The Role of Accounting in Risk Mitigation Strategies is paramount in today’s complex business environment. Effective accounting practices are not merely about recording transactions; they are crucial tools for proactively identifying, assessing, and mitigating a wide range of financial, operational, and strategic risks. This exploration delves into how robust accounting systems and insightful analysis provide a strong foundation for informed decision-making and ultimately, enhanced organizational resilience.

From identifying early warning signs of financial distress through the analysis of financial statements to leveraging key performance indicators (KPIs) for ongoing risk monitoring, accounting plays a vital role across all aspects of risk management. Understanding how internal controls, budgeting processes, and compliance procedures intersect with accounting data empowers businesses to build a robust framework for navigating uncertainty and achieving sustainable growth.

Identifying Financial Risks

Effective risk management is crucial for business sustainability, and a key component involves accurately identifying potential financial threats. Accounting provides the crucial data necessary to understand a company’s financial health and pinpoint areas of vulnerability. By analyzing financial statements and employing various risk assessment methodologies, businesses can proactively address potential problems and improve their chances of success.

Types of Financial Risks

Businesses face a wide range of financial risks that can significantly impact their profitability and stability. These risks can be broadly categorized, though often overlap. Understanding these categories is the first step in effective risk mitigation. Common types include credit risk (the risk of non-payment by customers or debtors), liquidity risk (the risk of not having enough cash to meet short-term obligations), market risk (the risk of losses due to changes in market conditions such as interest rates or exchange rates), operational risk (the risk of losses due to internal failures or external events disrupting operations), and financial risk (the risk of losses due to financial leverage or poor investment decisions). Each of these carries unique implications and requires a tailored approach to mitigation.

Revealing Potential Financial Risks with Accounting Data

Accounting data, particularly that found in financial statements, serves as a powerful tool for identifying potential financial risks. For example, consistently high levels of accounts receivable, as shown on the balance sheet, could indicate a potential credit risk. A declining trend in gross profit margin, revealed in the income statement, might signal issues with pricing strategy, competition, or rising input costs. Similarly, a low current ratio (current assets divided by current liabilities), also from the balance sheet, suggests a potential liquidity risk, highlighting the company’s inability to meet its short-term obligations. These are just a few examples of how seemingly simple accounting figures can provide crucial insights into potential financial instability.

Early Warning Signs of Financial Distress Using Financial Statements

Analyzing financial statements can reveal early warning signs of financial distress. Key indicators include a deteriorating current ratio, a declining quick ratio (a more stringent liquidity measure), increasing debt-to-equity ratio (indicating high reliance on debt financing), consistently negative cash flow from operations, and a declining inventory turnover ratio (suggesting potential inventory obsolescence or slow sales). These trends, when observed over time, can signal escalating financial problems. For instance, a company with a consistently negative cash flow from operations may struggle to meet its financial obligations, even if it reports positive net income. This highlights the importance of analyzing multiple financial ratios and metrics in conjunction with each other.

Risk Assessment Methodologies in Accounting

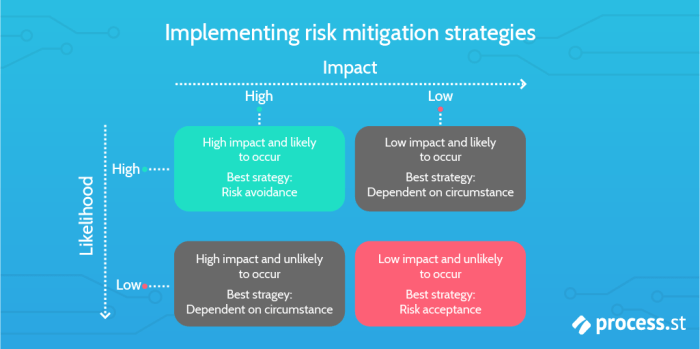

Different methodologies exist for assessing financial risks. The choice of methodology depends on the specific context and the information available.

| Methodology | Description | Advantages | Disadvantages |

|---|---|---|---|

| Ratio Analysis | Analyzing relationships between different financial statement items (e.g., current ratio, debt-to-equity ratio). | Simple, widely understood, readily available data. | Can be misleading if used in isolation; doesn’t account for qualitative factors. |

| Trend Analysis | Analyzing changes in financial data over time to identify patterns and potential problems. | Provides insights into the direction of financial performance. | Requires historical data; may not predict future accurately. |

| Sensitivity Analysis | Assessing the impact of changes in key variables (e.g., sales volume, interest rates) on financial performance. | Highlights potential vulnerabilities to specific risks. | Requires making assumptions about the future; can be computationally intensive. |

| Scenario Planning | Developing different scenarios (e.g., best-case, worst-case) to assess the potential impact of various risks. | Provides a holistic view of potential outcomes. | Requires significant expertise and judgment; can be time-consuming. |

Operational Risk Management through Accounting

Accounting plays a crucial role beyond simply recording financial transactions; it’s a powerful tool for managing operational risks. Effective accounting systems, coupled with robust internal controls, provide a framework for identifying, assessing, and mitigating potential disruptions to an organization’s operations. This involves leveraging accounting data to improve efficiency, detect fraud, and make informed decisions regarding resource allocation.

Internal Controls and Operational Risk Mitigation, The Role of Accounting in Risk Mitigation Strategies

Well-designed internal controls, as documented and implemented within the accounting system, are the cornerstone of operational risk management. These controls act as safeguards against errors, inefficiencies, and fraudulent activities. For instance, segregation of duties, where different individuals handle authorization, recording, and custody of assets, prevents a single person from perpetrating fraud. Regular reconciliations of bank statements and inventory counts help detect discrepancies and potential theft or errors early on. Furthermore, access controls to sensitive accounting data, implemented through user permissions and passwords, limit unauthorized access and manipulation of financial records. These controls are not merely compliance measures; they are proactive strategies to protect the organization’s operational integrity.

Accounting Procedures in Fraud Prevention and Detection

Accounting procedures are designed to provide a trail of transactions, making it easier to detect fraudulent activities. For example, a robust purchase order system, requiring approvals at multiple levels, minimizes the risk of fictitious invoices being processed. Regular audits of financial records, both internal and external, identify irregularities and potential weaknesses in internal controls. Variance analysis, comparing actual results against budgeted figures, can highlight unusual spending patterns that might indicate fraudulent behavior. The implementation of robust data analytics tools allows for the detection of anomalies in transaction data, potentially signaling fraudulent activities that might otherwise go unnoticed. For instance, an unusual spike in payments to a particular vendor might trigger an investigation.

Budgeting and Forecasting in Operational Risk Management

Budgeting and forecasting are integral parts of operational risk management. A well-defined budget provides a benchmark against which actual performance can be measured, allowing for early detection of variances and potential problems. Forecasting allows organizations to anticipate future challenges and opportunities, enabling proactive adjustments to resource allocation and operational strategies. For example, forecasting a potential decline in sales allows for adjustments in production levels, minimizing the risk of excess inventory and associated storage costs. Similarly, forecasting increased demand enables the organization to proactively secure resources, ensuring smooth operations during peak periods. This proactive approach significantly reduces the likelihood of operational disruptions.

Flowchart: Using Accounting Information for Operational Risk Mitigation

The following describes a flowchart illustrating the process:

[Start] –> [Data Collection (Transactions, Inventory, etc.)] –> [Data Processing (Recording, Summarizing)] –> [Financial Reporting (Income Statement, Balance Sheet)] –> [Variance Analysis (Comparison to Budget/Forecast)] –> [Risk Identification (Unusual Patterns, Variances)] –> [Risk Assessment (Severity, Likelihood)] –> [Risk Response (Mitigation Strategies)] –> [Monitoring and Evaluation (Effectiveness of Controls)] –> [Feedback and Adjustment (Process Improvement)] –> [End]

Each stage involves utilizing accounting information to manage operational risk. For example, variance analysis identifies risks, leading to the implementation of mitigation strategies, which are then monitored and evaluated through further accounting processes. This cyclical process ensures continuous improvement in operational risk management.

Compliance and Regulatory Risk Mitigation

Accurate and timely financial reporting is paramount not only for internal decision-making but also for fulfilling legal and regulatory obligations. Compliance failures can result in significant financial penalties, reputational damage, and even legal action. Effective accounting practices are therefore crucial for mitigating compliance and regulatory risks.

Accurate financial reporting ensures adherence to relevant accounting standards and regulations. This transparency allows organizations to demonstrate their compliance to regulatory bodies, fostering trust with stakeholders and reducing the likelihood of penalties. Conversely, accounting irregularities, even unintentional ones, can easily lead to non-compliance and subsequent repercussions.

Accounting Failures and Regulatory Penalties

Instances of accounting failures often result in significant regulatory penalties. For example, the Enron scandal, characterized by widespread accounting fraud, led to the collapse of the company and resulted in substantial fines and legal ramifications for those involved. Similarly, the WorldCom accounting scandal, involving the misclassification of expenses, resulted in massive penalties and criminal charges. These cases highlight the severe consequences of failing to maintain accurate and transparent financial records. The Sarbanes-Oxley Act of 2002 (SOX) in the US, a direct response to such corporate accounting scandals, exemplifies the regulatory response to accounting failures and emphasizes the importance of robust internal controls and independent audits. Non-compliance with SOX can lead to substantial fines and other sanctions.

The Role of Internal Audit Functions in Ensuring Compliance and Risk Mitigation

Internal audit functions play a vital role in ensuring compliance and mitigating regulatory risks. Independent internal audits provide an objective assessment of an organization’s financial reporting processes, internal controls, and compliance with relevant regulations. These audits help identify weaknesses in the accounting systems and processes, allowing for timely corrective actions. A robust internal audit function proactively identifies and addresses potential compliance issues before they escalate into significant problems, reducing the risk of regulatory penalties. They also provide assurance to management and external stakeholders that the organization’s financial reporting is reliable and compliant.

Key Accounting Standards and Regulations Relevant to Risk Management

A strong understanding of relevant accounting standards and regulations is crucial for effective risk management. Failure to comply with these standards can lead to significant financial and reputational consequences. The following list highlights some key standards and regulations:

- Generally Accepted Accounting Principles (GAAP): A common set of accounting rules, standards, and procedures issued by the Financial Accounting Standards Board (FASB) in the US, that ensure consistency and comparability in financial reporting.

- International Financial Reporting Standards (IFRS): A set of accounting standards developed by the International Accounting Standards Board (IASB) that are used by many countries around the world. These standards aim to create a globally consistent approach to financial reporting.

- Sarbanes-Oxley Act of 2002 (SOX): A US law enacted in response to major corporate accounting scandals that significantly strengthened corporate governance and financial reporting requirements.

- Securities and Exchange Commission (SEC) Regulations: Regulations issued by the SEC in the US that govern the financial reporting and disclosure requirements for publicly traded companies.

- Internal Revenue Service (IRS) Regulations: Regulations issued by the IRS in the US that govern tax compliance and reporting.

Strategic Risk Assessment Using Accounting Data

Accounting data provides a crucial foundation for assessing and mitigating strategic risks. Long-term financial projections, derived from historical trends and informed assumptions, are essential tools for evaluating the potential success and viability of strategic initiatives. By analyzing this data, businesses can make more informed decisions, allocate resources effectively, and proactively address potential threats.

Long-Term Financial Projections and Strategic Decision-Making

Long-term financial projections, built upon historical accounting data and market analysis, are invaluable for strategic decision-making. These projections provide a forward-looking view of the company’s financial health, allowing management to anticipate potential challenges and opportunities. For example, a company considering a significant expansion might use projected cash flows to determine if it can afford the investment without compromising its liquidity. Similarly, projections of revenue growth and profitability can inform decisions regarding pricing strategies, marketing investments, and research and development initiatives. By understanding the potential financial implications of various strategic options, businesses can make more informed and risk-averse choices.

Assessing the Financial Viability of Strategic Initiatives with Accounting Information

Accounting information plays a vital role in assessing the financial viability of strategic initiatives. For instance, a company considering a new product launch can use cost accounting data to estimate production costs, marketing expenses, and potential profit margins. Analyzing historical sales data for similar products can help predict potential market demand and revenue generation. Furthermore, break-even analysis, utilizing accounting data on fixed and variable costs, can help determine the sales volume needed to cover expenses and achieve profitability. This comprehensive analysis, based on reliable accounting information, allows businesses to evaluate the financial risks associated with the new product launch and make a data-driven decision.

Sensitivity Analysis and Scenario Planning in Mitigating Strategic Risks

Sensitivity analysis and scenario planning are powerful techniques for mitigating strategic risks using accounting data. Sensitivity analysis involves assessing the impact of changes in key variables, such as sales volume, production costs, or interest rates, on the financial projections. This helps identify which variables are most critical and where the greatest risks lie. Scenario planning goes further by creating multiple plausible future scenarios, each with its own set of assumptions and variables. By analyzing the financial outcomes under different scenarios (e.g., best-case, worst-case, and most-likely scenarios), businesses can prepare contingency plans and develop strategies to navigate uncertainty. For example, a company might use scenario planning to prepare for potential economic downturns by identifying cost-cutting measures or alternative revenue streams.

Relationship Between Strategic Goals and Associated Financial Risks

| Strategic Goal | Potential Financial Risks | Mitigation Strategies | Accounting Data Used |

|---|---|---|---|

| Market Expansion | Increased operating costs, higher marketing expenses, potential for lower-than-expected sales | Detailed market research, phased rollout, flexible marketing budget | Sales forecasts, cost accounting data, market research reports |

| New Product Development | High R&D costs, potential for product failure, competition | Thorough market analysis, phased development, robust testing | R&D budget data, projected sales, competitor analysis |

| Acquisition of another company | High acquisition costs, integration challenges, potential for goodwill impairment | Due diligence, phased integration, clear valuation | Financial statements of target company, projected synergies, acquisition costs |

| Debt Financing | Increased interest expense, potential for default, impact on credit rating | Careful debt management, maintaining strong cash flow | Cash flow projections, debt-to-equity ratio, interest rate sensitivity analysis |

Using Accounting Metrics for Risk Monitoring and Reporting: The Role Of Accounting In Risk Mitigation Strategies

Effective risk management relies heavily on the ability to monitor and report on key risk exposures. Accounting metrics, derived from a company’s financial data, provide a powerful tool for this purpose, offering quantifiable insights into potential vulnerabilities and allowing for proactive mitigation strategies. By transforming raw financial data into actionable intelligence, organizations can gain a clearer understanding of their risk landscape and make informed decisions.

Accounting data provides a rich source of information for tracking various risk exposures. Key Performance Indicators (KPIs), specifically designed to reflect specific aspects of a company’s performance, serve as critical signals in this process. These KPIs, when consistently monitored, reveal emerging trends and potential problems before they escalate into major crises.

Key Performance Indicators for Risk Monitoring

Several accounting metrics are particularly useful for monitoring specific types of risks. For example, high levels of accounts receivable past due could indicate a credit risk exposure, while a consistently high inventory turnover ratio might signal a risk of obsolescence or inefficient inventory management. Similarly, a declining gross profit margin could suggest a price competition risk or increasing input costs. These indicators, when considered in conjunction with other qualitative factors, provide a comprehensive picture of the company’s risk profile.

Designing a Risk Management Dashboard Using Accounting Data

A risk management dashboard, effectively designed, visualizes key risk metrics, facilitating quick identification of potential problems and enabling timely interventions. The process involves selecting relevant KPIs, establishing thresholds for acceptable risk levels, and developing a visual representation that clearly displays the current status of each metric against its threshold. The dashboard should be tailored to the specific needs of the organization, considering its industry, size, and risk appetite. Data should be updated regularly, preferably in real-time or near real-time, to provide a dynamic view of the organization’s risk profile. This allows for immediate responses to significant deviations from established norms.

Visual Representation of Key Risk Metrics

A line graph is a suitable visual representation for tracking key risk metrics over time. The horizontal axis would represent time (e.g., months or quarters), while the vertical axis would represent the value of the selected KPI. Multiple lines could be used to display different metrics simultaneously, allowing for comparisons and identification of correlations. For example, one line could track the company’s debt-to-equity ratio, another could track its current ratio, and a third could track its days sales outstanding. Each line would be color-coded for easy identification. The graph could include horizontal lines representing predefined thresholds for each metric, highlighting when a metric exceeds its acceptable range. This visual representation would instantly show trends, allowing management to proactively address any deviations from the desired levels. For instance, a consistently upward trending debt-to-equity ratio would be immediately apparent, prompting further investigation and potentially necessitating corrective actions.

The Role of Internal Audit in Risk Mitigation

Internal audit plays a crucial role in an organization’s risk mitigation strategy, acting as an independent and objective assurance function. It provides management and the board with an evaluation of the effectiveness of risk management, control, and governance processes. A robust internal audit function helps organizations identify vulnerabilities, improve operational efficiency, and safeguard assets.

Internal audit responsibilities encompass a wide range of activities designed to enhance risk management.

Internal Audit’s Responsibilities in Risk Identification and Assessment

Internal auditors are responsible for identifying and assessing risks across the organization. This involves understanding the organization’s business objectives, identifying potential threats and vulnerabilities, and evaluating the likelihood and impact of those risks. They utilize various techniques, including risk assessments, walkthroughs, and data analysis, to gain a comprehensive understanding of the risk landscape. For example, an internal audit might review the organization’s cybersecurity protocols to assess the risk of data breaches, or analyze financial processes to identify vulnerabilities to fraud. The findings from these assessments are then used to inform the development and improvement of risk mitigation strategies.

Examples of Improved Risk Management Practices Resulting from Internal Audit Findings

Internal audit findings frequently lead to significant improvements in risk management practices. For instance, an internal audit might uncover weaknesses in inventory management leading to substantial losses. This finding could prompt management to implement a new inventory control system with better tracking and security measures, directly reducing the risk of future losses. Similarly, an audit revealing inefficiencies in the procurement process might result in the implementation of a more streamlined and transparent system, reducing the risk of fraud and waste. The identification of non-compliance with regulations during an audit can lead to corrective actions, preventing potential fines and reputational damage.

Internal Audit’s Evaluation of Risk Mitigation Strategies

The process of evaluating the effectiveness of risk mitigation strategies typically involves a systematic review of the controls designed to address identified risks. Internal auditors test the design and operating effectiveness of these controls, documenting their findings and providing recommendations for improvement. This might involve examining documentation, interviewing personnel, and performing testing procedures. For example, an audit might assess the effectiveness of a newly implemented cybersecurity system by testing its ability to prevent unauthorized access to sensitive data. A comprehensive evaluation considers the control’s overall design, its implementation, and its actual performance in mitigating identified risks.

Internal Audit Reports and Improved Risk Management

Internal audit reports provide valuable insights into the effectiveness of risk management processes. These reports communicate the findings of the audit, including any identified risks, control weaknesses, and recommendations for improvement. The detailed information presented in these reports enables management to make informed decisions regarding resource allocation, control enhancements, and strategic risk adjustments. The reporting process ensures transparency and accountability, contributing to a stronger risk management culture within the organization. Regular and timely reporting, including follow-up on implemented recommendations, further strengthens the effectiveness of risk mitigation efforts.

Epilogue

In conclusion, the strategic integration of accounting principles into risk mitigation strategies is not merely a compliance exercise; it is a fundamental driver of organizational success. By harnessing the power of financial data, businesses can gain a clear understanding of their risk profile, make proactive adjustments, and build a more resilient and sustainable future. The proactive use of accounting information, coupled with robust internal controls and a commitment to compliance, positions organizations to not only survive but thrive in an increasingly unpredictable world.

Questions Often Asked

What are some common accounting errors that increase risk?

Common errors include inaccurate revenue recognition, misclassification of expenses, and inadequate inventory valuation. These can lead to misstated financial reports, hindering accurate risk assessment.

How does accounting support fraud prevention?

Strong internal controls, segregation of duties, and regular audits, all rooted in accounting principles, significantly reduce opportunities for fraudulent activity.

Can accounting help predict future risks?

Yes, through financial modeling, forecasting, and sensitivity analysis based on historical accounting data, businesses can anticipate potential future risks and develop proactive mitigation strategies.

How does technology enhance the role of accounting in risk mitigation?

Technology, such as ERP systems and data analytics tools, automates processes, improves data accuracy, and enables more sophisticated risk analysis and reporting.

Explore the different advantages of How to Improve Cash Flow with Better Accounting Practices that can change the way you view this issue.