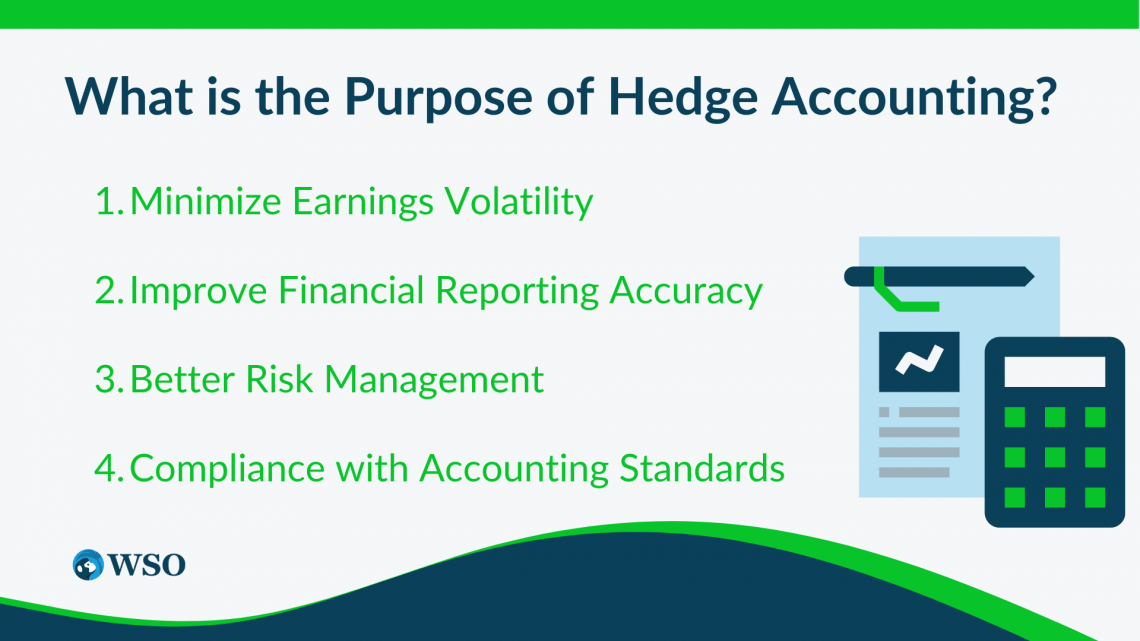

How Hedge Accounting Helps Businesses Manage Financial Risk

How Hedge Accounting Helps Businesses Manage Financial Risk is a critical aspect of modern finance. Navigating the complexities of volatile markets requires sophisticated strategies, and hedge accounting provides a powerful tool for businesses to mitigate exposure to various financial risks. Understanding how these strategies work, from identifying potential threats to implementing effective hedging techniques, is…