How Central Banks Rely on Accounting Data for Monetary Policy Decisions sets the stage for an exploration into the intricate relationship between financial reporting and macroeconomic management. Central banks, the guardians of economic stability, don’t operate in a vacuum; their decisions are profoundly shaped by the vast sea of accounting data that reflects the health of nations and their financial systems. This analysis delves into how this data, ranging from national accounts to individual bank statements, informs crucial monetary policy choices, from inflation targeting to assessments of financial stability.

We will examine the various types of accounting data employed, exploring their strengths and limitations. We’ll also consider how technological advancements, such as big data analytics and machine learning, are transforming the way central banks process and interpret this information, impacting the speed and accuracy of their decision-making. Ultimately, this exploration aims to illuminate the critical role of accounting data in maintaining a stable and prosperous global economy.

The Role of Accounting Data in Monetary Policy

Central banks rely heavily on accurate and timely accounting data to inform their monetary policy decisions. These decisions, aimed at maintaining price stability and promoting sustainable economic growth, are significantly influenced by the overall health and performance of the economy, which is reflected in various accounting metrics. The quality and availability of this data directly impact the effectiveness and precision of monetary policy interventions.

Importance of Accurate and Timely Accounting Data

Accurate and timely accounting data is paramount for effective monetary policy. Delays or inaccuracies can lead to misguided policy responses, potentially exacerbating economic instability. For instance, an underestimation of inflation based on flawed consumer price index (CPI) data could result in insufficient interest rate hikes, leading to further inflationary pressures. Conversely, overestimating economic growth based on inaccurate national accounts data might lead to premature tightening of monetary policy, hindering economic expansion. The reliability of forecasts and models used by central banks is entirely dependent on the underlying data’s integrity. Real-time data, especially during periods of rapid economic change, is crucial for timely intervention.

Types of Accounting Data Used in Monetary Policy

Central banks utilize a wide range of accounting data sources to gain a comprehensive understanding of the economy. This includes:

- National Accounts: These provide a comprehensive overview of a nation’s economic activity, including GDP, consumption, investment, and government spending. Changes in these indicators help central banks assess the overall health of the economy and identify potential risks.

- Financial Statements of Banks: Analyzing bank balance sheets and income statements provides insights into the financial health of the banking sector, a key component of the financial system. This helps central banks monitor credit conditions and assess systemic risks.

- Consumer Price Index (CPI) and Producer Price Index (PPI): These indices track changes in the price levels of goods and services, providing crucial information for inflation monitoring and targeting. Accurate CPI and PPI data are essential for assessing the effectiveness of monetary policy in controlling inflation.

- Trade Data: Imports and exports data help central banks understand the external sector’s contribution to economic growth and assess the impact of exchange rate fluctuations.

- Labor Market Data: Unemployment rates, employment levels, and wage growth are critical indicators of labor market conditions, influencing central bank decisions on interest rates and other policy tools.

Impact of Inconsistent or Inaccurate Accounting Data on Monetary Policy Effectiveness

Inconsistencies or inaccuracies in accounting data can lead to significant distortions in the central bank’s assessment of the economic situation. This can result in inappropriate policy responses, potentially leading to undesirable economic outcomes. For example, if inflation is underestimated due to flawed CPI data, the central bank might not raise interest rates sufficiently, leading to a prolonged period of high inflation and potentially asset bubbles. Conversely, overestimating economic growth based on inaccurate national accounts data could prompt premature monetary tightening, causing a recession. The credibility of the central bank is also at stake when policy decisions are based on flawed data.

Hypothetical Scenario: Consequences of Relying on Flawed Accounting Data

Imagine a scenario where a significant miscalculation in GDP growth occurs due to errors in national accounts data. The central bank, believing the economy is growing rapidly, implements a contractionary monetary policy by raising interest rates. However, the actual economic growth is significantly lower than reported. The resulting higher interest rates stifle investment and consumer spending, leading to a sharp economic downturn and increased unemployment. This hypothetical scenario highlights the potential severity of relying on flawed accounting data in monetary policy decision-making. The consequences can range from minor adjustments in policy to significant economic disruptions.

Inflation Measurement and Accounting Data

Central banks rely heavily on accounting data to understand and predict inflation, a key factor in their monetary policy decisions. Accurate inflation measurement is crucial for maintaining price stability, a primary goal of most central banks. The integration of accounting data into inflation forecasting models is a complex process, involving a variety of economic indicators and statistical techniques.

Accounting data provides the raw material for constructing measures of inflation and assessing its underlying drivers. Various metrics contribute to a comprehensive picture of inflationary pressures within an economy. The selection and weighting of these metrics often vary depending on the specific economic context and the central bank’s chosen policy framework.

Methods of Incorporating Accounting Data into Inflation Forecasting

Central banks employ sophisticated econometric models to incorporate accounting data into their inflation forecasts. These models typically incorporate various accounting metrics as input variables, often alongside other economic indicators like unemployment rates, commodity prices, and exchange rates. For example, a common approach involves using Vector Autoregression (VAR) models to analyze the interdependencies between different economic variables, including those derived from accounting data. These models help forecast inflation by considering the lagged effects of these variables and their dynamic interactions. Furthermore, Bayesian methods are increasingly used to incorporate prior knowledge and expert judgment into the forecasting process, improving the accuracy and reliability of the forecasts. The specific techniques and models employed vary across central banks, reflecting differences in data availability, institutional preferences, and economic structures.

Contribution of Different Accounting Metrics to Inflation Assessments

Gross Domestic Product (GDP) data, a core component of national accounts, provides insights into the overall health of the economy and its capacity for inflationary pressure. Rapid GDP growth, particularly if accompanied by low unemployment, can indicate potential inflationary risks. Consumer Price Indices (CPI), which track the average change in prices paid by consumers for a basket of goods and services, are the most commonly used direct measures of inflation. Producer Price Indices (PPI), which track changes in the prices received by domestic producers for their output, provide an early warning signal of potential future consumer price increases. Other relevant accounting metrics include wage data, which reflects labor costs and their impact on prices, and import/export price indices, reflecting the influence of global price changes on domestic inflation.

Comparative Analysis of Inflation Targeting Using Accounting Data, How Central Banks Rely on Accounting Data for Monetary Policy Decisions

The use of accounting data for inflation targeting differs across countries due to variations in institutional frameworks, economic structures, and data availability. For instance, the European Central Bank (ECB) emphasizes a broader range of indicators, including harmonized indices of consumer prices (HICPs) across the Eurozone, to ensure consistent inflation measurement across diverse member states. In contrast, the US Federal Reserve (FED) may place greater weight on domestic GDP growth and employment data in its assessment of inflation risks. The Bank of England, similarly, integrates a range of data including various measures of wage growth and services inflation, acknowledging the unique characteristics of the UK economy. These differences highlight the context-specific nature of inflation targeting and the adaptive use of accounting data to meet the unique challenges of each economic environment.

Key Accounting Data Used by Major Central Banks for Inflation Monitoring

| Central Bank | Key Accounting Data | Frequency | Purpose |

|---|---|---|---|

| US Federal Reserve (FED) | GDP, CPI, PCE (Personal Consumption Expenditures), PPI, Employment Cost Index | Monthly, Quarterly | Assess overall economic activity, inflation trends, and labor market conditions |

| European Central Bank (ECB) | HICP (Harmonised Index of Consumer Prices), GDP, Unemployment Rate, M3 (Broad Money Supply) | Monthly, Quarterly | Monitor inflation across the Eurozone, assess economic growth, and monitor monetary aggregates |

| Bank of Japan (BOJ) | CPI, GDP, Tankan (Short-Term Economic Survey of Enterprises), Unemployment Rate | Monthly, Quarterly | Assess inflation trends, monitor economic activity, and gauge business sentiment |

Assessing Financial Stability through Accounting Data

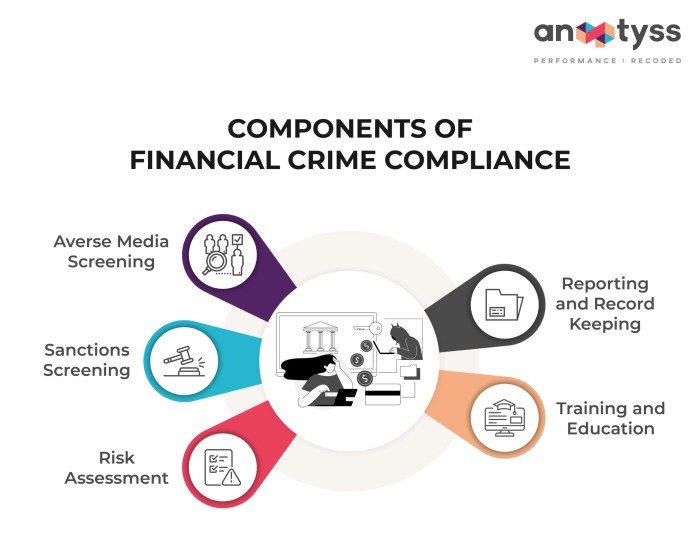

Central banks play a crucial role in maintaining financial stability within an economy. A significant part of this responsibility involves monitoring the health of financial institutions, and accounting data provides a critical lens through which to assess systemic risk and potential vulnerabilities. By analyzing financial statements and other accounting information, central banks can gain valuable insights into the resilience of the financial system and identify early warning signs of potential crises.

The use of accounting data for financial stability assessment is multifaceted. It allows central banks to scrutinize individual institutions, identify emerging trends across the sector, and ultimately contribute to the development of proactive and preventative measures to mitigate risks.

Key Financial Ratios and Accounting Metrics for Systemic Risk Assessment

Central banks employ a range of financial ratios and accounting metrics derived from publicly available financial statements to gauge the financial health of banks and other financial institutions. These metrics provide a quantitative assessment of solvency, liquidity, and leverage, offering critical insights into an institution’s ability to withstand economic shocks. A holistic approach, considering multiple metrics simultaneously, is essential for a comprehensive understanding of systemic risk.

For example, the capital adequacy ratio (CAR), a key metric reflecting a bank’s capital relative to its risk-weighted assets, is closely monitored. A low CAR suggests potential vulnerability to losses. Similarly, liquidity ratios, such as the loan-to-deposit ratio, help assess a bank’s ability to meet its short-term obligations. High levels of leverage, indicated by metrics like the debt-to-equity ratio, signal increased vulnerability to economic downturns. Other important metrics include non-performing loans (NPLs) as a percentage of total loans, which highlight the quality of a bank’s loan portfolio, and the net interest margin, providing insight into the bank’s profitability and ability to absorb losses.

Examples of Accounting Data Used to Detect Early Warning Signs of Financial Crises

The 2008 global financial crisis vividly demonstrated the importance of utilizing accounting data to identify early warning signs. Prior to the crisis, many institutions exhibited increasingly high levels of leverage and complex, opaque financial instruments, which were not fully captured by traditional accounting metrics. The rapid growth of subprime mortgages and the subsequent surge in mortgage defaults, reflected in rising NPLs, were clear warning signals that were unfortunately not adequately addressed. Similarly, the rapid expansion of off-balance-sheet activities, often obscured in traditional accounting reports, contributed to the severity of the crisis. Post-crisis regulatory reforms emphasized the importance of improved accounting transparency and more comprehensive risk assessment frameworks. The subsequent use of accounting data to detect emerging risks has become significantly more sophisticated.

Flowchart Illustrating the Process of Using Accounting Data for Financial Stability Analysis

The process of using accounting data for financial stability analysis can be represented by a flowchart.

The flowchart would begin with the Data Collection stage, where central banks gather financial statements (balance sheets, income statements, cash flow statements) and other relevant accounting data from banks and other financial institutions. This data undergoes Data Cleaning and Standardization, ensuring consistency and accuracy. Next, the Ratio Calculation and Metric Extraction stage involves computing key financial ratios and metrics, such as those discussed above. This is followed by Analysis and Risk Assessment, where the calculated ratios and metrics are analyzed to assess the financial health of individual institutions and the overall financial system. This stage might involve stress testing and scenario analysis. Finally, the Policy Recommendation stage utilizes the findings to inform monetary policy decisions, regulatory actions, and other interventions aimed at maintaining financial stability. The entire process is iterative, with continuous monitoring and updates as new data becomes available.

Check what professionals state about The Best Cloud-Based Accounting Tools for Entrepreneurs and its benefits for the industry.

The Impact of Accounting Standards on Monetary Policy

Central banks rely heavily on accounting data to formulate and implement monetary policy. The accuracy and reliability of this data, however, are significantly influenced by the prevailing accounting standards. Changes in these standards can ripple through the financial system, impacting the very metrics central banks use to assess economic health and guide their decisions. Understanding this interplay is crucial for effective monetary policy.

Changes in accounting standards directly affect the interpretation of accounting data used by central banks. For instance, a shift in how assets are valued (e.g., from historical cost to fair value) can drastically alter the reported balance sheets of banks and corporations. This, in turn, influences calculations of key monetary policy indicators like credit growth, leverage ratios, and overall financial stability. A move towards more stringent loan loss provisioning requirements, for example, could lead to a sudden contraction in reported bank capital, potentially prompting central banks to intervene to prevent a credit crunch. Conversely, relaxed accounting standards might mask underlying financial vulnerabilities, delaying necessary central bank action.

Challenges and Adjustments Faced by Central Banks Due to Evolving Accounting Standards

The evolution of accounting standards presents significant challenges for central banks. Adapting to new methodologies requires significant resources and expertise. Central banks need to update their statistical models, retrain their analysts, and develop new data collection and processing methods. Furthermore, there’s a risk of temporary data inconsistencies during the transition period between different accounting standards, making accurate assessments difficult. This necessitates careful planning and coordination between central banks and accounting standard-setters to ensure a smooth transition and minimize disruptions to monetary policy. Central banks may also need to adjust their forecasting models to account for the changes in accounting practices, which can be a complex and time-consuming process. For example, the adoption of IFRS 9 (International Financial Reporting Standard 9) significantly altered how banks account for expected credit losses, requiring central banks to revise their models for assessing bank capital adequacy and systemic risk.

Impact of Different Accounting Frameworks on the Accuracy and Reliability of Monetary Policy Inputs

Different accounting frameworks can lead to variations in the reported financial data, impacting the accuracy and reliability of monetary policy inputs. For instance, comparing economic data across countries using different Generally Accepted Accounting Principles (GAAP) can be challenging. This can hinder accurate assessment of cross-border capital flows and inflation rates. Furthermore, differences in accounting practices can influence the effectiveness of monetary policy tools. For example, if one country uses a more conservative accounting approach compared to another, the monetary policy response to a similar economic shock might differ significantly. The divergence in accounting standards between US GAAP and IFRS is a prime example of this challenge. A central bank trying to assess the overall health of the global economy faces a significant hurdle in comparing financial statements prepared under these different frameworks.

Effects of Inconsistent Accounting Standards Across Countries on International Monetary Cooperation

Inconsistencies in accounting standards across countries pose a significant challenge to international monetary cooperation. The lack of comparability in financial data makes it difficult for central banks to coordinate their monetary policies effectively. This can lead to inconsistencies in the global financial system, potentially amplifying economic shocks and hindering efforts to maintain global financial stability. For instance, differences in the treatment of derivatives or the recognition of impairment losses could lead to differing assessments of financial risk across jurisdictions. This lack of harmonization complicates the work of international organizations like the Bank for International Settlements (BIS) in monitoring global financial stability and coordinating responses to systemic risks. International efforts to converge accounting standards, such as the ongoing push towards IFRS adoption globally, are crucial to address this issue and facilitate greater international monetary cooperation.

Data Limitations and Challenges: How Central Banks Rely On Accounting Data For Monetary Policy Decisions

The reliance of central banks on accounting data for monetary policy decisions is not without its limitations. While accounting data provides a valuable snapshot of the economy, inherent biases, data gaps, and inconsistencies can significantly affect the accuracy and reliability of policy conclusions drawn from it. Understanding these limitations is crucial for effective monetary policy implementation.

Accounting data, by its nature, is subject to various biases. For instance, the use of different accounting standards across countries and sectors can lead to inconsistencies in reported financial information, making cross-sectional comparisons difficult. Furthermore, the inherent time lag in the release of accounting data can hinder timely policy responses to economic shocks. The focus on historical data also presents a challenge, as it may not fully capture the dynamics of a rapidly evolving economic landscape. Finally, intentional or unintentional misreporting by firms can introduce inaccuracies into the overall data pool.

Potential Biases in Accounting Data

Several factors contribute to potential biases in accounting data. One significant issue is the use of different accounting standards globally. International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) have notable differences, leading to variations in how similar transactions are reported. This makes comparisons between companies using different standards problematic for monetary policy analysis. Furthermore, the inherent subjectivity in certain accounting judgments, such as the valuation of assets or the recognition of liabilities, can introduce bias. Management’s incentives to manipulate earnings also present a risk, affecting the reliability of reported figures. Finally, the inherent limitations of backward-looking data can create a mismatch with the need for timely information for effective monetary policy responses.

Challenges in Data Availability, Timeliness, and Comparability

The availability, timeliness, and comparability of accounting data pose significant challenges for monetary policy. Data for smaller firms or those in less-developed economies may be scarce or unreliable, leading to an incomplete picture of the overall economic landscape. The time lag between the occurrence of economic events and the reporting of the corresponding accounting data can delay policy responses, reducing their effectiveness. Furthermore, inconsistencies in accounting standards and reporting practices across different sectors and countries hinder the ability to make meaningful comparisons and draw accurate conclusions. The lack of standardized reporting for certain crucial economic indicators also poses a challenge.

Methods for Mitigating the Impact of Data Limitations

Central banks employ several strategies to mitigate the impact of data limitations. These include using statistical techniques to adjust for known biases, employing data triangulation (comparing data from multiple sources), and using advanced econometric models to account for data imperfections. Data validation and quality checks are routinely performed to ensure accuracy and consistency. Furthermore, collaboration with other data providers, such as tax authorities and credit bureaus, enhances the available information and strengthens the overall analysis. The development and implementation of improved accounting standards, promoting greater transparency and comparability, also play a crucial role.

Alternative Data Sources for Monetary Policy Analysis

To complement traditional accounting data, central banks increasingly utilize alternative data sources.

- High-frequency data from payment systems: These data provide real-time insights into economic activity, offering a more timely picture than traditional accounting data.

- Credit card and debit card transactions: These provide valuable information on consumer spending patterns and economic sentiment.

- Satellite imagery: This can provide insights into economic activity in remote areas or industries not fully captured by traditional accounting data, such as agricultural production or construction activity.

- Social media sentiment analysis: Analyzing social media posts can provide insights into consumer and business confidence, potentially indicating future economic trends.

- Web scraping and online data: Gathering data from online sources like e-commerce platforms and job boards can provide real-time indicators of economic activity.

Technological Advancements and Data Analysis

The integration of technological advancements into central banking operations is revolutionizing how monetary policy decisions are made. The sheer volume and variety of data available, coupled with increasingly sophisticated analytical tools, are allowing central banks to gain a more nuanced and comprehensive understanding of the economy. This improved understanding translates into more effective and timely policy responses.

The use of big data analytics and machine learning is significantly altering the way central banks utilize accounting data. These technologies allow for the processing and analysis of massive datasets far exceeding the capabilities of traditional methods, uncovering hidden patterns and relationships that would otherwise remain undetected. This enhanced analytical capacity provides central banks with a more robust foundation for informed decision-making.

Benefits and Risks of Advanced Data Analysis

The benefits of incorporating advanced data analysis techniques are substantial. These technologies enhance the speed and accuracy of monetary policy decision-making by providing more timely and comprehensive insights into economic conditions. For example, machine learning algorithms can identify early warning signs of financial instability by analyzing vast amounts of accounting data from various sources, allowing for preemptive policy adjustments. Furthermore, these techniques can improve the accuracy of inflation forecasts by incorporating a wider range of data points and identifying non-linear relationships that traditional methods might miss. However, the use of these advanced techniques also presents potential risks. The complexity of these algorithms can make it challenging to interpret their results and understand the underlying assumptions. Data biases can lead to inaccurate or misleading conclusions, and the reliance on complex models can create vulnerabilities to unforeseen events or data breaches. Robust validation and careful oversight are crucial to mitigate these risks.

Examples of Enhanced Speed and Accuracy

Several central banks are already leveraging these advancements. The Bank of England, for example, uses machine learning to improve its forecasting models for inflation and GDP growth, incorporating a wider range of data sources than previously possible. The European Central Bank is exploring the use of big data analytics to monitor financial stability, identifying potential risks within the banking sector more effectively. These advancements allow for quicker identification of emerging economic trends, enabling more timely and targeted policy interventions. For instance, the ability to quickly detect early signs of a credit crunch allows for the implementation of proactive measures to prevent a full-blown financial crisis.

Comparison of Traditional and Modern Data Analysis Methods

| Feature | Traditional Methods | Modern Techniques (Big Data & Machine Learning) |

|---|---|---|

| Data Volume | Limited to structured, readily available data | Handles massive, unstructured and structured datasets |

| Analysis Techniques | Regression analysis, time series analysis, etc. | Machine learning algorithms (e.g., neural networks, random forests), deep learning |

| Processing Speed | Relatively slow, often manual | High-speed processing, automation capabilities |

| Insights Generated | Limited to established relationships | Identifies complex patterns, non-linear relationships, and anomalies |

Epilogue

In conclusion, the reliance of central banks on accounting data for monetary policy decisions is undeniable. While challenges related to data accuracy, timeliness, and comparability exist, the ongoing advancements in data analytics and the increasing sophistication of economic modeling are mitigating these limitations. The future of monetary policy hinges on the continued refinement of these data-driven approaches, ensuring that central banks possess the tools necessary to navigate the complexities of the modern global economy and maintain economic stability for all.

FAQ Summary

What are the potential consequences of using outdated accounting data?

Outdated data can lead to inaccurate assessments of economic conditions, resulting in ineffective or even counterproductive monetary policy decisions. This could exacerbate economic fluctuations, leading to higher inflation or deeper recessions.

How do central banks address the issue of data inconsistencies across different countries?

Central banks often collaborate internationally to harmonize data collection methods and standards. They also employ sophisticated statistical techniques to adjust for inconsistencies and improve the comparability of data across jurisdictions.

What role does auditing play in ensuring the reliability of accounting data used by central banks?

Independent audits provide an essential layer of verification, ensuring the accuracy and reliability of the accounting data used in monetary policy decisions. These audits help identify and address potential biases or errors.

Are there ethical considerations related to the use of accounting data in monetary policy?

Yes, ethical considerations include ensuring data privacy, preventing manipulation of data, and maintaining transparency in the use of accounting information for policy decisions. Maintaining public trust is paramount.