The Importance of Ethical Standards in Accounting underpins the integrity of the financial world. This exploration delves into the core principles of ethical conduct within the accounting profession, examining how these standards impact financial reporting, auditing practices, and the broader business landscape. We will navigate the ethical challenges posed by globalization, technological advancements, and the growing emphasis on environmental, social, and governance (ESG) factors, ultimately aiming to illuminate the crucial role ethics plays in maintaining trust and transparency in the financial markets.

From defining ethical standards and their implications for financial reporting accuracy to exploring the ethical responsibilities of auditors and the challenges presented by a rapidly evolving global economy, this discussion provides a comprehensive overview of the subject. We will consider real-world examples of ethical dilemmas, examine effective strategies for promoting ethical behavior within accounting firms, and analyze the potential consequences of unethical practices.

Defining Ethical Standards in Accounting

Ethical standards in accounting are the principles and guidelines that govern the conduct of accountants and ensure the integrity of financial reporting. These standards aim to maintain public trust and confidence in the financial information used for decision-making by individuals, businesses, and governments. Adherence to these standards is crucial for the smooth functioning of the global economy.

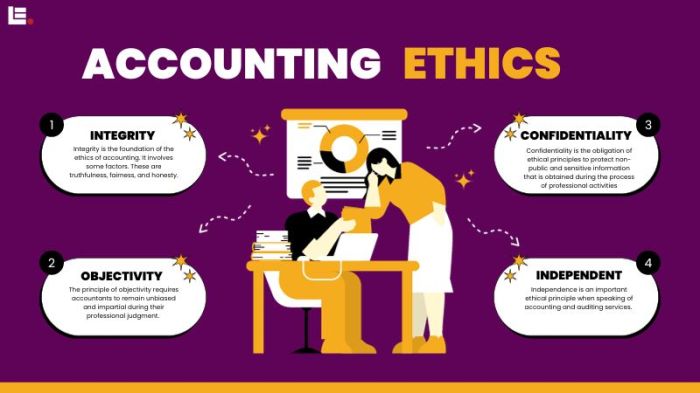

Ethical conduct in accounting rests on several core principles. These include integrity, objectivity, professional competence and due care, confidentiality, and professional behavior. Integrity demands honesty and straightforwardness in all professional relationships. Objectivity requires accountants to be impartial and free from bias when performing their duties. Professional competence and due care necessitate maintaining professional knowledge and skills, and exercising diligence in all professional work. Confidentiality protects sensitive client information, while professional behavior promotes the good reputation of the accounting profession.

Ethical Dilemmas in Accounting Practices

Ethical dilemmas frequently arise in accounting, often presenting challenging situations where the application of ethical principles is crucial. For instance, pressure from superiors to manipulate financial statements to meet unrealistic targets can create a conflict between loyalty to the employer and adherence to ethical standards. Another common dilemma involves the disclosure of confidential client information, particularly when legally compelled to do so or when faced with a situation where such disclosure could prevent serious harm. A further example is the temptation to accept gifts or favors from clients that could potentially compromise professional judgment and objectivity. These situations require careful consideration of the relevant ethical codes and potentially seeking guidance from professional bodies.

The Role of Professional Accounting Bodies

Professional accounting bodies, such as the American Institute of Certified Public Accountants (AICPA) or the Institute of Chartered Accountants in England and Wales (ICAEW), play a vital role in establishing and enforcing ethical standards within the accounting profession. These bodies develop comprehensive codes of ethics, provide guidance on ethical dilemmas, and investigate allegations of misconduct. They often create disciplinary procedures for members who violate their codes of conduct. This includes sanctions ranging from reprimands and fines to suspension or expulsion from the professional body, significantly impacting the careers of those found in violation. Furthermore, these bodies often offer continuing professional development programs to help accountants stay up-to-date on ethical issues and best practices.

Consequences of Unethical Accounting Practices

Unethical accounting practices can have severe consequences for both individuals and organizations. For individuals, the penalties can range from professional sanctions, such as license revocation or expulsion from professional bodies, to legal prosecution, leading to fines and even imprisonment. For organizations, the consequences can be far-reaching and include reputational damage, loss of investor confidence, significant financial losses, legal liabilities, and even bankruptcy. The Enron and WorldCom scandals serve as stark reminders of the devastating impact that unethical accounting practices can have, highlighting the importance of robust ethical frameworks and rigorous enforcement. The long-term effects can include difficulty in securing financing, reduced market share, and a general erosion of public trust.

The Impact of Ethical Standards on Financial Reporting

Ethical standards are the bedrock of accurate and reliable financial reporting. They provide a framework that ensures transparency, accountability, and ultimately, trust in the financial information presented by organizations. Without adherence to these standards, the integrity of financial statements is compromised, leading to potentially devastating consequences for investors, creditors, and the overall economy.

Ethical standards directly influence the accuracy and reliability of financial statements by promoting objectivity and preventing bias in the recording and reporting of financial transactions. This involves following generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), applying consistent accounting methods, and ensuring that all transactions are properly documented and supported by evidence. The rigorous application of these standards minimizes the potential for errors and omissions, thereby enhancing the credibility of the reported financial information.

Transparency and Full Disclosure in Financial Reporting

Transparency and full disclosure are crucial elements of ethical financial reporting. Transparency means presenting financial information in a clear, understandable, and readily accessible manner. Full disclosure requires the complete and accurate reporting of all material information that could influence the decisions of financial statement users. This includes not only positive aspects of a company’s financial performance but also any potential risks, liabilities, or uncertainties. For instance, a company must disclose any significant lawsuits, environmental liabilities, or pending regulatory actions that could materially affect its financial position. The absence of transparency and full disclosure can mislead investors and creditors, leading to poor investment decisions and potential financial losses.

Ethical Versus Unethical Accounting Practices and Investor Confidence

Ethical accounting practices foster trust and confidence among investors and other stakeholders. When investors believe that a company’s financial statements are accurate and reliable, they are more likely to invest in that company, leading to increased capital availability and lower borrowing costs. Conversely, unethical accounting practices, such as earnings management or fraudulent reporting, erode investor confidence. The Enron and WorldCom scandals serve as stark reminders of the devastating consequences of unethical accounting practices. These scandals resulted in significant investor losses, damaged reputations, and ultimately, the collapse of these once-powerful corporations. The resulting loss of investor confidence can have far-reaching economic effects, impacting market stability and overall investor sentiment.

Areas of Potential Manipulation or Misrepresentation and Mitigation Through Ethical Standards, The Importance of Ethical Standards in Accounting

Several areas within financial reporting are susceptible to manipulation or misrepresentation. Revenue recognition, for example, can be manipulated by accelerating revenue recognition before it is properly earned or delaying the recognition of expenses. Similarly, asset valuation can be subject to bias, with assets being overstated to inflate the company’s apparent financial strength. Inventory valuation methods can also be manipulated to present a more favorable financial picture. Ethical standards, enforced through internal controls, independent audits, and regulatory oversight, help mitigate these risks. Strong internal controls provide checks and balances to prevent fraudulent activities, while independent audits provide an objective assessment of the fairness and accuracy of financial statements. Regulatory oversight, such as the Securities and Exchange Commission (SEC) in the United States, ensures compliance with accounting standards and investigates instances of suspected fraud. These safeguards help to maintain the integrity of financial reporting and protect investors from potential harm.

Ethical Considerations in Auditing

Auditors play a crucial role in ensuring the reliability and integrity of financial statements. Their work underpins investor confidence and the stability of financial markets. Ethical considerations are paramount in this role, shaping the auditor’s approach to their responsibilities and influencing the quality of their work.

The Auditor’s Role in Maintaining Financial Information Integrity

Auditors are independent professionals who examine a company’s financial records to provide an opinion on whether those records fairly present the company’s financial position and performance in accordance with generally accepted accounting principles (GAAP). This opinion forms the bedrock of trust for investors, lenders, and other stakeholders. Maintaining this integrity requires adherence to strict ethical standards and a commitment to professional skepticism, which involves questioning management’s assertions and critically evaluating the evidence provided. A thorough and unbiased audit process helps detect errors and irregularities, ensuring the accuracy and reliability of financial information.

Ethical Responsibilities of Auditors in Detecting and Reporting Fraud

Auditors have a responsibility to plan and perform audits to obtain reasonable assurance about whether the financial statements are free from material misstatement, whether due to fraud or error. This involves actively seeking evidence of fraud, including considering the risks of fraud and designing audit procedures to respond to those risks. If fraud is detected, auditors have an ethical obligation to report it to the appropriate authorities, including management and, if necessary, the audit committee or regulatory bodies. Failure to report suspected fraud constitutes a serious ethical breach and can have significant legal and reputational consequences.

The Importance of Auditor Independence and Objectivity

Auditor independence is fundamental to the credibility of the audit process. Independence means that the auditor is free from any influence that could compromise their objectivity and professional judgment. This independence must be maintained throughout the audit process, from the acceptance of the engagement to the issuance of the audit report. Any financial or personal relationship with the client that could impair objectivity must be disclosed and addressed. Objectivity requires auditors to remain impartial and unbiased in their assessments, basing their conclusions solely on the evidence gathered. This is crucial to ensuring the reliability of their opinion.

Examples of Ethical Dilemmas Faced by Auditors and Potential Solutions

Auditors frequently encounter ethical dilemmas. For example, an auditor might discover a minor error that, while not material, reveals a pattern of sloppy accounting practices. The ethical dilemma lies in deciding whether to report this minor error, potentially disrupting the client relationship, or to overlook it, risking a future, more significant issue. Another dilemma might arise when a client pressures the auditor to ignore a significant accounting irregularity. In such situations, the auditor must prioritize their ethical responsibilities over maintaining a client relationship. Potential solutions involve clearly communicating the ethical implications of such actions to the client, documenting all findings thoroughly, and seeking guidance from professional ethics boards or legal counsel if necessary. In the case of significant pressure, reporting the situation to the audit committee or regulatory bodies may be necessary.

Types of Audit Risks and Their Ethical Implications

| Risk Type | Description | Ethical Implications | Mitigation Strategies |

|---|---|---|---|

| Fraud Risk | Risk that the financial statements contain material misstatements due to fraud. | Failure to detect and report fraud constitutes a serious ethical breach. Compromises auditor independence and objectivity. | Professional skepticism, robust audit procedures, and effective communication with management and the audit committee. |

| Management Override of Controls | Risk that management circumvents internal controls to commit fraud. | Failure to identify and address this risk could lead to undetected fraud. Challenges auditor objectivity. | Increased scrutiny of significant transactions, assessment of management’s integrity, and enhanced procedures to detect unusual activity. |

| Risk of Material Misstatement Due to Error | Risk that the financial statements contain material misstatements due to unintentional errors. | While not as severe as fraud, failure to detect material errors compromises the reliability of the audit opinion. | Thorough testing of internal controls, substantive procedures, and appropriate use of audit sampling techniques. |

| Lack of Auditor Independence | Risk that the auditor’s objectivity is compromised due to relationships with the client. | Undermines the credibility of the audit opinion and erodes public trust. Violates professional ethics codes. | Strict adherence to independence standards, disclosure of any potential conflicts of interest, and rotation of audit partners. |

Ethical Challenges in the Modern Accounting Environment

The modern accounting environment is a complex and rapidly evolving landscape, presenting numerous ethical challenges that require careful consideration and proactive strategies. Globalization, technological advancements, and the growing emphasis on environmental, social, and governance (ESG) factors all contribute to a heightened need for robust ethical frameworks and practices within the accounting profession. Failure to address these challenges can lead to significant financial and reputational damage for organizations and erode public trust in the integrity of financial reporting.

Globalization’s Impact on Accounting Practices

Globalization has created a more interconnected world, leading to increased complexity in accounting practices. Multinational corporations operate across diverse jurisdictions with varying accounting standards and regulatory frameworks. This presents ethical dilemmas related to transfer pricing, tax avoidance, and the consistent application of accounting principles across different subsidiaries. For example, a company might be tempted to shift profits to lower-tax jurisdictions, even if it is not strictly illegal, blurring the line between tax optimization and aggressive tax avoidance. This requires accountants to navigate a complex web of international regulations and ethical considerations, ensuring transparency and adherence to the highest ethical standards in all operational locations. The lack of universally accepted accounting standards across all countries can further exacerbate these challenges.

Ethical Challenges Posed by Technological Advancements

Technological advancements, particularly in artificial intelligence (AI) and big data analytics, are transforming the accounting profession. While these technologies offer increased efficiency and accuracy, they also introduce new ethical challenges. AI-powered auditing tools, for instance, may inadvertently perpetuate existing biases present in the data they are trained on, leading to inaccurate or unfair assessments. The use of big data analytics also raises concerns about data privacy and security. Accountants must ensure the responsible and ethical use of these technologies, considering potential biases, ensuring data security, and maintaining transparency in their application. The potential for algorithmic bias in AI-driven audit processes is a significant concern, requiring careful monitoring and validation of results.

Ethical Considerations Surrounding ESG Reporting

Environmental, social, and governance (ESG) reporting is gaining increasing prominence as stakeholders demand greater transparency and accountability from organizations regarding their environmental impact, social responsibility, and corporate governance practices. However, the lack of standardized ESG reporting frameworks and the subjective nature of many ESG metrics present significant ethical challenges. “Greenwashing,” the practice of making misleading or unsubstantiated claims about an organization’s environmental performance, is a growing concern. Accountants play a crucial role in ensuring the accuracy, reliability, and comparability of ESG information, promoting transparency and preventing misleading representations. The challenge lies in developing consistent and verifiable metrics for measuring ESG performance and ensuring that reporting is both accurate and comprehensive.

Emerging Ethical Issues and Strategies for Addressing Them

Several emerging ethical issues are impacting the accounting profession. The increasing use of cryptocurrencies and decentralized finance (DeFi) presents challenges related to transparency, traceability, and regulatory compliance. The rise of the gig economy and the use of independent contractors also raise questions about the classification of workers and the appropriate application of employment laws. Furthermore, the increasing pressure to meet short-term financial targets can incentivize unethical behavior, such as aggressive accounting practices. Addressing these issues requires a multi-pronged approach: strengthening professional ethics codes, enhancing regulatory oversight, promoting ethical leadership within organizations, and fostering a culture of integrity and transparency. Continuous professional development programs are also essential to equip accountants with the knowledge and skills needed to navigate these complex ethical challenges.

Best Practices for Maintaining Ethical Standards

Maintaining ethical standards in a rapidly changing business environment requires a proactive and multifaceted approach. The following best practices can help organizations and individual accountants uphold ethical conduct:

- Establish a strong code of ethics and ensure its consistent enforcement.

- Provide comprehensive ethics training for all employees.

- Create a culture of open communication and whistleblowing.

- Implement robust internal controls and oversight mechanisms.

- Promote transparency and accountability in all financial reporting.

- Stay informed about evolving ethical issues and regulatory changes.

- Seek guidance from professional organizations and ethical advisors when faced with difficult ethical dilemmas.

- Prioritize long-term value creation over short-term gains.

Promoting Ethical Behavior in Accounting Firms: The Importance Of Ethical Standards In Accounting

Cultivating a culture of ethical conduct within accounting firms is paramount for maintaining public trust and ensuring the integrity of financial reporting. This requires a multifaceted approach encompassing robust ethics training, a strong code of conduct, and committed leadership. These elements, working in concert, create a system of checks and balances that promote ethical decision-making at all levels of the organization.

A Comprehensive Ethics Training Program for Accounting Professionals

A comprehensive ethics training program should be a cornerstone of any accounting firm’s commitment to ethical behavior. This program should not be a one-time event, but rather an ongoing process of education and reinforcement. The curriculum should cover a wide range of topics, including relevant professional codes of conduct, ethical dilemmas commonly encountered in accounting, and practical strategies for navigating challenging situations. Interactive workshops, case studies, and role-playing exercises can enhance learning and promote critical thinking skills. Regular refresher courses and updates to reflect changes in regulations and best practices are also crucial. The program should also include mechanisms for reporting ethical violations and addressing concerns without fear of retaliation.

The Role of a Strong Code of Conduct in Fostering Ethical Behavior

A well-defined and widely disseminated code of conduct serves as a clear guide for ethical decision-making within an accounting firm. It should articulate the firm’s values, principles, and expectations regarding ethical behavior. The code should be concise, easily accessible, and written in plain language to ensure clarity and understanding. It should explicitly address common ethical challenges, such as conflicts of interest, confidentiality, and the responsible use of company resources. Importantly, the code should not only Artikel expectations but also provide practical guidance and resources for navigating ethical dilemmas. Regular review and updates of the code are necessary to ensure its continued relevance and effectiveness. Furthermore, the code should be actively enforced, with clear consequences for violations.

Leadership’s Role in Promoting Ethical Decision-Making

Leadership plays a pivotal role in shaping the ethical culture of an accounting firm. Leaders must model ethical behavior in their own actions and decisions, setting a clear example for their teams. They should actively communicate the importance of ethical conduct, incorporate ethical considerations into decision-making processes, and create an environment where employees feel comfortable raising ethical concerns without fear of reprisal. Leaders should also provide regular training and support to employees on ethical issues and encourage open dialogue and discussion. Establishing clear reporting mechanisms and ensuring prompt and fair investigation of ethical violations are essential responsibilities of leadership. By demonstrating a strong commitment to ethics at all levels, leaders can foster a culture of integrity and trust.

Visual Representation of an Effective Ethics Program

Imagine a three-tiered pyramid. The base, the largest section, represents the foundational elements: a comprehensive ethics training program, a clearly defined and readily accessible code of conduct, and robust reporting mechanisms for ethical violations. The middle section depicts the active implementation: regular ethics training sessions, consistent communication of ethical expectations, and the proactive investigation of any reported ethical breaches. The apex, the smallest section, represents the outcome: a culture of ethical behavior permeating the firm, characterized by high levels of trust, transparency, and integrity. The pyramid’s structure illustrates the interconnectedness of these elements; a strong foundation is crucial for effective implementation, ultimately leading to the desired outcome of a thriving ethical culture. This visual reinforces the idea that an effective ethics program isn’t a single initiative but a continuous, integrated system.

Summary

In conclusion, the importance of ethical standards in accounting cannot be overstated. Maintaining the highest ethical standards is not merely a matter of compliance; it is the cornerstone of a robust and trustworthy financial system. By fostering a culture of integrity, transparency, and accountability, accounting professionals can safeguard the interests of investors, stakeholders, and the public at large. The ongoing evolution of the accounting landscape necessitates a continuous commitment to ethical development and the adaptation of best practices to meet emerging challenges.

Questions Often Asked

What are the potential penalties for unethical accounting practices?

Penalties can range from fines and professional sanctions to imprisonment, depending on the severity and nature of the offense. Companies may also face reputational damage and loss of investor confidence.

How can whistleblowing contribute to ethical accounting practices?

Whistleblowing provides a crucial mechanism for reporting unethical behavior. Robust whistleblower protection policies are essential to encourage individuals to come forward without fear of retaliation.

How do ethical standards evolve with technological advancements?

Technological advancements, such as AI and big data, introduce new ethical challenges related to data security, algorithmic bias, and the potential for manipulation. Continuous professional development and the adaptation of ethical frameworks are crucial to address these issues.

Examine how The Role of Accounting in the Rise of Impact Investing can boost performance in your area.