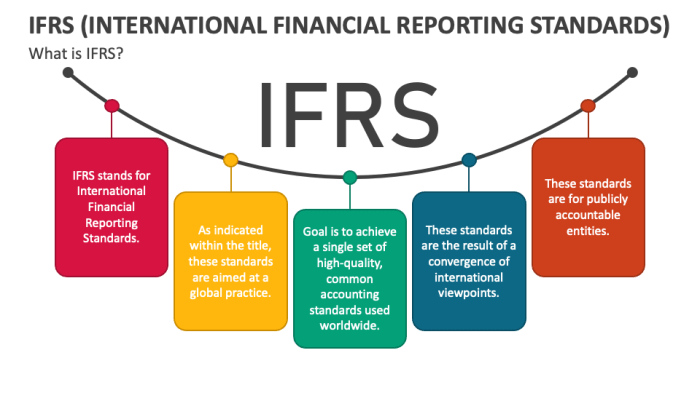

How Accounting Standards Impact Foreign Exchange Markets

How Accounting Standards Impact Foreign Exchange Markets is a critical area influencing global finance. The diverse accounting practices employed across nations, primarily IFRS and US GAAP, significantly affect how multinational corporations report their financial performance in international markets. These differences in accounting standards directly impact the translation of financial statements, creating challenges for investors seeking…