information asymmetries are often greater and the regulatory environment may differ significantly from the investor’s home country.

Transparent financial reporting helps mitigate risks by enabling investors to accurately assess the creditworthiness and solvency of potential investment targets. This allows for a more precise evaluation of the likelihood of default or other financial distress. Furthermore, transparency allows investors to identify potential red flags, such as inconsistencies in financial statements or questionable accounting practices, that might indicate underlying problems. Early identification of such issues can prevent significant financial losses.

Lack of Transparency and Increased Investment Risks

Opacity in financial reporting creates fertile ground for increased investment risks. A lack of transparency can mask instances of corruption, allowing companies to divert funds illicitly or engage in bribery without fear of detection. This can lead to significant financial losses for investors who are unaware of the underlying corruption. Similarly, a lack of transparency can facilitate fraudulent activities, such as misrepresentation of financial performance or asset valuations. Investors who rely on incomplete or inaccurate information are vulnerable to substantial financial losses from fraudulent schemes. For example, the Enron scandal, where accounting irregularities were hidden from investors, resulted in billions of dollars in losses for investors and the collapse of a major corporation. This highlights the devastating consequences of a lack of financial transparency.

The Role of Independent Audits and Credit Rating Agencies

Independent audits and credit rating agencies are critical in enhancing transparency and mitigating investment risks. Independent audits provide an external verification of a company’s financial statements, ensuring their accuracy and reliability. This independent verification helps build investor confidence and reduces information asymmetry. Credit rating agencies, on the other hand, assess the creditworthiness of companies and countries, providing investors with an independent assessment of the risk associated with lending or investing. These agencies utilize various financial and non-financial data to generate ratings that help investors make informed decisions. The higher the credit rating, generally the lower the perceived risk and the lower the cost of borrowing for the rated entity. A robust regulatory framework that mandates independent audits and encourages the use of credit rating agencies is essential for fostering financial transparency and reducing investment risks.

Improved Transparency and Reduced Cost of Capital, How Financial Transparency Affects International Investment

Improved financial transparency leads to a reduction in the cost of capital for firms seeking international investment. When investors have access to reliable and readily available information, they are more confident in the investment’s prospects. This increased confidence translates to a lower risk premium demanded by investors. A lower risk premium means that firms can borrow money at lower interest rates and issue equity at higher valuations. This reduction in the cost of capital allows firms to invest more in growth opportunities, increase their competitiveness, and ultimately enhance their long-term value. For instance, companies with a history of transparent reporting and strong corporate governance often attract investors willing to accept lower returns due to reduced perceived risk. This is reflected in lower borrowing costs and higher stock valuations compared to less transparent companies.

The Role of Technology in Enhancing Transparency

Technological advancements are revolutionizing financial transparency in international investment, offering unprecedented opportunities to track capital flows, monitor compliance, and reduce risks associated with opacity. The application of technologies like blockchain and big data analytics is particularly impactful, providing a more robust and reliable framework for international financial dealings.

Blockchain Technology and Enhanced Transparency

Blockchain’s decentralized and immutable ledger system offers significant potential for increasing transparency in international investment. By recording all transactions on a shared, publicly accessible ledger, blockchain can enhance traceability and accountability. This makes it significantly harder to conceal illicit activities such as money laundering or tax evasion. Furthermore, smart contracts, self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code, can automate processes and reduce the need for intermediaries, thereby streamlining transactions and reducing the potential for manipulation. For example, a blockchain-based platform could record and verify the ownership of assets in cross-border mergers and acquisitions, making it easier to track the movement of funds and ensure compliance with regulations. This increased transparency could attract more foreign investment by reducing the perceived risk associated with opaque transactions.

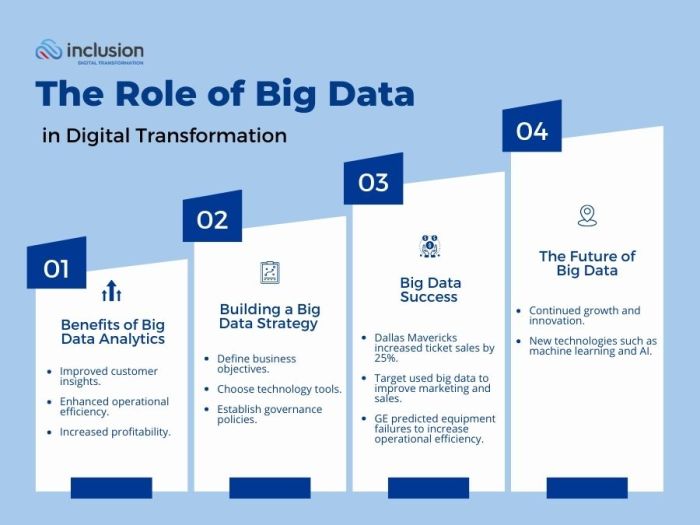

Big Data Analytics and Improved Oversight

Big data analytics offers another powerful tool for enhancing financial transparency. The ability to process and analyze vast amounts of data from various sources – including financial statements, news articles, social media, and regulatory filings – allows for the identification of patterns and anomalies that might indicate fraudulent activity or non-compliance. This can assist regulators in identifying potential risks and taking timely action. For instance, big data analytics can be used to monitor cross-border transactions for suspicious patterns, flagging potential money laundering schemes or instances of tax evasion. In the extractives sector, big data analysis can help track the flow of revenues from resource extraction, ensuring that payments are made transparently and that the host country receives its fair share.

Technology in Specific Sectors: Extractives and Infrastructure

The extractives industry, historically plagued by opacity and corruption, has seen some successful applications of technology to improve transparency. Blockchain technology is being explored to track the provenance of minerals and ensure responsible sourcing, reducing the risk of conflict minerals entering the global supply chain. Similarly, in infrastructure projects, the use of blockchain can improve the transparency of procurement processes, reducing the potential for corruption and ensuring that funds are used efficiently. Open data initiatives, coupled with big data analytics, can also be used to track the progress of infrastructure projects and ensure accountability to stakeholders. This increased transparency fosters trust and encourages greater investment.

Challenges and Opportunities in Leveraging Technology

While technology offers significant opportunities to enhance global financial transparency, several challenges remain. Data security and privacy concerns are paramount, requiring robust cybersecurity measures to protect sensitive information. The lack of standardized data formats and interoperability between different systems can also hinder the effective use of data analytics. Furthermore, the digital divide and the unequal access to technology across countries can exacerbate existing inequalities, potentially marginalizing less developed nations. Addressing these challenges through international collaboration and the development of appropriate regulatory frameworks is crucial to realizing the full potential of technology in promoting financial transparency.

Hypothetical Technology Solution for Cross-Border M&As

A hypothetical technology solution for enhancing transparency in cross-border mergers and acquisitions could involve a secure, blockchain-based platform that integrates with existing regulatory databases. This platform would require all parties involved in the transaction to upload relevant documentation, including financial statements, legal agreements, and ownership records. The platform would then use artificial intelligence and machine learning algorithms to analyze this data, identifying any inconsistencies or red flags that might indicate fraudulent activity or non-compliance. Real-time alerts would be sent to relevant regulatory bodies, allowing for timely intervention. Such a system would increase transparency, reduce the risk of fraud, and streamline the process of cross-border M&As, ultimately fostering greater confidence and attracting more investment.

International Cooperation and Harmonization of Standards

International cooperation is paramount in fostering greater financial transparency in international investment. Without a concerted global effort, inconsistencies in accounting practices and disclosure requirements create significant hurdles for investors and hinder the efficient allocation of capital. Harmonization of standards is not merely desirable; it’s crucial for a stable and globally integrated financial system.

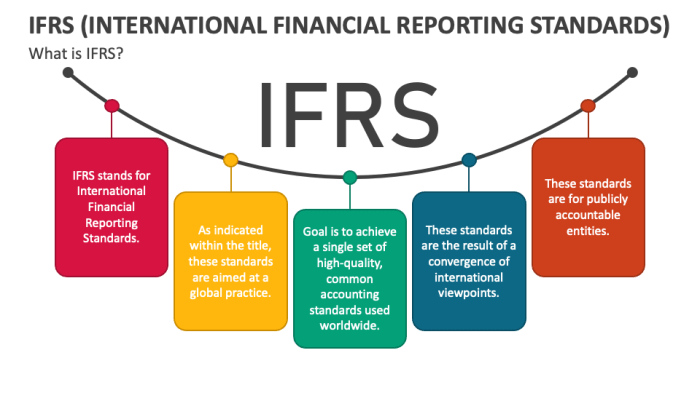

The pursuit of global financial transparency necessitates a multifaceted approach to harmonizing accounting standards and disclosure requirements. Different jurisdictions have adopted varying approaches, ranging from complete adoption of internationally recognized standards (like IFRS) to a more nuanced approach involving selective adoption or adaptation of these standards to suit local contexts. These different approaches reflect diverse legal frameworks, economic realities, and political considerations. A purely top-down approach to imposing uniform standards can be met with resistance, while a bottom-up approach, relying on voluntary adoption, may be too slow and uneven to be effective.

Comparison of Approaches to Harmonizing Accounting Standards

The International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB), represent a significant attempt at global harmonization. Many countries have adopted IFRS, leading to increased comparability of financial statements across borders. However, even within IFRS, there remains room for interpretation and application, leading to variations in practice. Other jurisdictions maintain their own Generally Accepted Accounting Principles (GAAP), often leading to complexities for multinational companies operating across diverse regulatory landscapes. The European Union, for instance, mandates IFRS for publicly listed companies, showcasing a strong commitment to harmonization. Conversely, the United States continues to primarily rely on US GAAP, although efforts are underway to enhance convergence between US GAAP and IFRS. This illustrates the range of approaches taken and the ongoing challenges in achieving complete uniformity.

Benefits and Challenges of Global Standards for Financial Transparency

Establishing global standards for financial transparency offers substantial benefits, including increased investor confidence, reduced information asymmetry, and improved capital allocation efficiency. A standardized framework would facilitate cross-border investment, simplify compliance for multinational corporations, and ultimately promote economic growth. However, the path to global harmonization is fraught with challenges. Differences in legal systems, cultural norms, and political priorities can impede the adoption of universal standards. Moreover, ensuring the effective enforcement of these standards globally presents a significant logistical and political hurdle. The costs of implementation, both for businesses and regulators, should also be carefully considered. A balance must be struck between the benefits of harmonization and the potential burdens imposed on various stakeholders.

Key Stakeholders in Promoting Financial Transparency

The promotion of financial transparency is a collective endeavor requiring the active participation of numerous stakeholders. Effective progress hinges on the coordinated efforts of diverse actors.

- Governments: Governments play a pivotal role in establishing legal frameworks, enforcing regulations, and fostering cooperation on international standards.

- Regulators: Regulatory bodies, such as securities commissions and accounting oversight boards, are responsible for implementing and enforcing transparency regulations and promoting consistent application of standards.

- Businesses: Multinational corporations have a significant stake in promoting transparency, as it enhances their access to capital and reduces their compliance costs. They also play a vital role in advocating for harmonized standards.

- Civil Society: Non-governmental organizations (NGOs) and other civil society groups play a crucial role in advocating for greater transparency, monitoring compliance, and holding stakeholders accountable.

- International Organizations: International bodies, such as the International Monetary Fund (IMF), the World Bank, and the Organisation for Economic Co-operation and Development (OECD), play a critical role in coordinating international efforts, providing technical assistance, and setting global standards.

Last Word: How Financial Transparency Affects International Investment

In conclusion, the impact of financial transparency on international investment is undeniable. Increased transparency fosters trust, reduces risk, and attracts greater capital flows, benefiting both developed and developing economies. While challenges remain in harmonizing global standards and implementing technological solutions, the ongoing efforts towards greater transparency promise a more stable, efficient, and equitable international investment environment. The future of international finance hinges on a commitment to open and accountable financial practices.

Question Bank

What are some examples of opaque financial practices that deter investors?

Lack of audited financial statements, inconsistent accounting standards, inadequate disclosure of related-party transactions, and a lack of independent oversight are all examples of opaque practices that raise concerns among investors and can deter investment.

How does financial transparency reduce the cost of capital?

Transparent reporting reduces perceived risk, leading to lower risk premiums demanded by investors and thus a lower cost of borrowing for firms.

What role do credit rating agencies play in enhancing transparency?

Credit rating agencies assess the creditworthiness of entities based on available financial information. Higher ratings, reflecting greater transparency and lower risk, lead to lower borrowing costs.

Can you give an example of how blockchain technology improves transparency?

Blockchain’s immutable ledger can record and track financial transactions securely and transparently, making it difficult to manipulate or conceal information.