The Impact of Political Instability on Financial Auditing Standards presents a compelling challenge to the integrity of financial reporting worldwide. Political upheaval, whether through regime changes, violence, or pervasive corruption, introduces significant uncertainties that ripple through financial markets and directly impact the reliability of audited financial statements. This exploration delves into the multifaceted ways political instability affects auditing practices, the adaptations required by international standards, and the crucial role of auditors in navigating these high-risk environments.

This analysis examines the various dimensions of political instability, from policy uncertainty to widespread corruption, and illustrates their influence on investor confidence and the reliability of financial reporting. We will explore how these factors affect auditing practices, the limitations of existing standards, and the need for enhanced due diligence and regulatory responses. The discussion also considers the vital role of international cooperation in strengthening auditing frameworks in politically volatile regions and safeguarding investor protection.

Defining Political Instability and its Dimensions

Political instability significantly impacts financial auditing standards, creating challenges for both auditors and investors. Understanding the various dimensions of this instability is crucial for assessing and mitigating its effects. This section will define political instability and explore its key facets, illustrating their impact with real-world examples.

Political instability encompasses a range of factors that undermine the predictability and stability of a country’s political environment. It’s not simply about coups or violent conflicts; it also includes more subtle, yet equally damaging, elements that erode investor confidence and complicate financial reporting.

Regime Change and its Financial Implications

Regime change, whether through elections, coups, or revolutions, introduces significant uncertainty into the economic and regulatory landscape. New governments may implement drastically different policies, potentially impacting taxation, property rights, and contract enforcement. This uncertainty can lead to volatility in financial markets, as investors react to the perceived risks associated with the change in leadership. For instance, the 2011 Egyptian revolution led to a sharp decline in the Egyptian stock market as investors reacted to the uncertainty surrounding the transition of power and the potential for policy shifts. The subsequent instability hindered foreign investment and complicated business operations, impacting financial reporting and audit processes.

Violence and its Effect on Economic Activity

Political violence, including civil unrest, terrorism, and armed conflict, directly disrupts economic activity. Damage to infrastructure, disruptions to supply chains, and a decline in consumer confidence all contribute to economic instability. This makes it difficult for businesses to operate normally, affecting their financial performance and the reliability of their financial statements. The ongoing conflict in Syria, for example, has devastated the Syrian economy, making accurate financial reporting extremely challenging and severely impacting investor confidence in the region. The destruction of infrastructure and displacement of populations make reliable financial auditing almost impossible in many affected areas.

Policy Uncertainty and its Impact on Investment

Policy uncertainty arises from inconsistent or unpredictable government policies. Frequent changes in regulations, taxation, or trade policies create uncertainty for businesses, making long-term planning and investment difficult. This uncertainty discourages foreign investment and can lead to capital flight, further destabilizing the economy. Venezuela, under the Chavez and Maduro regimes, provides a stark example. The unpredictable and often arbitrary changes in economic policy led to hyperinflation, currency devaluation, and a collapse in investor confidence. The resulting economic chaos made reliable financial reporting nearly impossible, with many companies struggling to even maintain basic accounting practices.

Corruption and its Influence on Financial Reporting

Corruption, including bribery, embezzlement, and cronyism, undermines the rule of law and erodes investor confidence. It distorts market mechanisms, creates unfair competition, and increases the cost of doing business. Corruption can also lead to inaccurate financial reporting, as companies may engage in fraudulent activities to conceal their dealings with corrupt officials. Many countries in Sub-Saharan Africa struggle with high levels of corruption, which makes attracting foreign investment challenging and complicates the work of independent auditors. The lack of transparency and accountability makes it difficult to assess the true financial health of companies operating in these environments.

Political Risk and Investor Confidence

Political risk is the risk that political instability will negatively affect a company’s operations or investments. Investors assess political risk when making investment decisions, and high levels of political risk tend to lead to lower investor confidence and higher risk premiums. This means that investors will demand a higher return on their investment to compensate for the increased risk associated with operating in politically unstable environments. This increased cost of capital can stifle economic growth and further hinder development. Countries with a history of political instability, such as many in Latin America, often face higher borrowing costs and difficulty attracting foreign direct investment due to this perceived higher political risk.

Impact on Financial Reporting Practices

Political instability significantly impacts the reliability and timeliness of financial reporting. The uncertainty and volatility inherent in such environments create challenges for businesses and auditors alike, leading to distortions in financial statements and potentially hindering informed investment decisions. This section will explore the various ways political instability affects financial reporting practices.

Political instability directly affects the reliability and timeliness of financial reporting in several ways. The uncertainty surrounding government policies, regulations, and the overall economic climate makes it difficult for businesses to accurately predict future outcomes and make sound financial decisions. This uncertainty is reflected in the financial statements, potentially leading to inaccuracies and inconsistencies. For example, fluctuating exchange rates due to political turmoil can make it challenging to accurately translate foreign currency transactions, leading to errors in the reported financial position. Furthermore, disruptions to supply chains, infrastructure damage, and increased security costs, all common consequences of political instability, can impact a company’s ability to collect timely and accurate data for financial reporting. Delays in reporting, due to these disruptions, can further compromise the timeliness and usefulness of the information.

Political Interference in Auditing Practices and Financial Statement Preparation, The Impact of Political Instability on Financial Auditing Standards

Political interference can manifest in various forms, ranging from subtle pressure to overt manipulation. Governments or powerful political actors might exert pressure on companies to manipulate their financial statements to present a more favorable image, perhaps to attract foreign investment or avoid negative publicity. Auditors, facing pressure from both the company management and potentially political entities, may find themselves in difficult ethical dilemmas. They might be pressured to overlook irregularities or even to actively participate in the falsification of financial information. This compromises the integrity of the audit process and undermines the credibility of financial reporting. For instance, a government might pressure a state-owned enterprise to underreport its losses to maintain a positive public image, leading to a misrepresentation of the entity’s true financial health. Similarly, companies might be pressured to overstate their profits to attract investors, potentially leading to inflated valuations and unsustainable growth.

Challenges Faced by Auditors in Assessing the Impact of Political Instability

Auditors face numerous challenges when assessing the impact of political instability on financial statements. The lack of reliable and consistent information, due to disruptions in data collection and reporting systems, presents a significant hurdle. The volatility of the economic and political environment makes it difficult to predict future outcomes and to assess the long-term implications of current events on a company’s financial position. Moreover, the increased risk of fraud and corruption in politically unstable environments necessitates enhanced due diligence and investigative procedures, adding complexity and cost to the audit process. Auditors also need to consider the potential for political interference in their own work, requiring them to maintain independence and integrity in the face of potential pressure. Navigating these complexities requires specialized skills, experience, and robust risk assessment methodologies.

Comparison of Financial Reporting Practices in Different Political Environments

| Country | Level of Political Stability | Impact on Financial Reporting | Examples of Challenges |

|---|---|---|---|

| Singapore | High | Reliable and timely reporting; strong regulatory framework | Minimal challenges; robust accounting standards consistently applied |

| Venezuela | Low | Significant unreliability and delays; difficulty in obtaining accurate data | Hyperinflation, currency devaluation, political interference in business operations, difficulty in accessing foreign currency |

| Canada | High | Generally reliable and timely; well-established regulatory framework | Relatively minor challenges; occasional instances of accounting scandals, but generally well-managed |

| Syria | Low | Highly unreliable and often unavailable; significant data gaps | Civil war, economic collapse, lack of functioning institutions, widespread corruption |

Auditing Standards and their Adaptability: The Impact Of Political Instability On Financial Auditing Standards

International auditing standards, primarily those issued by the International Auditing and Assurance Standards Board (IAASB), play a crucial role in maintaining the integrity and reliability of financial reporting globally. However, their effectiveness is significantly challenged in politically unstable environments where the usual assumptions underlying these standards are frequently violated. This section examines the adaptability of these standards in such contexts.

The key international auditing standards, primarily the International Standards on Auditing (ISAs), aim to provide a consistent framework for conducting audits worldwide. These standards address various aspects of the audit process, including planning, risk assessment, evidence gathering, and reporting. Their relevance in politically unstable environments is paramount because they offer a structured approach to navigating the heightened risks present in these contexts. However, the practical application of these standards often requires significant modification and adaptation.

Application of Auditing Standards in Different Political Contexts

In stable political contexts, the application of ISAs is relatively straightforward. Auditors can generally rely on the rule of law, the availability of reliable information, and the predictability of the business environment. Risks are often more predictable and manageable, allowing for a more routine application of auditing procedures. In contrast, politically unstable environments present numerous challenges. These include risks related to the enforcement of contracts, the security of assets, the reliability of financial information, and the potential for political interference or corruption. This necessitates a more nuanced and cautious approach to audit planning and execution. For example, an auditor operating in a country with frequent regime changes might need to place greater emphasis on assessing the risk of fraud or asset misappropriation, potentially increasing the scope and intensity of the audit procedures.

Limitations of Existing Auditing Standards in Addressing Risks Associated with Political Instability

Existing auditing standards, while comprehensive, have inherent limitations in addressing the unique risks associated with political instability. Many ISAs assume a relatively stable and predictable legal and regulatory framework. However, in politically volatile situations, these assumptions may not hold true. For instance, the sudden changes in laws and regulations can significantly impact the validity of financial statements, making it challenging for auditors to provide an unqualified opinion. Furthermore, the lack of independent judiciary or enforcement mechanisms can hinder the auditor’s ability to obtain sufficient appropriate audit evidence. The heightened risk of political violence or civil unrest can also pose significant threats to the auditor’s safety and the security of audit documentation. These factors are not explicitly addressed in detail within the standard ISA framework.

Hypothetical Scenario Illustrating Inadequate Standards

Imagine a hypothetical scenario in a country experiencing ongoing civil unrest and a rapidly depreciating currency. A multinational corporation operating in this country prepares its financial statements in accordance with International Financial Reporting Standards (IFRS). The local auditor, attempting to apply ISAs, faces several challenges. Firstly, obtaining reliable and complete financial records is difficult due to disrupted supply chains and the destruction of physical records. Secondly, assessing the fair value of assets becomes extremely challenging due to the volatile currency and the uncertainty surrounding future economic conditions. Thirdly, the risk of fraud and asset misappropriation is significantly heightened due to the breakdown of law and order. In this situation, the existing auditing standards, while providing a general framework, may prove inadequate in addressing the specific risks and uncertainties. The auditor might be forced to issue a qualified opinion or even decline the engagement entirely, highlighting the limitations of existing standards in extreme circumstances. The implications are far-reaching, potentially impacting investor confidence, hindering foreign investment, and contributing to further economic instability.

The Role of Auditors in High-Risk Environments

Auditors operating in politically unstable regions face significantly heightened challenges compared to their counterparts in stable environments. The inherent risks associated with political instability necessitate a more rigorous and proactive approach to auditing, demanding enhanced due diligence and a heightened awareness of potential threats to the integrity of financial reporting. This heightened scrutiny is crucial for safeguarding investor confidence and maintaining the overall credibility of the financial markets.

Enhanced Due Diligence and Risk Assessment Procedures

Auditors working in politically unstable environments must implement comprehensive risk assessments that go beyond standard procedures. This includes a thorough understanding of the specific political and economic risks present in the region, such as the potential for civil unrest, currency fluctuations, and changes in government regulations. The assessment should consider the client’s exposure to these risks and the potential impact on their financial statements. This might involve analyzing the client’s political connections, assessing the stability of their supply chains, and evaluating the reliability of their internal controls in the face of potential disruptions. A key component of this process is identifying potential vulnerabilities that could be exploited by those seeking to manipulate financial information.

Examples of Fraud and Auditor Response

Political instability often creates opportunities for fraud and manipulation. For example, a government’s seizure of assets might be disguised as a legitimate business transaction in financial records. Similarly, pressure from political entities could lead to the underreporting of liabilities or the overstatement of assets. Auditors must be vigilant in detecting such manipulations. This requires the use of advanced analytical procedures, such as benchmarking against industry peers in more stable regions, and a rigorous review of supporting documentation. Where inconsistencies or irregularities are detected, further investigation is required, potentially involving forensic accounting techniques and external expert consultation. If fraud is suspected, auditors have a legal and ethical obligation to report their findings to the appropriate authorities.

Challenges to Auditor Independence and Objectivity

Maintaining independence and objectivity in politically charged environments presents significant challenges for auditors. They might face pressure from government officials or powerful individuals to overlook irregularities or issue unqualified audit opinions. Auditors might also be subjected to intimidation, threats, or even violence. To mitigate these risks, auditors need to establish robust internal controls and reporting mechanisms to protect themselves from undue influence. This includes having clear policies and procedures for handling conflicts of interest, and ensuring that audit teams are adequately trained to recognize and respond to pressure tactics. Furthermore, strong professional oversight and a commitment to ethical conduct are essential for maintaining the integrity of the audit process in these challenging environments.

Best Practices for Auditors in Politically Unstable Regions

The following best practices are crucial for auditors operating in high-risk environments:

- Conduct thorough background checks on all key personnel within the client organization, paying close attention to their political affiliations and potential conflicts of interest.

- Develop detailed contingency plans to address potential disruptions to the audit process, such as civil unrest or communication breakdowns.

- Implement enhanced data security measures to protect sensitive audit information from unauthorized access or theft.

- Engage local experts with in-depth knowledge of the political and economic landscape to assist with the risk assessment and audit procedures.

- Maintain open communication channels with relevant regulatory bodies and international organizations to stay informed about evolving risks and regulatory changes.

- Document all audit procedures meticulously, including any instances of pressure or interference, to provide a comprehensive record of the audit process.

- Seek legal counsel to ensure compliance with local laws and regulations, and to protect the auditor’s legal rights and responsibilities.

- Prioritize the safety and security of the audit team by implementing robust security protocols and providing appropriate training and support.

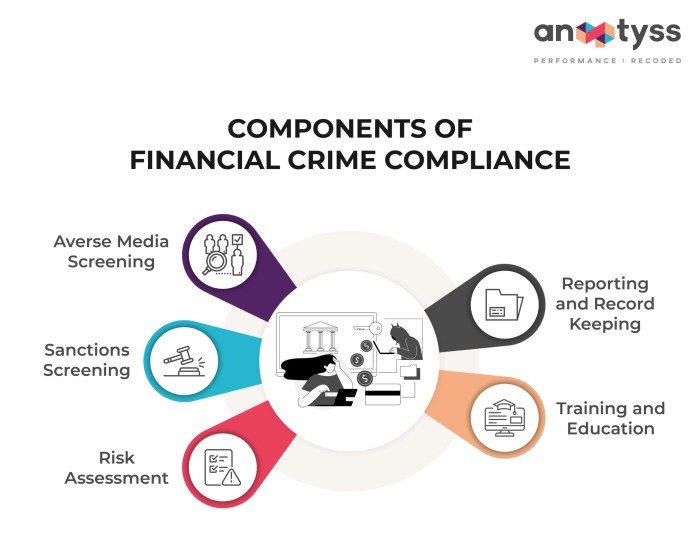

Regulatory Responses and International Cooperation

Political instability significantly impacts the reliability and integrity of financial reporting, necessitating robust regulatory responses and international collaboration to strengthen auditing standards. Regulatory bodies play a crucial role in adapting these standards to mitigate the risks associated with volatile political environments, while international cooperation fosters the development and implementation of globally consistent best practices.

The effectiveness of auditing standards hinges on the strength of regulatory frameworks and the capacity of enforcement mechanisms. This section examines the role of regulatory bodies, examples of international cooperation, challenges in enforcement, and the support provided by international organizations in bolstering auditing frameworks within politically unstable states.

Regulatory Body Adaptation of Auditing Standards

National regulatory bodies, such as securities commissions and accounting oversight boards, are primarily responsible for setting and enforcing auditing standards within their jurisdictions. In response to political instability, these bodies often adapt existing standards or introduce new ones to address specific risks. This may involve increased scrutiny of financial statements, stricter requirements for audit documentation, enhanced auditor independence rules, and greater emphasis on fraud detection and prevention. For example, countries experiencing frequent regime changes might require auditors to perform more extensive background checks on clients and to pay greater attention to the risks of political interference in business operations. Similarly, countries with weak rule of law might mandate more robust internal control assessments.

International Cooperation Initiatives

International cooperation is vital in harmonizing auditing standards and fostering best practices globally. Organizations like the International Auditing and Assurance Standards Board (IAASB) and the International Organization of Securities Commissions (IOSCO) play significant roles in this regard. The IAASB develops and promotes internationally accepted auditing standards (ISAs), while IOSCO works to coordinate regulatory approaches across different jurisdictions. Joint initiatives between these organizations and regional bodies like the European Union or the Association of Southeast Asian Nations (ASEAN) facilitate the dissemination of best practices and the development of tailored guidance for high-risk environments. One example of this cooperation is the development of specialized guidance on auditing in conflict zones or post-conflict reconstruction scenarios. These initiatives often involve sharing information, conducting joint training programs, and collaborating on enforcement strategies.

Challenges in Enforcing Auditing Standards in Weak Governance Environments

Enforcing auditing standards in countries with weak governance and rule of law presents significant challenges. Limited resources, lack of independence of regulatory bodies, corruption, and political interference can hinder effective oversight. Auditors may face pressure to compromise their independence or to overlook irregularities, particularly in environments where powerful political actors are involved in businesses. Furthermore, the lack of robust legal frameworks to support sanctions against non-compliant auditors weakens the deterrent effect of auditing standards. This can lead to a culture of non-compliance and erode public trust in financial reporting. The absence of effective investigative and prosecutorial mechanisms also complicates the process of bringing wrongdoers to justice.

International Organization Support for Robust Auditing Frameworks

International organizations, such as the World Bank, the International Monetary Fund (IMF), and the United Nations, play a crucial role in supporting the development of robust auditing frameworks in politically unstable states. This support can take various forms, including: providing technical assistance to strengthen regulatory institutions, funding capacity-building programs for auditors, promoting good governance and rule of law, and facilitating the adoption of internationally recognized auditing standards. The IMF, for instance, often incorporates conditions related to improving financial sector governance and auditing standards as part of its financial assistance programs. These programs often include training for local auditors and regulators, as well as support for developing effective enforcement mechanisms. The World Bank similarly provides funding and expertise for strengthening accounting and auditing professions in developing countries, particularly those facing political instability.

Impact on Investor Protection and Market Integrity

Political instability significantly undermines investor protection and market integrity, creating a volatile and unpredictable environment that discourages investment and hinders economic growth. The erosion of trust in institutions and the rule of law, hallmarks of politically unstable regions, directly impacts the confidence of both domestic and foreign investors. This lack of confidence can lead to capital flight, reduced investment, and ultimately, slower economic development.

Political instability creates fertile ground for market manipulation and fraud. When regulatory oversight weakens or becomes compromised due to political turmoil, opportunities for illicit activities increase. This lack of effective governance allows unscrupulous actors to engage in insider trading, accounting irregularities, and other forms of market manipulation, often with impunity. The resulting uncertainty and lack of accountability severely damage investor confidence and market integrity.

Investor Distrust and its Consequences

The consequences of investor distrust stemming from political instability are far-reaching. A climate of uncertainty makes it difficult for businesses to plan for the long term, hindering investment in productive capacity and innovation. This can lead to a decline in economic activity, job losses, and reduced overall prosperity. Furthermore, the perception of increased risk associated with investing in politically unstable regions leads to higher borrowing costs for businesses and governments, further hindering economic growth. This heightened risk is often reflected in lower credit ratings and higher risk premiums demanded by investors. The resulting capital flight can lead to currency devaluation and further economic instability, creating a vicious cycle of decline.

Market Crash Triggered by Political Uncertainty

Imagine a graph depicting a stock market index. Initially, the line steadily climbs, representing a period of economic growth and investor confidence. Then, as news of a major political crisis or escalating conflict emerges, the line begins to plummet sharply. The downward trajectory accelerates as uncertainty grows, reflecting a mass sell-off driven by panic and fear. The graph shows a steep, almost vertical drop, representing a significant market crash. The initially smooth, upward trending line transforms into a jagged, downward-sloping curve, with sharp declines punctuated by periods of slight recovery only to be followed by further plunges. The visual representation captures the rapid and dramatic loss of value, illustrating the devastating impact of political instability on investor confidence and market stability. The sharp drop signifies a loss of confidence in the future and the immediate flight of capital, leaving behind a landscape of uncertainty and economic disruption. This illustrates how a relatively stable market can quickly collapse under the weight of political uncertainty, leaving investors with significant losses and eroding public trust in the financial system.

Ending Remarks

In conclusion, the impact of political instability on financial auditing standards is profound and multifaceted. The inherent uncertainties associated with political volatility necessitate enhanced auditing procedures, adaptations to existing international standards, and strengthened regulatory frameworks. International cooperation is paramount in fostering robust auditing practices in high-risk environments, ultimately safeguarding investor confidence and maintaining the integrity of global financial markets. Addressing this complex interplay between politics and finance requires a continuous commitment to improving auditing methodologies and promoting transparency and accountability in all contexts.

Commonly Asked Questions

What specific ISA standards are most affected by political instability?

ISAs focusing on risk assessment (ISA 315), audit evidence (ISA 500), and going concern (ISA 570) are particularly relevant and challenged in politically unstable environments due to increased uncertainty and potential for fraud.

How do insurance companies address the increased risk in politically unstable regions?

Insurance companies often increase premiums, impose stricter underwriting criteria, or even refuse coverage in high-risk regions, reflecting the elevated risk profile.

What role do NGOs play in improving auditing standards in developing countries experiencing political instability?

NGOs often provide training and support to local auditors, advocate for better governance, and promote transparency and accountability initiatives.

Browse the multiple elements of Understanding the Role of Forensic Accounting in Fraud Detection to gain a more broad understanding.