The Role of Accounting in Corporate Governance is paramount to ensuring ethical and transparent business practices. This crucial function extends far beyond simply recording financial transactions; it underpins the very foundation of trust and accountability within a corporation. From setting robust internal controls to fostering transparent financial reporting, accounting plays a vital role in safeguarding stakeholder interests and promoting sustainable growth.

Effective accounting practices directly impact investor confidence, attract capital, and mitigate risks. Conversely, accounting irregularities can lead to significant governance failures, eroding investor trust and potentially resulting in legal repercussions. This exploration delves into the multifaceted relationship between accounting and corporate governance, highlighting the importance of accurate financial reporting, robust internal controls, and the crucial role of independent audits.

The Foundation

Effective corporate governance relies heavily on robust and transparent financial reporting. This foundation is built upon a consistent application of accounting principles and the rigorous scrutiny of independent audits. A strong understanding of these elements is crucial for maintaining investor confidence and ensuring the long-term sustainability of any organization.

Generally Accepted Accounting Principles (GAAP) and Corporate Governance

Generally Accepted Accounting Principles (GAAP) are a common set of accounting rules, standards, and procedures issued by the Financial Accounting Standards Board (FASB) in the United States. These principles ensure consistency and comparability in financial reporting, allowing stakeholders to make informed decisions. Compliance with GAAP is not merely a matter of legal compliance; it is a cornerstone of good corporate governance. Adherence to GAAP fosters trust among investors, creditors, and other stakeholders, thereby enhancing the company’s reputation and access to capital. Conversely, deviations from GAAP can lead to misrepresentation of financial performance, eroding investor confidence and potentially resulting in legal repercussions.

The Role of Independent Audits in Ensuring Financial Transparency and Accountability

Independent audits provide an external, objective assessment of a company’s financial statements. These audits are conducted by certified public accountants (CPAs) who are independent of the company’s management and board of directors. The auditors examine the company’s accounting records, internal controls, and financial statements to ensure that they are fairly presented and comply with GAAP. This process significantly enhances financial transparency and accountability. The auditor’s report, which is included in the company’s annual report, provides assurance to stakeholders that the financial information is reliable and credible. Without independent audits, the risk of financial misreporting and corporate governance failures would be substantially higher.

Examples of Accounting Irregularities Leading to Corporate Governance Failures

Several high-profile corporate scandals illustrate the devastating consequences of accounting irregularities on corporate governance. Enron, for example, employed complex accounting practices to hide massive debts and inflate profits, ultimately leading to bankruptcy and significant losses for investors. Similarly, WorldCom’s fraudulent accounting practices, which involved improperly classifying expenses as capital expenditures, resulted in a massive accounting scandal and the company’s collapse. These cases highlight the critical role of strong internal controls and independent audits in preventing accounting irregularities and maintaining sound corporate governance.

Comparison of Accounting Frameworks and Their Implications for Corporate Governance

Different accounting frameworks, such as GAAP and International Financial Reporting Standards (IFRS), have varying implications for corporate governance. While both aim to ensure financial transparency, their specific rules and requirements differ. This table summarizes some key differences:

| Framework | Rules-Based vs. Principles-Based | Enforcement | Impact on Corporate Governance |

|---|---|---|---|

| GAAP (US) | More rules-based | FASB and SEC | Emphasis on detailed rules, potentially leading to greater consistency but also complexity. Strong enforcement mechanisms. |

| IFRS (International) | More principles-based | IASB | Greater flexibility in application, potentially leading to more diverse reporting practices. Enforcement varies across jurisdictions. |

Financial Reporting and Transparency: The Role Of Accounting In Corporate Governance

Accurate and timely financial reporting is the cornerstone of robust corporate governance. It fosters trust among investors, creditors, and other stakeholders, enabling informed decision-making and promoting the overall stability of the financial system. Without reliable financial information, the market loses its ability to efficiently allocate capital, leading to potential instability and hindering economic growth.

Financial reporting, underpinned by sound accounting practices, plays a crucial role in preventing and detecting financial fraud and mismanagement. Robust internal controls, independent audits, and adherence to accounting standards all contribute to a system of checks and balances that reduces opportunities for unethical behavior and improves the accuracy and reliability of financial statements.

Accurate and Timely Financial Reporting Maintains Investor Confidence

Accurate and timely financial reporting directly impacts investor confidence. Investors rely on these reports to assess a company’s financial health, profitability, and future prospects. Delayed or inaccurate reporting can lead to misinformed investment decisions, potentially causing significant financial losses for investors and eroding trust in the capital markets. Conversely, consistent delivery of transparent and reliable financial information builds confidence, attracting investment and supporting long-term growth. Companies with a proven track record of transparent reporting often enjoy higher valuations and access to more favorable financing terms.

Accounting’s Role in Preventing Financial Fraud and Mismanagement

Accounting plays a vital role as a preventative measure against financial fraud and mismanagement. The implementation of strong internal controls, such as segregation of duties, regular reconciliations, and robust authorization processes, significantly reduces the risk of fraudulent activities. Furthermore, adherence to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) ensures consistency and comparability of financial information, making it harder to manipulate figures and conceal fraudulent activities. Independent audits provide an additional layer of assurance, verifying the accuracy and reliability of the financial statements.

Examples of Effective Disclosure Practices Promoting Transparency

Effective disclosure practices are paramount for transparency in corporate governance. Companies that proactively disclose information beyond the legally required minimum demonstrate a commitment to transparency and accountability. Examples include detailed explanations of financial performance, clear articulation of risk factors, and transparent reporting of executive compensation. Providing comprehensive information on environmental, social, and governance (ESG) factors also contributes to greater transparency and helps stakeholders assess a company’s sustainability practices. For instance, a company might publish a detailed sustainability report outlining its environmental impact, social responsibility initiatives, and governance structure. Another example could be the proactive disclosure of any material risks, such as potential lawsuits or regulatory investigations, even before they are publicly known.

Consequences of Inadequate Financial Reporting on Stakeholder Trust: A Hypothetical Scenario

Consider a hypothetical scenario where a publicly traded company consistently underreports its expenses and overstates its profits. Initially, this might attract investors seeking high returns. However, the truth eventually comes to light, perhaps through an internal whistleblower or an external audit. The subsequent revelation of accounting irregularities leads to a sharp decline in the company’s stock price, significant financial losses for investors, and potential legal repercussions for the company and its executives. Creditors lose confidence, making it difficult to secure further financing. Employees may lose their jobs, and the company’s reputation is severely damaged, making it difficult to attract new talent or business partners. This scenario illustrates the far-reaching consequences of inadequate financial reporting, highlighting the critical role of accurate and timely information in maintaining stakeholder trust and long-term sustainability.

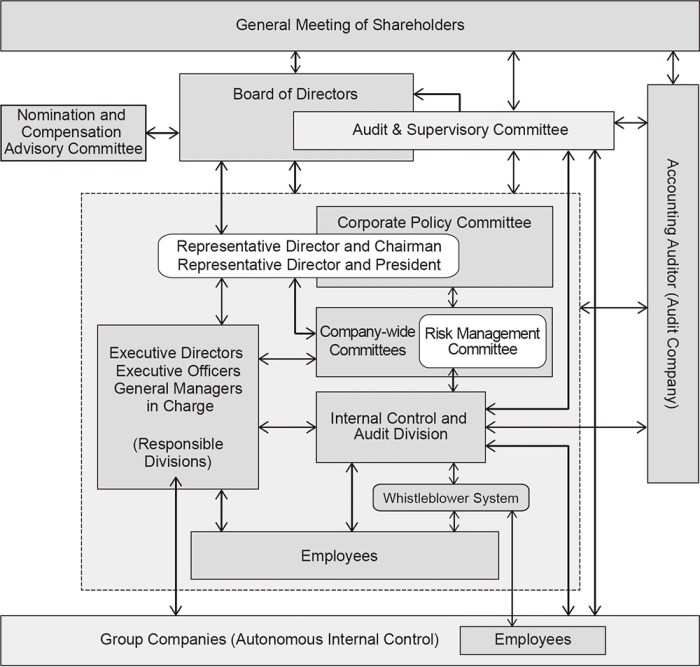

Internal Controls and Risk Management

Internal controls and risk management are integral components of sound corporate governance. They provide a framework for safeguarding assets, ensuring the reliability of financial reporting, promoting operational efficiency, and complying with applicable laws and regulations. Effective internal controls help mitigate risks and enhance the overall effectiveness of an organization’s operations. A robust system fosters trust among stakeholders, including investors, creditors, and the public.

Effective accounting systems are crucial for supporting risk assessment and mitigation strategies. They provide the necessary data and information to identify, analyze, and respond to potential risks. By tracking key performance indicators (KPIs), analyzing financial trends, and monitoring internal processes, organizations can proactively address potential threats before they materialize into significant problems. This proactive approach minimizes potential financial losses and operational disruptions.

Key Internal Control Systems and Their Contribution to Sound Corporate Governance

A strong internal control system typically comprises several key components. These include control activities, a monitoring process, a risk assessment process, and a control environment. The control environment sets the tone at the top, establishing ethical values and a commitment to competence. Risk assessment involves identifying and analyzing potential risks, while control activities are the specific actions taken to mitigate those risks. Finally, the monitoring process ensures that the internal control system is functioning effectively. Each component plays a crucial role in ensuring the integrity of financial reporting and the overall effectiveness of the organization. For example, segregation of duties prevents fraud and error by ensuring that no single individual has complete control over a transaction. Regular reconciliation of bank statements against internal records helps detect discrepancies and potential errors early.

Accounting Systems’ Support for Risk Assessment and Mitigation Strategies

Accounting systems play a vital role in providing the data necessary for risk assessment and the implementation of mitigation strategies. For example, a well-designed accounting system can track key financial metrics, allowing management to identify trends and potential problems. Real-time dashboards can visually represent critical data points, allowing for quicker identification of anomalies and potential risks. Furthermore, advanced analytics can be applied to the data to identify patterns and predict potential future risks. For instance, predictive modeling can forecast potential cash flow shortfalls based on historical data and current trends, allowing for proactive measures to be taken to secure additional funding or adjust spending plans.

Examples of Internal Control Weaknesses Leading to Financial Irregularities

Weaknesses in internal controls can create opportunities for fraud and financial irregularities. A common example is a lack of segregation of duties, where a single individual has control over multiple aspects of a transaction. This lack of checks and balances can allow for embezzlement or manipulation of financial records. Another weakness is inadequate authorization procedures, allowing transactions to be processed without proper approval. This can lead to unauthorized payments or expenses. Finally, a lack of independent verification and reconciliation can allow errors or fraud to go undetected for extended periods. The Enron scandal serves as a stark reminder of the devastating consequences of weak internal controls, highlighting the importance of robust systems and oversight.

Best Practices for Designing and Implementing Effective Internal Controls

Designing and implementing effective internal controls requires a systematic approach. Best practices include establishing a strong control environment with clear ethical standards and a commitment to competence; conducting regular risk assessments to identify and analyze potential risks; designing and implementing appropriate control activities to mitigate those risks; establishing a robust monitoring process to ensure the effectiveness of the controls; and documenting all internal control procedures. Regular review and updates of the internal control system are also essential to ensure it remains relevant and effective in light of changes in the business environment and technology. Furthermore, regular internal audits should be conducted to assess the effectiveness of the controls and identify any weaknesses. This combination of proactive design, regular review, and ongoing monitoring ensures the long-term effectiveness of internal control systems.

The Auditor’s Role in Corporate Governance

External auditors play a crucial role in maintaining the integrity of financial reporting and bolstering corporate governance. Their independent assessment of a company’s financial statements provides assurance to investors and other stakeholders, fostering trust and confidence in the market. This section will detail the responsibilities of external auditors, the importance of their independence, a comparison of their role with internal auditors, and the significant impact of their reports.

External Auditor Responsibilities in Ensuring Financial Statement Accuracy and Reliability, The Role of Accounting in Corporate Governance

External auditors are responsible for expressing an opinion on the fairness and accuracy of a company’s financial statements. This involves a thorough examination of the company’s accounting records, internal controls, and financial transactions. Their work encompasses various procedures, including testing internal controls, reviewing accounting policies, and analyzing significant transactions. The goal is to provide reasonable assurance that the financial statements are free from material misstatement, whether due to fraud or error. The level of assurance provided is not absolute certainty, but a high degree of confidence based on professional standards and procedures. A significant part of their responsibility involves evaluating the effectiveness of a company’s internal controls over financial reporting, a key element of corporate governance.

Auditor Independence and Objectivity in Maintaining Corporate Governance

Maintaining auditor independence and objectivity is paramount for the credibility of their work and the effectiveness of corporate governance. Independence ensures that auditors can perform their duties without undue influence from management or other stakeholders. This is achieved through strict adherence to professional ethics codes, which prohibit relationships that could impair objectivity. For example, auditors are prohibited from providing certain non-audit services to their audit clients, and there are strict rules regarding financial relationships between the auditor and the client. Objectivity ensures that the audit is conducted impartially and without bias, providing a fair and unbiased assessment of the financial statements. Without this independence and objectivity, the reliability of the audit opinion is severely compromised, undermining investor confidence and the integrity of the financial markets.

Comparison of Internal and External Auditors in Safeguarding Corporate Assets

Both internal and external auditors contribute to safeguarding corporate assets, but their roles and responsibilities differ significantly. Internal auditors work within the organization and report to management. Their focus is on evaluating the effectiveness of internal controls, identifying operational inefficiencies, and providing recommendations for improvement. External auditors, on the other hand, are independent of the organization and report to the audit committee of the board of directors. Their primary responsibility is to provide an independent opinion on the fairness and accuracy of the financial statements. While internal audit focuses on a broader range of operational and compliance matters, external audit concentrates specifically on the financial reporting process and the reliability of the financial statements. The two types of audits complement each other, with internal audit providing ongoing monitoring and risk assessment, and external audit providing independent assurance to external stakeholders.

Impact of Auditor’s Reports on Investor Decisions and Corporate Reputation

Auditor’s reports significantly influence investor decisions and corporate reputation. A clean audit opinion, indicating that the financial statements are fairly presented, builds investor confidence and enhances the company’s credibility. Conversely, a qualified or adverse opinion, suggesting material misstatements or significant deficiencies in internal controls, can severely damage investor confidence and lead to a decline in the company’s share price and reputation. Investors rely heavily on auditor’s reports to assess the financial health and integrity of a company before making investment decisions. A negative audit opinion can lead to reduced access to capital, difficulty in attracting investors, and legal ramifications. Therefore, the auditor’s report is a critical component of a company’s overall corporate governance framework, directly impacting its financial performance and long-term sustainability.

Accounting’s Influence on Decision-Making

Accounting information forms the bedrock of informed decision-making within corporations. Accurate and reliable financial data empowers boards of directors to make strategic choices that align with the company’s long-term goals, fostering sustainable growth and profitability. Without robust accounting practices, crucial insights remain obscured, hindering effective governance and potentially leading to significant financial setbacks.

Accurate accounting data is fundamental to effective resource allocation and performance evaluation. It provides a clear picture of the company’s financial health, allowing for informed decisions regarding investments, expansions, and operational efficiency. By analyzing key financial metrics, management can identify areas requiring attention, optimize resource deployment, and track the progress of various initiatives. This data-driven approach ensures resources are utilized effectively, maximizing returns and minimizing waste.

Accounting Metrics in Assessing Corporate Governance Effectiveness

Several key accounting metrics provide insights into the effectiveness of corporate governance practices. Return on Equity (ROE), for instance, reflects the profitability generated relative to shareholder investment, indicating how effectively management is utilizing shareholder capital. Similarly, debt-to-equity ratios highlight the company’s financial leverage and risk profile, reflecting the balance between debt financing and equity. A high debt-to-equity ratio may signal aggressive financial strategies and potential vulnerability to economic downturns. Analyzing these metrics, alongside others like earnings per share (EPS) and operating margins, provides a comprehensive view of a company’s financial health and the effectiveness of its governance mechanisms. Consistent monitoring of these metrics allows for timely adjustments to corporate strategies and mitigates potential risks.

Hypothetical Case Study: Flawed Accounting Data and Poor Strategic Decisions

Imagine a rapidly growing technology company, “InnovateTech,” that experienced a period of aggressive expansion fueled by venture capital. Due to internal pressures to show rapid growth, InnovateTech’s accounting department prematurely recognized revenue from long-term contracts, inflating reported earnings. This flawed accounting data led the board of directors to believe the company was significantly more profitable than it actually was. Based on this inflated performance, the board approved further expansion initiatives, including significant investments in new product development and acquisitions. However, as the true financial picture emerged, InnovateTech struggled to meet its financial obligations, ultimately leading to significant financial losses and a drastic reduction in its valuation. This scenario underscores the critical importance of accurate accounting data in supporting sound strategic decision-making. The consequences of flawed accounting can be severe, impacting not only the company’s financial health but also the confidence of investors and stakeholders.

The Impact of Accounting on Stakeholder Relationships

Accounting practices are not merely technical exercises; they are fundamental to building and maintaining trust with all stakeholders. Transparent and accurate financial reporting directly influences how investors, employees, and customers perceive a company’s stability, ethical conduct, and future prospects. The information provided shapes their decisions and ultimately impacts the organization’s success.

Accurate and timely financial reporting is crucial for fostering trust and confidence among stakeholders. Investors rely on audited financial statements to assess the company’s financial health, profitability, and risk profile before making investment decisions. Employees look to accounting information to understand the company’s performance and their job security. Customers, while less directly involved with the financial details, often associate a company’s financial strength with product quality and reliability.

Accounting Information’s Influence on Stakeholder Communication and Engagement

Effective communication of accounting information is paramount for building strong stakeholder relationships. This involves not only presenting accurate financial statements but also proactively engaging with stakeholders to explain complex financial data in a clear and accessible manner. Companies that actively communicate their financial performance, including both successes and challenges, are better positioned to build trust and understanding. This proactive approach reduces uncertainty and fosters a sense of partnership. Regularly scheduled investor calls, annual reports with detailed explanations, and accessible online financial information are examples of such initiatives. Furthermore, clear and concise communication regarding strategic decisions and their potential impact on the financial performance of the organization can preempt misunderstandings and maintain positive stakeholder relations.

Examples of Accounting Practices Enhancing or Damaging Stakeholder Relationships

Instances of fraudulent accounting practices, such as Enron and WorldCom, dramatically illustrate the devastating impact of unethical accounting on stakeholder relationships. These scandals eroded investor confidence, destroyed employee livelihoods, and tarnished the companies’ reputations irreparably. Conversely, companies with a history of transparent and accurate reporting often enjoy higher investor confidence, attracting more investment and fostering employee loyalty. For example, a company consistently exceeding its projected earnings and transparently sharing its financial success with employees through bonuses and profit-sharing programs cultivates a positive and trusting relationship. Similarly, a company that openly communicates its sustainability initiatives, backed by verifiable accounting data demonstrating environmental and social responsibility, strengthens its relationships with environmentally conscious consumers.

A Communication Strategy Using Accounting Information to Build Strong Stakeholder Relationships

A comprehensive communication strategy should utilize various channels to disseminate accounting information effectively. This includes:

- Regularly published, easily understandable annual reports that go beyond the basic financial statements to explain the company’s performance in a clear and concise manner.

- Interactive online platforms providing real-time access to key financial metrics and allowing stakeholders to ask questions and receive prompt responses.

- Targeted communications tailored to the specific needs and interests of different stakeholder groups (e.g., detailed financial reports for investors, concise summaries for employees, and sustainability reports for environmentally conscious consumers).

- Open and honest communication during periods of both success and challenge, acknowledging limitations and proactively addressing concerns.

- Active engagement with stakeholders through town hall meetings, investor conferences, and social media platforms.

This multifaceted approach fosters transparency, builds trust, and enhances stakeholder engagement, ultimately strengthening the company’s reputation and long-term success.

Accounting and Corporate Social Responsibility (CSR)

Accounting plays a crucial role in measuring, reporting, and ultimately driving a company’s commitment to Corporate Social Responsibility (CSR). It provides the framework for translating abstract CSR goals into tangible, measurable results, allowing for both internal assessment and external accountability. This section will explore the intersection of accounting and CSR, highlighting the increasing demand for transparency and the innovative ways companies are integrating these principles into their financial reporting.

Accounting offers a structured approach to quantifying a company’s environmental and social impact. Traditional financial statements, while essential, often fail to capture the full picture of a business’s sustainability efforts. However, through the development and application of specific metrics and reporting standards, accounting can measure factors like greenhouse gas emissions, water consumption, waste generation, employee diversity, community engagement, and ethical sourcing. This data, once collected and analyzed, provides a basis for evaluating performance, identifying areas for improvement, and setting future targets. Furthermore, robust accounting practices ensure that the reported data is reliable, consistent, and comparable across different organizations, enabling meaningful benchmarking and stakeholder assessment.

Measuring and Reporting Environmental and Social Performance

Several accounting methods are employed to measure and report on a company’s environmental and social performance. These range from simple metrics, such as the amount of renewable energy used, to more complex methodologies that incorporate life-cycle assessments and materiality assessments. For instance, a company might track its carbon footprint using a standardized protocol, disclosing its emissions in its annual report. Similarly, social impact might be measured by tracking employee satisfaction, charitable contributions, or the number of diversity and inclusion initiatives implemented. The increasing adoption of Global Reporting Initiative (GRI) standards and the Sustainability Accounting Standards Board (SASB) standards provides a framework for consistent and comparable reporting across different industries. These standards promote transparency by outlining key performance indicators (KPIs) relevant to specific sectors, ensuring that reported data is meaningful and readily understandable to stakeholders.

The Growing Demand for Transparency and Accountability in CSR Reporting

Stakeholders, including investors, customers, employees, and regulators, are increasingly demanding greater transparency and accountability in CSR reporting. This demand stems from a growing awareness of the interconnectedness of environmental, social, and economic performance. Investors recognize that ESG factors can significantly impact a company’s long-term value and profitability, while customers are increasingly seeking out businesses with strong ethical and sustainable practices. Regulators are also playing a more active role, introducing legislation and regulations that require companies to disclose their environmental and social performance data. This increased scrutiny is driving companies to adopt more robust accounting and reporting practices to meet these expectations and manage potential reputational risks.

Examples of Effective CSR Integration into Accounting Practices

Several companies have successfully integrated CSR principles into their accounting practices, demonstrating the potential for positive impact. Unilever, for example, has implemented a comprehensive sustainability strategy that is integrated into its business operations and financial reporting. The company tracks its progress against several key sustainability targets, including reducing its environmental footprint and improving its social impact. Patagonia, a clothing company known for its commitment to environmental sustainability, uses its accounting practices to track its supply chain’s environmental impact, working to minimize its ecological footprint and promote fair labor practices. These examples illustrate how accounting can be a powerful tool for driving positive change, both within the company and across its value chain.

A Framework for Integrating ESG Factors into Corporate Financial Reporting

A robust framework for integrating ESG factors into corporate financial reporting should incorporate several key elements. Firstly, it requires a comprehensive materiality assessment to identify the ESG issues most relevant to the company’s business and stakeholders. Secondly, it necessitates the development of clear, measurable, and achievable targets for each material ESG issue. Thirdly, it involves establishing a robust data collection and monitoring system to track progress towards these targets. Finally, it demands transparent and consistent reporting of ESG performance, using standardized frameworks like GRI or SASB, to ensure comparability and accountability. This integrated approach allows for a holistic view of the company’s performance, combining financial and non-financial data to provide a more complete picture of its value creation.

Final Thoughts

In conclusion, the interwoven relationship between accounting and corporate governance is undeniable. Sound accounting practices are not merely a compliance requirement but a cornerstone of responsible corporate leadership. By prioritizing accurate financial reporting, robust internal controls, and transparent communication, organizations can build strong stakeholder relationships, foster investor confidence, and ensure long-term sustainability. The effective implementation of these principles is vital for maintaining ethical standards and fostering a culture of accountability within any successful enterprise.

Essential FAQs

What are the potential consequences of poor accounting practices?

Poor accounting practices can lead to inaccurate financial reporting, investor distrust, legal penalties, reputational damage, and ultimately, business failure.

How does accounting contribute to effective risk management?

Accounting systems provide data for risk assessment, enabling companies to identify and mitigate potential threats. Strong internal controls, supported by accounting procedures, are crucial in risk mitigation.

What is the difference between internal and external audits?

Internal audits are conducted by a company’s own employees to assess its internal controls and processes. External audits are performed by independent firms to ensure the accuracy and reliability of financial statements for external stakeholders.

How can companies improve their CSR reporting through accounting?

Companies can integrate ESG (environmental, social, and governance) factors into their accounting practices by developing metrics to measure and report on their environmental and social performance, promoting transparency and accountability.

Expand your understanding about How Global Competition Affects Business Cost Accounting Strategies with the sources we offer.