How Climate Risk Disclosure Is Changing the Accounting Landscape sets the stage for a compelling examination of evolving accounting practices. The increasing urgency of climate change is forcing a fundamental shift in how businesses report their financial performance, incorporating previously intangible environmental risks into core financial statements. This transition presents significant challenges and opportunities for accountants, businesses, and investors alike, demanding new methodologies, technologies, and a broader understanding of materiality.

This exploration delves into the burgeoning regulatory landscape, examining the differences in mandatory climate risk disclosure regulations across various jurisdictions, including the EU, US, and UK. We’ll analyze the impact on financial statement preparation, the crucial role of materiality assessments and risk management, and the importance of independent assurance in verifying the accuracy of climate-related data. Furthermore, the discussion will explore the transformative potential of technology in streamlining climate risk reporting and addressing the evolving expectations of investors and stakeholders.

The Rise of Climate Risk Disclosure Regulations

The increasing awareness of climate change and its potential financial impacts has driven a significant shift in the accounting landscape. Companies are no longer simply reporting on their financial performance; they are increasingly required to disclose their climate-related risks and opportunities. This burgeoning regulatory environment aims to provide investors and stakeholders with the information they need to make informed decisions, fostering greater transparency and accountability within the global economy.

The evolution of mandatory climate risk disclosure regulations has been rapid and multifaceted, varying significantly across different jurisdictions. Initially, voluntary initiatives and frameworks played a crucial role in shaping the landscape, paving the way for the stricter mandatory requirements we see today. This evolution reflects a growing international consensus on the urgency of addressing climate change and the need for robust reporting mechanisms.

Global Landscape of Climate Risk Disclosure Regulations

Several jurisdictions are leading the charge in mandating climate-related financial disclosures. The European Union, for instance, has implemented the Corporate Sustainability Reporting Directive (CSRD), a far-reaching regulation that significantly expands the scope of mandatory ESG (Environmental, Social, and Governance) disclosures, including climate-related risks and opportunities. The United States, while lacking a comprehensive federal mandate comparable to the CSRD, has seen increasing pressure from the Securities and Exchange Commission (SEC) to enhance climate-related disclosures. The SEC has proposed rules requiring registrants to disclose climate-related risks and greenhouse gas emissions, though the final implementation and scope remain subject to ongoing debate and potential revisions. The United Kingdom, meanwhile, has implemented regulations requiring large companies to report on their climate-related financial risks, aligning with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). These differing approaches highlight the complexities and ongoing development of the regulatory landscape.

Key Reporting Frameworks and Standards

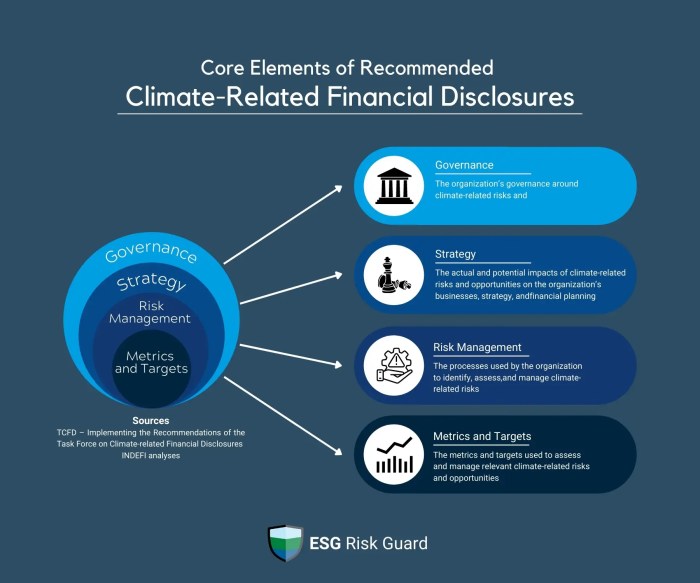

Several key frameworks and standards guide the preparation of climate-related disclosures. The Task Force on Climate-related Financial Disclosures (TCFD) framework, developed by the Financial Stability Board, provides a widely adopted framework for disclosing climate-related risks and opportunities, focusing on governance, strategy, risk management, and metrics and targets. The Sustainability Accounting Standards Board (SASB) standards offer industry-specific metrics and disclosures, focusing on material ESG issues for specific sectors. The Global Reporting Initiative (GRI) standards provide a comprehensive framework for sustainability reporting, including environmental, social, and governance (ESG) issues, though not solely focused on climate. These frameworks, while often used in conjunction with each other, offer different approaches and levels of specificity.

Comparison of Regulatory Frameworks

The following table compares the reporting requirements of three major regulatory frameworks: the EU CSRD, the proposed SEC climate disclosure rules (as of October 26, 2023), and the UK’s requirements. Note that the SEC rules are still proposed and subject to change.

| Framework | Scope of Companies | Key Reporting Requirements | Enforcement |

|---|---|---|---|

| EU CSRD | Large companies and listed SMEs (Small and Medium-sized Enterprises) meeting specific thresholds | Climate-related risks and opportunities, greenhouse gas emissions, climate-related targets, and assurance requirements. Double materiality. | EU Member States |

| US SEC Proposed Rules | Public companies | Climate-related risks, greenhouse gas emissions (Scope 1, 2, and 3), climate-related targets, and governance. | SEC |

| UK Climate-Related Financial Disclosures | Large companies | Climate-related financial risks and opportunities, aligned with the TCFD recommendations. | UK’s Financial Reporting Council |

Impact on Financial Statement Preparation

The rise of mandatory climate risk disclosure is fundamentally reshaping financial statement preparation. Accountants are no longer solely focused on historical financial data; they must now integrate forward-looking assessments of climate-related risks and opportunities, impacting the very fabric of financial reporting. This necessitates a shift from traditional accounting practices towards a more holistic and dynamic approach that incorporates environmental considerations.

The integration of climate-related data into financial statements presents significant challenges for accountants. Quantifying the financial impact of climate change is inherently complex, involving uncertainty and long-term projections. For example, accurately estimating the potential losses from extreme weather events or the costs of transitioning to a low-carbon economy requires sophisticated modeling and assumptions that can be difficult to validate. Furthermore, the lack of standardized methodologies and consistent data makes comparing climate-related disclosures across different companies a difficult task.

Challenges in Quantifying and Reporting Climate-Related Financial Impacts

Accurately assessing and reporting the financial implications of climate change presents numerous challenges. The long-term nature of climate risks makes prediction difficult, requiring the use of complex probabilistic models and scenario analysis. Data scarcity, particularly concerning physical climate risks at a granular level, further complicates the process. Inconsistent reporting standards across jurisdictions also hinder the ability to make meaningful comparisons between companies. For instance, a company might face challenges in evaluating the potential impact of rising sea levels on its coastal assets, particularly if there’s a lack of publicly available data on projected sea-level rise in that specific location. Similarly, estimating the financial implications of changes in consumer preferences due to climate concerns requires robust market research and forecasting capabilities.

New Accounting Metrics and Methodologies

To address these challenges, various new accounting metrics and methodologies are emerging. The Task Force on Climate-related Financial Disclosures (TCFD) framework, for instance, provides a widely adopted set of recommendations for disclosing climate-related risks and opportunities. This framework encourages companies to report on governance, strategy, risk management, and metrics and targets related to climate change. Furthermore, the development of climate-related scenario analysis tools helps companies assess the potential financial impacts of different climate scenarios, such as a 2°C or 4°C warming scenario. These tools often incorporate probabilistic modeling techniques to quantify the uncertainty associated with these future impacts. Moreover, new accounting standards, such as those being developed by the International Sustainability Standards Board (ISSB), aim to standardize climate-related financial disclosures, improving comparability and transparency.

Examples of Climate Data Integration into Financial Statements

Several companies are already integrating climate-related data into their financial statements, albeit often in a preliminary manner. Some companies are beginning to disclose the financial impacts of carbon pricing mechanisms, such as carbon taxes or emissions trading schemes, on their profitability. Others are incorporating estimates of the potential costs associated with physical climate risks, such as extreme weather events, into their risk assessments and financial planning. For example, an insurance company might explicitly report the projected increase in claims related to extreme weather events in their financial statements, while a manufacturing company might disclose the estimated costs of upgrading its facilities to meet stricter emissions regulations. These disclosures, while still evolving, represent a significant step towards greater transparency and accountability in corporate reporting on climate-related financial impacts.

Materiality Assessment and Risk Management

Materiality assessment is a crucial step in effective climate risk disclosure. It involves identifying and evaluating the climate-related risks and opportunities that are significant enough to impact a company’s financial statements and its overall strategic direction. This process is not simply a compliance exercise; it’s a vital tool for informed decision-making and proactive risk management.

The process of conducting a materiality assessment for climate-related risks requires a structured approach. It begins with identifying potential climate-related risks and opportunities, considering both physical risks (like extreme weather events) and transition risks (like changes in regulations or consumer preferences). These are then analyzed based on their likelihood and potential impact, both short-term and long-term. A key consideration is the materiality threshold – the point at which a risk or opportunity becomes significant enough to warrant disclosure. This threshold is often defined by a combination of quantitative and qualitative factors. Finally, the assessment results inform the development of appropriate risk mitigation and opportunity-seizing strategies.

Methods for Identifying and Evaluating Climate-Related Financial Risks and Opportunities

Several methods are employed to identify and evaluate climate-related financial risks and opportunities. Scenario analysis, for instance, involves projecting the potential financial impacts of different climate-related scenarios, such as a 2°C warming scenario versus a 4°C warming scenario. This helps companies understand the potential range of impacts and the uncertainty involved. Another common method is the use of climate-related financial risk models. These models use quantitative data and statistical techniques to estimate the potential financial impact of various climate-related risks, such as changes in asset values or increased insurance premiums. Qualitative assessments also play a role, incorporating expert judgment and stakeholder engagement to consider less easily quantifiable factors. For example, a company might use a qualitative assessment to understand the potential impact of changing consumer preferences on its product demand. Combining quantitative and qualitative methods offers a more comprehensive understanding of the financial implications of climate change.

Integrating Climate Risk Management into the Overall Risk Management Framework

Effective climate risk management requires integrating climate-related considerations into a company’s existing risk management framework. This means incorporating climate-related risks and opportunities into the overall risk assessment process, alongside other operational, financial, and strategic risks. This integrated approach allows for a more holistic view of risk, enabling companies to identify potential synergies and conflicts between different types of risks. For example, a company might find that its efforts to mitigate climate-related risks also lead to cost savings or improved operational efficiency. The integration process often involves updating existing risk registers, developing new policies and procedures, and providing training to employees on climate-related risks. Regular monitoring and review of the effectiveness of climate risk management strategies are crucial for ensuring their ongoing relevance and effectiveness.

Best Practices for Conducting a Robust Materiality Assessment

A robust materiality assessment is critical for effective climate risk disclosure and management. The following best practices can help ensure a thorough and reliable assessment:

- Establish a clear scope and methodology: Define the boundaries of the assessment, including the timeframe, geographical areas, and types of risks and opportunities to be considered. This ensures consistency and comparability.

- Engage relevant stakeholders: Involve key personnel from different departments, as well as external experts, to gain a broad range of perspectives and expertise. This ensures a more comprehensive assessment.

- Use both quantitative and qualitative data: Combine financial data with qualitative information from various sources, such as industry reports, scientific literature, and stakeholder consultations. This provides a more balanced perspective.

- Employ scenario analysis: Explore different climate-related scenarios to understand the potential range of impacts and the associated uncertainties. This enables more robust planning.

- Document the assessment process: Maintain detailed records of the assessment methodology, data sources, assumptions, and conclusions. This promotes transparency and accountability.

- Regularly review and update the assessment: Climate-related risks and opportunities are constantly evolving, so the assessment should be reviewed and updated regularly to reflect these changes. This ensures the ongoing relevance of the assessment.

Assurance and Verification of Climate-Related Information

The increasing prevalence of mandatory climate-related financial disclosures necessitates robust assurance and verification processes to ensure the credibility and reliability of the reported information. This section explores the evolving role of independent assurance providers, the challenges they face, and the emerging standards guiding their work. The ultimate goal is to build investor confidence and promote transparency in the market.

The role of independent assurance providers in verifying climate-related disclosures is becoming increasingly crucial. These providers, often accounting firms or specialized sustainability consultancies, offer an independent assessment of the accuracy and completeness of a company’s climate-related data and disclosures. Their involvement lends credibility to the reported information, reducing information asymmetry and enhancing trust among stakeholders. This is particularly vital given the complexity of climate-related risks and the potential for significant financial implications.

Independent Assurance Provider Roles and Responsibilities

Independent assurance providers are tasked with evaluating the quality and reliability of a company’s climate-related data and disclosures. This involves reviewing a company’s methodologies, data collection processes, and the overall presentation of information. The scope of their work can vary depending on the type of assurance engagement, ranging from a limited review to a more comprehensive audit. Their reports typically provide an opinion on the fairness and completeness of the disclosed information, highlighting any material discrepancies or limitations. For example, an assurance provider might examine a company’s greenhouse gas emissions calculations, ensuring the accuracy of the underlying data and the appropriateness of the methodologies used. They may also assess the robustness of the company’s climate-related risk management processes and the completeness of its disclosures related to climate-related risks and opportunities.

Challenges in Assuring Climate-Related Information

Assuring the accuracy and reliability of climate data presents several unique challenges. One significant hurdle is the inherent uncertainty associated with climate change projections. Future climate scenarios are inherently probabilistic, making it difficult to provide absolute assurance on future impacts. Furthermore, the data required for climate-related disclosures can be complex and dispersed across different parts of an organization, requiring sophisticated data management and analysis capabilities. Another challenge lies in the lack of universally accepted standards and methodologies for measuring and reporting climate-related information. This inconsistency makes it difficult to compare and contrast disclosures across different companies and sectors. Finally, the rapidly evolving nature of climate science and policy adds further complexity to the assurance process.

Evolving Standards and Guidelines for Climate-Related Assurance

Several organizations are developing standards and guidelines for assuring climate-related information. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations provide a widely accepted framework for climate-related disclosures, although they don’t explicitly address assurance. However, many assurance providers are using the TCFD recommendations as a basis for their assurance engagements. Other initiatives, such as the International Sustainability Standards Board (ISSB), are developing global standards that will likely incorporate specific requirements for assurance. These evolving standards aim to increase the consistency and comparability of climate-related disclosures and provide a clearer basis for assurance providers to conduct their work. The development of these standards represents a significant step towards enhancing the credibility and reliability of climate-related financial information.

Examples of Assurance Approaches for Climate-Related Disclosures

Various assurance approaches are used for climate-related disclosures, ranging from limited assurance to reasonable assurance. A limited assurance engagement provides a lower level of assurance and involves a review of a company’s climate-related disclosures, focusing on identifying any significant inconsistencies or errors. A reasonable assurance engagement, on the other hand, provides a higher level of assurance and involves a more comprehensive examination of the underlying data and processes. Some assurance providers offer specialized services focused on specific aspects of climate-related disclosures, such as greenhouse gas emissions verification or climate scenario analysis. For instance, one approach might focus on verifying the accuracy of Scope 1 and Scope 2 emissions data through direct review of operational data and energy consumption records. Another approach might involve assessing the completeness and reliability of a company’s climate risk assessment and management processes. The choice of approach will depend on the specific needs of the company and the level of assurance desired.

The Role of Technology in Climate Risk Disclosure

The increasing complexity and urgency of climate change necessitate sophisticated tools for data collection, analysis, and reporting. Technology plays a crucial role in enabling companies to meet the growing demands of climate risk disclosure regulations, providing the infrastructure for more accurate, efficient, and transparent reporting. This section will explore the ways in which technology is transforming climate risk disclosure practices.

Technology’s impact on climate risk disclosure is multifaceted, encompassing data acquisition, analytical processing, and ultimately, the generation of comprehensive reports. The ability to effectively manage and interpret vast datasets related to greenhouse gas emissions, carbon footprints, and climate-related financial risks is paramount. This requires robust technological solutions capable of handling complex calculations, integrating diverse data sources, and visualizing results in a user-friendly manner.

Data Collection and Analysis of Climate-Related Data

Technological advancements significantly streamline the process of gathering and analyzing climate-related data. Automated data collection systems, integrated with enterprise resource planning (ERP) software, can track energy consumption, waste generation, and emissions across an organization’s operations. Satellite imagery and remote sensing technologies provide valuable data on deforestation, land use changes, and other environmental factors impacting climate risk. This data is then fed into sophisticated analytical tools, facilitating more precise and comprehensive assessments.

Data Analytics and Machine Learning in Climate Risk Assessment

Data analytics and machine learning algorithms are increasingly utilized for advanced climate risk assessment. These technologies can analyze large datasets to identify patterns, predict future climate scenarios, and quantify the potential financial impacts of climate-related events. For example, machine learning models can be trained on historical weather data, emissions trends, and financial performance to forecast the likelihood and severity of future climate-related risks, such as extreme weather events or changes in market demand for carbon-intensive products. This allows for proactive risk management and more informed decision-making.

Software and Platforms for Climate Risk Reporting

Several software platforms and tools are specifically designed to facilitate climate risk reporting. These platforms often integrate data collection, analysis, and reporting functionalities, streamlining the entire process. Some examples include specialized software packages that calculate carbon footprints, assess climate-related financial risks, and generate standardized reports compliant with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). These tools can also help organizations track their progress towards climate-related targets and identify areas for improvement. Furthermore, cloud-based solutions allow for secure data storage and collaboration among teams, enhancing efficiency and data accessibility.

Hypothetical Scenario: Improving Climate Risk Disclosure with Technology

Imagine a large multinational manufacturing company using a comprehensive climate risk management platform. This platform integrates data from various sources – energy meters, supply chain partners, and weather forecasting models – to provide a real-time view of the company’s carbon footprint and climate-related exposures. Using machine learning algorithms, the platform analyzes this data to predict the financial impacts of potential climate-related events, such as disruptions to supply chains due to extreme weather. The platform then generates detailed reports, compliant with TCFD recommendations, showcasing the company’s climate-related risks, mitigation strategies, and resilience plans. This enables more transparent communication with investors and stakeholders, building trust and enhancing the company’s reputation. Furthermore, the platform facilitates internal decision-making by providing data-driven insights to guide resource allocation and strategic planning, enabling the company to proactively manage climate-related risks and capitalize on emerging opportunities in the green economy.

Investor and Stakeholder Expectations

The increasing awareness of climate change has significantly altered investor and stakeholder expectations regarding corporate transparency and responsibility. No longer is it sufficient for companies to simply focus on short-term profits; investors are demanding demonstrable action on climate-related risks and opportunities. This shift reflects a growing understanding that climate change poses significant financial risks, but also presents opportunities for innovation and sustainable growth. Stakeholders, including employees, customers, and communities, are also increasingly scrutinizing companies’ environmental performance, influencing their purchasing decisions and brand loyalty.

Investors are actively incorporating Environmental, Social, and Governance (ESG) factors, including climate risk, into their investment strategies. This means that companies failing to adequately address climate-related risks face potential consequences, such as decreased investment, lower share prices, and reputational damage. Conversely, companies demonstrating strong climate leadership are often rewarded with increased investment, enhanced brand reputation, and improved access to capital. The demand for robust climate-related financial disclosures is thus driven by a confluence of financial, ethical, and reputational considerations.

Investor Pressure for Enhanced Climate Transparency

Companies are responding to investor pressure in various ways. Many are enhancing their climate-related disclosures, going beyond basic regulatory requirements. This often involves conducting comprehensive climate risk assessments, setting science-based emission reduction targets, and integrating climate considerations into their business strategies. Some companies are even publishing dedicated sustainability reports, providing detailed information on their environmental performance and climate-related initiatives. Engagement with investors and stakeholders is also becoming increasingly common, with companies proactively communicating their climate strategies and responding to investor inquiries. For example, BlackRock, a leading asset manager, has publicly stated its intention to divest from companies with inadequate climate risk management practices, significantly influencing corporate behavior.

Climate Risk Disclosure, Reputation, and Value

A strong correlation exists between effective climate risk disclosure and corporate reputation and value. Companies that proactively disclose climate-related information, demonstrating transparency and accountability, often enjoy a stronger reputation among investors, customers, and the broader public. This enhanced reputation can translate into higher valuations, improved access to capital, and a stronger competitive advantage. Conversely, companies perceived as lacking transparency or failing to address climate risks adequately may suffer reputational damage, leading to reduced investment, lower share prices, and difficulties attracting and retaining talent. For instance, companies facing public criticism for their environmental practices or implicated in greenwashing scandals often experience significant negative impacts on their stock price and overall reputation.

Key Investor Questions Regarding Climate Risk, How Climate Risk Disclosure Is Changing the Accounting Landscape

Investors are increasingly focused on understanding the potential financial impacts of climate change on companies. The following questions illustrate the depth and breadth of their inquiries:

- What is the company’s strategy for mitigating and adapting to climate change?

- What are the company’s greenhouse gas emissions, and what targets have been set for reduction?

- How does the company assess and manage climate-related physical and transition risks?

- What are the financial implications of climate change for the company’s operations and value chain?

- What is the company’s plan for ensuring the resilience of its operations in a changing climate?

- How is the company engaging with its stakeholders on climate-related issues?

- What climate-related risks and opportunities are disclosed in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations?

- What is the company’s approach to climate-related lobbying and advocacy?

Future Trends in Climate Risk Disclosure

The landscape of climate risk disclosure is rapidly evolving, driven by increasing regulatory pressure, technological advancements, and heightened investor and stakeholder expectations. Predicting the future with certainty is impossible, but analyzing current trends allows us to forecast likely developments in reporting practices and regulatory frameworks over the next decade. This section explores potential future scenarios, focusing on regulatory shifts, technological influences, and the challenges and opportunities facing companies and accountants.

Increased Regulatory Harmonization and Scope

Global efforts towards harmonizing climate-related financial disclosures are gaining momentum. We can expect to see a convergence of standards, potentially around the International Sustainability Standards Board (ISSB) framework, leading to greater consistency and comparability of climate-related information across jurisdictions. This harmonization will likely extend beyond Scope 1 and 2 emissions to encompass Scope 3 emissions, requiring companies to account for their entire value chain’s climate impact. The European Union’s Corporate Sustainability Reporting Directive (CSRD) serves as a strong example of this trend, mandating comprehensive sustainability reporting for a broad range of companies. This increased scope will necessitate more robust data collection and analysis capabilities. Further, we might see the integration of climate risk reporting into existing financial reporting frameworks, blurring the lines between traditional financial statements and sustainability reports.

The Impact of Emerging Technologies

Emerging technologies will play a significant role in shaping the future of climate risk disclosure. Artificial intelligence (AI) and machine learning (ML) can automate data collection, analysis, and reporting processes, enhancing efficiency and accuracy. Blockchain technology can improve the transparency and traceability of climate-related data, ensuring the integrity of information throughout the reporting process. Remote sensing technologies, such as satellite imagery and drones, can provide more granular data on deforestation, greenhouse gas emissions, and other environmental impacts, enabling more precise assessments of climate risks. For example, AI-powered platforms are already being used to analyze satellite data to monitor deforestation rates in real-time, providing companies with more accurate information about their supply chains’ environmental impact.

Challenges and Opportunities for Companies and Accountants

Companies will face significant challenges in adapting to the evolving landscape of climate risk disclosure. These include the need to invest in new technologies and expertise, improve data management capabilities, and enhance internal processes to ensure accurate and reliable reporting. Accountants will play a crucial role in navigating these challenges, providing assurance and verification services, developing new auditing methodologies, and advising companies on compliance with evolving regulations. The increasing demand for climate-related expertise will create new opportunities for accountants to specialize in this field, offering consulting services, training, and other support to companies. The potential for green finance and investment opportunities will also expand, creating a need for accountants to understand and apply new financial instruments and valuation methodologies.

Potential Future Scenarios for Climate Risk Reporting Frameworks

Several potential future scenarios can be envisioned for climate risk reporting frameworks. One scenario is the complete integration of climate-related information into mainstream financial reporting, with climate risks and opportunities explicitly disclosed in the financial statements. Another scenario involves the development of standardized metrics and disclosures for climate-related risks, ensuring greater comparability and facilitating the development of climate-related financial products. A third scenario sees the emergence of a global, unified reporting framework that encompasses all material environmental, social, and governance (ESG) factors, moving beyond a solely climate-focused approach. The development of these frameworks will necessitate ongoing collaboration between regulators, standard-setters, businesses, and other stakeholders to ensure effectiveness and avoid unnecessary burdens on companies. Each scenario will require different levels of technological adaptation and investment in data management and reporting capabilities.

Ending Remarks: How Climate Risk Disclosure Is Changing The Accounting Landscape

In conclusion, the integration of climate risk disclosure into the accounting landscape marks a significant evolution in corporate reporting. The increasing pressure from regulators, investors, and stakeholders is driving a transition towards greater transparency and accountability regarding environmental impacts. While challenges remain in quantifying and reporting climate-related financial impacts, the adoption of new technologies and methodologies promises to enhance the accuracy and reliability of climate-related disclosures. This evolving landscape demands proactive adaptation from businesses and accountants, fostering a more sustainable and responsible approach to financial reporting.

Clarifying Questions

What are the potential penalties for non-compliance with climate risk disclosure regulations?

Penalties vary significantly by jurisdiction but can include fines, legal action, reputational damage, and difficulty securing investments.

How can small and medium-sized enterprises (SMEs) effectively manage climate risk disclosure requirements?

SMEs can leverage readily available resources, utilize simplified frameworks, and consider collaborative approaches with industry peers or consultants to manage their disclosure obligations.

What are the key differences between the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB)?

While both aim to improve climate-related disclosures, TCFD focuses on governance, strategy, risk management, and metrics, while SASB offers industry-specific standards for material environmental, social, and governance (ESG) issues.

How can companies ensure the accuracy and reliability of their climate-related data?

Companies should implement robust data collection processes, utilize data analytics tools for verification, and engage independent assurance providers to validate their disclosures.

Obtain recommendations related to The Effects of Hyperinflation on Corporate Financial Statements that can assist you today.