The Challenges of Standardizing Accounting in the Digital Asset Industry represent a significant hurdle for the continued growth and maturation of this rapidly evolving sector. The inherent volatility, diverse nature, and global regulatory inconsistencies surrounding digital assets—including cryptocurrencies, NFTs, and stablecoins—create a complex landscape for accounting professionals. This necessitates a re-evaluation of traditional accounting frameworks and the development of new, industry-specific standards to ensure transparency, investor confidence, and ultimately, the long-term health of the digital asset market.

Traditional accounting principles struggle to adequately address the unique characteristics of digital assets. For example, the decentralized and often pseudonymous nature of many transactions makes verification of ownership and valuation particularly challenging. Furthermore, the lack of consistent tax regulations across jurisdictions adds another layer of complexity, hindering cross-border transactions and investment. This article will delve into the key challenges, exploring the need for globally harmonized accounting standards and the technological innovations that could help shape the future of digital asset accounting.

Defining Digital Assets and Their Accounting Complexity

The rapid growth of the digital asset industry presents significant challenges to traditional accounting frameworks. The diverse nature of these assets, ranging from cryptocurrencies like Bitcoin and Ethereum to non-fungible tokens (NFTs) and stablecoins pegged to fiat currencies, necessitates a re-evaluation of existing accounting standards. This complexity arises from the unique characteristics of digital assets, which often defy easy categorization under established accounting principles.

The heterogeneity of digital assets significantly impacts their accounting treatment. Traditional accounting principles primarily focus on tangible assets with readily ascertainable values and clear ownership structures. Digital assets, however, often lack these characteristics. For example, cryptocurrencies are decentralized and operate on blockchain technology, making their ownership and valuation complex. NFTs, representing unique digital items, present additional challenges due to their variability and the lack of standardized valuation methods. Stablecoins, designed to maintain a stable value relative to a fiat currency, introduce further complexities related to their underlying collateral and associated risks. This inherent variability makes applying traditional accounting methods difficult and often results in inconsistencies in reporting across different organizations.

Classification of Digital Assets, The Challenges of Standardizing Accounting in the Digital Asset Industry

Classifying digital assets under existing accounting standards (like IFRS or GAAP) is a major hurdle. The question of whether to classify them as assets, liabilities, or equity depends heavily on the specific circumstances and the nature of the asset. For instance, a cryptocurrency held as an investment might be classified as an asset, while a cryptocurrency used as a medium of exchange might be treated differently. Similarly, NFTs held for resale might be classified as inventory, while NFTs held as part of a collection could be considered a long-term asset. The lack of clear guidance on these classifications leads to inconsistencies and makes comparisons between companies difficult.

Valuation and Reporting Challenges

The volatile nature of digital assets presents significant challenges in valuation and reporting. Unlike traditional assets with relatively stable market values, the prices of many digital assets fluctuate dramatically in short periods. Determining the fair value of these assets at any given point in time is therefore challenging. This volatility also complicates the preparation of financial statements, as the reported values of digital assets can change significantly between reporting periods, impacting a company’s overall financial position and performance. Furthermore, the lack of established valuation models specifically for digital assets adds to the complexity. While market prices can be used as a starting point, these prices can be easily manipulated, particularly in less liquid markets. For example, a small number of large trades can significantly impact the reported market price, leading to inaccurate valuations.

Comparative Accounting Treatment Across Jurisdictions

The accounting treatment of digital assets varies significantly across different jurisdictions. There is currently no universally accepted accounting standard for these assets, leading to a patchwork of regulations and interpretations. This lack of harmonization makes cross-border comparisons difficult and can hinder the growth of the digital asset industry.

| Jurisdiction | Cryptocurrency Treatment | NFT Treatment | Stablecoin Treatment |

|---|---|---|---|

| United States (GAAP) | Generally treated as intangible assets, valued at fair value if readily determinable; otherwise, cost basis. | Similar to cryptocurrencies, often intangible assets; valuation challenges exist. | Treatment depends on the underlying collateral; may be treated as cash equivalents or other assets. |

| European Union (IFRS) | Similar to US GAAP; fair value measurement challenges remain prominent. | Guidance is limited; often assessed based on individual circumstances. | Treatment dependent on the nature of the collateral and regulatory classification. |

| Singapore | Specific guidelines are emerging, often mirroring international standards. | Guidance is still evolving; considerations for both tangible and intangible aspects. | Treatment depends on the nature and regulatory status. |

| Japan | Specific regulations are in place; treatment depends on the purpose of holding. | Regulations are developing; valuation methods are still being established. | Regulations are still developing. |

Taxation and Regulatory Hurdles

The lack of globally harmonized tax regulations for digital assets presents a significant challenge to standardizing accounting practices within the industry. The diverse interpretations of digital assets by different tax authorities worldwide lead to inconsistencies in tax treatment, creating complexities for businesses and individuals operating across borders. This lack of clarity significantly impacts the ability to develop consistent and reliable accounting standards.

The inconsistent application of existing tax frameworks to novel digital asset transactions necessitates a nuanced approach to accounting. This section will explore the key challenges posed by taxation and regulation, focusing on the difficulties in determining tax basis, varying capital gains tax approaches, and the complications arising from cross-border transactions.

Tax Basis Determination for Digital Assets

Determining the tax basis of digital assets acquired through various methods presents a considerable challenge. Assets acquired through mining involve significant energy costs and computational resources, making it difficult to establish a precise cost basis. Staking, which involves locking up digital assets to validate transactions, presents a similar challenge; the return on investment (ROI) is not always immediately clear and can be affected by fluctuating market prices. Furthermore, airdrops—the distribution of tokens for free—introduce another layer of complexity, as the fair market value at the time of receipt needs to be determined, which is often volatile and subjective. These inconsistencies make it difficult to accurately reflect the true cost of the assets on financial statements. For example, a miner’s cost basis could include electricity, hardware depreciation, and opportunity costs, making precise calculation challenging. Similarly, the value of staked assets fluctuates constantly, impacting the calculation of ROI and hence, the tax basis. Airdrops, often promotional, lack a clear cost basis and their value is determined at the time of receipt, subject to immediate market fluctuations.

Capital Gains Tax on Digital Asset Trading

Countries employ diverse approaches to taxing capital gains from digital asset trading. Some treat digital assets as property, subjecting them to capital gains taxes similar to traditional assets like stocks. Others classify them as commodities, currencies, or intangible assets, each resulting in a different tax treatment. This lack of uniformity creates significant compliance challenges for businesses and individuals engaging in cross-border transactions. For instance, country A might tax capital gains from Bitcoin at a rate of 15%, while country B might consider it a currency and exempt it from capital gains tax, creating a significant tax advantage or disadvantage depending on the jurisdiction. The classification itself can also be contentious, with some countries considering specific cryptocurrencies as securities, requiring different reporting and taxation than other crypto assets.

Hypothetical Scenario: Cross-Border Digital Asset Taxation

Consider a scenario where an individual residing in Country X, which treats digital assets as property, mines Bitcoin and subsequently sells it to a buyer in Country Y, which classifies Bitcoin as a currency and exempts it from capital gains tax. Country X will tax the capital gains realized by the miner, based on the difference between the cost basis (including mining expenses) and the sale price. However, Country Y might not impose any tax on the buyer, creating an uneven tax landscape. Further complicating matters, if the buyer then sells the Bitcoin to a buyer in Country Z, which has different tax regulations yet again, the tax implications cascade, making a simple transaction incredibly complex to navigate. The lack of international cooperation in defining and taxing digital assets significantly increases the administrative burden and potential for disputes.

Auditing Challenges in the Digital Asset Space

Auditing digital assets presents a unique set of challenges for accounting professionals, stemming from the inherent characteristics of these assets and the rapidly evolving regulatory landscape. The decentralized and often pseudonymous nature of blockchain technology, coupled with the volatility of digital asset prices, significantly complicates the verification of ownership, valuation, and transaction history. This necessitates the development of specialized auditing methodologies and the adoption of robust security protocols to ensure the integrity and reliability of financial statements involving digital assets.

Unique Challenges in Verifying Ownership and Valuation

Auditors face significant hurdles in verifying the ownership and valuation of digital assets. Unlike traditional assets, digital assets are often held in digital wallets, the security and control of which can be complex and vulnerable to hacking or theft. Determining true ownership requires meticulous examination of cryptographic keys, transaction histories, and smart contract code. Furthermore, the volatile nature of digital asset markets makes valuation a particularly challenging task. Traditional valuation methods may not be suitable, and the use of fair value accounting introduces subjectivity and potential for discrepancies. For example, determining the fair value of a non-fungible token (NFT) with unique characteristics requires considering factors beyond simple market price, such as its artistic merit, rarity, and future utility. The lack of standardized valuation models further exacerbates this challenge.

Risks and Vulnerabilities Related to Digital Asset Custody and Security

The custody and security of digital assets pose significant risks. Private keys, which are essential for accessing and controlling digital assets, are susceptible to loss, theft, or compromise. A compromised private key can result in the irreversible loss of assets. Further, exchanges and custodians holding digital assets on behalf of clients face risks of hacking, operational failures, and insider threats. Examples of high-profile exchange hacks, resulting in substantial losses for users, highlight the critical need for robust security measures and stringent audit procedures. These security breaches can lead to misstatements in financial statements and erode investor confidence. Moreover, the decentralized nature of some digital assets makes tracing and recovering stolen assets extremely difficult.

Need for Specialized Expertise and Tools

Auditing digital asset transactions demands specialized expertise and tools. Auditors need a deep understanding of blockchain technology, cryptography, smart contracts, and the regulatory landscape governing digital assets. This includes familiarity with various blockchain platforms, consensus mechanisms, and the intricacies of decentralized finance (DeFi) protocols. Specialized software and analytical tools are crucial for efficiently analyzing large volumes of blockchain data, identifying anomalies, and verifying the accuracy of transactions. The lack of readily available, standardized auditing tools and the scarcity of auditors with the necessary expertise represent significant obstacles to the effective audit of digital assets.

Best Practices for Mitigating Risks in Digital Asset Audits

To mitigate risks associated with digital asset audits, several best practices should be implemented. This includes: thorough due diligence of the client’s digital asset holdings and custody arrangements; verification of the client’s control over private keys and access to digital wallets; independent verification of digital asset balances using blockchain explorers and other publicly available data; application of appropriate valuation methods based on market conditions and asset characteristics; regular review and update of audit procedures to adapt to the rapidly evolving digital asset landscape; and the engagement of experts with specialized knowledge of blockchain technology and digital asset markets. These measures, combined with a strong focus on cybersecurity and data integrity, are crucial for ensuring the reliability and credibility of digital asset audits.

Lack of Standardized Accounting Frameworks

The rapid growth of the digital asset industry has exposed a significant gap: the absence of universally accepted accounting standards. Existing frameworks, designed for traditional assets, struggle to adequately capture the unique characteristics of digital assets, leading to inconsistencies in financial reporting and hindering investor confidence. This lack of standardization creates challenges for businesses operating in this space, as well as for regulators seeking to oversee the industry effectively.

The existing accounting standards, such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP), were developed for tangible assets and traditional financial instruments. They lack the specific guidance needed to address the complexities of digital assets, including their volatility, decentralized nature, and the potential for significant price fluctuations. For instance, IFRS 9 and similar GAAP standards primarily focus on the fair value measurement of financial assets, but the determination of fair value for many digital assets is highly subjective and dependent on the chosen valuation methodology, leading to potential inconsistencies across different companies. This lack of clear guidance results in inconsistent financial reporting and makes it difficult to compare the financial performance of different companies in the digital asset industry.

Limitations of Existing Accounting Standards in Addressing Digital Assets

IFRS and GAAP, while robust for traditional assets, fall short when applied to the dynamic world of digital assets. Their inherent limitations stem from the unique characteristics of digital assets: volatility, decentralized governance, and the lack of a centralized registry for ownership verification. Applying existing frameworks often results in inconsistent valuation methods, making financial statement comparisons unreliable. For example, the treatment of cryptocurrency holdings as either current or non-current assets varies significantly across companies, hindering meaningful financial analysis. Furthermore, the accounting for mining activities and staking rewards lacks clear guidelines, contributing to the overall lack of standardization. The lack of clarity around the recognition of gains and losses further exacerbates the inconsistencies.

The Need for a Globally Recognized Framework for Digital Asset Accounting

The absence of a globally recognized framework for digital asset accounting poses significant risks to the industry’s growth and stability. Inconsistencies in reporting practices undermine investor confidence, making it difficult to attract capital and hindering the development of a mature and regulated market. A globally accepted framework would create a level playing field, enabling better comparability and transparency across businesses. This, in turn, would foster trust among investors and regulators, leading to increased market participation and reduced regulatory uncertainty. The development of such a framework would require international collaboration, involving standard-setters, regulators, industry experts, and technology developers to ensure that the standards are both practical and adaptable to the ever-evolving nature of digital assets.

Efforts Towards Standardized Accounting Practices for Digital Assets

Several organizations are actively involved in developing standardized accounting practices for digital assets. These include standard-setting bodies like the IASB (International Accounting Standards Board) and the FASB (Financial Accounting Standards Board), as well as industry consortia and regulatory bodies. The IASB and FASB are exploring potential amendments to existing standards or the creation of new ones to address the specific challenges posed by digital assets. Industry groups are also contributing by developing best practices and guidance documents, aiming to bridge the gap until formal standards are established. Regulatory bodies are also playing a crucial role by engaging in discussions and developing regulatory frameworks that align with emerging accounting practices. These combined efforts aim to create a more robust and reliable accounting ecosystem for the digital asset industry.

Potential Benefits of Standardized Accounting in Improving Transparency and Trust

The adoption of standardized accounting practices for digital assets would significantly enhance transparency and trust within the industry. This would facilitate more informed investment decisions, attracting greater capital inflows and fostering innovation. Standardized reporting would improve the ability of regulators to monitor and oversee the industry, reducing the risk of market manipulation and fraud. Increased transparency would also benefit businesses by streamlining their financial reporting processes and reducing the cost of compliance. Ultimately, a standardized framework would contribute to the overall maturity and stability of the digital asset industry, leading to greater participation and broader adoption of digital assets in the global economy.

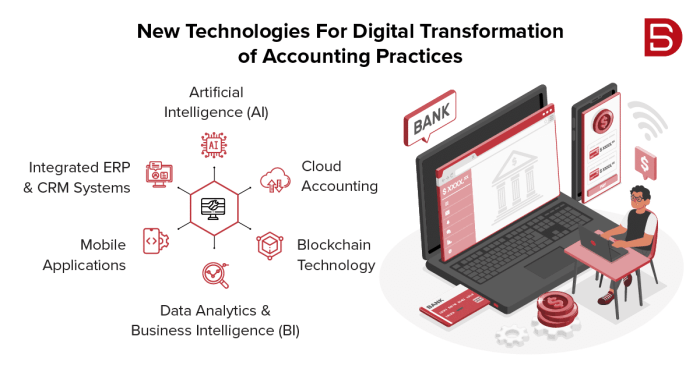

Technological Considerations

The inherent nature of digital assets, often residing on decentralized ledgers like blockchain, presents unique challenges for accounting standardization. Understanding the interplay between blockchain technology, traditional accounting systems, and emerging financial technologies like DeFi is crucial for developing effective accounting practices in this space. The opacity and complexity of these systems necessitate a careful examination of the technological factors influencing the recording and verification of digital asset transactions.

Blockchain technology fundamentally alters how transactions are recorded and tracked. Its distributed, immutable ledger provides a transparent and auditable record of all transactions, potentially enhancing the reliability of accounting data. However, integrating this data into traditional accounting systems, designed for centralized databases, poses significant technical and logistical hurdles. The sheer volume of data, the need for real-time updates, and the lack of standardized data formats all contribute to the integration challenges.

Blockchain Technology’s Role in Transaction Tracking and Auditing

Blockchain’s decentralized and immutable nature offers a significant advantage in auditing digital asset transactions. Every transaction is cryptographically secured and recorded on the blockchain, creating a permanent and verifiable audit trail. This enhances transparency and reduces the risk of fraud or manipulation. Auditors can directly access and verify transaction data on the blockchain, streamlining the audit process and improving the reliability of financial reporting. However, the technical expertise required to access and interpret blockchain data remains a significant barrier. Auditors need specialized skills and tools to navigate the complexities of blockchain technology and ensure the accuracy of their analysis.

Challenges of Integrating Blockchain Data into Traditional Accounting Systems

Integrating blockchain data into existing accounting systems presents several key challenges. First, the sheer volume of data generated by blockchain networks can overwhelm traditional systems, requiring significant upgrades in infrastructure and processing power. Second, the lack of standardized data formats between blockchain platforms and accounting software makes data integration complex and time-consuming. Third, the real-time nature of blockchain transactions necessitates continuous data synchronization, which requires robust and reliable data integration processes. Finally, existing accounting systems are typically designed for centralized databases, while blockchain data is distributed across multiple nodes, demanding a fundamental shift in data management strategies.

Smart Contracts and Decentralized Finance (DeFi) Protocols: Accounting Implications

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, introduce further complexities. The automated nature of smart contracts can lead to rapid and frequent transactions, making it challenging to track and record all activity accurately. Furthermore, the decentralized nature of DeFi protocols, where financial services are offered without intermediaries, creates a fragmented and complex ecosystem. Tracking transactions across various DeFi platforms and protocols requires sophisticated data aggregation and analysis techniques, adding significant complexity to the accounting process. For example, yield farming strategies involving multiple DeFi protocols can generate complex transaction sequences that are difficult to reconcile using traditional accounting methods.

Visual Representation of a Digital Asset Transaction and Accounting Implications

Imagine a flow chart. The process begins with User A initiating a transaction to send digital asset X to User B. This transaction is broadcast to the blockchain network. Nodes on the network validate the transaction, ensuring its legitimacy and adding it to a block. Once the block is added to the blockchain, the transaction is considered final and irreversible. This creates an immutable record on the blockchain, visible to all participants. For accounting purposes, this transaction needs to be recorded in the accounting system of both User A and User B. User A records a debit to the digital asset account and a credit to the recipient account (User B), representing the outflow of asset X. User B records a debit to the digital asset account and a credit to a relevant account (e.g., revenue, investment) reflecting the inflow of asset X. The challenge lies in the real-time integration of the blockchain data into the accounting systems to ensure timely and accurate recording. Any discrepancies between the blockchain record and the accounting records need to be investigated and reconciled, highlighting the complexities of accounting for digital asset transactions.

Impact on Financial Reporting and Transparency

Inconsistent accounting practices within the digital asset industry significantly hinder the reliability and comparability of financial reporting, ultimately eroding investor confidence and market stability. The lack of standardized accounting frameworks leads to a fragmented landscape where diverse methodologies are employed, making it challenging to assess the true financial health and performance of companies operating in this sector. This lack of clarity directly impacts the ability of investors to make informed decisions, potentially leading to misallocation of capital and increased market volatility.

The absence of standardization affects the comparability of financial statements across different companies. Different firms might use varying valuation methods for their digital assets, leading to discrepancies in reported profits, losses, and overall financial position. This makes it difficult for analysts and investors to compare the performance of one company against another, hindering effective market analysis and hindering investment strategies. For example, one company might value its Bitcoin holdings at historical cost, while another uses the fair value method, resulting in vastly different reported asset values and potentially misleading financial statements.

Implications for Investor Confidence

The lack of standardized accounting practices directly undermines investor confidence. When investors lack confidence in the accuracy and reliability of financial reporting, they are less likely to invest in the digital asset industry. This hesitancy can stifle growth and prevent the sector from reaching its full potential. The uncertainty surrounding valuation methods and reporting practices creates a climate of distrust, making it harder for legitimate businesses to attract investment and compete with less transparent actors. The lack of transparency increases the risk of fraud and manipulation, further damaging investor confidence. A robust, standardized accounting framework would alleviate these concerns, attracting greater investment and fostering a more mature and stable market.

Comparability of Financial Statements

Improved accounting standards are crucial for enhancing the comparability of financial statements across different companies in the digital asset industry. Currently, the lack of standardization makes it difficult, if not impossible, to directly compare the financial performance of two companies operating in this sector. This is because companies might use different accounting methods to report their revenues, expenses, and assets, making it difficult to draw meaningful conclusions about their relative success or risk profiles. A unified accounting framework would provide a common baseline for comparison, allowing investors and analysts to make more informed decisions and fostering a more efficient and competitive market.

Enhancing Transparency and Reducing Market Manipulation

Standardized accounting practices would significantly enhance transparency and reduce the potential for market manipulation in the digital asset space. Currently, the lack of clarity around valuation methods and reporting practices creates opportunities for manipulation and misleading reporting. By implementing robust accounting standards, it would become significantly more difficult for companies to artificially inflate their asset values or misrepresent their financial performance. This increased transparency would level the playing field, making it easier for investors to identify legitimate opportunities and avoid fraudulent schemes. For example, standardized reporting requirements for cryptocurrency holdings would make it harder to conceal losses or engage in wash trading, improving the overall integrity of the market.

Recommendations for Improving Financial Reporting Practices

The digital asset industry needs a concerted effort to improve its financial reporting practices. This requires collaboration between industry stakeholders, regulators, and standard-setting bodies. Key recommendations include:

- Development of industry-specific accounting standards that address the unique characteristics of digital assets.

- Establishment of a robust regulatory framework to oversee the implementation and enforcement of these standards.

- Increased investment in education and training to ensure that accountants and auditors have the necessary skills and knowledge to work with digital assets.

- Encouragement of the adoption of best practices in financial reporting, including the use of transparent and verifiable valuation methods.

- Increased collaboration between regulators, standard-setters, and industry players to develop a globally consistent approach to accounting for digital assets.

Final Thoughts: The Challenges Of Standardizing Accounting In The Digital Asset Industry

In conclusion, standardizing accounting practices within the digital asset industry is crucial for fostering trust, transparency, and sustainable growth. While significant challenges remain, including the need for globally recognized frameworks, technological integration, and enhanced regulatory clarity, the potential benefits are substantial. By addressing these issues proactively, the industry can move towards a more mature and robust financial ecosystem, attracting greater institutional investment and paving the way for broader adoption.

Frequently Asked Questions

What are the main differences between accounting for traditional assets and digital assets?

Traditional assets typically have clear ownership records and established valuation methods. Digital assets often lack centralized registries, possess volatile values, and may be subject to unique risks like hacking or loss of private keys, making valuation and ownership verification significantly more complex.

How do stablecoins affect accounting practices?

Stablecoins, designed to maintain a stable value relative to a fiat currency, present unique accounting challenges due to their underlying collateralization mechanisms. Determining the appropriate accounting treatment depends on the specific type of stablecoin and its backing assets.

What role do smart contracts play in the accounting complexities?

Smart contracts automate transactions on blockchains, introducing complexities in tracking and verifying their execution. Auditing smart contracts requires specialized skills and tools to ensure accuracy and transparency in financial reporting.

In this topic, you find that Best Ways to Maintain Financial Transparency in Business is very useful.