The Influence of Political Risk on International Financial Statements sets the stage for a compelling examination of how geopolitical instability significantly impacts the financial reporting of multinational corporations. This exploration delves into the multifaceted nature of political risk, encompassing sovereign risk, expropriation, and broader political instability, and analyzes its effects on key financial statement elements like asset valuation, revenue recognition, and expense reporting. We will explore how different accounting standards address these challenges and examine effective risk mitigation strategies employed by businesses navigating this complex landscape.

The study will cover diverse methodologies for assessing and quantifying political risk, comparing and contrasting disclosure requirements across various jurisdictions. Case studies will illustrate the real-world consequences of political risk on corporate financial performance, highlighting both the challenges and the adaptive strategies companies utilize to navigate these volatile environments. The role of financial institutions in assessing and managing these risks will also be critically examined.

Defining Political Risk in International Finance

Political risk in international finance encompasses the potential for governmental actions or political instability to negatively impact the profitability or viability of foreign investments. It’s a multifaceted threat, significantly influencing multinational corporations’ (MNCs) strategic decision-making processes and financial reporting. Understanding and mitigating this risk is crucial for successful international operations.

Political risk manifests in various forms, each posing unique challenges to businesses operating across borders. These risks are not evenly distributed globally; certain regions are inherently more susceptible than others due to factors such as governance structures, economic development levels, and geopolitical dynamics.

Types of Political Risk

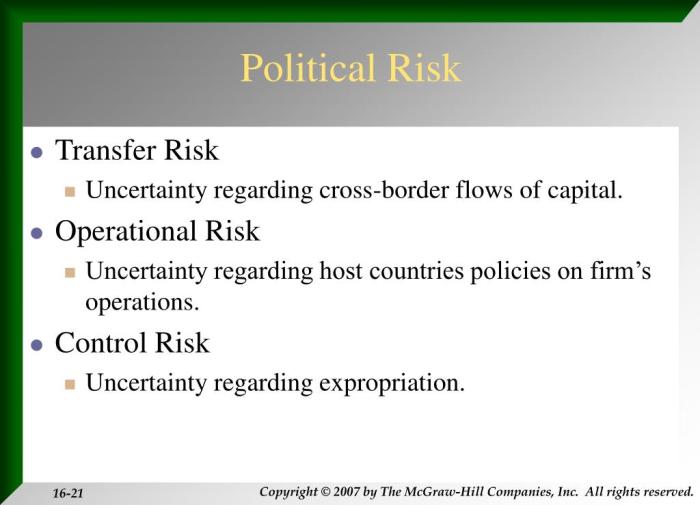

Political risk is broadly categorized into several distinct types. Each type presents different levels of threat and requires tailored risk mitigation strategies. Failing to accurately assess and manage these risks can lead to significant financial losses and operational disruptions.

Sovereign risk, for instance, refers to the risk that a government might default on its debt obligations. This can trigger a cascade of negative effects, impacting not only the government’s creditworthiness but also the financial stability of businesses operating within that nation. Expropriation risk, on the other hand, represents the possibility that a government might seize a company’s assets, often without compensation. This risk is particularly acute in countries with weak rule of law or a history of nationalization. Finally, political instability, encompassing factors like civil unrest, terrorism, and regime change, can create a volatile and unpredictable operating environment, making long-term planning and investment extremely difficult. The impact of these risks varies greatly depending on the specific context and the nature of the investment.

Regional Manifestations of Political Risk

The prevalence and nature of political risk vary significantly across different global regions. Latin America, for example, has historically experienced higher levels of expropriation risk and political instability compared to, say, North America. This difference is often attributed to variations in institutional quality, economic development, and historical political trajectories. Similarly, regions experiencing ongoing conflicts or significant geopolitical tensions often face heightened political risk, impacting investor confidence and foreign direct investment (FDI) flows. The Middle East and North Africa, for example, have witnessed periods of significant political instability, leading to substantial uncertainty for businesses operating in the region. Conversely, regions with strong rule of law, stable political systems, and transparent regulatory frameworks generally exhibit lower political risk profiles, attracting greater levels of foreign investment.

Assessing and Quantifying Political Risk

Multinational corporations employ a variety of methodologies to assess and quantify political risk. These methods range from qualitative assessments based on expert opinion and country risk ratings to quantitative models that incorporate various macroeconomic and political indicators. Country risk ratings, provided by agencies like the World Bank and Moody’s, offer a general overview of a country’s political and economic stability. These ratings, however, often lack the granular detail needed for specific investment decisions. More sophisticated quantitative models integrate multiple variables, including political stability indices, corruption perceptions, and economic growth forecasts, to generate a numerical score reflecting the overall political risk. These models can be valuable tools for informing strategic decision-making, but they should be used in conjunction with qualitative assessments to account for nuances and unforeseen events. Ultimately, a comprehensive approach, combining both qualitative and quantitative methods, provides the most robust assessment of political risk.

Impact on Financial Statement Elements

Political risk significantly impacts the valuation of assets, liabilities, and equity within international financial statements. The uncertainty inherent in politically unstable environments necessitates careful consideration of potential losses and adjustments to reported figures. This section will detail how political risk affects various components of the financial statements.

Valuation of Assets, Liabilities, and Equity

Political risk directly influences the fair value of assets held by multinational corporations operating in volatile regions. For example, expropriation, nationalization, or changes in regulations can dramatically reduce the value of physical assets like factories or land. Similarly, political instability can impact the recoverability of receivables, leading to impairment charges and reducing the value of assets on the balance sheet. On the liability side, political risk can affect the value of foreign currency denominated liabilities, especially if currency controls or devaluation occur. Finally, equity valuation is affected by the overall perception of risk; heightened political uncertainty typically leads to lower market valuations of a company’s stock. A company’s perceived risk increases, potentially leading to a decrease in its market capitalization and thus the reported value of its equity.

Impact of Political Instability on Revenue Recognition and Impairment Losses

Political instability can disrupt operations, leading to delays in revenue recognition. For instance, civil unrest or sanctions can hinder the ability of a company to deliver goods or services, causing revenue to be delayed or even lost altogether. Furthermore, the uncertainty created by political instability can trigger impairment losses. If a company anticipates significant losses due to political events, it must recognize these losses immediately, reducing the reported value of assets and impacting profitability. This might be triggered by a sudden change in government leading to a reassessment of the long-term viability of an investment.

Influence of Political Events on Expenses and Profitability

Political events such as elections, regime changes, or policy shifts can significantly influence a company’s reported expenses and profitability. For example, a change in government might lead to increased regulatory burdens, resulting in higher compliance costs. Similarly, trade wars or sanctions can increase import costs, impacting the cost of goods sold and ultimately reducing profitability. Conversely, favorable policy changes, such as tax cuts or deregulation, can reduce expenses and boost profitability. The introduction of new tariffs, for example, might increase the cost of imported raw materials, directly affecting the cost of goods sold and subsequently reducing gross profit margins.

Comparative Effects of Political Risk on Financial Statement Components

| Financial Statement Component | Effect of High Political Risk | Example | Potential Mitigation Strategies |

|---|---|---|---|

| Assets | Reduced valuation due to expropriation risk, impairment, or currency devaluation. | A company’s factory is nationalized, leading to a write-down of its value. | Diversification of assets, political risk insurance. |

| Liabilities | Increased risk of non-payment due to currency controls or political instability. | A company struggles to repay loans denominated in a devalued currency. | Hedging foreign exchange risk, negotiating favorable loan terms. |

| Equity | Lower market valuation due to increased perceived risk. | Investor confidence falls, leading to a decrease in share price. | Transparency, strong corporate governance, risk management strategies. |

| Revenue | Decreased revenue due to operational disruptions or sanctions. | A company’s sales decline due to a trade embargo. | Diversification of markets, contingency planning. |

| Expenses | Increased expenses due to compliance costs, security measures, or import tariffs. | A company incurs higher security costs due to political unrest. | Careful cost management, lobbying efforts. |

Disclosure and Transparency Requirements

The accurate and transparent disclosure of political risk is crucial for maintaining the integrity of international financial reporting. Investors and other stakeholders rely on financial statements to make informed decisions, and the omission or misrepresentation of politically-driven risks can lead to significant consequences. This section examines the accounting standards and regulatory frameworks that govern the disclosure of such risks, highlighting the challenges involved and providing an example of appropriate disclosure.

International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) provide the primary frameworks for financial reporting globally. However, the specific requirements concerning political risk disclosure vary significantly across jurisdictions and are often interpreted differently by companies. While both IFRS and GAAP emphasize the importance of fair presentation and full disclosure, the practical application in the context of political risk remains complex.

Accounting Standards and Regulatory Frameworks

IFRS 1, *Presentation of Financial Statements*, mandates a true and fair view of the financial position of an entity. This principle implicitly requires disclosure of material risks, including political risks, that could significantly affect the entity’s financial performance. Similarly, GAAP, through its principle of full disclosure, necessitates reporting material information relevant to a company’s financial health. However, neither standard offers specific guidance on how to quantify and disclose the financial impact of political risk. Instead, guidance is often found in interpretive pronouncements and regulatory frameworks specific to individual jurisdictions or industry sectors. For example, the Securities and Exchange Commission (SEC) in the United States requires companies to disclose material risks in their filings, including those related to political instability in their operating regions. The European Union’s Non-Financial Reporting Directive also mandates disclosure of certain environmental, social, and governance (ESG) risks, which often encompass political risk factors.

Comparative Disclosure Requirements Across Jurisdictions

The level of detail required in disclosing political risk varies significantly across different jurisdictions. Some countries have more stringent regulations and enforcement mechanisms than others. For instance, the SEC in the U.S. tends to demand more comprehensive disclosures compared to some emerging market regulators. This discrepancy stems from differences in investor protection laws, enforcement capabilities, and the overall level of transparency within a given financial market. Furthermore, the specific types of political risks considered material may differ across jurisdictions, reflecting variations in political and economic environments. A political risk deemed material in a volatile region might be considered less significant in a politically stable country.

Challenges in Quantifying and Disclosing Political Risk

Accurately quantifying and disclosing the financial impact of political risk presents significant challenges. Unlike other financial risks, political risks are often difficult to predict and measure objectively. The inherent uncertainty associated with political events makes it challenging to assign precise financial values to potential outcomes. For example, the impact of a sudden change in government policy, civil unrest, or an expropriation is hard to predict with certainty. Moreover, the impact might be indirect and diffuse, making it difficult to trace to specific financial statement items. Companies often rely on qualitative assessments and scenario analysis to estimate potential impacts, which inherently involves subjectivity and judgment. This lack of precise quantification can lead to inconsistencies in disclosure practices across companies and jurisdictions.

Sample Disclosure Note

A company operating in a politically unstable region might include a disclosure note similar to this example:

“The Company operates in [Country Name], a region characterized by significant political instability. Recent events, including [specific event, e.g., protests, changes in government regulations], have increased the uncertainty surrounding the Company’s operations. While management believes the current operations are not directly threatened, there is a risk of future disruptions, including potential limitations on repatriation of profits, increased operating costs due to security measures, and the possibility of asset expropriation. The financial impact of these risks is inherently uncertain and difficult to quantify precisely. However, management is actively monitoring the situation and implementing mitigating strategies to minimize potential negative consequences. A significant adverse event could materially impact the Company’s financial position, results of operations, and cash flows.”

Risk Management Strategies

Multinational corporations (MNCs) operating in volatile political environments face significant challenges. Effective risk management is crucial for ensuring the long-term viability and profitability of their international operations. A multifaceted approach, combining proactive assessment with reactive mitigation strategies, is essential.

Mitigating political risk involves a range of strategies designed to reduce the potential negative impacts of adverse political events. These strategies can be broadly categorized into insurance, hedging, and diversification, each with its own strengths and weaknesses depending on the specific risk profile and the context of the operation.

Insurance Strategies

Political risk insurance, offered by government agencies (like the Overseas Private Investment Corporation (OPIC) in the US or similar agencies in other countries) and private insurers, provides financial protection against various political risks, including expropriation, nationalization, and political violence. These policies typically cover losses incurred due to specific insured events, offering financial compensation to the affected company. For example, a company investing in a developing nation might purchase insurance against the risk of nationalization of its assets, ensuring that it can recoup a significant portion of its investment should such an event occur. The cost of insurance varies depending on the level of risk assessed for a particular country or project.

Hedging Strategies

Hedging involves employing financial instruments to offset potential losses from political risk. This might include currency hedging to protect against exchange rate fluctuations resulting from political instability, or using derivatives to manage commodity price volatility influenced by political factors. For instance, a mining company operating in a country prone to political upheaval might hedge its exposure to fluctuations in the price of its extracted commodity by entering into forward contracts or options agreements. This reduces the financial impact of unexpected price swings caused by, for example, changes in government policy or disruptions to supply chains due to political unrest.

Diversification Strategies

Diversification involves spreading investments across multiple countries or regions to reduce the impact of political risk in any single location. This strategy minimizes dependence on any one political jurisdiction, thus reducing overall vulnerability. A manufacturing company, for instance, might establish production facilities in several countries to reduce its reliance on any single nation’s political stability. If political instability arises in one location, production can be shifted to another, minimizing disruption to the company’s operations and profitability. The effectiveness of diversification depends on the correlation of political risks across different countries. If political risks are highly correlated (for example, regional conflicts), diversification may offer less protection.

Political Risk Assessments and Investment Decisions

Political risk assessments are crucial in guiding investment decisions and operational strategies. Companies employ various methods to assess political risk, including analyzing country risk ratings from agencies like the World Bank or Moody’s, conducting on-the-ground due diligence, and engaging political risk consultants. This information informs decisions regarding market entry strategies, investment levels, and operational procedures. For example, a company might decide against investing in a country with a high level of political instability or corruption, opting instead for a location with a more stable political environment, even if it means potentially lower returns.

Best Practices for Managing Political Risk

Before outlining best practices, it’s important to note that the effectiveness of each strategy depends heavily on the specific political risk profile of the target country and the nature of the business operation. A tailored approach is always recommended.

- Conduct thorough due diligence and political risk assessments before making any investment decisions.

- Develop contingency plans to address potential political risks.

- Utilize a combination of risk mitigation strategies, including insurance, hedging, and diversification.

- Maintain strong relationships with local stakeholders, including government officials and community leaders.

- Engage in proactive communication and advocacy to influence the political environment.

- Regularly monitor the political landscape and adapt strategies as needed.

- Ensure compliance with all applicable laws and regulations.

- Invest in robust security measures to protect assets and personnel.

- Develop a comprehensive crisis management plan.

- Maintain transparent and ethical business practices.

Case Studies of Political Risk Impact: The Influence Of Political Risk On International Financial Statements

Political risk significantly impacts multinational corporations, leading to substantial financial consequences and requiring adaptive strategies. Analyzing specific instances provides valuable insight into the nature and scope of these challenges and the responses employed by affected businesses. This section will examine a detailed case study to illustrate these impacts.

ExxonMobil in Venezuela

ExxonMobil’s experience in Venezuela serves as a compelling case study of the devastating financial consequences of political risk. For decades, ExxonMobil held significant oil assets in Venezuela, a country with vast petroleum reserves. However, under the Chávez and Maduro administrations, the Venezuelan government implemented policies increasingly hostile to foreign investors. These included nationalization of oil projects, expropriation of assets without adequate compensation, and the imposition of stringent and unpredictable regulations.

Financial Consequences and Company Response

The nationalization of ExxonMobil’s assets resulted in a substantial loss of revenue and a significant write-down of assets on their financial statements. The company was forced to abandon billions of dollars worth of investments and faced lengthy legal battles to secure some form of compensation, a process which yielded limited success. In response, ExxonMobil engaged in extensive lobbying efforts, pursued legal avenues to recover some of its losses, and ultimately restructured its global portfolio to mitigate future exposure to similar political risks. The company also strengthened its internal risk assessment processes and diversified its investments geographically.

Long-Term Effects on Financial Statements

The long-term effects on ExxonMobil’s financial statements included reduced profitability, a decrease in asset value, and increased legal expenses. The impact extended beyond immediate financial losses; the company’s reputation was affected, and investor confidence was shaken. These factors had ripple effects on the company’s credit rating and its ability to secure future financing. The Venezuelan experience served as a cautionary tale, shaping the company’s strategic decision-making for years to come.

Adaptation of Reporting Practices, The Influence of Political Risk on International Financial Statements

Following the Venezuelan events, ExxonMobil likely enhanced its disclosures regarding political risk in its financial reports. This likely included a more detailed breakdown of its geographical exposure to political risk, increased transparency regarding potential legal disputes related to expropriation or nationalization, and a more robust assessment of the contingent liabilities related to its international operations. The company likely adopted more conservative accounting practices, reflecting a greater awareness of the inherent uncertainties associated with operating in politically unstable regions.

Visual Representation of Financial Impact

A bar chart could effectively depict the financial impact of the Venezuelan nationalization on ExxonMobil’s key performance indicators (KPIs). The X-axis would represent time periods (e.g., pre-nationalization, during nationalization, post-nationalization). The Y-axis would represent the value of key KPIs, such as net income, total assets, and return on assets (ROA). Bars representing the pre-nationalization period would show relatively high values for these KPIs. During the nationalization period, the bars would sharply decrease, reflecting the loss of assets and revenue. In the post-nationalization period, the bars would likely remain lower than pre-nationalization levels, although potentially showing a gradual recovery depending on the success of legal efforts and the company’s strategic adjustments. The chart would visually highlight the significant negative impact of the political event on ExxonMobil’s financial performance. A clear annotation would indicate the specific period of nationalization and the corresponding sharp drop in the KPIs.

The Role of Financial Institutions

Financial institutions play a crucial role in navigating the complexities of political risk in international finance. Their assessments and risk mitigation strategies significantly influence the flow of capital across borders and the stability of the global financial system. Banks, in particular, are at the forefront, directly exposed to the potential for losses stemming from political instability. Rating agencies, meanwhile, provide vital information that shapes investor perceptions and influences lending decisions.

Financial institutions incorporate political risk into their credit risk assessments and lending decisions through a variety of methods. These methods range from rigorous due diligence processes examining a country’s political landscape to sophisticated quantitative models that assign probabilities to various political risk scenarios. The information gathered helps them understand the potential for disruptions to business operations, including nationalization, expropriation, contract breaches, and changes in regulatory environments. This analysis directly impacts lending terms – higher political risk often translates to higher interest rates, shorter loan maturities, or stricter collateral requirements.

Credit Risk Assessment and Lending Decisions

The incorporation of political risk into credit assessments is a multi-faceted process. Banks often employ specialized teams to analyze political developments and their potential impact on borrowers. This involves monitoring political events, analyzing economic indicators, and engaging with local experts. The output of this analysis is integrated into credit scoring models, alongside traditional financial metrics. For example, a country experiencing significant political instability might receive a lower credit rating, leading to a higher risk premium applied to loans extended to businesses operating within that country. This could involve increasing the interest rate charged or demanding additional collateral to offset the heightened risk. Lenders may also choose to reduce their exposure to a specific country altogether, particularly if the political risk profile deteriorates significantly.

Impact on International Financial System Stability

Political risk significantly impacts the stability of the international financial system. Large-scale political events, such as revolutions, coups, or protracted conflicts, can trigger widespread financial instability. Sudden capital flight, currency devaluations, and defaults on sovereign debt are common consequences. These events can have a ripple effect, impacting global financial markets and potentially leading to systemic risk. The 1997 Asian financial crisis, for instance, highlighted the interconnectedness of global financial markets and the devastating impact that political and economic instability in one region can have on others. The rapid spread of the crisis demonstrated the need for robust risk management strategies within financial institutions and greater international cooperation in addressing systemic risks.

Adjusting Lending Practices Based on Political Risk Changes

A shift in a country’s political risk profile necessitates a reassessment of lending practices. For instance, if a previously stable country experiences a sudden surge in political unrest, a financial institution might immediately curtail new lending to businesses in that country. Existing loans might be reviewed to assess the potential for increased risk. The institution might demand additional collateral from existing borrowers, increase interest rates, or shorten the repayment period. In extreme cases, the institution may even initiate foreclosure proceedings if it deems the risk of default too high. Alternatively, if a country undertakes significant political reforms that improve its stability, the institution might adjust its lending practices accordingly, potentially offering more favorable terms to attract new business and investments. This dynamic adaptation to changing political landscapes is crucial for maintaining the financial health of institutions and mitigating potential losses.

Final Review

In conclusion, understanding the influence of political risk on international financial statements is crucial for all stakeholders. The complexities of assessing, disclosing, and mitigating these risks require a multi-faceted approach, incorporating robust risk management strategies, transparent reporting practices, and a deep understanding of the geopolitical landscape. This analysis underscores the need for continuous adaptation and vigilance in the face of evolving political dynamics, emphasizing the importance of proactive risk management for long-term financial stability and success in international business operations.

FAQ Guide

What are some examples of political events that significantly impact financial statements?

Examples include elections leading to policy shifts, regime changes causing asset nationalization, civil unrest disrupting operations, and changes in trade agreements affecting revenue streams.

How do rating agencies incorporate political risk into their assessments?

Rating agencies consider political risk by analyzing a country’s political stability, governance, and regulatory environment. This influences their credit ratings for sovereign debt and corporate entities operating within those jurisdictions.

Can political risk be fully quantified and disclosed?

No, political risk is inherently uncertain and difficult to fully quantify. Disclosing it involves explaining the potential impacts and the company’s strategies for managing the risks, rather than providing precise numerical figures.

Obtain recommendations related to Payroll Tax Basics for Employers that can assist you today.