How Climate Change Regulations Affect Corporate Financial Reporting is a critical topic impacting businesses globally. The increasing urgency of climate action is forcing companies to adapt, leading to significant shifts in financial strategies and reporting practices. This examination explores the multifaceted effects of these regulations, from direct financial impacts like carbon taxes and compliance costs to indirect consequences such as reputational risks and stakeholder pressure. We will delve into how companies are integrating climate-related risks and opportunities into their financial statements, the role of assurance providers, and the future trajectory of this evolving landscape.

Understanding these impacts is crucial for businesses to navigate the changing regulatory environment and maintain financial stability. The analysis presented will provide insights into the challenges and opportunities presented by climate change regulations, offering a framework for informed decision-making and strategic planning. This includes examining the evolving role of investors and stakeholders in driving climate action and the increasing demand for transparency and accountability in corporate environmental performance.

Direct Financial Impacts of Climate Change Regulations

Climate change regulations are fundamentally reshaping the financial landscape for corporations globally. The increasing urgency to mitigate greenhouse gas emissions is driving significant changes in operational strategies, investment decisions, and ultimately, corporate profitability. This section details the direct financial impacts these regulations impose on businesses.

Carbon Pricing Mechanisms and Corporate Profitability

Carbon pricing mechanisms, such as carbon taxes and emissions trading schemes (ETS), directly impact a company’s profitability by adding a cost to carbon emissions. A carbon tax levies a fixed fee per ton of CO2 emitted, while an ETS creates a market where companies can buy and sell permits to emit. For companies with high carbon footprints, these mechanisms translate to increased operational costs, potentially reducing profit margins and impacting shareholder value. The effectiveness of these mechanisms depends on the carbon price level and the company’s ability to reduce emissions or offset their carbon footprint. Companies may respond by investing in cleaner technologies, improving energy efficiency, or purchasing carbon offsets, all of which involve additional expenses.

Increased Capital Expenditure for Compliance

Meeting stricter environmental regulations often necessitates significant capital investments. This can include upgrading existing facilities to meet emission standards, investing in renewable energy sources, implementing waste management systems, and adopting cleaner production processes. These investments represent a substantial upfront cost that can strain a company’s finances, particularly for smaller businesses or those operating in capital-intensive industries. The return on these investments can be long-term and uncertain, further adding to the financial burden. For example, a manufacturing plant might need to install expensive scrubbers to reduce air pollution or invest in electric vehicles to replace its fleet of diesel trucks.

Increased Auditing and Consulting Costs

More stringent environmental reporting standards, such as those required under the Task Force on Climate-related Financial Disclosures (TCFD), lead to increased costs associated with auditing and consulting services. Companies need to ensure their reporting is accurate, complete, and compliant with the relevant regulations. This necessitates engaging specialized firms to conduct audits, assess climate-related risks, and provide expert advice on compliance matters. These professional services can be expensive, adding another layer of financial pressure on companies. The complexity of climate-related reporting, especially for multinational corporations with diverse operations, further increases these costs.

Examples of Companies Affected by Climate Regulations

Several companies have experienced significant financial shifts due to climate change regulations. The following table provides some illustrative examples, though the impact varies considerably across sectors and jurisdictions:

| Company Name | Industry | Regulation Impact | Financial Consequence |

|---|---|---|---|

| BP | Oil and Gas | Carbon tax in the UK, EU ETS | Increased operating costs, investment in renewables |

| Volkswagen | Automotive | EU emissions standards, fines for diesel emissions scandal | Significant fines, increased R&D in electric vehicles |

| NextEra Energy | Utilities | Renewable portfolio standards, carbon pricing | Investment in renewable energy, increased profitability from green energy |

| United Airlines | Airlines | Carbon offsetting schemes, fuel efficiency regulations | Increased fuel costs, investment in fuel-efficient aircraft |

Indirect Financial Impacts and Risks: How Climate Change Regulations Affect Corporate Financial Reporting

Climate change regulations, while directly impacting a company’s bottom line through compliance costs, also exert significant indirect financial pressures. These indirect impacts stem from the physical risks associated with a changing climate, damage to a company’s reputation, and potential legal liabilities. Understanding these indirect risks is crucial for effective financial planning and risk management. The interconnectedness of these factors means that even companies seemingly unaffected by direct regulatory costs can face substantial financial consequences.

Climate-Related Physical Risks and Their Impact on Corporate Assets and Operations

Climate change manifests in various ways, including increased frequency and intensity of extreme weather events (e.g., hurricanes, floods, wildfires) and changes in resource availability (e.g., water scarcity). These physical risks can directly damage corporate assets, disrupting operations and leading to significant financial losses. For instance, a manufacturing plant located in a flood-prone area might experience production halts and damage to equipment, resulting in lost revenue and costly repairs. Similarly, agricultural businesses reliant on consistent water supplies could face reduced yields and increased operational costs due to droughts. The financial impact extends beyond immediate damage; supply chain disruptions, insurance premium increases, and decreased asset values are all potential consequences. Consider the case of a coastal hotel repeatedly damaged by hurricanes; the cumulative repair costs, lost tourism revenue, and potential decrease in property value represent a substantial indirect financial burden.

Reputational Damage from Inadequate Climate Action

Consumers, investors, and employees are increasingly scrutinizing companies’ environmental performance. A company perceived as lagging in climate action can suffer significant reputational damage, impacting its brand value, customer loyalty, and investor confidence. This reputational risk can translate into decreased sales, difficulty attracting and retaining talent, and higher borrowing costs. For example, a company facing public criticism for its carbon emissions might experience a decline in stock price, reduced consumer demand for its products, and difficulties in securing financing. The intangible nature of reputational damage makes it difficult to quantify precisely, yet its impact on a company’s long-term financial health can be substantial.

Potential Liabilities Associated with Non-Compliance with Environmental Regulations

Failure to comply with increasingly stringent environmental regulations can lead to significant financial liabilities. These liabilities can include fines, penalties, legal costs, and remediation expenses. The potential for such liabilities varies across jurisdictions and industries, but non-compliance can represent a substantial financial risk. For example, a company discharging pollutants into a waterway without the necessary permits could face hefty fines and be legally obligated to clean up the contamination. The costs associated with environmental litigation can be substantial, even if a company is ultimately found not guilty. The uncertainty surrounding potential legal outcomes adds to the financial risk.

Comparative Financial Risks Across Industries

The financial risks associated with climate change regulations vary considerably across industries. Industries heavily reliant on fossil fuels, such as oil and gas, face significant direct and indirect financial risks from the transition to cleaner energy sources. These risks include stranded assets (e.g., oil reserves becoming uneconomical to extract), increased regulatory scrutiny, and reputational damage. In contrast, companies in sectors like renewable energy and sustainable agriculture may experience fewer direct regulatory burdens but could still face indirect risks, such as supply chain disruptions caused by extreme weather events. Companies in sectors such as insurance and real estate face significant risks from increased frequency of extreme weather events and rising sea levels. Understanding the specific risks facing different industries is essential for effective risk management and investment decisions.

Impact on Financial Reporting Practices

Climate change is fundamentally altering corporate financial reporting. The increasing recognition of climate-related risks and opportunities is driving significant changes in how companies disclose financial information, moving beyond traditional financial metrics to incorporate environmental and social factors. This shift reflects a growing demand for transparency and accountability from investors, regulators, and stakeholders concerned about the long-term sustainability of businesses.

The integration of climate-related information into financial reporting is a complex process, requiring companies to develop robust methodologies for assessing, quantifying, and disclosing relevant data. This involves navigating evolving regulatory frameworks and developing internal capabilities to manage climate-related risks and opportunities effectively. This section explores the key aspects of this evolving landscape.

Climate-Related Financial Disclosures and Reporting Frameworks

The Task Force on Climate-related Financial Disclosures (TCFD) recommendations and the Sustainability Accounting Standards Board (SASB) standards are significantly shaping climate-related financial disclosures. The TCFD framework encourages companies to disclose information on governance, strategy, risk management, and metrics and targets related to climate change. SASB standards provide industry-specific metrics and disclosures focusing on material environmental, social, and governance (ESG) factors. These frameworks provide a common language and structure for reporting, enhancing comparability and consistency across different companies and industries. Adoption of these frameworks is increasing, driven by investor demand and regulatory pressure. For example, many companies are now including TCFD-aligned disclosures in their annual reports and sustainability reports. Furthermore, increasing numbers of jurisdictions are mandating or strongly encouraging TCFD alignment in corporate reporting.

Integrating Climate-Related Risks and Opportunities into Financial Statements

Companies are increasingly integrating climate-related risks and opportunities into their financial statements through various methods. This involves identifying potential physical risks (e.g., extreme weather events, sea-level rise) and transition risks (e.g., policy changes, technological advancements) that could impact their financial performance. Opportunities, such as developing new climate-friendly products or services or improving energy efficiency, are also being considered. For example, a company might incorporate the potential costs associated with adapting to climate change (e.g., upgrading infrastructure to withstand extreme weather) into its capital expenditure projections. Similarly, a company might estimate the potential revenue generated from selling electric vehicles and include this in its future revenue forecasts. This integration often requires sophisticated scenario analysis and modelling to project the potential financial impact of different climate scenarios.

Methods for Quantifying and Reporting Greenhouse Gas Emissions

Quantifying and reporting greenhouse gas (GHG) emissions is a crucial aspect of climate-related financial disclosures. Companies commonly use the Greenhouse Gas Protocol, a widely accepted accounting standard, to measure their direct (Scope 1) and indirect (Scope 2 and 3) emissions. Scope 1 emissions are direct emissions from owned or controlled sources, while Scope 2 emissions are indirect emissions from the generation of purchased energy. Scope 3 emissions are the most challenging to quantify and encompass all other indirect emissions in a company’s value chain. Companies often use various methodologies to estimate Scope 3 emissions, such as life cycle assessments and supply chain surveys. The reported data is often presented in a standardized format, such as tons of carbon dioxide equivalent (CO2e). Many companies are also starting to use carbon accounting software to improve the accuracy and efficiency of their GHG emission reporting.

Types of Climate-Related Financial Disclosures

The types of climate-related financial disclosures are diverse and expanding. A comprehensive disclosure strategy typically includes:

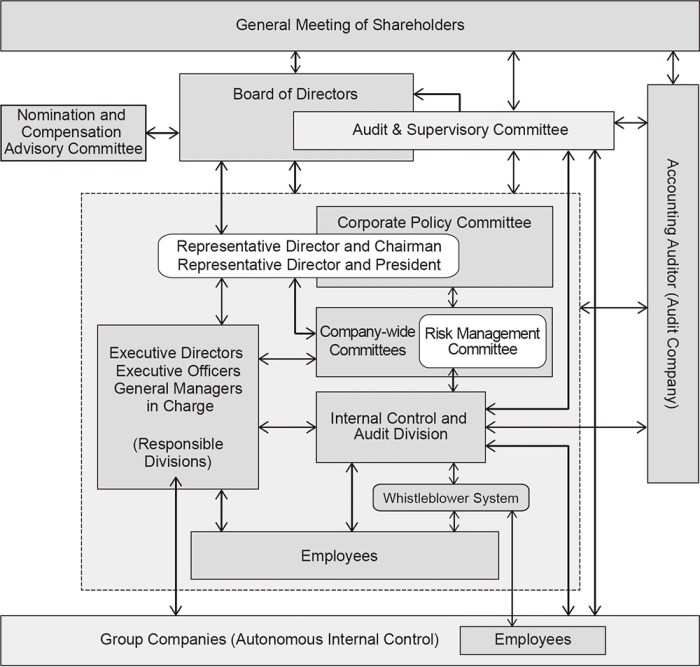

- Governance structures and processes related to climate change.

- Climate-related risks and opportunities identified and assessed.

- Strategies and targets for reducing emissions and adapting to climate change.

- Metrics and targets related to GHG emissions and other relevant environmental indicators.

- Financial impacts of climate change, both current and projected.

- Scenario analysis illustrating the potential financial impacts of different climate scenarios.

- Details of climate-related investments and expenditures.

- Assurance on the reported data, ideally by an independent third party.

Investor and Stakeholder Responses

The increasing awareness of climate change and its financial implications has fundamentally altered how investors and stakeholders interact with corporations. Investors are actively integrating Environmental, Social, and Governance (ESG) factors into their investment strategies, while stakeholders are exerting pressure on companies to improve their climate performance through various means. This heightened scrutiny is driving greater transparency in climate-related financial reporting, significantly influencing investor confidence and access to capital.

ESG Integration in Investment Decisions

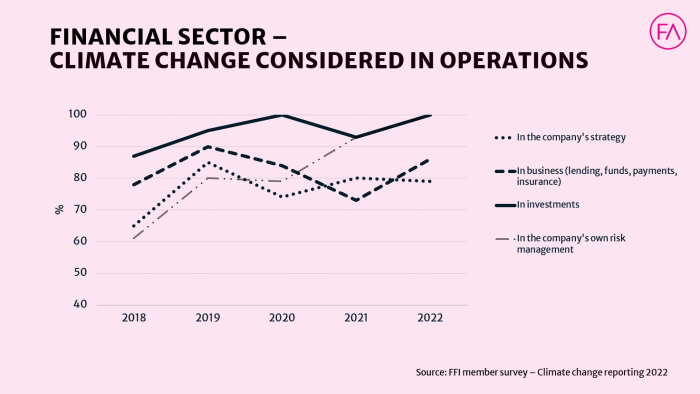

Investors are increasingly recognizing the materiality of climate-related risks and opportunities. This has led to a significant shift in investment strategies, with many incorporating ESG factors, including climate performance, into their due diligence processes and investment decisions. For example, many institutional investors now utilize ESG rating agencies to assess the climate-related risks and opportunities of potential investments. These ratings, often factoring in carbon emissions, climate-related policies, and governance structures, influence portfolio allocation decisions. Furthermore, a growing number of investors are actively engaging with companies to push for improved climate action, using their shareholder power to influence corporate strategy. This engagement ranges from collaborative dialogue to shareholder resolutions demanding more aggressive climate targets.

Stakeholder Pressure for Improved Climate Performance

Stakeholders, including consumers, employees, and non-governmental organizations (NGOs), are playing an increasingly crucial role in holding companies accountable for their climate impact. Consumers are demonstrating a growing preference for environmentally responsible products and services, leading companies to prioritize sustainability initiatives to maintain market share. NGOs are actively monitoring corporate climate performance, publicly scrutinizing companies perceived as lagging behind in climate action, and leveraging campaigns to pressure for change. For example, Greenpeace’s campaigns targeting companies with high carbon footprints have resulted in significant shifts in corporate climate strategies. Similarly, employee activism, including walkouts and public statements, has put pressure on employers to adopt more sustainable practices.

Transparency and Investor Confidence

Increased transparency in climate-related financial reporting is fostering greater investor confidence and facilitating access to capital for companies demonstrating strong climate performance. Mandatory climate-related disclosures, such as those promoted by the Task Force on Climate-related Financial Disclosures (TCFD), are enhancing the reliability and comparability of climate-related information, allowing investors to make more informed investment decisions. Companies with robust climate strategies and transparent reporting are often rewarded with lower cost of capital, improved credit ratings, and increased investor interest. Conversely, companies perceived as lacking transparency or exhibiting poor climate performance face higher costs of capital and may struggle to attract investors.

Hypothetical Scenario: Stakeholder Response and Financial Performance

Imagine a hypothetical scenario involving “GreenTech,” a renewable energy company, and “FossilFuel,” a traditional fossil fuel producer. GreenTech, having proactively invested in sustainable practices and transparently reported its climate-related data, receives overwhelmingly positive stakeholder responses. This results in increased investor confidence, leading to lower borrowing costs, higher stock valuations, and increased market share. Conversely, FossilFuel, facing criticism for its environmental impact and lack of transparency, experiences negative stakeholder responses. This leads to divestment from socially responsible investors, higher borrowing costs, reputational damage, and decreased market share, impacting its profitability and overall financial performance. The contrast between these two scenarios illustrates how stakeholder responses, significantly influenced by a company’s climate action and transparency, directly affect financial performance.

The Role of Assurance and Verification

The increasing importance of climate-related financial disclosures necessitates robust assurance and verification mechanisms. Independent assurance providers play a crucial role in bolstering the credibility and reliability of this information, ultimately enhancing investor confidence and market transparency. Their involvement helps ensure that companies are accurately representing their climate-related risks and opportunities, contributing to a more informed and sustainable financial landscape.

The accuracy and reliability of climate-related disclosures depend heavily on the quality of underlying data and the methodologies used to project future impacts. This presents significant challenges for assurance providers. Data collection can be complex, involving diverse sources and potentially inconsistent measurement methodologies across different operations or geographical locations. Furthermore, projecting future climate impacts involves inherent uncertainties, requiring sophisticated modeling and assumptions that need to be rigorously evaluated.

Challenges in Assuring the Accuracy of Climate-Related Data and Projections

Verifying the accuracy of climate-related data and projections presents several significant challenges. Data quality varies considerably depending on the source and the methods used for collection and aggregation. Inconsistent methodologies across different companies and jurisdictions make comparisons difficult. Furthermore, the long-term nature of climate change impacts necessitates the use of complex models and assumptions, introducing inherent uncertainties into projections of future financial consequences. These projections often depend on assumptions about future policy, technological advancements, and consumer behavior, all of which are subject to considerable uncertainty. For example, projecting the financial impact of a future carbon tax requires assumptions about the tax rate, its implementation timeline, and the company’s ability to adapt. These uncertainties make it challenging to provide absolute assurance on the accuracy of financial projections related to climate change.

Methods Used to Verify Greenhouse Gas Emission Data and Climate-Related Financial Information, How Climate Change Regulations Affect Corporate Financial Reporting

Several methods are employed to verify greenhouse gas emission data and climate-related financial information. These include:

- Direct Measurement: This involves directly measuring emissions at the source, such as using monitoring equipment at industrial facilities to quantify greenhouse gas releases. This method provides the most accurate data but can be expensive and impractical for all emissions sources.

- Indirect Estimation: This involves calculating emissions based on activity data, such as energy consumption or material inputs. Emission factors, representing the amount of greenhouse gases emitted per unit of activity, are used in these calculations. The accuracy of this method depends on the reliability of both the activity data and the emission factors.

- Third-Party Verification: Independent assurance providers review companies’ internal data collection and calculation processes, examining the methodologies used, the quality of the data, and the assumptions made in projecting future impacts. This process often involves on-site visits, document review, and interviews with company personnel.

- Data Reconciliation: Comparing reported emissions data with data from other sources, such as government databases or industry benchmarks, can help identify inconsistencies and potential errors.

Best Practices for Ensuring the Quality and Credibility of Climate-Related Financial Reporting

The quality and credibility of climate-related financial reporting can be significantly enhanced by adopting best practices. These include:

- Establishing robust data governance frameworks: This involves defining clear roles and responsibilities for data collection, management, and reporting, ensuring data accuracy and consistency.

- Using standardized methodologies: Adopting internationally recognized standards and frameworks, such as the Greenhouse Gas Protocol, enhances comparability and transparency.

- Implementing robust internal controls: Strong internal controls help to prevent errors and ensure the integrity of the data used in climate-related reporting.

- Seeking independent assurance: Engaging independent assurance providers to verify the accuracy and reliability of climate-related disclosures builds trust and credibility.

- Transparent and comprehensive disclosures: Clearly communicating the methodologies used, the assumptions made, and the limitations of the data enhances transparency and allows stakeholders to assess the reliability of the information.

- Regular review and updates: Regularly reviewing and updating climate-related disclosures, incorporating new data and insights, demonstrates a commitment to continuous improvement.

Future Trends and Developments

The landscape of climate change regulations is constantly evolving, driven by increasing scientific understanding of climate risks and growing pressure from investors, stakeholders, and the public. This dynamic environment necessitates a proactive approach from corporations in adapting their financial reporting practices to reflect these changes and emerging best practices. The future will likely see more stringent regulations, greater standardization of disclosures, and a more sophisticated approach to climate risk management.

The anticipated changes in climate change regulations will significantly impact corporate financial reporting. We can expect a global shift towards more comprehensive and granular reporting requirements, moving beyond simple carbon footprint disclosures to encompass a broader range of climate-related risks and opportunities, including physical risks like extreme weather events and transition risks associated with the shift to a low-carbon economy. This will necessitate more robust data collection, analysis, and internal control mechanisms within organizations. For example, the increasing adoption of mandatory climate-related financial disclosures, such as those encouraged by the Task Force on Climate-related Financial Disclosures (TCFD), will push companies to integrate climate considerations more deeply into their core business strategies and financial planning processes. This will likely lead to a greater focus on scenario analysis, stress testing, and the development of climate-resilient business models.

Increased Standardization and Harmonization of Climate-Related Financial Disclosures

Growing international cooperation and the increasing recognition of the systemic nature of climate risk are driving efforts to standardize and harmonize climate-related financial disclosures. This standardization will reduce inconsistencies and improve the comparability of information across different jurisdictions and industries, enhancing the usefulness of climate-related data for investors and other stakeholders. Initiatives such as the International Sustainability Standards Board (ISSB)’s global baseline standards are designed to achieve this goal. Harmonization will simplify compliance for multinational corporations and reduce the burden of navigating a patchwork of differing regulations. A consistent global framework will allow for more meaningful comparisons between companies and facilitate the development of more robust climate-related financial markets. The ultimate goal is to foster greater trust and transparency in climate-related disclosures, enabling informed investment decisions and promoting responsible corporate behavior.

Emerging Trends in Climate Risk Management and Their Implications for Corporate Financial Reporting

Several emerging trends are shaping climate risk management and will influence how companies report on their climate-related performance. These include a greater emphasis on integrating climate risk into enterprise risk management (ERM) frameworks, increased use of scenario analysis and stress testing to assess the potential financial impacts of climate change, and a growing focus on developing and implementing climate-related strategies and targets aligned with the goals of the Paris Agreement. The increased integration of climate risk into ERM will require companies to assess and manage climate-related risks alongside other traditional business risks, leading to more holistic and integrated risk management practices. This integration will require companies to refine their risk assessment methodologies and incorporate climate-related factors into their decision-making processes. Scenario analysis and stress testing, while already gaining traction, will become even more sophisticated, incorporating a wider range of climate scenarios and assessing their impact on different aspects of the business. This will require companies to develop more robust data collection and modeling capabilities.

Technological Advancements in Climate-Related Financial Reporting

Technological advancements are significantly improving the accuracy and efficiency of climate-related financial reporting. Data analytics, artificial intelligence (AI), and blockchain technology are playing increasingly important roles in automating data collection, enhancing data quality, and improving the transparency and reliability of climate-related disclosures. For example, AI-powered tools can analyze large datasets to identify climate-related risks and opportunities more effectively than traditional methods. Blockchain technology can enhance the security and transparency of climate-related data, making it more difficult to manipulate or misrepresent.

Hypothetical Technology for Improved Climate-Related Financial Reporting

Imagine a platform, “ClimateLens,” which utilizes AI and blockchain technology to streamline and enhance the accuracy of climate-related financial reporting. ClimateLens would integrate with existing enterprise resource planning (ERP) systems to automatically collect and analyze relevant data on energy consumption, emissions, waste generation, and other climate-related metrics. AI algorithms would then identify potential climate-related risks and opportunities, using predictive modeling based on various climate scenarios. The results would be stored securely on a blockchain, ensuring data integrity and transparency. The platform would also generate standardized reports compliant with relevant regulatory frameworks, reducing the manual effort required for compliance and minimizing the risk of errors. Finally, ClimateLens would allow for real-time tracking of progress towards climate targets, providing companies with valuable insights into their performance and enabling more effective climate risk management. This hypothetical technology would dramatically improve the accuracy, efficiency, and reliability of climate-related financial reporting, enabling more informed decision-making by investors and stakeholders and contributing to a more sustainable global economy.

Closing Notes

In conclusion, the impact of climate change regulations on corporate financial reporting is profound and multifaceted. From direct costs associated with compliance to indirect risks stemming from reputational damage and stakeholder pressure, businesses must adapt to this evolving landscape. Increased transparency, driven by investor demand and regulatory changes, is reshaping financial reporting practices, demanding a more comprehensive and integrated approach to climate-related risks and opportunities. Proactive adaptation, robust risk management strategies, and a commitment to transparency are crucial for businesses to thrive in this new era of sustainable finance.

Quick FAQs

What are the key differences between mandatory and voluntary climate-related disclosures?

Mandatory disclosures are legally required and often have specific reporting standards, while voluntary disclosures are undertaken by companies exceeding minimum requirements, often to enhance their reputation or attract investors.

How do climate change regulations impact small and medium-sized enterprises (SMEs)?

SMEs often face greater challenges complying with climate regulations due to limited resources and expertise. However, many support programs and resources exist to help them adapt.

What are the potential legal consequences of non-compliance with climate-related regulations?

Penalties can vary significantly depending on the jurisdiction and the severity of the non-compliance, ranging from fines and legal action to reputational damage and loss of business opportunities.

Further details about Cost Control Strategies Using Accounting Data is accessible to provide you additional insights.