How Globalization Has Changed Financial Reporting Frameworks is a topic of increasing relevance in our interconnected world. The rise of multinational corporations and the need for consistent financial information across borders have fundamentally reshaped accounting practices. This exploration delves into the evolution of international accounting standards, the impact on financial statement presentation, the challenges faced by auditors, the influence on corporate governance, and the role of technological advancements. We will examine how globalization has driven the need for greater transparency, comparability, and harmonization in financial reporting, while also highlighting the persistent challenges of navigating diverse regulatory landscapes and cultural nuances.

The shift towards International Financial Reporting Standards (IFRS) is a key example of globalization’s impact. This convergence, however, has not been without its challenges, particularly for countries transitioning from national Generally Accepted Accounting Principles (GAAP). The differences between IFRS and US GAAP, for instance, necessitate careful consideration and adaptation by companies operating globally. Furthermore, the increased scrutiny on corporate governance and the integration of technology, such as XBRL and data analytics, have further transformed the financial reporting landscape.

The Rise of International Accounting Standards

Globalization, with its interconnected markets and increased cross-border transactions, has significantly impacted the need for consistent and comparable financial reporting. The resulting demand for a universally accepted set of accounting standards led to the rise of the International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB). This move towards standardization aimed to enhance transparency, improve investor confidence, and facilitate cross-border investment.

The impact of globalization on the adoption of IFRS has been profound. Many countries have either fully adopted IFRS or are in the process of converging their national Generally Accepted Accounting Principles (GAAP) towards IFRS. This adoption is driven by the desire to attract foreign investment, integrate with global capital markets, and enhance the comparability of financial statements across jurisdictions. The European Union, for example, mandated IFRS adoption for publicly listed companies, demonstrating the significant influence globalization has had on accounting standard setting.

Challenges of IFRS Adoption

Transitioning from national GAAP to IFRS presents numerous challenges for countries. These challenges often include the need for significant changes in accounting systems, training of accounting professionals, and the interpretation and application of complex IFRS standards. The cost of implementation can be substantial, particularly for smaller companies with limited resources. Furthermore, differences in legal and cultural contexts can create complexities in adapting IFRS to a specific national environment. For instance, a country with a strong emphasis on conservatism in its accounting practices might find it challenging to fully embrace the principles-based approach of IFRS, which allows for more professional judgment. Resistance from established accounting professionals accustomed to national GAAP also presents a hurdle.

Comparison of IFRS and US GAAP

While both IFRS and US GAAP aim to provide a fair presentation of financial information, key differences exist. IFRS is generally considered a principles-based system, providing broad guidelines that allow for more professional judgment in application. US GAAP, on the other hand, is often described as a rules-based system, with more detailed and specific requirements. This difference can lead to variations in financial reporting outcomes, even when the underlying economic transactions are the same. The impact of globalization is evident in the ongoing efforts to reduce these differences, with both IASB and the Financial Accounting Standards Board (FASB) collaborating on convergence projects. However, complete harmonization remains elusive due to fundamental differences in philosophical approaches.

Revenue Recognition under IFRS and US GAAP

The differences between IFRS and US GAAP are particularly apparent in the area of revenue recognition. Before 2018, significant variations existed, leading to inconsistencies in how companies reported revenue across jurisdictions. However, the adoption of IFRS 15 and ASC 606 (the equivalent US GAAP standard) has largely addressed this issue by converging the core principles of revenue recognition. Despite this convergence, subtle differences still remain in the application of the standards.

| Criterion | IFRS 15 | ASC 606 | Key Difference |

|---|---|---|---|

| Identification of Performance Obligations | Distinct goods or services promised to a customer | Distinct goods or services promised to a customer | Minor differences in application guidance |

| Transaction Price | Considered at contract inception | Considered at contract inception | Similar approach, with slight differences in variable consideration treatment |

| Allocation of Transaction Price | Based on relative stand-alone selling prices | Based on relative stand-alone selling prices | Similar approach, minor differences in application guidance |

| Transfer of Control | Key indicator of revenue recognition | Key indicator of revenue recognition | Minor differences in interpretation and application |

Impact on Financial Statement Presentation

Globalization has profoundly reshaped the presentation of financial statements, demanding greater consistency, transparency, and comparability across international borders. The rise of international accounting standards, like IFRS, has been a key driver, pushing companies to adopt standardized formats and disclosures to cater to a wider range of investors and stakeholders with varying financial literacy and regulatory expectations. This shift necessitates a more nuanced approach to financial reporting, moving beyond simply complying with local regulations.

The influence of globalization on financial statement presentation is evident in the increased adoption of standardized formats. Companies are increasingly presenting their financial statements according to internationally recognized standards, ensuring that investors worldwide can readily understand and compare their performance. This facilitates cross-border investments and enhances the efficiency of capital markets. For example, the adoption of IFRS by many companies globally has led to a more consistent presentation of items like revenue recognition, inventory valuation, and intangible assets. This standardization minimizes the need for extensive reconciliation efforts and facilitates more efficient investment decisions.

Adaptation to Diverse Stakeholder Needs

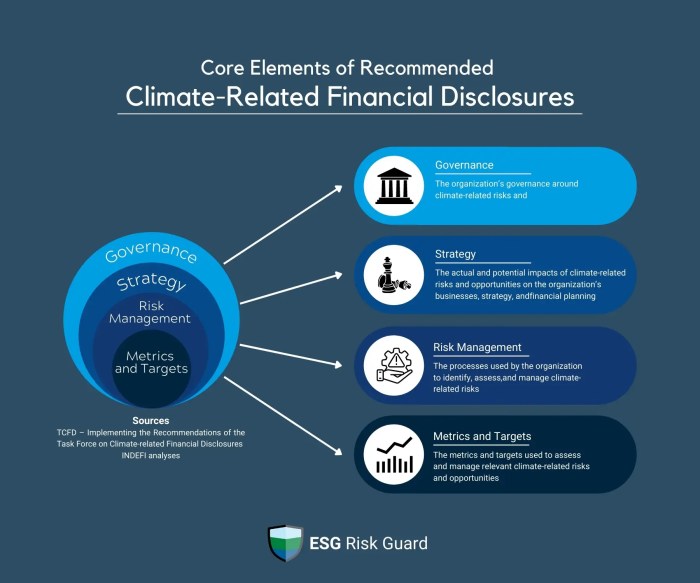

Companies adapt their financial reporting to meet the needs of diverse international stakeholders by providing detailed disclosures tailored to specific regional and investor preferences. This might involve providing supplementary information alongside the core financial statements, such as country-specific breakdowns of revenue, expenses, and assets. Further, companies might translate their financial statements into multiple languages, or provide summaries of key financial metrics in local currencies. For instance, a multinational corporation operating in both the US and Japan might present its financial statements according to US GAAP alongside a reconciliation to IFRS to cater to the diverse investor base and regulatory requirements of both markets. Furthermore, increased emphasis on Environmental, Social, and Governance (ESG) reporting reflects the growing demand from investors and stakeholders for information beyond traditional financial metrics.

Enhanced Transparency and Comparability

Globalization has significantly increased the importance of transparency and comparability in financial reporting. Investors now have access to a wider range of financial information from companies around the world, and they require a consistent basis for comparing performance and assessing risk. Transparency is achieved through clear and concise disclosures, avoiding ambiguity and promoting accurate interpretation of financial data. Comparability is achieved through the use of standardized accounting principles and reporting formats. The increased scrutiny from international investors and regulatory bodies has encouraged companies to enhance their disclosure practices and adopt best practices for financial reporting. This leads to greater accountability and reduces information asymmetry between companies and their stakeholders.

Sample Global Financial Statement

A sample financial statement incorporating best practices for global reporting would include:

| Line Item | Amount (in USD) | Notes |

|---|---|---|

| Revenue | 100,000,000 | Breakdown by geographic region provided in Note 1 |

| Cost of Goods Sold | 60,000,000 | Detailed breakdown of manufacturing costs in Note 2 |

| Gross Profit | 40,000,000 | |

| Operating Expenses | 20,000,000 | Explanation of significant operating expenses in Note 3 |

| Operating Income | 20,000,000 | |

| Net Income | 15,000,000 | Includes tax expense and other comprehensive income details in Note 4 |

Note: This is a simplified example. A complete financial statement would include a balance sheet, statement of cash flows, and comprehensive notes to the financial statements, complying with IFRS or other relevant international standards.

Influence on Auditing and Assurance: How Globalization Has Changed Financial Reporting Frameworks

Globalization has profoundly impacted the auditing profession, creating both opportunities and significant challenges. The increasing interconnectedness of businesses and the rise of international accounting standards necessitate a more complex and nuanced approach to auditing, demanding greater expertise and coordination across borders. Auditors now navigate a multifaceted landscape where consistency and comparability of financial information are paramount.

The harmonization of accounting standards, primarily driven by the adoption of International Financial Reporting Standards (IFRS), has aimed to enhance comparability of financial statements globally. However, this harmonization doesn’t eliminate all differences. Auditors still encounter variations in regulatory frameworks, legal environments, and enforcement mechanisms across jurisdictions, leading to complexities in the audit process. Moreover, the growing prevalence of cross-border transactions and multinational operations introduces additional layers of complexity, requiring auditors to possess a deep understanding of diverse business models and legal structures.

International Auditing Standards and Consistency

International Standards on Auditing (ISAs) play a critical role in establishing a common framework for audit quality globally. These standards provide a consistent set of guidelines and procedures that auditors follow regardless of the country in which they operate or the type of entity they audit. By promoting a consistent approach to auditing, ISAs aim to enhance the reliability and credibility of financial statements across borders, fostering greater investor confidence in international capital markets. The adherence to ISAs, however, relies heavily on effective enforcement and regulatory oversight by national accounting bodies, and variations in the level of enforcement can still lead to discrepancies in audit quality across different jurisdictions. For example, a rigorous enforcement of ISAs in one country might contrast sharply with a less stringent approach in another, potentially affecting the reliability of audits performed in those differing jurisdictions.

Impact of Cross-Border Listings and Multinational Operations on Audit Procedures

Companies with cross-border listings or multinational operations present unique challenges for auditors. The audit process must consider the complexities of consolidating financial statements from various subsidiaries operating under different accounting standards and regulatory environments. Auditors must coordinate their work across multiple jurisdictions, potentially involving multiple audit teams and a complex network of communication and data sharing. This necessitates the use of advanced technology and sophisticated risk assessment methodologies to manage the increased complexity and potential risks associated with these types of operations. For example, a multinational corporation with subsidiaries in several countries requires the lead auditor to coordinate and review the work of local auditors, ensuring consistency and adherence to both ISAs and local regulations. This process is far more demanding than auditing a purely domestic entity.

Potential Audit Risks Associated with Global Operations

The globalization of business activities introduces a range of potential audit risks. Effective risk management is crucial for maintaining audit quality and mitigating potential issues.

- Increased Complexity of Financial Statements: Consolidating financial information from multiple subsidiaries operating under diverse accounting standards and regulatory frameworks increases the complexity of the audit process and the potential for errors or misstatements.

- Foreign Exchange Risk: Fluctuations in exchange rates can significantly impact the financial statements of multinational corporations, requiring auditors to carefully assess and account for these risks.

- Regulatory Differences: Variations in accounting standards, legal frameworks, and enforcement mechanisms across jurisdictions create challenges for auditors in ensuring compliance and consistency.

- Fraud Risk: The increased complexity and opacity of global operations can increase the opportunities for fraud, requiring auditors to employ enhanced fraud detection and prevention techniques.

- Operational Risks: Difficulties in accessing information, coordinating audit procedures across multiple jurisdictions, and managing communication across different teams can lead to operational inefficiencies and increased risk.

- Data Security and Privacy: The handling of sensitive financial data across multiple jurisdictions necessitates robust data security and privacy protocols to comply with various data protection regulations.

Globalization and Corporate Governance

Globalization has profoundly impacted corporate governance practices, creating both opportunities and challenges for businesses operating in an increasingly interconnected world. The rise of multinational corporations and cross-border investments necessitates a harmonized approach to corporate governance, ensuring transparency, accountability, and investor protection across diverse jurisdictions. However, the lack of universally accepted standards and the varying legal and cultural contexts present significant hurdles.

The influence of globalization on corporate governance is multifaceted. Increased capital mobility and access to international markets incentivize companies to adopt higher standards of governance to attract foreign investment. Conversely, the complexity of operating across different legal and regulatory frameworks requires businesses to navigate a diverse landscape of corporate governance codes and expectations. This can lead to inconsistencies in practice and potentially hinder the comparability of financial reporting across nations.

Variations in Corporate Governance Codes and their Impact on Financial Reporting Quality

Corporate governance codes vary significantly across countries, reflecting differing legal traditions, cultural norms, and stakeholder priorities. For instance, the shareholder-centric model prevalent in the United States, emphasizing maximizing shareholder value, contrasts sharply with the stakeholder model adopted in many European countries, which considers the interests of employees, customers, and the wider community. These differing approaches influence the focus and content of financial reporting. A shareholder-centric model may prioritize short-term financial performance metrics, while a stakeholder model might include broader environmental, social, and governance (ESG) disclosures. This diversity can complicate cross-border comparisons of financial statements and necessitates a careful understanding of the specific governance framework within which a company operates. For example, the detailed reporting requirements mandated under the Sarbanes-Oxley Act (SOX) in the US are not mirrored in many other jurisdictions, leading to variations in the level of transparency and accountability.

The Role of International Organizations in Promoting Good Corporate Governance

International organizations play a crucial role in fostering good corporate governance practices globally. The Organisation for Economic Co-operation and Development (OECD), for example, has developed Principles of Corporate Governance that provide a framework for best practices. Similarly, the International Organization of Securities Commissions (IOSCO) works to promote cooperation and information sharing among securities regulators worldwide, contributing to greater harmonization of corporate governance standards. These organizations encourage the adoption of robust corporate governance structures, promoting transparency, accountability, and investor protection across borders. Their influence is significant in guiding national regulatory bodies and shaping corporate behavior, particularly in developing economies where strong governance frameworks may be lacking. The work of these organizations helps to level the playing field, creating a more equitable and efficient global market.

The Relationship Between Strong Corporate Governance and Improved Financial Reporting Quality

Strong corporate governance is inextricably linked to improved financial reporting quality. Independent boards, robust internal controls, and effective audit committees are crucial in ensuring the accuracy and reliability of financial statements. A strong governance structure reduces the risk of financial reporting fraud and manipulation, enhancing investor confidence and promoting market stability. Companies with strong governance frameworks tend to attract higher valuations and lower cost of capital, demonstrating the tangible benefits of adhering to high standards. Conversely, weak governance can lead to accounting irregularities, misleading disclosures, and ultimately, investor losses. The Enron and WorldCom scandals serve as stark reminders of the devastating consequences of poor corporate governance and their impact on the integrity of financial reporting. These cases highlighted the need for stronger regulatory oversight and a renewed focus on ethical business practices.

Technological Advancements and Financial Reporting

The globalization of financial markets has significantly accelerated the adoption and development of technology in financial reporting. This integration has revolutionized how companies prepare, audit, and analyze financial information, fostering greater transparency and efficiency in a globally interconnected environment. The impact spans from data collection and processing to the dissemination and analysis of financial statements, creating both opportunities and challenges.

Technological advancements, particularly in areas like XBRL and data analytics, have dramatically reshaped the landscape of global financial reporting. The increased volume and complexity of financial data necessitate sophisticated tools for processing and interpretation, leading to the adoption of technologies that streamline these processes and enhance accuracy. Furthermore, the need for consistent and comparable financial reporting across borders has fueled the development of standardized data formats and reporting methodologies.

XBRL and Data Analytics in Financial Reporting

Extensible Business Reporting Language (XBRL) is a crucial technology enabling the electronic exchange of financial information. By tagging financial data with specific meanings, XBRL facilitates the automated processing and analysis of financial statements. This standardization allows for easier comparison of financial data across companies and jurisdictions, enhancing the quality and comparability of global financial reporting. Data analytics, in turn, leverage this structured data to identify trends, anomalies, and insights that might otherwise be missed through manual review. Sophisticated algorithms can detect potential fraud, assess credit risk more effectively, and provide valuable insights for investment decisions. For example, a multinational corporation using XBRL can automatically consolidate financial statements from various subsidiaries located around the world, significantly reducing the time and resources needed for this complex process. The resulting data can then be analyzed using data analytics tools to identify performance trends and areas for improvement across different geographical regions.

Benefits and Challenges of Technology in Financial Reporting

The benefits of using technology in financial reporting are substantial. Improved efficiency and accuracy in data processing lead to faster reporting cycles and reduced costs. Enhanced data analysis capabilities allow for more informed decision-making by investors, regulators, and management. Furthermore, technology facilitates greater transparency and comparability of financial information across borders, fostering greater trust and confidence in global financial markets. However, challenges also exist. The implementation of new technologies requires significant upfront investment in software, training, and infrastructure. Data security and privacy concerns are paramount, requiring robust cybersecurity measures to protect sensitive financial information. Moreover, the complexity of some technologies can create a skills gap, requiring specialized expertise to effectively utilize these tools. Maintaining data integrity and ensuring accuracy are also crucial considerations, necessitating rigorous quality control procedures.

Technology Facilitating Cross-Border Financial Reporting and Data Sharing

Technology plays a vital role in simplifying cross-border financial reporting and data sharing. XBRL, as previously mentioned, facilitates the seamless exchange of financial information across different jurisdictions. Cloud-based platforms enable secure data storage and access from various locations, making collaboration among global teams easier. Automated translation tools can assist in overcoming language barriers, ensuring that financial information is readily understandable across different cultures and languages. For instance, a company with operations in multiple countries can utilize cloud-based financial reporting software to consolidate financial data from all its subsidiaries, generating consolidated financial statements that comply with relevant local and international accounting standards. This centralized system streamlines the reporting process, improving efficiency and accuracy while facilitating timely compliance.

Blockchain Technology and Future Financial Reporting

Blockchain technology, with its decentralized and immutable ledger system, holds the potential to revolutionize financial reporting. Its inherent transparency and security could enhance the accuracy and reliability of financial information, reducing the risk of fraud and manipulation. Blockchain could streamline audit processes by providing an auditable trail of all financial transactions. While still in its early stages of adoption, the application of blockchain in financial reporting could lead to a more efficient, transparent, and secure system, particularly in managing complex cross-border transactions. For example, imagine a system where all financial transactions are recorded on a shared, immutable blockchain, instantly verifiable by all stakeholders. This could significantly reduce the time and cost associated with auditing and reconciliation, while simultaneously enhancing the transparency and trust in financial reporting. However, challenges remain in terms of scalability, regulatory frameworks, and the need for widespread adoption.

Challenges of Global Financial Reporting

The harmonization of financial reporting standards, while aiming for increased transparency and comparability across borders, faces significant hurdles. Implementing consistent practices globally requires navigating a complex landscape of differing legal systems, cultural norms, and levels of economic development. These factors contribute to inconsistencies in the application and enforcement of international standards, ultimately impacting the reliability and usefulness of financial information for investors and other stakeholders.

Cultural Differences and Regulatory Enforcement

Cultural variations significantly influence accounting practices. For example, some cultures prioritize long-term relationships and implicit contracts, leading to less emphasis on detailed financial disclosures compared to cultures that value transparency and short-term performance. Similarly, the effectiveness of regulatory enforcement varies considerably across jurisdictions. Strong regulatory frameworks with robust enforcement mechanisms in some countries ensure compliance, while weaker enforcement in others can lead to inconsistencies and a higher risk of financial reporting irregularities. This uneven enforcement creates an uneven playing field for multinational corporations and reduces the overall reliability of global financial data. The lack of uniform penalties for non-compliance also exacerbates this issue.

Currency Fluctuations and Exchange Rate Risks

Dealing with currency fluctuations and exchange rate risks presents a major challenge in global financial reporting. Companies operating in multiple currencies must translate their financial statements into a single reporting currency, typically the parent company’s currency. This process introduces complexities, as exchange rates fluctuate constantly, affecting the reported values of assets, liabilities, revenues, and expenses. The choice of exchange rate (e.g., average rate, historical rate, current rate) significantly impacts the reported financial performance and position. Furthermore, fluctuations can create uncertainty and make it difficult for investors to compare the performance of companies operating in different currencies. The use of hedging strategies to mitigate these risks also adds complexity to the reporting process. For example, a company reporting in US dollars that has significant operations in the Eurozone must account for the fluctuating EUR/USD exchange rate, which can significantly impact reported profits and assets.

Recommendations for Improving Global Financial Reporting Harmonization, How Globalization Has Changed Financial Reporting Frameworks

Effective harmonization requires a multi-faceted approach. Improvements are needed across several key areas:

- Strengthening Regulatory Frameworks: Developing and enforcing consistent and robust accounting standards globally is paramount. This includes establishing clear penalties for non-compliance and fostering international cooperation to ensure consistent enforcement.

- Promoting Capacity Building: Providing training and resources to accounting professionals in developing countries is crucial to improve the quality of financial reporting. This involves educating professionals on the application of international standards and best practices.

- Enhancing Transparency and Disclosure Requirements: Increased transparency and standardized disclosure requirements can improve the comparability of financial statements across jurisdictions. This includes clear guidelines on accounting policies and practices.

- Improving Cross-Border Cooperation: Increased collaboration among regulatory bodies and standard-setting organizations is necessary to ensure the consistent application of global accounting standards. This involves sharing information and best practices, and working towards a more unified approach.

- Developing Technology Solutions: Leveraging technology to streamline the reporting process and enhance data analysis can improve the efficiency and accuracy of global financial reporting. This could include the development of standardized reporting platforms and data analytics tools.

Final Review

In conclusion, globalization has profoundly reshaped financial reporting frameworks, pushing for greater international harmonization and transparency. While the adoption of standards like IFRS has improved comparability, significant challenges remain, including navigating diverse regulatory environments, addressing cultural differences, and managing currency fluctuations. The ongoing integration of technology promises further advancements in efficiency and accuracy, yet requires careful consideration of potential risks and ethical implications. The future of global financial reporting hinges on continued collaboration between international organizations, regulatory bodies, and businesses to ensure a robust, reliable, and globally consistent system.

FAQ Guide

What are the main criticisms of IFRS?

Criticisms of IFRS often center on its complexity, leading to increased costs for implementation and auditing. Concerns also exist regarding the potential for inconsistencies in interpretation and application across different jurisdictions.

How does political risk affect global financial reporting?

Political instability and changes in government regulations can significantly impact financial reporting, creating uncertainty for investors and potentially leading to inconsistencies in reporting practices across countries.

What role does the IASB play in global financial reporting?

The International Accounting Standards Board (IASB) is responsible for developing and issuing IFRS, playing a crucial role in promoting consistent and high-quality financial reporting globally.

Obtain access to How to Use QuickBooks for Small Business Accounting to private resources that are additional.