Navigating the Complexities of Payroll Processing can feel like traversing a labyrinthine maze, but understanding its intricacies is crucial for any business, regardless of size. From mastering fundamental payroll calculations to navigating intricate tax regulations and leveraging technology for efficiency, the journey requires careful planning and execution. This exploration will illuminate the path, offering insights into best practices, common pitfalls, and strategic solutions for successful payroll management.

This guide provides a comprehensive overview of payroll processing, covering everything from basic calculations and legal compliance to software selection and efficient process management. We’ll delve into the challenges businesses face, explore solutions for streamlining workflows, and discuss the advantages and disadvantages of outsourcing versus in-house payroll management. Ultimately, the goal is to empower you with the knowledge and tools needed to confidently manage your payroll function and ensure accurate and timely payments to your employees.

Understanding Payroll Fundamentals

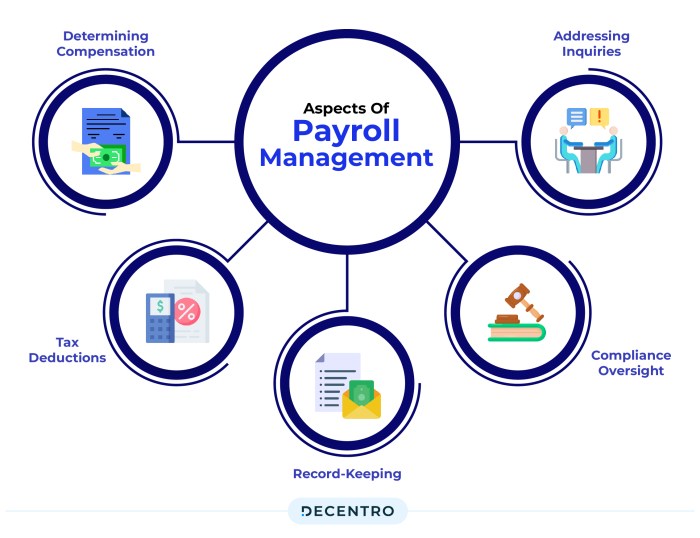

Payroll processing, while seemingly straightforward, involves a complex interplay of regulations, calculations, and record-keeping. A thorough understanding of its fundamental components is crucial for ensuring accurate and timely payment to employees while maintaining compliance with applicable laws. This section will explore the core elements of payroll systems, detailing the processes involved in calculating employee compensation and the various deductions that may apply.

Core Components of a Payroll System

A robust payroll system encompasses several key components working in concert. These include employee data management (collecting and maintaining accurate employee information such as name, address, tax identification numbers, and pay rates), time and attendance tracking (recording hours worked, overtime, sick leave, and vacation time), wage calculation (determining gross pay based on hours worked or salary), deduction processing (calculating and withholding taxes, insurance premiums, and other deductions), tax compliance (ensuring adherence to all relevant federal, state, and local tax regulations), payment processing (disbursing payments to employees via direct deposit or check), and reporting and record-keeping (generating payroll reports and maintaining accurate payroll records for auditing and compliance purposes). Efficient management of these components ensures accurate and timely payroll processing.

Types of Payroll Deductions and Their Implications

Payroll deductions represent amounts subtracted from an employee’s gross pay to cover various obligations. These can be categorized as mandatory deductions (legally required, such as federal, state, and local income taxes, Social Security tax, and Medicare tax) and voluntary deductions (employee-initiated, such as health insurance premiums, retirement plan contributions, and union dues). Understanding the implications of each deduction is critical for both the employer and the employee. Mandatory deductions are legally mandated and failure to withhold them correctly can result in significant penalties. Voluntary deductions, while not legally required, are essential for managing employee benefits and financial planning. Incorrect processing of voluntary deductions can lead to employee dissatisfaction and potential legal issues.

Calculating Gross Pay and Net Pay: A Step-by-Step Guide

Calculating gross and net pay involves a straightforward yet crucial process. Gross pay represents the total earnings before any deductions. For hourly employees, this is calculated by multiplying the hourly rate by the number of hours worked. For salaried employees, it’s the fixed annual salary divided by the number of pay periods. Net pay, on the other hand, is the amount an employee receives after all deductions have been subtracted from gross pay.

Gross Pay – Total Deductions = Net Pay

For example, an employee earning $20 per hour who worked 40 hours in a week would have a gross pay of $800 ($20/hour * 40 hours). If their total deductions amounted to $150, their net pay would be $650 ($800 – $150).

Payroll Processing Flowchart, Navigating the Complexities of Payroll Processing

A simple payroll processing flowchart can visually represent the sequence of steps involved.

[Imagine a flowchart here. The flowchart would begin with “Employee Time Data Input,” proceed to “Calculate Gross Pay,” then to “Calculate Deductions,” followed by “Calculate Net Pay,” then “Generate Paystubs,” and finally “Disburse Payments.”] This flowchart visually demonstrates the sequential nature of payroll processing, highlighting the interdependencies of various stages.

Comparison of Different Payroll Methods

Different compensation methods impact payroll calculations and employee compensation.

| Payroll Method | Calculation | Advantages | Disadvantages |

|---|---|---|---|

| Hourly | Hourly rate x Hours worked | Flexibility, overtime pay | Inconsistent income, administrative overhead |

| Salary | Fixed annual salary / Pay periods | Consistent income, simpler administration | No overtime pay, potential for burnout |

| Commission | Sales x Commission rate | Incentivizes sales, high earning potential | Inconsistent income, potential for low earnings |

| Piece Rate | Units produced x Rate per unit | Incentivizes productivity | Potential for disputes over unit counts, less job security |

Navigating Payroll Regulations and Compliance

Payroll processing involves more than just calculating wages; it necessitates a thorough understanding and adherence to a complex web of federal, state, and local regulations. Failure to comply can result in significant financial penalties, legal repercussions, and damage to a company’s reputation. This section explores the key aspects of navigating payroll regulations and ensuring compliance.

Federal, State, and Local Tax Regulations

Payroll taxes are a significant component of payroll processing, encompassing various federal, state, and local levies. At the federal level, employers are responsible for withholding income tax, Social Security tax (FICA), and Medicare tax from employee wages. They also typically match the employee’s contributions for Social Security and Medicare. State income taxes vary widely, with some states having no income tax while others impose significant rates. Furthermore, local jurisdictions may impose additional taxes, such as city or county income taxes, further complicating the payroll tax landscape. Accurate calculation and timely remittance of these taxes are crucial for avoiding penalties. For example, failure to remit payroll taxes can lead to significant financial penalties and even legal action from the IRS and state taxing authorities. Understanding the specific tax requirements for each location where employees work is paramount.

Adherence to Labor Laws and Employment Standards

Beyond tax regulations, employers must navigate a complex array of labor laws and employment standards. These laws dictate minimum wage, overtime pay, working hours, employee classification (employee vs. independent contractor), and various other employment-related matters. The Fair Labor Standards Act (FLSA) in the United States, for instance, sets federal minimum wage, overtime pay requirements, and child labor standards. State and local laws may further enhance these protections, resulting in a patchwork of regulations that employers must carefully consider. Misclassifying employees as independent contractors to avoid payroll taxes and benefits is a common violation with serious legal consequences. Maintaining accurate records of employee hours, wages, and benefits is critical for demonstrating compliance with these regulations.

Common Payroll Compliance Mistakes and Consequences

Several common mistakes can lead to payroll compliance issues. Incorrectly classifying employees, miscalculating overtime pay, failing to withhold or remit taxes, and neglecting to maintain accurate records are among the most prevalent errors. The consequences of these mistakes can be severe, including penalties, back taxes, legal fees, and reputational damage. For example, misclassifying employees as independent contractors can result in significant back taxes, penalties, and even legal action from government agencies. Failing to pay minimum wage or overtime can lead to lawsuits and substantial financial liabilities. Maintaining accurate and up-to-date records is the best defense against these potential issues.

Best Practices for Maintaining Accurate Payroll Records

Maintaining accurate payroll records is essential for compliance and efficient payroll processing. This involves using reliable payroll software, regularly reviewing payroll data for accuracy, and implementing robust internal controls. Implementing a system of checks and balances, such as having multiple individuals review payroll data before processing, can significantly reduce the risk of errors. Regularly backing up payroll data and ensuring data security are also crucial steps. Properly documenting all payroll-related transactions and retaining these records for the required duration (typically several years) is a legal necessity. This documentation serves as evidence of compliance should any audit or legal dispute arise.

Resources for Staying Updated on Payroll Regulations

The landscape of payroll regulations is constantly evolving, requiring employers to stay informed about changes. Several resources can help employers remain compliant. The IRS website provides comprehensive information on federal tax regulations. State and local government websites offer information on specific state and local tax laws and labor regulations. Professional organizations, such as the American Payroll Association (APA), offer educational resources, certifications, and networking opportunities. Consulting with payroll professionals or utilizing payroll software with integrated compliance features can also provide valuable support in navigating the complexities of payroll regulations.

Payroll Software and Technology

Choosing the right payroll software is crucial for efficient and accurate payroll processing. The market offers a wide array of options, each with its own strengths and weaknesses, impacting everything from cost-effectiveness to security. Understanding these differences is vital for businesses of all sizes.

Payroll Software Options: A Comparison

Payroll software options range from simple, entry-level programs suitable for small businesses with minimal payroll needs to sophisticated, enterprise-level systems designed for large organizations with complex payroll structures. Simple programs might offer basic features like calculating gross pay and deductions, while more advanced solutions incorporate features such as time and attendance tracking, benefits administration, and reporting capabilities. The choice depends heavily on the size and complexity of the business, its budget, and its specific payroll requirements. For example, a small business with only a few employees might find a basic, desktop-based solution sufficient, whereas a large multinational corporation would require a robust, cloud-based system with advanced features and scalability.

Cloud-Based Payroll Solutions: Features and Benefits

Cloud-based payroll solutions offer numerous advantages over traditional, on-premise software. These benefits include accessibility from anywhere with an internet connection, automatic updates, reduced IT infrastructure costs, and enhanced scalability. Features often include automated tax calculations and filings, direct deposit capabilities, employee self-service portals, and robust reporting tools. For instance, a cloud-based system allows employees to access their pay stubs online, reducing the need for paper paychecks and improving efficiency. The automatic updates ensure the software always complies with the latest tax laws and regulations, minimizing the risk of penalties.

Security Considerations for Payroll Software

Security is paramount when choosing and using payroll software, as it involves sensitive employee data. Robust security measures are essential to protect against data breaches and unauthorized access. Factors to consider include data encryption, access controls, regular security audits, and compliance with relevant data privacy regulations such as GDPR and CCPA. Choosing a reputable vendor with a strong security track record is crucial. Multi-factor authentication, strong password policies, and regular software updates are also important elements of a comprehensive security strategy.

Implementing New Payroll Software: A Step-by-Step Guide

Implementing new payroll software requires careful planning and execution. A step-by-step approach ensures a smooth transition. This typically involves: 1) Needs assessment and vendor selection; 2) Data migration from the old system; 3) Training for employees and administrators; 4) Testing and validation of the new system; 5) Go-live and ongoing support. Thorough testing before the go-live date is vital to identify and resolve any issues. Post-implementation support from the vendor is also crucial to address any problems that may arise after the new system is launched.

Payroll Software Feature Comparison

| Feature | On-Premise Software | Cloud-Based Software | Hybrid Software |

|---|---|---|---|

| Cost | Higher upfront cost, lower ongoing cost | Lower upfront cost, higher ongoing cost | Moderate upfront and ongoing costs |

| Accessibility | Limited to the office network | Accessible from anywhere with internet | Accessible from various locations with varying levels of access |

| Security | Requires robust on-site security measures | Relies on vendor’s security infrastructure | Combines on-site and cloud security measures |

| Scalability | Difficult to scale | Easy to scale | Moderate scalability depending on the setup |

Managing Payroll Processes Efficiently

Efficient payroll processing is crucial for maintaining employee satisfaction, ensuring legal compliance, and optimizing a company’s financial health. Streamlining processes, automating tasks, and minimizing errors are key to achieving this efficiency. This section will explore strategies for enhancing the overall payroll management process.

Automating Payroll Tasks

Automating payroll tasks significantly reduces manual effort, minimizes human error, and frees up valuable time for other critical business functions. This can involve integrating payroll software with other systems, such as HR and time and attendance tracking. For instance, automatic import of employee hours from a time clock system directly into the payroll software eliminates manual data entry and the associated risk of transcription errors. Furthermore, automated calculations for gross pay, deductions, and net pay ensure consistent and accurate results. Direct deposit functionality streamlines payment distribution, eliminating the need for manual check writing and mailing. Using automated reporting features allows for quick generation of payroll summaries, tax reports, and other necessary documentation.

Streamlining Payroll Workflows

Streamlining payroll workflows involves optimizing the entire process from data collection to payment distribution. This can be achieved through process mapping to identify bottlenecks and inefficiencies. For example, establishing clear roles and responsibilities within the payroll team ensures accountability and prevents duplication of effort. Implementing a centralized system for managing employee information reduces data inconsistencies and simplifies data retrieval. Regularly reviewing and updating payroll procedures helps to adapt to changes in legislation, technology, and business needs. Utilizing a well-defined checklist for each stage of the payroll process ensures that no steps are missed and maintains consistency.

Improving Payroll Accuracy and Reducing Errors

Accuracy in payroll is paramount to avoid legal issues and maintain employee trust. Implementing robust data validation checks within the payroll system helps prevent incorrect data entry. Regular reconciliation of payroll data with other financial records identifies discrepancies and allows for timely correction. Cross-checking calculations manually or using independent verification tools provides an additional layer of quality control. Providing comprehensive training to payroll staff on proper procedures and the use of payroll software minimizes errors stemming from a lack of knowledge. Finally, establishing a system for regular audits of payroll processes helps to identify and address potential weaknesses.

Handling Payroll Discrepancies and Resolving Issues

Even with robust processes, discrepancies can arise. Establishing a clear protocol for handling these discrepancies is vital. This involves promptly investigating any reported issues, gathering all relevant information, and determining the root cause. Once the cause is identified, corrective actions should be implemented to prevent recurrence. Open communication with employees regarding any payroll issues is essential to maintaining trust and transparency. Documenting all discrepancies and resolutions provides a record for future reference and helps to identify trends or patterns. In cases of significant errors, seeking professional advice from payroll specialists or legal counsel may be necessary.

Managing Employee Payroll Changes

A well-defined process for managing employee payroll changes is essential for maintaining accurate records and complying with regulations. This includes a centralized system for updating employee information, such as address changes, tax withholding status, and direct deposit details. Implementing a formal request and approval process ensures that all changes are properly authorized and documented. Regularly reviewing employee data for accuracy helps to identify and correct any inconsistencies. Clear communication with employees regarding the process for submitting changes ensures smooth and efficient updates. Utilizing automated workflows for processing these changes streamlines the update process and reduces manual intervention. For example, a self-service portal allows employees to update their own information, subject to manager approval, reducing the administrative burden on the payroll department.

Handling Payroll Challenges and Problem Solving

Payroll processing, while essential, presents various challenges for businesses of all sizes. Successfully navigating these hurdles requires proactive planning, robust systems, and a commitment to accurate and timely payment. Understanding common difficulties and implementing effective solutions is crucial for maintaining employee morale and ensuring legal compliance.

Common Payroll Challenges Faced by Businesses

Businesses encounter a range of payroll challenges, varying in complexity depending on their size and structure. Small businesses often grapple with limited resources and expertise, potentially leading to manual errors and delays. Larger organizations, on the other hand, might face complexities arising from managing geographically dispersed workforces, intricate compensation structures, and the need to integrate with various HR systems. Common challenges include inaccurate timekeeping, inconsistent application of payroll regulations across different locations, difficulty integrating payroll with other business systems, and managing fluctuating employee headcounts. These challenges can lead to increased administrative burden, financial penalties, and damage to employee relations.

Managing Payroll During High Employee Turnover

High employee turnover significantly impacts payroll processing. The constant onboarding and offboarding of employees requires efficient processes to manage changes in pay rates, tax withholdings, and benefit deductions. Automated systems can help streamline these processes, reducing manual data entry and minimizing errors. Clear communication with departing employees regarding final paychecks and benefits is crucial to avoid disputes. Implementing a robust checklist for each stage of the employee lifecycle – from hiring to termination – can significantly reduce errors and delays associated with high turnover. For example, a standardized separation process with clear deadlines for final pay and benefits information reduces confusion and potential disputes.

Risks Associated with Inaccurate or Delayed Payroll Processing

Inaccurate or delayed payroll processing carries significant risks. Errors in pay calculations can lead to employee dissatisfaction, impacting morale and productivity. Delayed payments can damage employee trust and potentially lead to legal action. Furthermore, non-compliance with tax regulations can result in substantial penalties and legal ramifications for the business. Reputational damage, resulting from negative employee experiences and potential legal issues, can also negatively impact the business’s ability to attract and retain talent. For instance, a delay in paying wages might lead to employees filing complaints with labor agencies, resulting in costly investigations and potential fines.

Resolving Payroll Discrepancies and Errors

When payroll discrepancies arise, prompt investigation and resolution are vital. Establish clear procedures for identifying and rectifying errors. This involves regular reconciliation of payroll data with timekeeping records and other relevant information. Implement a system for tracking and resolving discrepancies, including documenting the process and the corrective actions taken. For example, a dedicated team or individual could be responsible for investigating discrepancies, working with employees and relevant departments to gather information, and correcting errors. Clear communication throughout the process is crucial to maintain transparency and build trust.

Effective Communication Strategies for Addressing Employee Payroll Concerns

Open and proactive communication is essential for addressing employee payroll concerns. Establish multiple channels for employees to inquire about their pay, such as dedicated email addresses, help desks, or online portals. Provide employees with regular, clear, and easily understandable payroll statements. Offer payroll training sessions to educate employees on payroll processes and address common questions. Responding promptly and empathetically to employee inquiries demonstrates a commitment to their well-being and fosters trust. For example, a regularly updated FAQ section on the company intranet can address common payroll questions, reducing the workload on payroll staff and ensuring employees have access to information when needed.

Outsourcing vs. In-House Payroll Management

Choosing between outsourcing and in-house payroll management is a critical decision for any business, impacting efficiency, cost, and compliance. The optimal approach depends heavily on factors such as company size, budget, internal expertise, and the complexity of payroll needs. This section will explore the advantages and disadvantages of each option to help you make an informed choice.

Comparison of Outsourcing and In-House Payroll Management

Outsourcing payroll involves contracting a third-party provider to handle all or part of your payroll processing. In contrast, in-house payroll management means employing dedicated staff and utilizing internal systems to manage the entire payroll function. Both approaches have inherent strengths and weaknesses that must be carefully weighed. Outsourcing often offers access to specialized expertise and technology, reducing the burden on internal resources. However, it can lead to reduced control and potentially higher costs in the long run if not managed effectively. In-house management offers greater control and potentially lower costs in the long term, but requires significant investment in personnel, training, and technology.

Factors to Consider When Choosing Between Outsourcing and In-House Payroll

Several key factors influence the decision between outsourcing and in-house payroll. Company size plays a significant role; small businesses might find outsourcing more cost-effective, while larger organizations with complex payroll needs may benefit from in-house management. The complexity of payroll requirements, including international payroll, multiple locations, or specialized compensation plans, significantly impacts the feasibility of in-house management. The availability of skilled internal personnel and the cost of recruiting, training, and retaining them are also crucial considerations. Finally, the budget available for payroll management, including software, hardware, and personnel costs, needs to be carefully assessed against the potential benefits of each approach.

Cost Implications of Outsourcing and In-House Payroll

The cost implications of each approach vary greatly. Outsourcing typically involves fixed monthly fees based on the number of employees and services required. These fees may include setup costs, transaction fees, and additional charges for specific services like tax filing or reporting. In-house payroll involves a combination of fixed costs (salaries, software licenses, hardware) and variable costs (overtime, benefits). While initial investment for in-house payroll might be higher, long-term costs could be lower if the volume of payroll processing is substantial. A detailed cost-benefit analysis is crucial to determine the most economical option for a specific organization. For example, a small business with 10 employees might find outsourcing significantly cheaper than investing in the necessary infrastructure and personnel for in-house management. Conversely, a large multinational corporation with thousands of employees might find in-house management more cost-effective in the long run due to economies of scale.

Scenarios Where Outsourcing Payroll is Advantageous

Outsourcing payroll is particularly advantageous in several specific scenarios. For rapidly growing businesses, outsourcing offers scalability and flexibility to adapt to changing workforce sizes without the need for immediate hiring. Companies with limited internal expertise in payroll processing or complex tax regulations can benefit significantly from the specialized knowledge and experience of outsourcing providers. Businesses with seasonal fluctuations in their workforce may find outsourcing more cost-effective than maintaining a full-time payroll staff throughout the year. Finally, organizations with multiple locations or international operations often find outsourcing simplifies compliance with varying local regulations and reduces administrative complexity.

Responsibilities in Outsourcing vs. In-House Payroll Management

The responsibilities associated with each approach differ significantly.

- In-House Payroll Management: This includes all aspects of payroll processing, from data entry and calculation to tax filing, reporting, and employee communication. It also encompasses the management of payroll software, system maintenance, compliance with all relevant laws and regulations, and handling employee inquiries and issues related to payroll.

- Outsourcing Payroll Management: The company’s responsibility primarily shifts to selecting a reputable provider, providing accurate employee data, reviewing payroll reports for accuracy, and addressing any discrepancies or issues that may arise. The outsourcing provider takes on the responsibility for all aspects of payroll processing, including compliance, data security, and timely payment of employees.

Year-End Payroll Processing and Reporting

Year-end payroll processing is a critical period requiring meticulous attention to detail and adherence to regulatory guidelines. Accurate and timely completion ensures compliance with tax laws and avoids potential penalties. This section Artikels the key procedures, requirements, and best practices for successful year-end payroll processing and reporting.

Year-End Payroll Procedures

The year-end payroll process involves several crucial steps. These steps generally begin several weeks before the end of the calendar year to allow ample time for verification and correction. First, a thorough review of employee records is necessary to ensure accuracy of wages, deductions, and other relevant information. This includes verifying hours worked, verifying correct tax withholdings, and confirming employee classifications. Next, final payroll calculations are performed, including the processing of any outstanding payments or adjustments. Following this, all necessary year-end reports are generated, including W-2s and 1099s. Finally, these reports are filed with the appropriate government agencies by the mandated deadlines. Failure to meet these deadlines can result in significant penalties.

W-2 and 1099 Form Generation Requirements

Accurate generation of W-2 (Wage and Tax Statement) and 1099 (Information Return) forms is paramount. W-2 forms report wages paid to employees, while 1099 forms report payments made to independent contractors. Both forms require precise information, including the recipient’s name, address, Social Security Number (SSN) or Taxpayer Identification Number (TIN), and the total amount paid during the year. Any discrepancies can lead to delays in processing and potential penalties. Employers are legally obligated to provide these forms to recipients by January 31st of the following year and file them electronically with the IRS by the same date. Software specifically designed for payroll processing often simplifies the generation and filing of these forms.

Importance of Accurate Year-End Reporting for Tax Purposes

Accurate year-end reporting is crucial for compliance with tax regulations. The information reported on W-2 and 1099 forms directly impacts the tax liabilities of both the employer and the employee or contractor. Inaccurate reporting can result in penalties, audits, and legal repercussions. Accurate reporting also ensures the correct calculation of payroll taxes, including Social Security and Medicare taxes. Moreover, maintaining accurate records facilitates efficient tax preparation for both the business and its employees. The IRS provides detailed guidelines and resources to help employers navigate the complexities of year-end reporting.

Best Practices for Year-End Reporting Compliance

Several best practices can ensure compliance with year-end reporting regulations. Regularly reviewing and updating employee information throughout the year minimizes errors at year-end. Utilizing payroll software with integrated reporting capabilities streamlines the process and reduces the risk of human error. Furthermore, conducting internal audits of payroll data before generating reports helps identify and correct any discrepancies. Finally, seeking professional advice from a payroll specialist or tax advisor can provide valuable guidance and ensure compliance with all applicable regulations. Staying informed about changes in tax laws and regulations is also essential.

Year-End Payroll Task Checklist

A comprehensive checklist can aid in the efficient completion of year-end payroll tasks. This checklist should include:

- Review and update employee information (address, SSN, etc.)

- Verify wages, deductions, and other payroll data for accuracy.

- Calculate and process final payroll payments.

- Generate W-2 and 1099 forms.

- Electronically file W-2 and 1099 forms with the IRS.

- Distribute W-2 forms to employees by January 31st.

- Maintain accurate records for at least three years.

- Reconcile payroll tax accounts.

- Review and update payroll policies and procedures.

Concluding Remarks

Successfully navigating the complexities of payroll processing is not merely about ensuring timely payments; it’s about fostering a positive employee experience, maintaining legal compliance, and protecting your business’s financial health. By understanding the fundamentals, leveraging available technology, and proactively addressing potential challenges, businesses can streamline their payroll operations, minimize errors, and ultimately achieve greater efficiency and peace of mind. The insights provided in this guide serve as a foundation for building a robust and reliable payroll system that supports your organization’s growth and success.

Question Bank: Navigating The Complexities Of Payroll Processing

What are the penalties for payroll non-compliance?

Penalties for payroll non-compliance vary depending on the violation but can include significant fines, back taxes, interest charges, and even legal action.

How often should payroll be processed?

Payroll processing frequency depends on company policy and employee agreements; common schedules include weekly, bi-weekly, semi-monthly, or monthly.

What is the best payroll software for small businesses?

The best payroll software for small businesses depends on specific needs and budget; researching options like Gusto, QuickBooks Payroll, or Xero is recommended.

How do I handle employee payroll changes?

Employee payroll changes (address, tax withholding, etc.) should be processed promptly and accurately, usually via an online portal or direct communication with the payroll department.

Discover the crucial elements that make How the Internet of Things (IoT) Impacts Financial Asset Tracking the top choice.