The Future of Digital Accounting and Its Business Implications is rapidly reshaping the business landscape. Automation, cloud computing, big data analytics, and blockchain technology are converging to transform how businesses manage their finances. This evolution presents both exciting opportunities and significant challenges for accountants and businesses alike, demanding adaptation and the adoption of new skills and strategies to navigate this changing environment successfully. This exploration delves into the core aspects of this transformation, examining its impact on efficiency, security, and the very nature of the accounting profession.

From the increasing automation of routine tasks through robotic process automation (RPA) and artificial intelligence (AI) to the enhanced security and collaboration offered by cloud-based accounting software, the digital revolution is fundamentally altering the accounting function. We will explore the ethical considerations surrounding automation, the security challenges inherent in cloud-based systems, and the transformative potential of big data and blockchain technology. Furthermore, we will analyze the evolving skillset required for future accountants and the broader business implications of this digital shift, including improved financial reporting, enhanced compliance, and more informed decision-making.

Automation in Digital Accounting

The integration of automation into digital accounting is revolutionizing the industry, significantly impacting efficiency, cost, and the overall role of accounting professionals. Automation is no longer a futuristic concept; it’s a present-day reality reshaping how businesses manage their financial data. This transformation is driven by advancements in robotic process automation (RPA) and artificial intelligence (AI), enabling more accurate, faster, and cost-effective accounting practices.

Impact of Automation on Accounting Tasks

Automation’s influence on accounting tasks is profound. Repetitive, manual processes are being replaced by automated systems, freeing up human accountants to focus on higher-value activities like strategic analysis and financial planning. This shift increases efficiency and reduces the risk of human error.

| Task | Manual Process | Automated Process | Efficiency Improvement |

|---|---|---|---|

| Data Entry | Manual data entry from source documents, prone to errors and time-consuming. | Automated data extraction using OCR and AI, minimizing errors and significantly reducing processing time. | 90%+ reduction in processing time, significant error reduction. |

| Reconciliation | Manual comparison of bank statements and internal records, a tedious and error-prone process. | Automated reconciliation using AI-powered matching algorithms, identifying discrepancies quickly and accurately. | 80%+ reduction in processing time, near-elimination of manual errors. |

| Reporting | Manual compilation of data from various sources, time-consuming and potentially inaccurate. | Automated report generation using pre-defined templates and data extraction tools, providing timely and accurate insights. | 70%+ reduction in report generation time, improved data accuracy. |

Robotic Process Automation (RPA) and Artificial Intelligence (AI) in Accounting

RPA and AI are transforming the accounting landscape. RPA automates repetitive, rule-based tasks, such as data entry and invoice processing. AI, on the other hand, goes beyond automation; it leverages machine learning to analyze data, identify patterns, and make predictions. Examples of AI-powered tools include:

- AI-powered audit tools: These tools can analyze vast datasets to identify potential anomalies and risks, improving audit efficiency and effectiveness. For example, an AI tool might flag unusual expense reports or identify inconsistencies in financial statements that a human auditor might miss.

- Predictive analytics tools: These tools use machine learning to forecast future financial performance, helping businesses make informed decisions. For instance, a tool might predict cash flow based on historical data and current market trends.

- Chatbots for customer service: These tools can handle basic customer inquiries, freeing up human accountants to focus on more complex tasks. For example, a chatbot could answer questions about invoice payments or account balances.

Ethical Implications of Automation in Accounting

While automation offers significant benefits, it also raises ethical concerns. One major concern is job displacement. As automation takes over routine tasks, some accounting jobs may become redundant. However, it’s important to note that automation will also create new roles requiring specialized skills in areas such as AI implementation and data analysis.

Another ethical concern is the potential for bias in algorithms. If the data used to train AI models is biased, the resulting algorithms may perpetuate and even amplify those biases. This could lead to unfair or discriminatory outcomes in areas such as loan applications or credit scoring. Therefore, it’s crucial to ensure that AI systems in accounting are developed and used responsibly, with a focus on fairness and transparency. Regular audits of algorithms and data sets are essential to mitigate this risk.

Cloud Computing and Data Security in Digital Accounting

The shift towards digital accounting has been significantly accelerated by the rise of cloud computing. This technology offers numerous benefits, transforming how businesses manage their financial data and impacting operational efficiency. However, the adoption of cloud-based solutions also necessitates a robust understanding of the associated security challenges and the implementation of effective mitigation strategies.

Advantages of Cloud-Based Accounting Software

Cloud-based accounting software offers a compelling suite of advantages for businesses of all sizes. These advantages stem from enhanced accessibility, streamlined collaboration, and effortless scalability, leading to significant improvements in productivity and cost-effectiveness.

- Accessibility: Access financial data anytime, anywhere, from any device with an internet connection. This eliminates geographical limitations and enhances real-time decision-making.

- Collaboration: Multiple users can access and work on the same data simultaneously, facilitating seamless teamwork and improved communication among accountants, clients, and other stakeholders.

- Scalability: Cloud-based systems easily adapt to changing business needs. As your business grows, you can effortlessly scale your resources up or down, without significant upfront investment in hardware or software.

Security Challenges of Cloud-Based Accounting

Storing sensitive financial data in the cloud presents inherent security risks. Data breaches, unauthorized access, and non-compliance with regulations pose significant threats. Robust security measures are paramount to mitigate these risks and ensure data integrity and confidentiality.

Best Practices for Cloud Security in Digital Accounting

Implementing a multi-layered security approach is crucial for protecting sensitive financial data stored in the cloud. This involves a combination of technical, administrative, and physical safeguards.

| Security Threat | Mitigation Strategy | Implementation Details | Cost Implications |

|---|---|---|---|

| Data Breaches | Data Encryption (at rest and in transit), Multi-Factor Authentication (MFA), Intrusion Detection/Prevention Systems (IDS/IPS) | Implement end-to-end encryption for all data; enforce MFA for all users; deploy IDS/IPS to monitor network traffic for malicious activity. | Varying, depending on chosen solutions and level of security desired. Can range from minimal costs for basic MFA to significant investment for advanced security solutions. |

| Unauthorized Access | Access Control Lists (ACLs), Role-Based Access Control (RBAC), Regular Security Audits | Restrict access to data based on user roles and responsibilities; conduct regular security audits to identify and address vulnerabilities. | Moderate, involving costs for audit services and potentially for specialized access control software. |

| Compliance Violations (e.g., GDPR, HIPAA) | Data Loss Prevention (DLP) tools, Compliance Training for Employees, Regular Data Backup and Recovery | Implement DLP tools to prevent sensitive data from leaving the system; provide regular compliance training to employees; establish robust backup and recovery procedures. | Moderate to High, depending on the complexity of compliance requirements and the chosen solutions. |

| Malware and Viruses | Antivirus Software, Regular Software Updates, Security Awareness Training | Install and maintain updated antivirus software on all devices; regularly update software and operating systems; provide employees with security awareness training to recognize and avoid phishing attacks. | Low to Moderate, primarily involving the cost of antivirus software and training materials. |

Comparison of Cloud-Based Accounting Platforms

Several cloud-based accounting platforms cater to diverse business needs. Choosing the right platform depends on factors such as business size, specific requirements, and budget. The following provides a brief overview of some popular options.

Xero

- Features: Invoice creation, expense tracking, bank reconciliation, reporting, inventory management.

- Security Measures: Data encryption, multi-factor authentication, regular security audits.

- Pricing Model: Subscription-based, with varying plans based on features and number of users.

QuickBooks Online

- Features: Invoice creation, expense tracking, bank reconciliation, reporting, payroll integration.

- Security Measures: Data encryption, two-factor authentication, regular security updates.

- Pricing Model: Subscription-based, with various plans offering different features and user limits.

Sage Business Cloud Accounting

- Features: Invoice creation, expense tracking, bank reconciliation, reporting, project management.

- Security Measures: Data encryption, multi-factor authentication, ISO 27001 certification.

- Pricing Model: Subscription-based, with plans tailored to different business sizes and needs.

The Role of Big Data and Analytics in Digital Accounting

The integration of big data and analytics is revolutionizing digital accounting, moving beyond simple record-keeping to provide insightful, data-driven decision-making capabilities. This allows businesses to not only manage their finances effectively but also to gain a competitive edge by understanding market trends, customer behavior, and operational efficiency in unprecedented detail.

Big data analytics offers valuable insights into financial performance by processing vast quantities of financial and operational data to identify patterns, anomalies, and trends that would be impossible to discern through traditional methods. This allows for proactive identification of potential risks, improved forecasting accuracy, and optimized resource allocation. For example, analyzing sales data alongside inventory levels can predict future demand and prevent stockouts or overstocking. Similarly, analyzing expense data can pinpoint areas for cost reduction and improve profitability. This enhanced visibility leads to more informed and strategic decision-making across all levels of the business.

Types of Data Used in Digital Accounting and Their Processing

Digital accounting utilizes a diverse range of data types, including transactional data (sales, purchases, payments), financial statements, customer information, inventory data, market data, and even social media sentiment. This data is collected from various sources – accounting software, ERP systems, CRM platforms, and external data providers. The process involves data cleaning, transformation, and integration into a unified data warehouse or data lake. Advanced analytics techniques, such as machine learning and artificial intelligence, are then applied to extract meaningful insights. Data visualization tools present these findings in easily understandable formats, such as dashboards and reports, enabling timely and effective decision-making.

Data Flow in a Digital Accounting System

The following workflow diagram illustrates the typical data flow within a digital accounting system:

Data originates from various sources (e.g., POS systems, bank statements, invoices). This raw data is then extracted, transformed, and loaded (ETL) into a central data repository (data warehouse or data lake). Data cleaning and validation steps ensure data accuracy and consistency. The cleaned data is then processed using various analytical techniques (e.g., regression analysis, forecasting models). The results of this analysis are then visualized and presented through dashboards and reports, providing actionable insights to stakeholders. Finally, these insights inform business decisions, leading to improved financial performance and operational efficiency. The entire process is iterative, with feedback loops enabling continuous improvement and refinement of the analytical models.

Challenges and Opportunities of Increasing Data Volume and Complexity

The increasing volume and complexity of financial data present both challenges and opportunities. Challenges include managing the sheer volume of data, ensuring data quality and security, and developing the analytical skills needed to interpret complex datasets. Opportunities include improved forecasting accuracy, enhanced risk management, proactive identification of fraud, and the ability to make more informed strategic decisions based on data-driven insights. For example, companies like Amazon leverage vast datasets to optimize their supply chain, predict customer demand, and personalize their shopping experience. This data-driven approach allows them to maintain a competitive edge in a highly dynamic market. Similarly, financial institutions use sophisticated analytical techniques to detect fraudulent transactions and manage credit risk effectively. The successful navigation of these challenges and the effective harnessing of these opportunities will be crucial for businesses to thrive in the increasingly data-driven world of digital accounting.

Blockchain Technology and its Impact on Digital Accounting

Blockchain technology, a decentralized and immutable ledger, offers transformative potential for digital accounting. Its inherent security and transparency features promise to revolutionize how financial transactions are recorded and audited, leading to increased efficiency and reduced fraud. This section explores the benefits, challenges, and comparative advantages of blockchain in the accounting landscape.

Potential Benefits of Blockchain in Digital Accounting

Blockchain’s decentralized nature eliminates the need for a central authority, fostering greater trust and transparency. Every transaction is cryptographically secured and added to a shared, immutable ledger, creating an auditable trail that is virtually tamper-proof. This enhanced transparency reduces the risk of fraudulent activities, as any attempt to alter past transactions would be immediately detectable. For example, in supply chain management, blockchain can track the movement of goods from origin to consumer, providing irrefutable evidence of authenticity and preventing counterfeiting. Similarly, in financial reporting, blockchain can streamline the audit process by providing auditors with a complete and readily accessible record of all transactions. This significantly reduces the time and resources required for audits, making them more efficient and cost-effective. The increased efficiency also stems from automated processes; smart contracts, for example, can automate payment releases upon fulfillment of pre-defined conditions, reducing manual intervention and the associated risks of human error.

Challenges of Implementing Blockchain in Accounting

Despite its potential, widespread adoption of blockchain in accounting faces significant challenges. Scalability remains a major hurdle, as blockchain networks can struggle to handle a large volume of transactions efficiently. Regulatory uncertainty also presents a considerable obstacle. The lack of clear regulatory frameworks for blockchain technology makes it difficult for businesses to comply with existing accounting standards and regulations. Interoperability is another key concern. Different blockchain platforms often lack the ability to communicate with each other, hindering seamless data exchange between businesses and accounting systems. Furthermore, the integration of blockchain technology with existing accounting software and infrastructure can be complex and costly, requiring significant investment in both technology and expertise. Finally, the need for skilled professionals who understand both blockchain technology and accounting principles is a significant constraint on its widespread adoption.

Comparison of Traditional and Blockchain-Based Accounting Systems

Traditional accounting systems rely on centralized databases, often managed by a single entity. This creates a single point of failure and increases the risk of data breaches and manipulation. Auditing in traditional systems is a labor-intensive process, prone to errors and delays. In contrast, blockchain-based accounting systems utilize a decentralized, immutable ledger, enhancing security and transparency. The audit trail is automatically generated and readily available, making audits more efficient and less prone to errors. The immutability of blockchain eliminates the possibility of altering past transactions, reducing the risk of fraud. However, traditional systems are well-established and widely understood, while blockchain technology is still relatively new and requires specialized knowledge. The cost of implementing and maintaining blockchain-based systems can also be higher initially, although the long-term cost savings from increased efficiency and reduced fraud may outweigh the initial investment. While traditional accounting relies on trust in centralized authorities, blockchain leverages cryptography and consensus mechanisms to build trust among participants without the need for a central intermediary.

The Future Skills for Digital Accountants: The Future Of Digital Accounting And Its Business Implications

The rapid evolution of digital accounting necessitates a shift in the skillset required for success in this field. Accountants must adapt to leverage technological advancements and embrace new roles that extend beyond traditional bookkeeping. This requires a proactive approach to continuous learning and the acquisition of both technical and soft skills.

Essential Skills for Digital Accountants

The modern digital accountant needs a diverse skillset encompassing both technical proficiency and strong analytical abilities. These skills are crucial for navigating the complexities of automated systems, interpreting data-driven insights, and providing valuable strategic advice to clients.

| Skill | Importance | Acquisition Method | Resources |

|---|---|---|---|

| Data Analytics & Interpretation | Essential for extracting meaningful insights from large datasets, informing business decisions. | Online courses (Coursera, edX), workshops, professional certifications (e.g., CPA with data analytics specialization). | Data analytics software (e.g., Tableau, Power BI), industry publications, online tutorials. |

| Cloud Computing Platforms (e.g., Xero, QuickBooks Online) | Fundamental for efficient and collaborative accounting processes. | Vendor-specific training, online tutorials, practical experience. | Cloud platform documentation, online communities, professional networking. |

| Automation Tools (e.g., RPA, workflow automation software) | Crucial for streamlining tasks and improving efficiency. | Vendor training, online courses, hands-on projects. | Software documentation, online forums, case studies of successful implementations. |

| Cybersecurity and Data Privacy | Critical for protecting sensitive financial data and maintaining client trust. | Certifications (e.g., CompTIA Security+, CISSP), online courses, industry best practice guides. | Industry regulations (e.g., GDPR, CCPA), cybersecurity frameworks (e.g., NIST Cybersecurity Framework). |

| Blockchain Technology Fundamentals | Increasingly relevant for understanding and implementing blockchain-based accounting solutions. | Online courses, workshops, industry conferences. | Blockchain technology publications, research papers, industry news. |

| Communication and Client Relationship Management | Essential for effective collaboration and building strong client relationships. | Workshops, mentorship programs, on-the-job experience. | Communication skills training resources, client relationship management (CRM) software. |

| Financial Modeling and Forecasting | Critical for providing insightful financial projections and strategic advice. | Advanced accounting courses, financial modeling software training. | Financial modeling software (e.g., Excel, specialized financial modeling software), case studies. |

Continuous Professional Development (CPD) for Digital Accountants

Continuous professional development is paramount for digital accountants to remain competitive and adapt to the ever-evolving technological landscape. This involves actively seeking opportunities to enhance skills and knowledge through various avenues. Examples include attending industry conferences, pursuing relevant certifications (such as those offered by the AICPA or ACCA incorporating digital skills), and engaging in online courses focusing on emerging technologies in accounting. For instance, the AICPA offers various certifications and continuing education courses covering topics like data analytics and blockchain technology. Similarly, ACCA provides resources and programs to help accountants develop digital skills and adapt to the changing landscape.

Evolving Roles and Responsibilities, The Future of Digital Accounting and Its Business Implications

The role of the accountant is transforming from a primarily transactional function to a more strategic and advisory one. Instead of solely focusing on bookkeeping tasks, digital accountants are increasingly involved in data analysis, financial forecasting, and providing business insights to clients. This shift requires a deeper understanding of business operations and the ability to translate complex financial data into actionable recommendations. For example, instead of simply preparing tax returns, an accountant might use data analytics to identify tax optimization strategies for a client, proactively advising them on minimizing tax liabilities. Similarly, instead of just recording transactions, they might use predictive modeling to forecast future cash flows and help clients make informed investment decisions.

Business Implications of Digital Accounting Transformation

The adoption of digital accounting technologies is reshaping the business landscape, offering significant advantages in operational efficiency, cost reduction, and enhanced profitability. This transformation impacts not only the accounting function itself but also broader aspects of business operations, from strategic decision-making to regulatory compliance. Understanding these implications is crucial for businesses seeking to remain competitive in today’s rapidly evolving digital environment.

The shift to digital accounting systems directly impacts a company’s operational efficiency, cost structure, and profitability. Automation of routine tasks like data entry, invoice processing, and reconciliation frees up valuable time for accountants to focus on higher-value activities such as financial analysis and strategic planning. This increased efficiency translates to reduced labor costs and faster processing times, leading to improved cash flow management. Simultaneously, the reduced risk of human error inherent in manual processes minimizes costly mistakes and ensures greater accuracy in financial reporting. The improved data accessibility and real-time insights provided by digital systems allow for more proactive and informed decision-making, leading to better resource allocation and optimized business strategies.

Impact on Operational Efficiency and Cost Reduction

Digital accounting systems streamline numerous processes. For example, automated invoice processing eliminates manual data entry, reducing errors and accelerating payment cycles. Real-time financial dashboards provide instant access to key performance indicators (KPIs), enabling faster identification of potential problems and more timely interventions. Furthermore, cloud-based solutions reduce the need for expensive on-site servers and IT infrastructure, lowering capital expenditure and ongoing maintenance costs. The overall effect is a leaner, more efficient operation with significantly reduced administrative overhead.

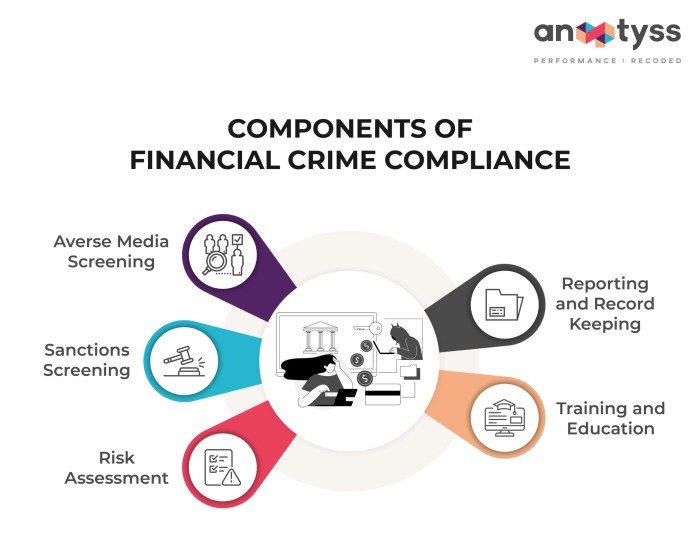

Improved Financial Reporting and Regulatory Compliance

Digital accounting enhances the accuracy and timeliness of financial reporting. Automated data capture and processing minimize the risk of human error, ensuring greater reliability of financial statements. The integration of various accounting systems simplifies the consolidation of data from different departments and subsidiaries, providing a more comprehensive and holistic view of the company’s financial position. Moreover, digital platforms often incorporate features that help organizations maintain compliance with relevant accounting standards and regulatory requirements. Automated tax calculations and reporting, for example, reduce the risk of non-compliance and associated penalties.

Enhanced Decision-Making and Strategic Planning

Access to real-time financial data and advanced analytics capabilities empowers businesses to make more informed decisions. Digital accounting systems can generate insightful reports and dashboards, visualizing key financial trends and providing early warnings of potential risks or opportunities. This enhanced visibility allows for more proactive strategic planning, enabling businesses to adapt quickly to changing market conditions and optimize their operations for maximum profitability. Predictive analytics, enabled by the vast amounts of data collected and analyzed by these systems, can forecast future financial performance and assist in identifying areas for improvement.

Case Study: GreenThumb Landscaping

GreenThumb Landscaping, a medium-sized landscaping company with 50 employees, struggled with manual accounting processes. Their outdated system resulted in slow invoice processing, frequent errors, and difficulty generating timely financial reports. After implementing a cloud-based accounting solution, GreenThumb experienced a significant transformation. Invoice processing time decreased by 75%, reducing accounts receivable days by 50%. The accuracy of financial reporting improved dramatically, leading to more reliable financial forecasting and better strategic decision-making. The company also benefited from reduced IT infrastructure costs and improved employee productivity. While the initial implementation presented challenges in data migration and employee training, the long-term benefits far outweighed the initial hurdles. GreenThumb’s experience demonstrates how digital accounting can significantly improve operational efficiency, cost structure, and profitability, even for businesses with relatively modest resources.

Conclusion

The future of accounting is undeniably digital. Embracing automation, cloud technologies, and data analytics is no longer optional but essential for businesses to thrive in the modern competitive landscape. While challenges exist regarding security, ethical considerations, and skill development, the potential benefits – improved efficiency, enhanced security, and data-driven insights – far outweigh the risks. By proactively adapting to this digital transformation, businesses can unlock significant operational and strategic advantages, ensuring a future where accounting is not merely a record-keeping function, but a powerful engine for growth and informed decision-making.

FAQ Overview

What are the biggest risks associated with cloud-based accounting software?

The biggest risks include data breaches, unauthorized access, and compliance failures. Robust security measures, such as strong passwords, multi-factor authentication, and regular security audits, are crucial to mitigate these risks.

How can small businesses afford to implement digital accounting solutions?

Many cloud-based accounting platforms offer tiered pricing plans, allowing small businesses to choose a solution that fits their budget and needs. Furthermore, the long-term cost savings from increased efficiency and reduced manual labor often outweigh the initial investment.

What new skills will accountants need in the future?

Future accountants will need strong analytical skills, data interpretation abilities, proficiency in using accounting software, and a deep understanding of data security and compliance regulations. They’ll also need to be adaptable and embrace continuous professional development.

Further details about The Relationship Between Accounting and Business Valuation is accessible to provide you additional insights.