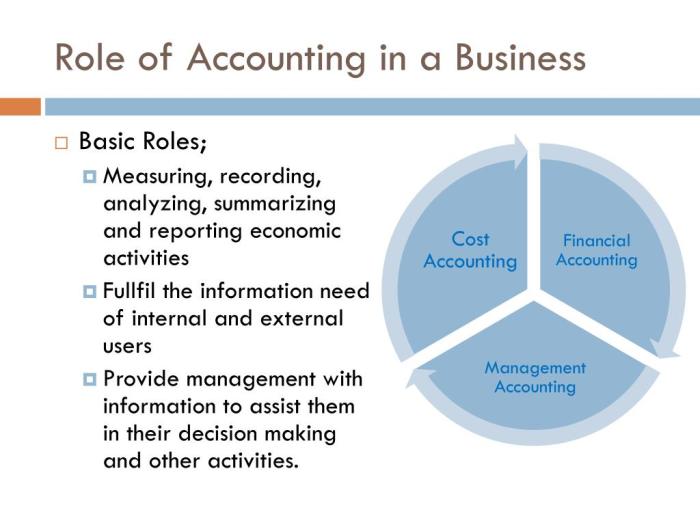

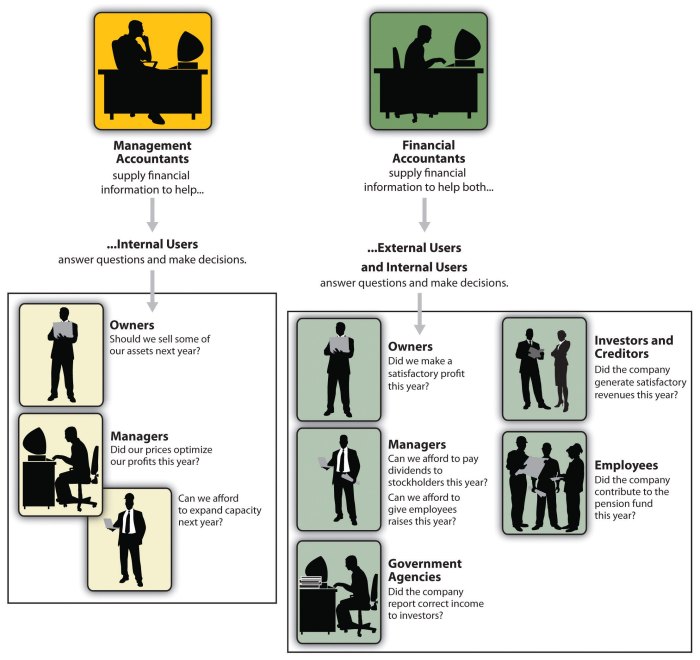

The Role of Accounting in Economic Stability is far more significant than simply recording transactions; it’s the bedrock upon which sound economic systems are built. From informing government policy to influencing investor confidence, accounting practices shape the very fabric of economic growth and stability. This exploration delves into the multifaceted ways accounting impacts macroeconomic trends, risk assessment, and the overall health of economies worldwide.

This analysis will examine how consistent accounting standards foster trust, how accurate financial reporting enables effective forecasting, and the crucial role of auditing in maintaining transparency. We will also explore the influence of taxation, government accounting, and corporate governance on economic stability, considering both the challenges and opportunities presented by the digital age and its transformative technologies.

The Foundation: The Role Of Accounting In Economic Stability

Accounting standards form the bedrock of economic stability. Consistent and transparent accounting practices are crucial for fostering trust among investors, facilitating efficient capital allocation, and promoting sustainable economic growth. Without a reliable framework for reporting financial information, markets become vulnerable to manipulation and instability.

The impact of consistent accounting standards on investor confidence and economic growth is significant. Uniformity in reporting allows investors to readily compare the financial performance of different companies, enabling informed investment decisions. This, in turn, boosts investor confidence, leading to increased capital investment in businesses and stimulating economic growth. Conversely, inconsistent accounting practices create uncertainty and distrust, deterring investment and hindering economic progress.

International Accounting Discrepancies and Their Effects

Discrepancies in accounting practices across nations significantly impact international trade and investment. Differences in accounting standards can make it difficult to compare the financial statements of companies from different countries, leading to information asymmetry and hindering cross-border investments. For instance, variations in revenue recognition, depreciation methods, and inventory valuation can distort financial comparisons, making it challenging for investors to assess the true financial health of a foreign company. This lack of transparency can discourage foreign direct investment and limit international trade opportunities. Harmonization of accounting standards, through initiatives like the International Financial Reporting Standards (IFRS), aims to mitigate these challenges and promote greater integration of global capital markets.

Robust Accounting Frameworks and Efficient Capital Markets

Robust accounting frameworks are essential for creating transparent and efficient capital markets. These frameworks provide a standardized system for financial reporting, ensuring that investors receive reliable and comparable information. This transparency reduces information asymmetry, allowing investors to make informed decisions and allocate capital efficiently. Furthermore, robust accounting standards help to deter fraudulent activities and promote corporate governance, fostering trust and confidence in the market. For example, the Sarbanes-Oxley Act of 2002 (SOX) in the United States, enacted in response to major accounting scandals, strengthened corporate governance and accounting oversight, contributing to greater market stability. Similarly, the adoption of IFRS by many countries has improved the comparability of financial statements globally, enhancing investor confidence and facilitating cross-border capital flows.

Financial Reporting and Economic Forecasting

Accurate and timely financial reporting is crucial for sound economic forecasting. The reliability of economic models and predictions hinges heavily on the quality of the underlying accounting data. Inaccurate or manipulated financial statements can lead to flawed economic assessments, impacting policy decisions and potentially causing significant economic instability.

Financial reporting forms the bedrock of macroeconomic analysis. Economists utilize various methods to extract meaningful insights from accounting data, enabling them to construct predictive models for various economic indicators. The interplay between accounting practices and economic forecasting is a complex, yet vital, relationship.

The Impact of Inaccurate Financial Reporting on Economic Predictions

Consider a hypothetical scenario involving a major publicly traded corporation, “GlobalTech,” a significant player in the technology sector. Suppose GlobalTech, under pressure to meet investor expectations, engages in aggressive accounting practices, underreporting liabilities and overstating assets. This manipulation leads to inflated reported profits. Economists relying on GlobalTech’s reported financials in their macroeconomic models will overestimate the overall health and growth of the technology sector and, consequently, the broader economy. This could lead to policymakers underestimating potential risks and delaying necessary corrective actions, potentially exacerbating an economic downturn when the truth about GlobalTech’s financial position eventually emerges. The inaccurate data creates a false sense of economic security, leading to delayed responses to emerging economic problems.

Methods for Analyzing Accounting Data in Macroeconomic Forecasting

Economists employ several sophisticated methods to analyze accounting data for macroeconomic forecasting. These include time-series analysis, which examines trends and patterns in accounting data over time to predict future values; econometric modeling, which uses statistical techniques to build models that relate accounting data to macroeconomic variables; and input-output analysis, which examines the interdependencies between different sectors of the economy based on their financial flows. Furthermore, economists increasingly utilize machine learning techniques to identify patterns and relationships within large accounting datasets that might be missed by traditional methods. The application of these advanced analytical techniques enhances the accuracy and sophistication of macroeconomic forecasts.

The Role of Timely and Accurate Financial Statements in Informing Government Policy Decisions

Timely and accurate financial statements are critical for evidence-based government policymaking. For instance, accurate corporate tax filings allow governments to accurately assess tax revenues and design appropriate fiscal policies. Reliable financial data on employment, wages, and investment from various sectors helps in formulating effective monetary and fiscal policies. Furthermore, accurate financial information on national debt and government spending is vital for managing public finances and ensuring long-term economic stability. The timely availability of this information enables governments to make informed decisions, preventing potentially disastrous consequences that could arise from relying on outdated or inaccurate data. For example, if a government relies on outdated data showing strong economic growth while a recession is actually beginning, it may delay crucial stimulus measures, prolonging the economic downturn.

Accounting’s Role in Risk Assessment and Management

Accurate and timely financial information is crucial for assessing and managing risks, both at the individual business level and within the broader economic landscape. Accounting provides the framework for understanding a company’s financial health and predicting potential vulnerabilities. This allows stakeholders, including investors, creditors, and regulators, to make informed decisions and contribute to overall economic stability.

Accounting data, when analyzed effectively, paints a picture of a business’s financial strength and potential weaknesses. This analysis relies on various financial ratios and metrics, derived from the company’s financial statements (balance sheet, income statement, and cash flow statement). By comparing these metrics to industry benchmarks and historical trends, it is possible to identify emerging risks and opportunities.

Learn about more about the process of How to Pay Estimated Taxes as a Small Business Owner in the field.

Key Financial Ratios and Metrics for Risk Assessment

Several key financial ratios and metrics are instrumental in assessing the financial health of businesses and the overall economy. These metrics provide insights into liquidity, solvency, profitability, and efficiency. Understanding these indicators allows for a comprehensive evaluation of a company’s risk profile.

For example, the current ratio (current assets divided by current liabilities) indicates a company’s ability to meet its short-term obligations. A low current ratio may signal liquidity problems and increased risk of default. Similarly, the debt-to-equity ratio (total debt divided by total equity) measures the proportion of a company’s financing that comes from debt. A high debt-to-equity ratio suggests higher financial risk, as the company is more vulnerable to interest rate changes and economic downturns. Profitability ratios, such as return on assets (ROA) and return on equity (ROE), reflect the efficiency of a company’s operations and its ability to generate profits. A declining trend in these ratios could indicate potential problems.

Comparison of Accounting Methods and Their Ability to Reveal Economic Risks, The Role of Accounting in Economic Stability

Different accounting methods, such as accrual accounting and cash accounting, can significantly impact the perception of a company’s financial health and, consequently, its perceived risk. Accrual accounting, which recognizes revenues and expenses when they are earned or incurred, regardless of when cash changes hands, provides a more comprehensive picture of a company’s financial performance over time. This method is generally preferred for risk assessment because it offers a more accurate representation of a company’s financial position and potential risks than cash accounting, which only records transactions when cash is received or paid. However, accrual accounting requires more judgment and estimation, potentially leading to greater subjectivity and the possibility of misrepresentation. Cash accounting, while simpler, might mask underlying financial problems.

Comparison of Risk Assessment Techniques Using Accounting Data

Various techniques utilize accounting data for risk assessment. Each technique offers specific advantages and disadvantages, impacting its applicability to different situations.

| Technique | Advantages | Disadvantages | Applicability |

|---|---|---|---|

| Ratio Analysis | Simple, widely understood; allows for benchmarking and trend analysis; reveals potential financial weaknesses. | Can be manipulated; may not capture all aspects of risk; relies on historical data. | Widely applicable for assessing financial health of businesses of all sizes. |

| Financial Statement Analysis | Provides a holistic view of a company’s financial position; identifies trends and patterns; useful for detecting fraud. | Time-consuming; requires expertise in accounting and finance; may not be sufficient for predicting future events. | Useful for in-depth assessment of a company’s financial health and for credit risk assessment. |

| Benchmarking | Provides context for performance; helps identify areas for improvement; allows for comparison with competitors. | Requires comparable data; industry differences may affect comparability; doesn’t guarantee future performance. | Useful for identifying potential risks and opportunities by comparing a company’s performance to industry averages or best practices. |

| Predictive Modeling | Allows for forecasting future financial performance; can identify potential risks and opportunities; supports proactive risk management. | Requires sophisticated statistical techniques; relies on assumptions and forecasts; accuracy depends on data quality and model assumptions. | Useful for assessing credit risk, operational risk, and strategic risk, particularly in large organizations. |

The Impact of Taxation and Government Accounting

Taxation and government accounting are inextricably linked to economic stability. The design and implementation of tax systems significantly influence economic activity, while transparent and effective government accounting ensures responsible use of public funds. Understanding their interplay is crucial for fostering sustainable economic growth.

Government accounting practices, particularly in the areas of budget preparation, execution, and reporting, play a critical role in shaping a nation’s economic landscape. The choices made regarding tax policies – progressive, regressive, or flat – and the mechanisms for collecting and managing tax revenue directly impact investment, consumption, and overall economic output. Furthermore, the transparency and accountability of government financial management are key determinants of public trust and investor confidence.

Effects of Different Tax Systems on Economic Activity

Different tax systems create varying incentives for economic behavior. A progressive tax system, where higher earners pay a larger percentage of their income in taxes, aims to redistribute wealth and fund social programs. Examples include the tax systems of many European countries like Sweden or France, which feature high marginal tax rates for high-income earners coupled with extensive social safety nets. These systems can stimulate demand in the lower and middle classes, potentially boosting overall consumption but may also discourage high-income individuals from taking risks or investing heavily, leading to slower economic growth in certain sectors. In contrast, a regressive tax system, where lower earners pay a higher percentage of their income in taxes (like sales tax), can disproportionately impact lower-income households, potentially widening income inequality. Sales tax is prevalent in many parts of the United States, for instance, and its impact on lower-income families is a subject of ongoing debate. A flat tax system, where everyone pays the same percentage of their income in taxes, aims for simplicity and fairness, but may not address income inequality effectively. Examples include Russia or some of the Baltic states, and these systems often result in debates about their impact on social welfare provisions.

Government Accounting Practices and Their Economic Influence

Effective government accounting systems are essential for responsible fiscal management. They provide transparency in how public funds are allocated and spent, fostering accountability and building public trust. Conversely, opaque or inefficient accounting practices can lead to waste, corruption, and economic instability.

| Government Action | Accounting Impact | Economic Effect | Example Country |

|---|---|---|---|

| Implementation of a Value Added Tax (VAT) | Increased tax revenue accurately recorded and reported. | Increased government revenue for public services; potential impact on consumer prices. | Canada |

| Investment in infrastructure projects (e.g., roads, bridges) | Detailed project costing and tracking of expenditures. | Stimulates economic growth through job creation and improved infrastructure; potential for long-term economic benefits. | China |

| Cuts in public spending due to budget deficit | Reduced budget allocations reflected in government accounts. | Potential for reduced economic activity due to lower government spending; potential for fiscal stability. | Greece (during the Eurozone crisis) |

| Adoption of accrual accounting | More comprehensive and accurate picture of government finances. | Improved financial management and decision-making; increased transparency and accountability. | New Zealand |

Effective Government Accounting and Fiscal Responsibility

Effective government accounting systems, characterized by transparency, accuracy, and timeliness, are crucial for achieving fiscal responsibility and promoting economic stability. These systems enable governments to make informed decisions about resource allocation, track the effectiveness of public spending, and identify potential risks. For example, a well-designed accounting system allows for better budget forecasting, leading to more stable government finances and reduced reliance on emergency borrowing. This, in turn, minimizes disruptions to the economy caused by sudden fiscal adjustments. Furthermore, robust accounting practices enhance public trust and investor confidence, attracting foreign investment and fostering economic growth. Countries with strong government accounting frameworks, such as those adhering to International Public Sector Accounting Standards (IPSAS), generally demonstrate greater fiscal discipline and economic resilience.

Auditing and Economic Transparency

Independent audits are a cornerstone of economic stability, acting as a crucial mechanism for ensuring the reliability of financial information and fostering trust among investors, creditors, and the public. The process provides an objective assessment of an entity’s financial health, promoting transparency and accountability within the economic system. Without this critical function, markets would be significantly more vulnerable to manipulation and instability.

Auditing procedures, when rigorously applied, serve as a vital safeguard against fraudulent activities that can have devastating consequences for the economy. These procedures encompass a comprehensive examination of financial records, internal controls, and operational processes, designed to detect anomalies and irregularities indicative of potential fraud. The detection and prevention of such activities are crucial in maintaining investor confidence and preventing economic shocks.

The Importance of Independent Audits in Maintaining Credibility and Trust

Independent audits, conducted by qualified and unbiased professionals, provide an external validation of a company’s financial statements. This validation enhances the credibility of the information presented, reducing the information asymmetry between the company and its stakeholders. Trust in the reliability of financial reporting is fundamental for attracting investment, securing loans, and facilitating efficient capital allocation within the economy. Without this trust, investment decisions would be based on unreliable information, leading to potentially disastrous outcomes. The perceived independence of the auditing firm is key; any suggestion of bias or conflict of interest significantly diminishes the value of the audit.

Auditing Procedures in Fraud Detection and Prevention

Auditing employs a variety of techniques to detect and prevent fraudulent activities. These include detailed examination of financial transactions, testing of internal controls, analytical procedures to identify unusual patterns, and substantive testing to verify the accuracy of financial information. For example, auditors might use data analytics to identify unusual transactions or patterns that could indicate fraud, such as unusually large or frequent payments to shell companies. Regular audits can deter fraudulent activity simply by virtue of their existence; knowing that their actions will be subject to scrutiny discourages potential wrongdoers. Furthermore, effective internal controls, properly assessed and recommended by auditors, are a first line of defense against fraud.

Examples of Auditing Failures Leading to Economic Crises

The failure of auditing firms to adequately identify and report fraudulent activities has contributed to significant economic crises and scandals. A notable example is the Enron scandal in the early 2000s. The failure of Arthur Andersen, Enron’s auditor, to detect and report the company’s accounting irregularities contributed to Enron’s collapse and had a significant negative impact on investor confidence and the broader economy. Similarly, the financial crisis of 2008 highlighted failures in the auditing of mortgage-backed securities, where inadequate scrutiny of the underlying assets contributed to the widespread collapse of financial institutions. These events underscore the critical role of robust and independent auditing in maintaining economic stability.

Accounting and Corporate Governance

Strong corporate governance and robust accounting practices are inextricably linked, forming the bedrock of economic stability and investor confidence. Sound accounting systems provide the transparent and reliable financial information that underpins effective corporate governance, enabling stakeholders to make informed decisions. Conversely, robust governance structures ensure the integrity of accounting processes, mitigating risks and fostering accountability.

Effective corporate governance relies heavily on the accuracy and reliability of financial reporting. This reliance highlights the critical role of accounting in providing a true and fair view of a company’s financial position, performance, and cash flows. Without accurate accounting, the mechanisms of corporate governance – such as board oversight, executive compensation, and shareholder rights – operate with significantly reduced effectiveness. The resulting information asymmetry can lead to poor decision-making, increased risk, and ultimately, economic instability.

Internal Controls and Corporate Accountability

Effective internal controls, embedded within a company’s accounting systems, are fundamental to ensuring corporate accountability. These controls, encompassing authorization, recording, segregation of duties, and independent verification, safeguard assets, maintain data integrity, and promote operational efficiency. Robust internal controls reduce the likelihood of errors, fraud, and mismanagement, thereby strengthening the reliability of financial reporting and fostering trust among stakeholders. For instance, a well-designed system of internal controls might include regular audits of inventory, separation of purchasing and payment functions, and a robust system for authorization of transactions above a certain value. The absence of such controls increases the vulnerability of a company to financial irregularities and reputational damage, potentially impacting its access to capital and overall economic contribution.

Improving Corporate Governance Through Accounting

Several methods leverage accounting information and practices to enhance corporate governance. Strengthening internal audit functions, independent of management, provides an objective assessment of the effectiveness of internal controls and the accuracy of financial reporting. Implementing robust risk management frameworks, informed by accounting data and analysis, allows companies to proactively identify and mitigate potential threats to their financial stability. Furthermore, enhancing transparency through clear and concise financial reporting, supplemented by non-financial information such as environmental, social, and governance (ESG) data, increases accountability and builds stakeholder trust. Finally, fostering a strong ethical culture within an organization, where ethical accounting practices are valued and enforced, is crucial for promoting responsible corporate behavior and long-term sustainability. Companies that proactively adopt these methods demonstrate a commitment to good governance, attracting investors and contributing to a more stable economic environment.

Accounting Information and Investment Decisions

Accounting data forms the bedrock of investment decisions, influencing both individual investors and large institutional players. The reliability and transparency of this information directly impact the allocation of capital, ultimately affecting market efficiency and broader economic stability. Access to accurate and timely financial statements allows investors to make informed choices, fostering a more efficient capital market.

Accounting information significantly influences investment decisions by providing crucial insights into a company’s financial health and performance. Investors analyze financial statements – balance sheets, income statements, and cash flow statements – to assess profitability, liquidity, solvency, and overall risk. These statements reveal key metrics such as revenue growth, profit margins, debt levels, and return on equity, all vital factors in evaluating an investment’s potential. For instance, a consistently high return on equity suggests strong management and a potentially profitable investment, while high debt levels might signal increased risk. Similarly, institutional investors, like pension funds and mutual funds, rely heavily on this data to diversify portfolios and maximize returns while managing risk.

Accounting Information Asymmetry and its Impact

Accounting information asymmetry, where some market participants possess more or better information than others, can severely distort market efficiency and undermine economic stability. This informational imbalance can lead to market manipulation, mispricing of assets, and increased volatility. For example, if a company possesses material non-public information (e.g., impending bankruptcy) and insiders exploit this knowledge to sell their shares before the information becomes public, it creates an unfair advantage and can cause significant losses for uninformed investors. This lack of transparency erodes investor confidence and can lead to market crashes or prolonged periods of instability. Stricter regulations and improved auditing practices are crucial to mitigate the negative effects of information asymmetry. Independent audits, for instance, aim to ensure the accuracy and reliability of financial statements, thereby reducing information asymmetry and fostering trust in the market.

A Scenario Illustrating Capital Allocation

Imagine two similar startups, “InnovateTech” and “TechSolutions,” both seeking funding. InnovateTech provides comprehensive and transparent financial statements, clearly outlining its revenue projections, cost structure, and potential risks. TechSolutions, however, offers limited financial information, making it difficult for investors to assess its true financial health. As a result, investors are more likely to allocate capital to InnovateTech, perceiving it as a lower-risk investment due to the availability of reliable information. This scenario highlights how access to transparent and reliable accounting information directly influences capital allocation, favoring companies that demonstrate financial accountability and transparency, and ultimately contributing to a more efficient and stable economy. The capital flows towards InnovateTech represent a more efficient allocation of resources, benefiting both the company and the overall economy.

Accounting in the Digital Age and its Economic Implications

The integration of technology into accounting practices is rapidly transforming the field, presenting both significant challenges and exciting opportunities. This technological shift impacts not only the efficiency and accuracy of accounting processes but also has profound implications for economic stability and decision-making at all levels. The adoption of new technologies requires adaptation and investment, while simultaneously unlocking potential for enhanced transparency, improved risk management, and more informed economic policies.

The increasing use of technology in accounting is fundamentally altering the landscape of financial reporting and economic analysis. This evolution demands a reassessment of traditional accounting methodologies and a proactive approach to integrating technological advancements into existing frameworks. The potential benefits are substantial, ranging from improved efficiency and reduced costs to enhanced accuracy and more timely information for stakeholders. However, navigating the challenges of data security, cybersecurity, and the ethical implications of artificial intelligence requires careful consideration and robust regulatory frameworks.

Data Analytics and AI in Accounting

Data analytics and artificial intelligence (AI) are revolutionizing accounting processes. AI-powered tools can automate routine tasks like data entry and reconciliation, freeing up human accountants to focus on more complex and strategic activities such as financial analysis and forecasting. Machine learning algorithms can identify anomalies and patterns in financial data that might otherwise go unnoticed, enhancing fraud detection and risk management capabilities. For example, AI can analyze vast datasets of transaction history to predict potential defaults or identify unusual spending patterns, allowing for proactive intervention and mitigating financial risks. This enhanced analytical capacity provides valuable insights for economic decision-making, enabling businesses and governments to make more informed strategic choices. The improved accuracy and speed of data processing lead to more reliable financial reporting and contribute to greater economic stability.

Blockchain Technology and its Impact on Accounting

Blockchain technology, the underlying technology of cryptocurrencies like Bitcoin, offers the potential to significantly improve the transparency and efficiency of accounting processes. Its decentralized and immutable nature makes it extremely difficult to alter or tamper with financial records. This enhanced security can significantly reduce the risk of fraud and errors in financial reporting. Imagine a scenario where all financial transactions are recorded on a shared, transparent ledger accessible to all authorized parties. This would eliminate the need for intermediaries in many instances, streamlining processes and reducing costs. Furthermore, the real-time nature of blockchain allows for immediate updates and reconciliation of accounts, providing stakeholders with more current and accurate information. While widespread adoption requires overcoming technical and regulatory hurdles, the potential benefits for economic transparency and efficiency are considerable. The enhanced auditability and reduced reliance on intermediaries could lead to a more efficient and trustworthy financial system. Successful implementation in supply chain management, for instance, could significantly improve traceability and accountability, reducing instances of fraud and counterfeiting.

Final Summary

In conclusion, the role of accounting in fostering economic stability is undeniable. From the foundation of standardized practices to the cutting-edge applications of data analytics and AI, accounting acts as a vital compass, guiding economic decision-making and promoting transparency and accountability. A robust accounting infrastructure is not merely a tool for businesses; it is a cornerstone of a healthy and thriving global economy, mitigating risks and promoting sustainable growth. Understanding its intricacies is crucial for navigating the complexities of the modern economic landscape.

FAQs

What are some examples of accounting scandals that negatively impacted economic stability?

Examples include Enron and WorldCom, where fraudulent accounting practices led to significant market downturns and investor losses, highlighting the importance of robust auditing and regulatory oversight.

How does accounting information asymmetry affect market efficiency?

Asymmetric information, where some market participants have more access to financial data than others, can lead to inefficient capital allocation and potentially distort market prices, hindering overall economic efficiency.

What is the role of blockchain technology in improving accounting processes?

Blockchain’s potential lies in enhancing transparency and security in financial transactions, reducing the risk of fraud and improving the efficiency of auditing processes.

+China.jpg?w=700)