How Political Risk Affects International Accounting Strategies is a critical consideration for multinational corporations operating in diverse global environments. Political instability, regulatory changes, and unforeseen events can significantly impact financial reporting, asset valuation, and overall operational efficiency. Understanding these risks and implementing effective mitigation strategies are crucial for maintaining financial stability and long-term success in international markets. This exploration delves into the complexities of navigating these challenges, examining the various types of political risk, their impact on accounting practices, and the strategies companies employ to mitigate potential losses.

From the challenges of applying globally recognized accounting standards like GAAP and IFRS in volatile political landscapes to the complexities of managing currency fluctuations and tax policies, the interplay between politics and accounting is multifaceted. We will analyze real-world examples of how political events have shaped accounting decisions, highlighting both successful navigation of crises and instances where unforeseen political risks led to significant financial losses. The role of auditing and assurance in high-risk environments will also be examined, emphasizing the importance of independent and objective assessments.

Defining Political Risk in International Accounting

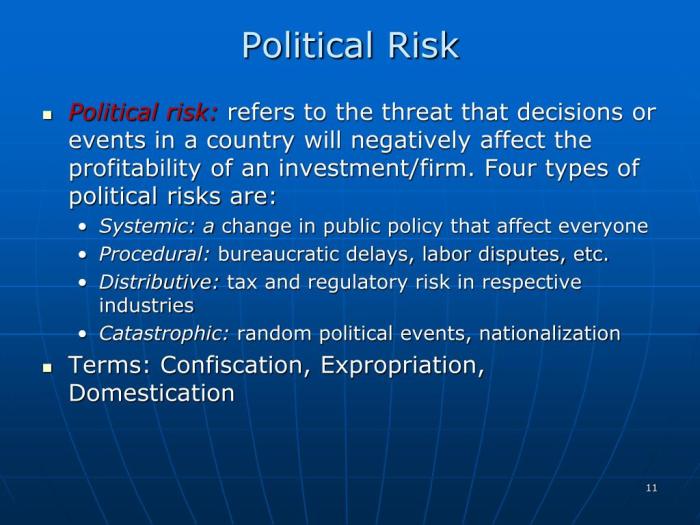

Political risk significantly impacts multinational corporations (MNCs) operating in diverse global environments. It encompasses a broad range of events and circumstances that can unexpectedly affect the profitability and even the viability of international investments and operations. Understanding and mitigating this risk is crucial for effective international accounting strategies.

Political risk in international accounting refers to the potential for government actions, political instability, or other political events to negatively influence the financial performance and reporting of a company operating internationally. This encompasses a wide spectrum of issues, from subtle policy changes to outright nationalization of assets. The impact can be felt across various aspects of accounting, including financial reporting, auditing, and taxation.

Types of Political Risk Impacting Multinational Corporations

Several distinct types of political risk affect MNCs. These risks often interact and compound each other, creating complex challenges for international accounting. For example, expropriation (the seizure of assets by a government) can be preceded by a period of increasing political instability and regulatory uncertainty.

Political Instability and Financial Reporting Standards Adherence

Political instability creates an environment of uncertainty that directly affects adherence to financial reporting standards. When governments are weak or undergoing significant change, enforcement of accounting regulations often weakens. This can lead to inconsistent application of Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), making it difficult to compare financial statements across countries and increasing the risk of fraudulent reporting. Furthermore, the lack of a stable legal framework can hinder the ability to enforce contracts and protect investor rights, ultimately affecting the reliability of financial information.

Examples of Political Events Altering Accounting Practices

Numerous historical events illustrate the significant impact of political events on accounting practices. For instance, the Argentine economic crisis of 2001 resulted in significant changes to accounting regulations and practices as the government attempted to address the economic fallout. Similarly, the political and economic transitions in post-Soviet countries led to a period of significant accounting reform and adaptation to international standards, a process that continues to this day. The nationalization of industries in Venezuela under Hugo Chávez’s presidency drastically altered the accounting landscape for companies operating in that sector, often resulting in significant losses for foreign investors.

Comparative Analysis of Political Risk Profiles

The following table compares the political risk profiles of three countries and their implications for accounting:

| Country | Political Risk Level (High, Medium, Low) | Impact on Accounting | Specific Considerations |

|---|---|---|---|

| United States | Low | Relatively stable and consistent application of GAAP. | Focus on regulatory compliance and corporate governance. |

| Brazil | Medium | Potential for inconsistencies in application of IFRS due to political and economic volatility. | Need for robust internal controls and risk management strategies. Currency fluctuations must be carefully managed. |

| Venezuela | High | Significant challenges in adhering to international accounting standards due to political instability and economic crisis. | Increased risk of asset expropriation and difficulties in enforcing contracts. Significant challenges in repatriation of profits. |

Impact on Financial Reporting Standards

Applying Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) in internationally diverse and politically volatile environments presents significant challenges for accountants and auditors. The inherent uncertainties and risks associated with political instability directly impact the reliability and comparability of financial statements produced by multinational corporations. These challenges stem from the unpredictable nature of government actions and the difficulty in accurately forecasting their long-term effects on a company’s operations and assets.

Political risk significantly influences the reliability and comparability of financial statements across borders. The lack of consistent legal frameworks and enforcement mechanisms in some countries can lead to inconsistent accounting practices, making cross-border comparisons difficult and potentially misleading for investors. Furthermore, the impact of political events, such as civil unrest or regime changes, can be unpredictable and difficult to quantify, leading to inconsistencies in financial reporting across different jurisdictions. This lack of consistency undermines the value of financial statements as tools for informed decision-making.

Government Actions and Financial Statement Preparation

Government actions, particularly those related to economic policy, directly influence the preparation of financial statements. For example, currency controls can severely limit the ability of a foreign subsidiary to repatriate profits, impacting the valuation of assets and liabilities denominated in foreign currencies. Similarly, changes in tax policies can significantly affect a company’s reported income and tax liabilities, requiring adjustments to financial statements. Unexpected changes in import/export regulations can also impact the valuation of inventory and the recognition of revenue. These government actions create significant uncertainty for accountants, making it difficult to produce accurate and reliable financial statements.

Hypothetical Scenario: Government Policy Change and Asset Valuation

Imagine a US-based multinational corporation, “GlobalCorp,” with a significant manufacturing subsidiary in Country X. GlobalCorp uses IFRS for its consolidated financial statements. Country X, initially enjoying stable economic growth, experiences a sudden change in government, leading to a significant devaluation of its currency. The new government also introduces strict capital controls, limiting the repatriation of profits from Country X. Prior to the change, GlobalCorp valued its Country X subsidiary’s assets (primarily manufacturing equipment) based on fair market value in the local currency. After the devaluation and imposition of capital controls, the fair value of these assets in US dollars significantly decreases, reflecting both the currency devaluation and the increased difficulty in liquidating the assets. This necessitates a downward adjustment in the value of GlobalCorp’s consolidated assets, impacting the company’s overall financial position and potentially triggering impairment charges. The impact on the balance sheet is a reduction in the reported value of the subsidiary’s assets, potentially leading to a decrease in overall equity. The income statement might reflect impairment losses. This scenario demonstrates how a sudden change in government policy can directly affect the valuation of assets held by a foreign subsidiary, highlighting the challenges of applying IFRS in politically unstable environments.

Strategies for Managing Political Risk

Managing political risk in international accounting requires a proactive and multifaceted approach. Companies must anticipate potential disruptions and implement strategies to mitigate their impact on financial reporting and overall operations. This involves a combination of risk assessment, preventative measures, and contingency planning. The effectiveness of each strategy depends on the specific political environment, the nature of the business, and the company’s risk tolerance.

Mitigation Strategies for Political Risks

Several strategies can be employed to mitigate political risk. These can be broadly categorized into preventative measures, reactive strategies, and building organizational resilience. Effective risk management often involves a combination of these approaches, tailored to the specific circumstances.

- Preventative Measures: This includes thorough due diligence before entering a new market, establishing strong relationships with local stakeholders, and adhering to all relevant laws and regulations. Proactive engagement with government officials and community leaders can help build trust and understanding.

- Reactive Strategies: These strategies address political risks that have already materialized. Examples include crisis management plans, insurance policies, and legal recourse.

- Building Organizational Resilience: This involves developing flexible and adaptable operational structures, diversifying supply chains and revenue streams, and fostering a culture of risk awareness throughout the organization.

Comparing Insurance, Hedging, and Diversification

Insurance, hedging, and diversification offer distinct approaches to managing political risk exposure. Insurance provides financial protection against specific events, such as nationalization or expropriation. Hedging involves using financial instruments to offset potential losses from adverse political developments. Diversification spreads risk across multiple markets and business activities, reducing the impact of any single political event.

- Insurance: Political risk insurance policies can cover a range of events, including expropriation, nationalization, and currency inconvertibility. However, premiums can be substantial, and coverage may not be available for all types of risks in all jurisdictions. For example, a company operating in a politically unstable region might secure insurance against the risk of asset seizure by the government.

- Hedging: Hedging strategies might involve using currency futures or options to protect against fluctuations in exchange rates caused by political instability. A company expecting a devaluation of the local currency could hedge this risk by purchasing currency futures contracts.

- Diversification: Operating in multiple countries reduces the reliance on any single market and thus diminishes the impact of political risks in any one location. For example, a multinational corporation with operations in several countries is less vulnerable to political instability in a single country than a company operating solely in that country.

Transfer Pricing Strategies and Political Risk

Transfer pricing, the setting of prices for goods and services exchanged between related entities in different countries, can be adjusted to minimize the impact of political risks. Strategic transfer pricing can help companies shift profits to lower-tax jurisdictions or protect against currency fluctuations. However, it’s crucial to ensure compliance with international tax laws and regulations to avoid penalties.

Careful consideration should be given to arm’s length principles when setting transfer prices, ensuring that transactions are conducted as if between unrelated parties.

Building Resilience in International Accounting Operations

Building resilience involves implementing robust internal controls, fostering a culture of risk awareness, and developing flexible operational structures. This might include:

- Robust Internal Controls: Implementing strong internal controls over financial reporting ensures accuracy and transparency, enhancing the company’s ability to withstand political pressures.

- Risk Awareness Culture: Training employees on political risk awareness and providing them with tools to identify and report potential issues enhances the organization’s preparedness.

- Flexible Operational Structures: Developing flexible supply chains and production processes allows companies to adapt quickly to changing political circumstances. For example, having multiple sourcing options for raw materials reduces vulnerability to disruptions in a single location.

The Role of Auditing and Assurance

Auditing financial statements of multinational corporations operating in politically volatile environments presents unique and significant challenges for auditors. The inherent uncertainties and risks associated with these environments necessitate a more rigorous and nuanced approach to audit procedures, impacting both the feasibility and reliability of the audit opinion. The auditor’s role extends beyond simply verifying financial figures; it encompasses assessing the impact of political risk on the company’s overall financial health and the validity of its reported information.

Auditors face heightened difficulties in obtaining sufficient appropriate audit evidence in high-political-risk environments. The unpredictability of political events, such as regime changes, nationalizations, or currency devaluations, can significantly impact a company’s operations and financial position. Furthermore, accessing reliable information might be hampered by governmental restrictions, lack of transparency, or even active obstruction from the entities being audited. This makes it difficult to form an accurate and reliable opinion on the financial statements.

Auditor Independence and Objectivity in High-Risk Environments

Political risk can compromise the independence and objectivity of auditors in several ways. Governmental pressure or influence, either direct or indirect, could incentivize auditors to issue favorable opinions even when the financial statements do not accurately reflect the company’s financial position. This pressure might stem from a desire to attract foreign investment or maintain a positive international image. Furthermore, the safety and security of audit teams operating in politically unstable regions can be a concern, potentially influencing their judgment and willingness to challenge potentially problematic accounting practices. The potential for bribery and corruption further erodes auditor independence, as auditors may be tempted to compromise their professional standards to avoid adverse consequences. For example, an auditor working in a country with a history of government interference in business might face pressure to overlook certain accounting irregularities to maintain a positive relationship with the client and avoid potential repercussions.

Auditor Procedure Adaptations for Political Risk, How Political Risk Affects International Accounting Strategies

To mitigate the risks associated with operating in high-political-risk environments, auditors adapt their audit procedures in several ways. They often increase the scope and intensity of their audits, conducting more extensive testing of internal controls and performing more detailed substantive procedures. This includes enhanced scrutiny of revenue recognition, foreign currency transactions, and related-party transactions. Auditors may also engage local experts with in-depth knowledge of the political and regulatory landscape to gain insights and perspectives that would otherwise be unavailable. Furthermore, heightened reliance on corroborative evidence from external sources, such as industry benchmarks and governmental statistics, is common practice to counter the potential unreliability of internal information. For example, an auditor might use satellite imagery to verify the existence of assets in a conflict zone, or they might engage a local legal expert to assess the risk of nationalization.

Additional Considerations for Auditors in Politically Volatile Regions

The following list Artikels additional considerations for auditors working in politically volatile regions:

- Security Risks: Assessing and mitigating personal safety risks for audit teams, including travel safety, accommodation security, and potential threats from political instability or crime.

- Regulatory Compliance: Staying abreast of constantly evolving local laws and regulations, including those related to accounting standards, taxation, and foreign exchange controls.

- Currency Fluctuations: Addressing the impact of significant currency fluctuations on the financial statements and the reliability of financial data.

- Data Availability and Reliability: Developing strategies to overcome challenges in accessing reliable and complete financial data, potentially utilizing alternative sources of information.

- Political Interference: Establishing protocols to identify and respond to potential instances of political interference or pressure on the audit process.

- Reputational Risk: Recognizing the potential impact of operating in a high-risk environment on the auditor’s reputation and the credibility of their audit opinion.

- Ethical Considerations: Maintaining professional skepticism and adherence to ethical standards in the face of potential pressure or incentives to compromise their objectivity.

Case Studies

Examining real-world examples of how companies have navigated political risk illuminates the practical application of the strategies discussed previously. These case studies showcase both successful mitigation and instances where unforeseen political events led to substantial financial losses, highlighting the critical role of proactive risk assessment and robust accounting practices.

Nestlé’s Successful Navigation of Political Risk in Venezuela

Nestlé, a global food and beverage giant, faced significant challenges in Venezuela due to political instability, hyperinflation, and currency controls. The company employed a multi-pronged approach to mitigate these risks. This included hedging currency exposure through forward contracts and other financial instruments, adapting its product portfolio to local preferences and affordability, and maintaining strong relationships with local stakeholders, including government officials and community leaders. Importantly, Nestlé prioritized transparent and accurate financial reporting, even amidst the economic turmoil. This transparency, coupled with their proactive risk management strategies, allowed them to maintain operational continuity and minimize the negative impact on their financial statements. While profits were certainly affected, the company avoided catastrophic losses and maintained a long-term presence in the market. Their accounting decisions emphasized the fair presentation of financial information, including appropriate adjustments for inflation and currency fluctuations, ensuring compliance with international accounting standards (IFRS) even under challenging circumstances. This allowed investors to accurately assess the company’s performance despite the turbulent political environment.

Unilever’s Financial Losses in Egypt

In contrast, Unilever experienced significant financial setbacks in Egypt due to unexpected political upheaval and subsequent economic instability. The rapid devaluation of the Egyptian pound, coupled with supply chain disruptions caused by political unrest, led to substantial inventory losses and increased operational costs. Unilever’s accounting practices, while adhering to IFRS, reflected the full extent of these losses. The company was forced to recognize significant impairments on its assets, write-downs of inventory, and substantial foreign exchange losses. These events dramatically impacted their financial statements, resulting in reported losses for several quarters. The case highlights the limitations of even the most sophisticated risk management strategies in the face of unpredictable and rapidly evolving political events. The lack of predictability in the political landscape hampered Unilever’s ability to effectively hedge against the risks, leading to substantial financial consequences.

Comparative Analysis of Nestlé and Unilever Responses

| Company | Political Risk Event | Accounting Response | Financial Impact | Key Strategies Employed |

|---|---|---|---|---|

| Nestlé (Venezuela) | Political instability, hyperinflation, currency controls | Transparent reporting, inflation adjustments, currency hedging | Reduced profitability, but maintained operational continuity | Proactive risk management, stakeholder engagement, product adaptation |

| Unilever (Egypt) | Unexpected political upheaval, currency devaluation, supply chain disruptions | Asset impairments, inventory write-downs, foreign exchange loss recognition | Significant financial losses | Limited hedging effectiveness due to unpredictable events |

Ending Remarks

In conclusion, navigating the intricate relationship between political risk and international accounting strategies requires a proactive and multifaceted approach. By understanding the various types of political risk, implementing robust mitigation strategies, and fostering close collaboration between management, auditors, and external stakeholders, multinational corporations can enhance their resilience and safeguard their financial well-being in the face of global uncertainty. The case studies presented underscore the importance of preparedness, adaptability, and a comprehensive understanding of the political landscape in which a company operates. Ultimately, a successful international accounting strategy hinges on anticipating potential risks and developing proactive measures to mitigate their impact.

FAQ Compilation: How Political Risk Affects International Accounting Strategies

What are some examples of political risks that directly impact accounting practices?

Examples include nationalization of assets, changes in tax laws, currency devaluation, trade wars, and political instability leading to disruptions in operations.

How does political risk affect the independence of auditors?

Government pressure, regulatory capture, and threats to auditor safety can all compromise auditor independence and objectivity, potentially leading to biased financial reporting.

What role does insurance play in mitigating political risk?

Political risk insurance can help protect against losses due to events like expropriation, nationalization, or political violence. However, it’s crucial to understand the specific coverage and limitations of such policies.

Can transfer pricing strategies be used to mitigate political risk?

Yes, carefully structured transfer pricing can help minimize the impact of tax policies and currency fluctuations on a company’s profitability across different jurisdictions. However, this must be done in compliance with tax regulations to avoid penalties.

In this topic, you find that How to Evaluate Financial Performance Using Accounting Metrics is very useful.