The Financial Implications of Corporate Social Responsibility (CSR) Reporting explores the complex interplay between a company’s social and environmental actions and its bottom line. This examination delves into the costs and benefits of implementing CSR initiatives, analyzing how responsible business practices impact financial performance, investor relations, and stakeholder engagement. We’ll examine real-world examples, explore the evolving regulatory landscape, and consider future trends shaping the landscape of CSR reporting.

This analysis will cover a range of topics, from measuring the direct and indirect costs of CSR programs to quantifying the returns on investment generated through improved brand reputation, enhanced customer loyalty, and increased operational efficiencies. We will also investigate the influence of CSR reporting on access to capital, credit ratings, and overall investor sentiment, demonstrating how a commitment to social responsibility can translate into tangible financial gains.

Introduction to Corporate Social Responsibility (CSR) Reporting: The Financial Implications Of Corporate Social Responsibility (CSR) Reporting

Corporate Social Responsibility (CSR) reporting has evolved significantly over the past few decades, transitioning from a niche practice to a widely adopted business strategy. Initially driven by a desire to enhance a company’s public image, CSR reporting now encompasses a broader range of stakeholders and increasingly reflects a growing awareness of the interconnectedness between business operations and societal well-being. The current landscape is characterized by a push for greater standardization, transparency, and accountability in reporting practices.

The evolution of CSR reporting can be broadly categorized into several phases. Early efforts focused primarily on philanthropic activities and environmental concerns, often presented in separate sustainability reports. Subsequently, the integration of social and governance aspects alongside environmental considerations (ESG) became more prevalent. Today, integrated reporting, combining financial and non-financial performance data, is gaining traction, reflecting a growing understanding that social and environmental factors materially impact long-term business value. This shift is driven by increasing investor demand for ESG information, regulatory pressures, and growing consumer expectations.

Types of CSR Reports and Common Components

CSR reports take various forms, each with its own focus and level of detail. Common types include stand-alone sustainability reports, integrated reports that combine financial and non-financial information, and ESG reports focusing specifically on environmental, social, and governance performance. Regardless of the format, most CSR reports share common components. These often include a description of the company’s materiality assessment (identifying the most significant ESG issues for the business), a statement of the company’s CSR strategy and goals, performance data on key ESG indicators, information on stakeholder engagement, and a description of the reporting methodology and assurance procedures. Many reports also include targets and progress toward those targets.

Examples of Leading Companies and Their CSR Reporting Practices, The Financial Implications of Corporate Social Responsibility (CSR) Reporting

Several companies are recognized for their exemplary CSR reporting practices. Unilever, for instance, is known for its comprehensive sustainability strategy and detailed reporting on its progress towards achieving its ambitious sustainability goals. Their reports often include data on their environmental footprint, social impact initiatives, and governance structures. Similarly, Microsoft publishes a detailed sustainability report that covers a wide range of environmental, social, and governance issues, including their efforts to reduce their carbon emissions, promote diversity and inclusion, and foster ethical AI development. These companies often use third-party assurance to verify the accuracy and reliability of their reported data, further enhancing transparency and credibility. Their reports showcase a commitment to integrated reporting, aiming to demonstrate the link between their sustainability performance and financial outcomes.

The Costs of CSR Initiatives

Implementing Corporate Social Responsibility (CSR) programs, while beneficial for brand reputation and stakeholder relations, incurs significant costs. These expenses are not always immediately apparent and can vary widely depending on the nature of the initiatives, the industry, and the size of the company. Understanding these costs is crucial for effective CSR strategy development and resource allocation.

The costs associated with CSR initiatives can be broadly categorized as direct and indirect. Direct costs are readily identifiable and quantifiable, such as salaries for dedicated CSR personnel, investments in new technologies or sustainable practices, and the cost of materials for environmentally friendly products. Indirect costs, however, are more subtle and challenging to measure. These include opportunity costs – the potential profits forgone by pursuing CSR activities rather than maximizing short-term profits – and the administrative burden of managing and reporting on CSR performance.

Explore the different advantages of Budgeting for Small Business Owners that can change the way you view this issue.

Direct Costs of CSR Initiatives

Direct costs represent the tangible financial outlays associated with implementing specific CSR programs. These can range from relatively minor expenses, like updating company brochures to reflect new sustainability commitments, to substantial investments in new infrastructure or supply chain overhauls. For example, a manufacturing company transitioning to renewable energy sources would face significant upfront capital expenditures for solar panels or wind turbines, as well as ongoing maintenance costs. Similarly, a retailer committing to ethical sourcing might incur higher procurement costs for fair-trade products. These direct costs are often easier to budget and track than indirect costs.

Indirect Costs of CSR Initiatives

Indirect costs, while less easily quantifiable, are nonetheless crucial to consider. These costs often relate to the time and resources diverted from core business activities to manage and implement CSR programs. For instance, the time spent by employees in data collection for CSR reports, the cost of external audits to verify CSR claims, and the potential loss of efficiency due to process changes all contribute to the overall cost. Further, the opportunity cost – the potential profits that could have been earned by investing resources elsewhere – is a significant indirect cost. A company choosing to invest in employee training programs rather than marketing campaigns, for example, faces the opportunity cost of potentially lower short-term sales.

Investment in Data Collection, Reporting, and Verification

The process of collecting, analyzing, and reporting CSR data requires significant investment. This includes the costs of dedicated personnel, specialized software, and external verification services. Companies often need to implement new data management systems to track their environmental impact, social performance, and governance practices. External audits and certifications, while adding credibility to CSR reports, also represent a considerable expense. For instance, obtaining a B Corp certification requires a rigorous assessment process, involving substantial time and financial commitment. The cost of these activities can be particularly burdensome for smaller companies with limited resources.

Cost Comparison Across Industries and Company Sizes

The cost of CSR initiatives varies significantly across different industries and company sizes. Resource-intensive industries like manufacturing or energy often face higher direct costs associated with adopting sustainable practices. Larger companies, with more resources and established CSR departments, generally invest more heavily in comprehensive CSR programs than smaller businesses. However, even smaller companies can benefit from targeted CSR initiatives, although their costs may be proportionally higher due to limited economies of scale. For example, a small cafe implementing a compost program will have a lower overall cost than a large supermarket chain undertaking a similar initiative, but the per-unit cost might be greater for the cafe.

Hypothetical Cost-Benefit Analysis Framework for a CSR Program

A cost-benefit analysis (CBA) is essential for evaluating the financial viability of a CSR program. A hypothetical framework might include:

Cost Side: Direct costs (e.g., employee training, new equipment, materials), Indirect costs (e.g., staff time, opportunity costs), and Reporting and verification costs.

Benefit Side: Improved brand reputation and customer loyalty, increased employee engagement and retention, enhanced investor relations, potential cost savings from improved efficiency, and avoidance of fines or penalties for non-compliance.

The CBA would then involve quantifying these costs and benefits (where possible) and comparing them using metrics such as Return on Investment (ROI) or Net Present Value (NPV). For example, a company investing in energy-efficient equipment might see a positive ROI within a few years due to reduced energy bills, while the positive impact on brand reputation might be harder to quantify but nonetheless significant. A thorough CBA should consider both short-term and long-term impacts.

The Benefits of CSR Reporting

Implementing robust CSR initiatives and transparently reporting on them offers significant financial advantages beyond the immediate costs. A growing body of research demonstrates a strong correlation between strong CSR performance and improved financial outcomes, attracting investors and enhancing a company’s bottom line. This section explores the financial benefits of CSR reporting, highlighting how responsible business practices translate into tangible economic gains.

Improved Brand Reputation and Increased Revenue

A positive brand reputation, cultivated through demonstrable CSR efforts, is a powerful driver of revenue growth. Consumers are increasingly conscious of ethical and sustainable practices, favoring companies aligned with their values. Companies with strong CSR profiles often enjoy higher customer loyalty, leading to increased repeat business and positive word-of-mouth marketing. For example, Patagonia’s commitment to environmental sustainability and fair labor practices has fostered a fiercely loyal customer base, contributing significantly to its brand value and market success. This increased consumer trust translates directly into higher sales and market share. Similarly, Unilever’s Sustainable Living Plan, focused on improving health and well-being and reducing environmental impact, has demonstrably boosted its brand reputation and contributed to its financial performance.

Operational Efficiencies and Cost Savings

CSR initiatives, while initially requiring investment, often lead to long-term operational efficiencies and cost savings. Implementing sustainable practices, such as reducing energy consumption and waste management, can significantly lower operational expenses. Investing in employee well-being programs, for instance, can lead to reduced absenteeism and improved productivity, ultimately saving money on healthcare costs and recruitment. For example, a company that invests in energy-efficient technologies may experience a reduction in utility bills over time. Similarly, a company with a strong employee wellness program might see a decrease in employee turnover and related recruitment costs. These cost savings contribute directly to increased profitability.

Enhanced Investor Relations and Access to Capital

Strong CSR performance enhances a company’s attractiveness to investors. Socially responsible investors (SRIs) actively seek out companies with robust CSR strategies, leading to increased investment opportunities and potentially lower borrowing costs. Transparency in CSR reporting demonstrates accountability and reduces investor risk, making a company a more appealing investment. Furthermore, many investors consider ESG (Environmental, Social, and Governance) factors when making investment decisions. Companies with strong ESG profiles tend to attract more capital at favorable terms. This improved access to capital can facilitate growth and expansion opportunities.

Financial Benefits of CSR Reporting

| Metric | Potential Benefit | Example | Quantifiable Impact |

|---|---|---|---|

| Revenue Growth | Increased customer loyalty and brand preference | Patagonia’s commitment to sustainability leads to premium pricing and high customer retention. | 5-15% increase in revenue (estimated based on industry benchmarks) |

| Reduced Operational Costs | Improved energy efficiency and waste reduction | Implementation of energy-saving technologies leading to lower utility bills. | 2-10% reduction in operational expenses (depending on the specific initiatives) |

| Enhanced Investor Relations | Improved access to capital and lower cost of borrowing | Higher credit rating due to strong ESG performance leading to lower interest rates on loans. | 0.5-2% reduction in cost of capital (based on market data and credit rating impact) |

| Improved Employee Retention | Reduced recruitment and training costs | Improved employee satisfaction and loyalty programs reduce turnover. | 5-15% reduction in recruitment and training costs (depending on turnover rates) |

Investor Relations and CSR Reporting

CSR performance significantly impacts a company’s relationship with investors, influencing their investment decisions and access to capital. Strong CSR reporting acts as a vital communication tool, showcasing a company’s commitment to environmental, social, and governance (ESG) factors, thereby attracting investors who prioritize these considerations. This section will explore the multifaceted relationship between CSR reporting and investor relations.

CSR Performance Influences Investor Decisions and Capital Access

A company’s commitment to CSR is increasingly becoming a key factor in investor decision-making. Investors, particularly institutional investors and asset managers, are incorporating ESG factors into their investment strategies. Positive CSR performance, transparently communicated through comprehensive reporting, signals to investors a lower risk profile and potentially higher long-term returns. This improved perception can lead to increased investor confidence, attracting more capital and potentially enabling access to more favorable financing terms. Conversely, poor CSR performance or a lack of transparency can deter investors, making it more challenging to secure funding. The growing prevalence of ESG investing demonstrates a clear shift in the market, rewarding companies with strong CSR profiles.

Attracting Environmentally and Socially Conscious Investors

Strong CSR reporting is crucial for attracting environmentally and socially conscious investors. These investors, often driven by ethical considerations alongside financial returns, actively seek companies aligned with their values. Detailed and credible reporting on environmental sustainability initiatives (e.g., carbon reduction targets, waste management), social responsibility programs (e.g., fair labor practices, community engagement), and governance structures (e.g., board diversity, ethical business practices) helps attract this investor segment. These investors are often willing to pay a premium for companies demonstrating a strong commitment to CSR, reflecting a growing demand for responsible investing. This can translate to higher valuations and increased investor loyalty.

Impact of CSR Reporting on Credit Rating and Borrowing Costs

Robust CSR reporting can positively influence a company’s credit rating and borrowing costs. Rating agencies are increasingly incorporating ESG factors into their assessment models. Strong CSR performance, demonstrated through transparent reporting, can signal lower financial and operational risks, leading to improved credit ratings. A higher credit rating, in turn, translates to lower borrowing costs, as lenders perceive the company as less risky. This can significantly reduce the company’s financing expenses and improve its overall financial health. Conversely, poor CSR performance can lead to downgraded credit ratings and higher borrowing costs.

Case Study: Comparing Two Companies

Let’s consider two hypothetical companies, “GreenTech Solutions” and “Indifferent Industries.” GreenTech Solutions proactively implements sustainable practices, actively engages in community initiatives, and publishes comprehensive, independently verified CSR reports annually. Their reporting highlights their commitment to reducing their carbon footprint, promoting ethical sourcing, and fostering diversity and inclusion within their workforce. In contrast, Indifferent Industries has a limited CSR program, provides minimal reporting, and faces several controversies related to environmental damage and labor practices.

GreenTech Solutions enjoys a higher credit rating, attracts socially responsible investors, and benefits from lower borrowing costs. They have experienced steady growth in their share price, reflecting investor confidence in their long-term sustainability and profitability. Indifferent Industries, on the other hand, struggles to attract investors, faces higher borrowing costs due to a lower credit rating, and experiences greater volatility in its share price, reflecting investor concerns about their ESG performance. This comparison highlights the significant impact that CSR reporting and performance can have on investor relations and overall financial outcomes.

Regulatory and Legal Aspects of CSR Reporting

The increasing global focus on environmental, social, and governance (ESG) factors has led to a proliferation of regulations and legal frameworks governing corporate social responsibility (CSR) reporting. These regulations vary significantly across jurisdictions, impacting how companies disclose their CSR performance and the potential consequences of non-compliance. Understanding these legal landscapes is crucial for businesses operating internationally or aiming to attract investors sensitive to ESG considerations.

Key Regulations and Legal Frameworks

Numerous countries have implemented legislation mandating or incentivizing CSR reporting. The European Union, for example, has spearheaded significant initiatives, including the Non-Financial Reporting Directive (NFRD) and the upcoming Corporate Sustainability Reporting Directive (CSRD), which significantly expand the scope and stringency of mandatory ESG disclosures for large companies. In the United States, while there isn’t a single overarching federal mandate for CSR reporting, various state-level regulations and SEC guidelines increasingly influence corporate disclosure practices, particularly regarding climate-related risks and opportunities. Similarly, countries like Japan, Australia, and Canada have developed their own frameworks, often aligning with international standards such as the Global Reporting Initiative (GRI) standards or the Sustainability Accounting Standards Board (SASB) standards. These frameworks frequently differ in their specific requirements, the types of information they mandate, and the size and types of companies subject to the regulations.

Comparison of CSR Reporting Requirements

A direct comparison reveals considerable differences in CSR reporting requirements across countries. For instance, the EU’s CSRD mandates far more extensive reporting than the NFRD, requiring assurance for large companies and encompassing a broader range of ESG issues. Conversely, the U.S. approach, while evolving, remains more fragmented and less prescriptive. Some countries focus primarily on environmental disclosures, while others place greater emphasis on social and governance aspects. This lack of global harmonization presents challenges for multinational corporations, forcing them to navigate a complex web of differing regulations and reporting standards. The absence of a universally accepted standard can also lead to inconsistencies in the quality and comparability of CSR reports across jurisdictions.

Liabilities and Penalties for Inaccurate Reporting

Inaccurate or incomplete CSR reporting can expose companies to significant legal and financial liabilities. Penalties can range from financial fines to reputational damage and even legal action from stakeholders. The EU’s CSRD, for example, includes provisions for penalties for non-compliance, reflecting the increasing seriousness with which regulators view the accuracy and completeness of ESG disclosures. In the U.S., while penalties may be less explicitly defined in a single federal framework, misleading statements or omissions related to material ESG factors can lead to SEC enforcement actions, including substantial fines and legal repercussions. Furthermore, inaccurate reporting can damage a company’s credibility, erode investor confidence, and negatively impact its brand reputation, leading to long-term financial consequences.

Role of Independent Assurance Providers

To enhance the credibility and reliability of CSR information, the role of independent assurance providers is becoming increasingly critical. These providers, often accounting firms or specialized sustainability consultancies, verify the accuracy and completeness of CSR data and disclosures. The level of assurance provided can range from limited assurance to reasonable assurance, with the latter providing a higher degree of confidence in the reported information. The demand for independent assurance is growing, driven by both regulatory requirements, such as those mandated by the CSRD, and investor expectations. Independent assurance not only enhances the trustworthiness of CSR reports but also mitigates the risk of legal and reputational damage associated with inaccurate reporting. Increasingly, investors are seeking assurance as a key factor in their investment decisions, recognizing its importance in assessing the reliability of ESG information.

Future Trends in CSR Reporting

The landscape of Corporate Social Responsibility (CSR) reporting is constantly evolving, driven by increasing stakeholder expectations, stricter regulations, and the growing awareness of environmental and social issues. Future trends point towards a more integrated, data-driven, and impactful approach to CSR communication. This section will explore some key developments shaping the future of CSR reporting.

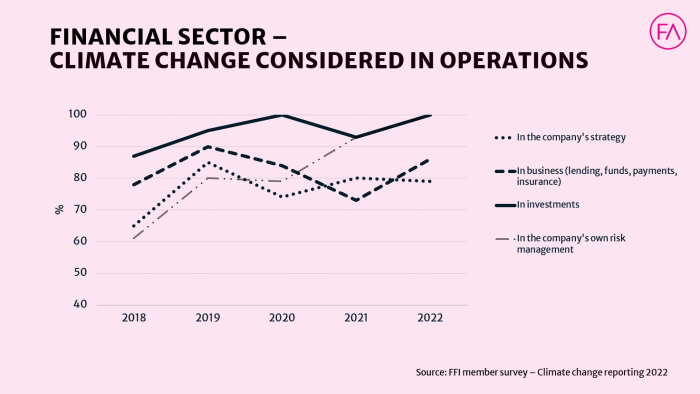

The integration of environmental, social, and governance (ESG) factors into mainstream financial reporting is rapidly gaining traction. This move reflects a growing understanding that non-financial performance is just as crucial as financial performance in assessing a company’s long-term value and sustainability.

Integrated Reporting and Sustainability Accounting Standards

Integrated reporting aims to provide a holistic view of a company’s performance, encompassing both financial and non-financial aspects. This contrasts with traditional reporting which often treats these areas in isolation. The International Integrated Reporting Council (IIRC) framework provides guidance on integrated reporting, emphasizing the interconnectedness of various aspects of a company’s operations and their impact on value creation. Similarly, the development and adoption of sustainability accounting standards, such as those proposed by the Sustainability Accounting Standards Board (SASB), are driving greater consistency and comparability in CSR reporting. These standards provide a framework for disclosing material ESG information relevant to specific industries, enhancing the reliability and usefulness of CSR data for investors and other stakeholders. For example, a company in the energy sector would be expected to report on different ESG metrics than a company in the consumer goods sector, ensuring that the disclosed information is relevant to the industry’s specific challenges and opportunities.

Innovative Approaches to CSR Reporting and Data Visualization

Companies are increasingly employing innovative methods to make their CSR reports more engaging and accessible. Interactive dashboards, infographics, and short videos are replacing lengthy, text-heavy reports. For example, a company might use an interactive map to show the geographical distribution of its renewable energy projects, or an animated graphic to illustrate its progress towards reducing carbon emissions. This shift towards data visualization aims to improve transparency and make complex information easier to understand for a broader audience, including investors, employees, and the general public. Furthermore, the use of blockchain technology is being explored to enhance the credibility and transparency of CSR data, ensuring that information is verifiable and tamper-proof.

Materiality Assessments in Defining the Scope of CSR Reporting

Materiality assessments are becoming increasingly important in determining the scope and focus of CSR reports. A materiality assessment identifies the ESG issues that are most significant to a company’s business, operations, and stakeholders. This process involves engaging with stakeholders to understand their priorities and concerns, and then analyzing the potential impact of various ESG issues on the company’s long-term value creation. By focusing on material issues, companies can ensure that their CSR reporting is relevant, impactful, and aligned with stakeholder expectations. A well-conducted materiality assessment helps companies avoid reporting on immaterial issues, allowing them to prioritize their efforts and resources on the aspects that truly matter. This leads to more focused and effective CSR reporting, ultimately contributing to greater stakeholder engagement and trust.

Hypothetical CSR Report for “GreenTech Solutions”

Imagine a fictional company, “GreenTech Solutions,” a renewable energy provider. Their CSR report, incorporating the latest trends, might include an integrated report showcasing both their financial performance and their progress towards their sustainability goals. The report would utilize interactive data visualizations, such as a map displaying the locations of their solar and wind farms and their contribution to local economies. A detailed materiality assessment would highlight key issues such as greenhouse gas emissions, community engagement, and employee well-being. The report would showcase their progress towards achieving specific, measurable, achievable, relevant, and time-bound (SMART) goals, using clear and concise language to avoid jargon and technical details. The report would also incorporate a section highlighting stakeholder engagement, demonstrating their commitment to transparency and accountability. Finally, the report would include an assurance statement from an independent third party, adding further credibility and trust to the reported information. This hypothetical report demonstrates how a company can effectively communicate its CSR performance using innovative approaches and best practices.

Last Recap

Ultimately, the evidence suggests a strong correlation between robust CSR reporting and improved financial outcomes. While initial investments in CSR initiatives may seem significant, the long-term benefits – from attracting socially conscious investors and bolstering brand reputation to fostering stronger stakeholder relationships and enhancing operational efficiency – often outweigh the costs. By understanding and effectively managing the financial implications of CSR reporting, companies can position themselves for sustainable growth and long-term success in an increasingly socially and environmentally aware world.

FAQ Section

What are the potential risks associated with inadequate CSR reporting?

Inadequate CSR reporting can lead to reputational damage, loss of investor confidence, decreased consumer loyalty, and potential legal or regulatory penalties. It can also hinder a company’s ability to attract and retain top talent.

How can companies measure the ROI of their CSR initiatives?

Measuring ROI requires a comprehensive approach, tracking key performance indicators (KPIs) related to both financial and social/environmental impacts. This might include metrics like reduced operational costs, improved employee retention, increased sales, and enhanced brand reputation. A well-defined framework for tracking and analyzing this data is crucial.

How can small and medium-sized enterprises (SMEs) effectively implement CSR reporting?

SMEs can start with a focused approach, identifying material issues relevant to their business and stakeholders. They can leverage readily available resources and frameworks, focusing on reporting the most impactful aspects of their CSR activities. Simplicity and transparency are key.