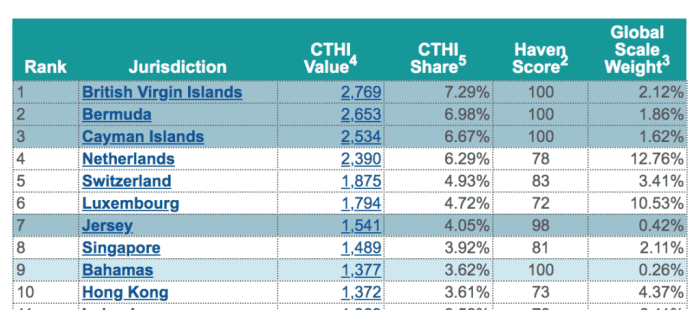

How Global Tax Havens Affect Corporate Financial Statements

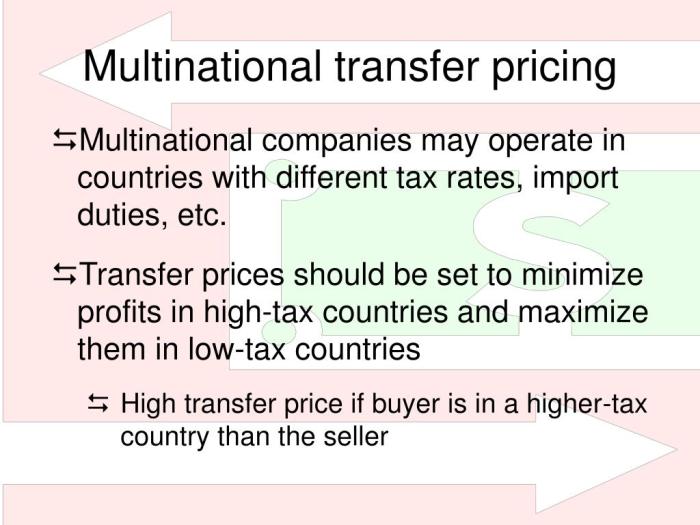

How Global Tax Havens Affect Corporate Financial Statements is a critical issue impacting global finance. The use of tax havens by multinational corporations significantly alters the presentation of their financial health, often obscuring the true picture of profitability and financial stability. This manipulation of reported earnings raises concerns about transparency and fairness, impacting investors, governments,…