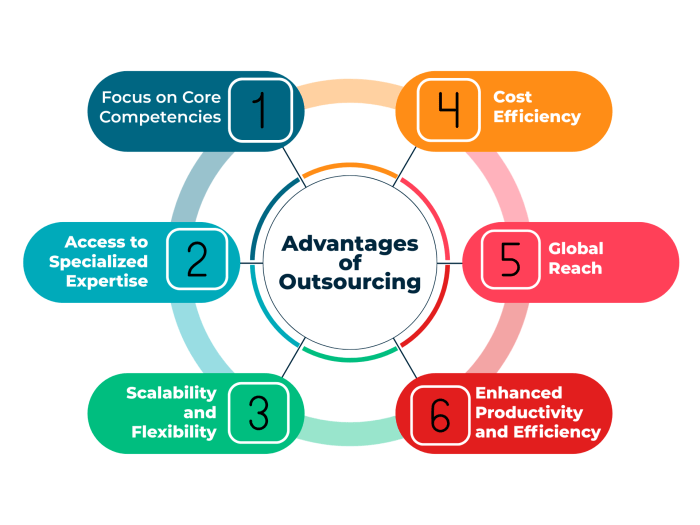

The Benefits of Outsourcing Your Accounting Functions extend far beyond simple cost reduction. By strategically delegating accounting tasks, businesses gain access to specialized expertise, freeing up internal resources to focus on core competencies and driving revenue growth. This allows for greater scalability and flexibility to adapt to market changes, ultimately leading to improved efficiency and a more robust financial foundation.

This strategic move offers significant advantages. Outsourcing mitigates risks associated with internal accounting errors and non-compliance, while simultaneously leveraging advanced technologies and data analytics for sharper financial insights. The result? A streamlined, efficient operation better equipped to navigate the complexities of modern business.

Cost Savings and Efficiency

Outsourcing your accounting functions offers significant advantages in terms of cost reduction and operational efficiency. By leveraging the expertise and resources of a specialized accounting firm, businesses can streamline their financial processes and free up internal resources for core business activities. This approach not only reduces overhead but also improves accuracy and compliance.

Outsourcing eliminates the need for a dedicated in-house accounting department, significantly reducing overhead costs. These savings stem from reduced expenses related to salaries, benefits, office space, software licenses, and IT infrastructure. Furthermore, outsourcing firms often possess economies of scale, allowing them to negotiate better rates for services and software, translating to further cost advantages for their clients. Improved efficiency comes from access to specialized expertise and advanced technologies, leading to faster processing times and reduced errors.

Cost Reduction through Outsourcing

The following table illustrates potential cost reductions achieved by outsourcing various accounting functions. These figures are illustrative and will vary depending on specific circumstances and the size of the business.

| Function Outsourced | Previous Cost (Annual) | Outsourced Cost (Annual) | Cost Savings (Annual) |

| Payroll Processing | $20,000 | $12,000 | $8,000 |

| Accounts Payable | $15,000 | $9,000 | $6,000 |

| Accounts Receivable | $10,000 | $6,000 | $4,000 |

| Tax Preparation | $5,000 | $3,000 | $2,000 |

Improved Efficiency Metrics

Outsourcing frequently results in measurable improvements in efficiency. For instance, a mid-sized manufacturing company outsourced its accounts payable function. Previously, processing invoices took an average of 5 days; after outsourcing, this was reduced to 2 days. This faster turnaround time allowed the company to take advantage of early payment discounts, leading to additional cost savings. Similarly, a retail business reported a 20% reduction in accounting errors after outsourcing its general ledger management. This reduction minimized the time spent on error correction and improved the accuracy of financial reporting.

Access to Specialized Expertise

Outsourcing your accounting functions provides access to a wealth of specialized skills and knowledge that may be unavailable or cost-prohibitive to maintain in-house. This access translates to significant improvements in accuracy, efficiency, and strategic decision-making. By leveraging external expertise, businesses can focus their internal resources on core competencies, driving overall growth and profitability.

Outsourcing offers superior expertise in numerous accounting areas. Smaller businesses, in particular, often lack the resources to hire specialists in every niche. This is where outsourcing shines. Consider the complexities of international accounting standards, for instance, or the intricacies of tax planning in a constantly evolving regulatory landscape. These are areas where specialized knowledge is paramount and often best left to experts.

Specialized Accounting Areas Where Outsourcing Excels

Outsourcing significantly enhances capabilities in several critical accounting areas. For example, tax planning requires a deep understanding of constantly shifting tax laws and regulations. A specialized tax firm possesses the resources and expertise to identify and implement strategies to minimize tax liabilities, something often beyond the capabilities of a small in-house accounting team. Similarly, international accounting involves navigating a complex web of varying standards and regulations across different jurisdictions. Outsourcing provides access to professionals deeply familiar with these nuances, ensuring compliance and minimizing potential risks. Another key area is forensic accounting, investigating financial fraud or irregularities. This requires highly specialized skills and experience, making outsourcing a cost-effective and efficient solution.

Comparison of In-House vs. Outsourced Accounting Expertise

The quality of work from outsourced specialists often surpasses that of in-house staff with limited expertise. Outsourced firms invest heavily in training and professional development, ensuring their staff remains at the cutting edge of accounting practices and technology. They also benefit from economies of scale, allowing them to access sophisticated software and tools unavailable to smaller businesses. This translates to greater accuracy, improved efficiency, and a reduced risk of errors.

| Skill | In-House Capability | Outsourced Capability | Impact on Business |

| Tax Planning | Limited expertise, potential for missed opportunities | Deep expertise in tax law and regulations, access to specialized software | Significant tax savings, reduced risk of penalties |

| International Accounting | Lack of familiarity with international standards, potential compliance issues | Expertise in various international accounting standards (e.g., IFRS, US GAAP) | Improved compliance, reduced risk of penalties, easier expansion into new markets |

| Forensic Accounting | Generally unavailable | Access to specialized investigators and tools | Detection and prevention of financial fraud, improved internal controls |

| Payroll Processing | Prone to errors, time-consuming | Automated systems, specialized knowledge of payroll regulations | Reduced errors, increased efficiency, compliance with labor laws |

Improved Focus on Core Business Activities

Outsourcing your accounting functions offers a significant advantage beyond cost savings and access to specialized expertise: it frees up valuable internal resources, allowing your team to concentrate on the core activities that drive your business forward. This shift in focus can lead to substantial improvements in productivity and revenue generation, ultimately strengthening your competitive position.

By delegating time-consuming accounting tasks to a specialized external team, you unlock the potential of your in-house personnel. They can dedicate their energy and skills to strategic initiatives that directly impact your bottom line, rather than being bogged down in administrative details. This reallocation of resources is a catalyst for growth and innovation.

Core Business Activities Often Neglected Due to Accounting Tasks

The time spent on routine accounting tasks often diverts attention from critical aspects of your business. This can lead to missed opportunities and a decline in overall performance. Prioritizing core activities through outsourcing ensures these vital areas receive the necessary attention.

- Product Development and Innovation: Investing in research and development, creating new products, and improving existing offerings are often hampered by the demands of internal accounting processes.

- Sales and Marketing: Developing effective marketing strategies, expanding market reach, and building strong customer relationships require significant time and resources. Accounting tasks can detract from these essential growth drivers.

- Customer Service and Relationship Management: Providing excellent customer service and fostering strong customer relationships are crucial for long-term success. Internal accounting demands can impede the ability to deliver timely and effective customer support.

- Strategic Planning and Business Development: Developing long-term strategies, identifying new business opportunities, and making informed decisions require focused attention and in-depth analysis. Accounting tasks can hinder this critical strategic thinking.

Impact of Resource Reallocation on Business Performance

Reallocating resources from accounting to core business functions demonstrably improves business performance. For example, a small manufacturing company that outsourced its accounting saw a 15% increase in sales within the first year, primarily due to the increased time spent on product development and targeted marketing campaigns. This demonstrates how efficient resource allocation directly translates to tangible business growth. Another example is a retail business that experienced a 10% increase in customer retention after outsourcing its accounting, allowing its staff to focus on enhancing customer service and building stronger relationships. These improvements can be measured using various key performance indicators (KPIs), including:

- Increased Sales Growth: Focusing on sales and marketing efforts leads to higher revenue generation.

- Improved Market Share: Effective product development and strategic planning result in a stronger competitive position.

- Enhanced Customer Satisfaction: Dedicated customer service improves customer loyalty and retention.

- Higher Profit Margins: Efficient resource allocation reduces operational costs and maximizes profitability.

Scalability and Flexibility

Outsourcing your accounting functions offers a significant advantage in terms of scalability and flexibility, allowing businesses to adapt their accounting resources to match their evolving needs. This dynamic approach contrasts sharply with the rigidity often associated with maintaining an in-house accounting team.

Outsourcing provides the ability to easily scale accounting operations up or down based on fluctuating demands. During periods of rapid growth, an outsourced provider can quickly increase the number of accountants or specialists dedicated to your business, ensuring timely and accurate financial reporting. Conversely, during slower periods, you can easily reduce your outsourced resources, avoiding the costs associated with maintaining a large, underutilized in-house team. This flexibility is particularly beneficial for businesses experiencing seasonal fluctuations or unpredictable market changes.

Cost and Challenges of Scaling In-House vs. Outsourced Teams

Scaling an in-house accounting team involves significant upfront costs. Hiring, training, onboarding, and providing equipment and workspace for new employees represent a substantial financial commitment. Furthermore, downsizing an in-house team can be complex and potentially costly, involving severance packages and potential legal implications. In contrast, scaling an outsourced team is significantly more streamlined and cost-effective. Increasing or decreasing the scope of the outsourced services typically involves a simple contract modification, with costs adjusting proportionally to the level of service required. The lack of fixed employment costs and overhead expenses inherent in outsourcing contributes significantly to its scalability advantages. For example, a small business experiencing a sudden surge in orders might struggle to hire and train new accounting staff quickly enough, leading to delays in financial reporting and potential errors. An outsourced provider, however, can immediately allocate additional resources to handle the increased workload, ensuring business continuity.

Examples of Adaptability through Outsourcing

Consider a retail company experiencing a dramatic increase in online sales during a holiday season. An in-house team might struggle to manage the increased volume of transactions and associated accounting tasks. Outsourcing allows the company to seamlessly scale its accounting operations to accommodate the peak demand, ensuring accurate and timely financial reporting without compromising quality. Similarly, a manufacturing company facing unexpected supply chain disruptions might need to quickly adjust its production and financial forecasting. An outsourced accounting team can provide the necessary flexibility to adapt to these unforeseen circumstances, providing real-time financial data to inform strategic decision-making. A company undergoing a merger or acquisition can leverage outsourced accounting services to quickly integrate the financial systems and reporting of the newly acquired entity, ensuring a smooth transition and accurate consolidated financial statements. This rapid adaptation capability is often unattainable with a fixed in-house team.

Risk Mitigation and Compliance

Outsourcing your accounting functions can significantly reduce the risks associated with internal accounting processes, particularly concerning errors and fraudulent activities. By leveraging the expertise and established procedures of a specialized firm, businesses can enhance their compliance posture and protect their financial stability. This section explores how outsourcing mitigates these risks and ensures adherence to relevant regulations.

Outsourcing to a reputable accounting firm brings a level of expertise and oversight that is often difficult and expensive to replicate internally. These firms employ experienced professionals, utilize advanced accounting software, and adhere to stringent internal controls, all contributing to a lower likelihood of errors and fraud. Furthermore, outsourced firms are generally more adept at navigating the complexities of constantly evolving accounting regulations and standards.

Compliance with Accounting Regulations and Standards

Maintaining compliance with accounting regulations, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), is paramount for any business. Non-compliance can lead to significant financial penalties, legal repercussions, and reputational damage. Outsourced accounting firms possess the necessary knowledge and resources to ensure adherence to these standards, reducing the risk of non-compliance for their clients. They regularly update their processes and training to reflect changes in legislation and best practices. For example, a firm specializing in IFRS would be well-versed in the latest interpretations and amendments, ensuring a client’s financial statements are prepared according to the most current standards.

Methods Outsourced Firms Use to Ensure Compliance and Minimize Risk

Outsourced accounting firms employ a range of strategies to minimize risk and ensure compliance. These include robust internal controls, regular audits, and ongoing professional development for their staff. They also utilize advanced accounting software with built-in compliance features and leverage technology to automate processes, reducing the potential for human error. For instance, many firms utilize data analytics to identify anomalies and potential red flags, allowing for prompt investigation and remediation. The implementation of segregation of duties within the outsourced team further minimizes the risk of fraud. One individual might handle data entry, while another reviews and approves transactions, preventing any single person from controlling the entire process.

Risks of In-House Accounting Management

The decision to manage accounting functions internally carries inherent risks. A comprehensive understanding of these risks is crucial for informed decision-making.

The following points highlight key risks associated with managing accounting functions internally:

- Lack of specialized expertise leading to errors and inefficiencies.

- Higher risk of fraud due to limited internal controls and oversight.

- Increased costs associated with hiring, training, and retaining qualified accounting personnel.

- Difficulty keeping up with evolving accounting regulations and standards.

- Limited scalability and flexibility to handle fluctuating workloads.

- Potential for internal conflicts of interest.

Technology and Innovation: The Benefits Of Outsourcing Your Accounting Functions

Outsourcing your accounting functions often grants access to a level of technological sophistication that many small and medium-sized businesses would struggle to match internally. This technological advantage translates directly into increased efficiency, accuracy, and ultimately, profitability. Outsourcing firms invest heavily in robust software and systems, providing their clients with a significant competitive edge.

Outsourcing firms leverage advanced accounting software and technology to streamline processes and enhance accuracy. This access provides significant benefits for businesses of all sizes. The integration of automated workflows, real-time data analysis, and sophisticated reporting tools contributes to a more efficient and effective accounting function. For example, the use of optical character recognition (OCR) software can automate data entry from invoices and receipts, drastically reducing manual effort and the associated risk of human error.

Advanced Accounting Software Utilized by Outsourced Firms

Many outsourced accounting firms utilize industry-leading software packages such as Xero, QuickBooks Online, and Sage Intacct. These platforms offer a comprehensive suite of tools, including automated bank reconciliation, accounts payable and receivable management, financial reporting, and tax preparation capabilities. In contrast, many in-house accounting departments rely on less sophisticated software or even manual processes, limiting their efficiency and the depth of analysis they can perform. The difference in technology often translates to significant time savings and improved accuracy for outsourced clients. For instance, automated bank reconciliation can save hours each month, allowing accounting staff to focus on more strategic tasks.

Benefits of Advanced Technology Access

Access to this advanced technology offers numerous benefits. Real-time financial dashboards provide immediate insights into a company’s financial health, allowing for quicker decision-making. Predictive analytics, available through many of these platforms, can help identify potential financial challenges and opportunities before they become significant issues. Furthermore, these systems often incorporate robust security measures, protecting sensitive financial data from unauthorized access. For example, cloud-based solutions typically employ multi-factor authentication and encryption to safeguard information.

Cloud-Based Accounting Solutions and Their Advantages

The shift towards cloud-based accounting solutions is a significant technological advancement that benefits both outsourced firms and their clients. Cloud-based systems offer enhanced accessibility, allowing authorized personnel to access financial data from anywhere with an internet connection. This flexibility is particularly valuable for businesses with remote employees or those operating across multiple locations. Moreover, cloud-based systems often provide automatic data backups and disaster recovery capabilities, mitigating the risk of data loss due to hardware failure or other unforeseen events. A well-known example of a robust cloud-based accounting system is Xero, which boasts strong security features and user-friendly interface. Its accessibility and automated features significantly improve the efficiency of accounting operations.

Improved Reporting and Analysis

Outsourcing your accounting functions grants access to comprehensive and timely financial reporting, significantly improving your understanding of your business’s financial health. This goes beyond basic bookkeeping; it unlocks deeper insights that inform strategic decision-making and drive growth. Outsourced firms typically employ sophisticated accounting software and experienced analysts capable of transforming raw financial data into actionable intelligence.

Outsourcing provides access to sophisticated reporting and analytics tools that significantly enhance decision-making capabilities. These tools often go beyond the capabilities of in-house accounting teams, particularly for smaller businesses. Data visualization techniques, predictive modeling, and advanced analytics allow for a more nuanced and comprehensive understanding of financial performance. This improved understanding enables proactive adjustments to business strategies, leading to better outcomes.

Examples of Insightful Reports

Access to advanced reporting tools allows for the generation of various insightful reports. For example, a detailed cash flow projection can highlight potential shortfalls or surpluses, enabling proactive financial planning. Similarly, a comprehensive profitability analysis by product line can reveal which areas are most profitable and which require attention. Detailed variance analysis reports comparing actual performance against budgets and forecasts offer a clear picture of areas exceeding or falling short of expectations, allowing for corrective actions. Finally, key performance indicator (KPI) dashboards provide a concise overview of critical metrics, facilitating quick identification of trends and potential problems.

Types of Reports and Their Business Value, The Benefits of Outsourcing Your Accounting Functions

| Report Type | Data Provided | Business Application | Benefits |

| Balance Sheet | Assets, Liabilities, Equity at a specific point in time | Assessing financial position, creditworthiness, and solvency | Improved understanding of financial health, better loan applications, informed investment decisions |

| Income Statement | Revenues, expenses, and net income over a period | Evaluating profitability, identifying cost drivers, and tracking revenue growth | Strategic pricing decisions, cost reduction initiatives, performance evaluation |

| Cash Flow Statement | Cash inflows and outflows from operating, investing, and financing activities | Managing liquidity, forecasting cash needs, and identifying potential cash flow problems | Improved cash management, reduced risk of insolvency, better financial planning |

| Profitability Analysis (by product/service) | Revenue, cost of goods sold, and profit margin for each product/service | Identifying profitable and unprofitable product lines, optimizing pricing strategies | Improved resource allocation, increased profitability, informed product development decisions |

| Budget vs. Actual Report | Comparison of budgeted figures against actual results | Monitoring performance against targets, identifying variances, and taking corrective actions | Enhanced control over expenses, improved budget accuracy, better financial forecasting |

Final Thoughts

In conclusion, outsourcing your accounting functions presents a compelling opportunity for businesses of all sizes to enhance efficiency, reduce costs, and gain a competitive edge. By leveraging specialized expertise and advanced technologies, companies can unlock valuable resources, improve financial reporting, and ultimately focus on their core business objectives. The benefits extend beyond immediate cost savings to encompass long-term strategic advantages, making outsourcing a worthwhile investment for sustainable growth.

Top FAQs

What types of businesses benefit most from outsourcing accounting?

Businesses of all sizes can benefit, but those experiencing rapid growth, seasonal fluctuations, or lacking in-house accounting expertise often see the most significant advantages.

How do I choose a reputable accounting outsourcing firm?

Look for firms with proven experience, strong client testimonials, relevant industry certifications (e.g., CPA), and a clear understanding of your business needs. Check their security protocols and ensure compliance with relevant regulations.

What are the potential downsides of outsourcing accounting?

Potential downsides include communication challenges, potential data security risks (though mitigated by reputable firms), and the need for clear contract terms and service level agreements.

How much does accounting outsourcing typically cost?

Costs vary significantly depending on the services required, the size of the business, and the chosen firm. It’s crucial to obtain detailed quotes and compare pricing structures before making a decision.

Obtain direct knowledge about the efficiency of How to Reduce Operational Costs with Accounting Insights through case studies.