The Best Cloud-Based Accounting Tools for Entrepreneurs: Navigating the complexities of modern business requires efficient financial management. For entrepreneurs, this often translates to a need for streamlined accounting processes that don’t detract from core business activities. Cloud-based accounting solutions offer a powerful answer, providing accessibility, scalability, and features designed to meet the unique needs of small and growing businesses. This exploration delves into the top contenders, highlighting their strengths and weaknesses to help entrepreneurs choose the ideal tool for their specific circumstances.

This guide examines leading cloud accounting software, comparing their features, pricing models, and integrations with other crucial business tools. We’ll discuss essential features to consider, security protocols, and the importance of selecting a solution that scales with business growth. Understanding these factors is crucial for making informed decisions and ensuring long-term financial success.

Introduction

Entrepreneurs, the driving force behind innovation and economic growth, often face unique accounting challenges. Juggling multiple responsibilities, from product development to marketing and sales, leaves little time for meticulous bookkeeping. This often leads to delayed financial reporting, inaccurate financial insights, and ultimately, poor decision-making. The complexity of tax regulations further adds to the burden, particularly for those operating across multiple jurisdictions or dealing with various income streams. Efficient financial management is crucial for sustainable growth, yet many entrepreneurs struggle to find the time and expertise needed for effective accounting practices.

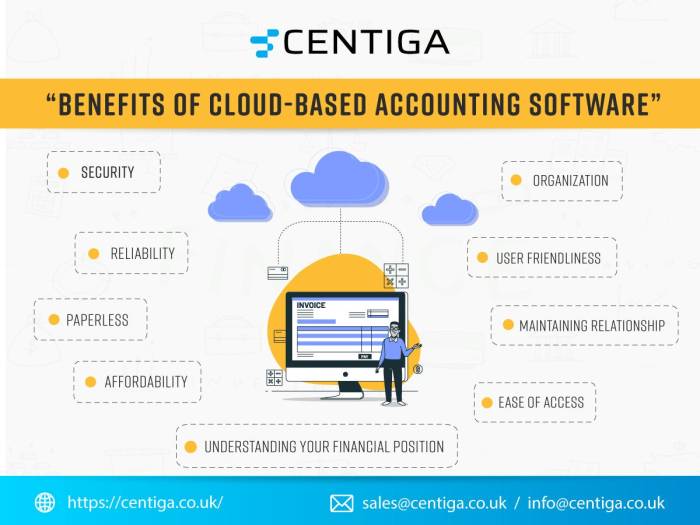

Cloud-based accounting solutions offer a compelling alternative to traditional methods, addressing many of these challenges. These solutions provide accessibility, automation, and real-time insights, empowering entrepreneurs to focus on their core business activities while maintaining accurate financial records. The integration with other business tools, such as CRM and project management software, further streamlines operations and improves overall efficiency. The cost-effectiveness of cloud-based systems, particularly their subscription-based models, makes them a financially viable option for even the smallest startups.

Types of Entrepreneurs Benefitting from Cloud Accounting

Several entrepreneurial profiles significantly benefit from the transition to cloud-based accounting. Freelancers, for instance, often manage multiple projects concurrently and require a system capable of tracking income and expenses associated with each. Similarly, online retailers need tools to manage inventory, track sales transactions, and generate reports for tax purposes. Small business owners with physical locations can utilize cloud accounting to manage payroll, track cash flow, and generate financial statements for decision-making and investor reporting. Finally, even those operating within larger corporate structures but managing independent projects or divisions can find cloud accounting solutions particularly beneficial for maintaining transparent and efficient financial records. The flexibility and scalability of cloud-based systems adapt well to the varying needs of these diverse entrepreneurs.

Top Cloud-Based Accounting Software Options

Choosing the right cloud-based accounting software is crucial for entrepreneurs. A well-chosen system streamlines financial management, improves accuracy, and ultimately saves time and money. This section will explore some of the leading options available, highlighting their key features and helping you determine the best fit for your business needs.

Top Cloud-Based Accounting Software Comparison

Selecting the right accounting software depends heavily on your business size, complexity, and specific requirements. The following table compares five popular options, focusing on key features, pricing models, and their respective strengths and weaknesses. Remember that pricing can vary based on the chosen plan and features.

| Feature | Xero | QuickBooks Online | FreshBooks | Zoho Books | Wave Accounting |

|---|---|---|---|---|---|

| Invoicing | Yes, customizable templates | Yes, customizable templates, recurring invoices | Yes, professional templates, automated invoicing | Yes, customizable templates, recurring invoices | Yes, simple templates |

| Expense Tracking | Yes, receipt capture, bank feeds | Yes, receipt capture, bank feeds, mileage tracking | Yes, receipt capture, expense reports | Yes, receipt capture, expense reports | Yes, manual entry |

| Reporting | Yes, customizable reports, real-time dashboards | Yes, extensive reporting options, customizable dashboards | Yes, basic reports, profit & loss, balance sheet | Yes, customizable reports, real-time dashboards | Yes, basic reports |

| Payroll Integration | Yes, integrated payroll solutions available | Yes, integrated payroll solutions available | Limited integration, often requires third-party solutions | Yes, integrated payroll solutions available | No |

| Pricing | Starts at ~$12/month | Starts at ~$25/month | Starts at ~$15/month | Starts at ~$10/month | Free (limited features), paid plans available |

| Pros | User-friendly interface, scalable, excellent customer support | Robust reporting, extensive integrations, widely used | Simple and intuitive, good for freelancers and small businesses | Affordable, comprehensive features, good for growing businesses | Free plan for basic needs |

| Cons | Can be expensive for larger businesses | Can be complex for beginners, some features require add-ons | Limited reporting compared to others | Can be less intuitive than Xero or QuickBooks | Limited features in free plan, lacks advanced functionalities |

Xero’s Features: User-Friendliness and Scalability

Xero is known for its intuitive interface, making it accessible to users with varying levels of accounting expertise. Its clean design and straightforward navigation contribute to a positive user experience. The software also scales well with business growth. As a business expands, Xero can easily adapt to accommodate increasing transaction volumes and more complex financial needs, without requiring a significant shift in workflow or training. For example, a small freelancer using Xero for basic invoicing can seamlessly transition to using more advanced features like inventory management and project tracking as their business expands.

QuickBooks Online’s Strengths: Robust Reporting and Integrations

QuickBooks Online boasts robust reporting capabilities, offering a wide array of customizable reports to provide comprehensive financial insights. These reports go beyond the basics, allowing users to delve into detailed analyses of profitability, cash flow, and other key performance indicators. Furthermore, its extensive integration capabilities allow seamless connections with other business applications, such as CRM systems, e-commerce platforms, and payment gateways. This integration simplifies workflows and streamlines data management, avoiding manual data entry and potential errors. For instance, connecting QuickBooks Online to an e-commerce platform automatically imports sales data, eliminating the need for manual reconciliation.

Essential Features to Consider

Choosing the right cloud-based accounting software is crucial for entrepreneurial success. The right tool will streamline your financial management, improve accuracy, and ultimately save you time and money. Selecting software based on your specific needs and business size is essential, but several key features are universally beneficial.

Several features are paramount when evaluating cloud accounting software. These features contribute to efficiency, accuracy, and informed decision-making, allowing entrepreneurs to focus on growing their businesses rather than wrestling with administrative tasks.

Mobile Accessibility

Mobile accessibility is no longer a luxury; it’s a necessity. Entrepreneurs are rarely tethered to a desk. The ability to access and manage financial data from smartphones and tablets allows for on-the-go invoice creation, expense tracking, and client communication. Imagine reviewing sales figures while attending a networking event or approving an invoice from a coffee shop – this level of flexibility is transformative for business owners. This immediate access ensures timely responses to financial matters, preventing potential delays or missed opportunities.

Real-Time Data Access

Real-time data access provides an up-to-the-minute view of your financial health. This eliminates the lag time associated with traditional accounting methods, allowing for quicker identification of trends and potential problems. For example, a sudden drop in sales can be immediately spotted and investigated, leading to proactive measures to address the issue. Real-time data fosters informed, data-driven decision-making, empowering entrepreneurs to make strategic adjustments promptly.

Automated Reporting and Analytics

Comprehensive reporting and analytics features are critical for understanding your business’s performance. Automated reports, such as profit and loss statements, balance sheets, and cash flow reports, provide a clear picture of your financial position. Advanced analytics tools can identify key performance indicators (KPIs) and highlight areas for improvement. For instance, the software could automatically identify your best-selling products or highlight periods of high or low profitability, allowing for targeted adjustments to your business strategy.

Bank Reconciliation

Efficient bank reconciliation is a time-consuming but crucial task. Cloud-based accounting software often integrates directly with your bank accounts, automating the reconciliation process and significantly reducing manual effort. This integration minimizes the risk of errors and frees up valuable time that can be spent on other aspects of the business. Automatic matching of transactions saves hours each month, reducing the chances of discrepancies and ensuring accurate financial records.

Integrations with Other Business Tools

Seamless integration with other business tools, such as CRM software, e-commerce platforms, and payroll systems, streamlines operations and reduces data entry duplication. For example, integrating your accounting software with your e-commerce platform will automatically record sales transactions, eliminating the need for manual data entry. This integration fosters a more efficient and cohesive workflow, reducing errors and saving valuable time.

Integration with Other Business Tools

Cloud-based accounting software’s true power lies not just in its core functionalities but in its ability to seamlessly integrate with other essential business tools. This interconnectedness streamlines workflows, minimizes data entry, and provides a holistic view of your business performance. Effective integration eliminates the need for manual data transfer between different platforms, saving time and reducing the risk of errors.

The integration capabilities of cloud accounting software significantly enhance operational efficiency and provide a more comprehensive understanding of your business. This section will explore the advantages of integrating cloud accounting with CRM systems, project management tools, and e-commerce platforms.

CRM System Integration

Integrating your cloud accounting software with a Customer Relationship Management (CRM) system creates a powerful synergy. This integration allows for automatic synchronization of customer data, such as contact information and invoices, between the two systems. For instance, when an invoice is paid in your accounting software, the CRM system automatically updates the customer’s payment status, eliminating manual updates and ensuring data consistency. This streamlined approach reduces administrative overhead and provides sales teams with real-time insights into customer payment history, facilitating more effective sales strategies and improved customer service. This direct link between financial data and customer interactions provides a complete picture of customer relationships and their profitability.

Project Management Tool Integration

Connecting your accounting software with project management tools enhances efficiency by providing a clear link between project costs and profitability. Time tracking data from the project management system can automatically populate your accounting software, accurately reflecting labor costs associated with each project. This eliminates the need for manual time entry, minimizing the risk of errors and providing more accurate financial reporting. For example, if a project management tool like Asana or Monday.com is integrated with Xero, project costs are automatically reflected in the accounting software, providing real-time insights into project profitability and facilitating better budget management. This real-time data ensures that project managers have an accurate understanding of costs and profitability, enabling informed decision-making.

E-commerce Platform Integration

Integrating your cloud accounting software with your e-commerce platform is crucial for businesses selling online. This integration automates the process of recording sales transactions, managing inventory, and reconciling payments. When a sale is made on your e-commerce platform, the transaction details are automatically transferred to your accounting software, eliminating manual data entry and reducing the risk of errors. This real-time synchronization ensures accurate financial records and provides up-to-date insights into sales performance. For example, if you use Shopify as your e-commerce platform, integrating it with QuickBooks Online allows for automatic import of sales data, reducing administrative burden and providing accurate financial reports. This seamless flow of information minimizes discrepancies and streamlines the entire order-to-payment process.

Security and Data Protection: The Best Cloud-Based Accounting Tools For Entrepreneurs

Choosing a cloud-based accounting tool necessitates a thorough understanding of the security measures in place to protect your sensitive financial data. Reputable providers prioritize data security through a multi-layered approach, ensuring the confidentiality, integrity, and availability of your information. This involves robust technical safeguards, comprehensive security policies, and adherence to relevant industry standards and regulations.

Data encryption and robust backup solutions are paramount for safeguarding your business’s financial information. The risk of data breaches and loss is ever-present, and a comprehensive security strategy mitigates these risks. A strong security posture is not just a technical implementation; it’s a continuous process requiring ongoing monitoring and adaptation to evolving threats.

Data Encryption Methods

Data encryption is the process of converting readable data into an unreadable format, known as ciphertext. Only authorized users with the correct decryption key can access the original data. Cloud accounting providers typically employ various encryption methods, including data-at-rest encryption (protecting data stored on servers) and data-in-transit encryption (protecting data transmitted over networks). For example, many providers utilize AES-256 encryption, a widely recognized and robust standard. The implementation of strong encryption protocols is crucial to preventing unauthorized access to financial records, even in the event of a data breach. This protects sensitive information like bank account details, tax records, and customer payment information.

Backup and Disaster Recovery Procedures

Regular data backups are essential to ensure business continuity in the event of data loss due to hardware failure, cyberattacks, or natural disasters. Reputable cloud accounting providers implement redundant systems and multiple data centers geographically dispersed to minimize the impact of outages. These providers typically perform automated backups at regular intervals, ensuring that your data is consistently protected. Furthermore, they often have detailed disaster recovery plans in place, outlining the steps to restore data and services in case of a major disruption. This ensures minimal downtime and reduces the potential impact on your business operations. The frequency and methods of backups should be clearly Artikeld in the provider’s service level agreement (SLA).

Compliance with Industry Standards

Selecting a cloud accounting provider that meets relevant compliance standards is crucial for ensuring data security and protecting your business from potential legal repercussions. Compliance with regulations such as GDPR (General Data Protection Regulation) in Europe and SOC 2 (System and Organization Controls 2) in the United States demonstrates a provider’s commitment to data security and privacy. GDPR, for instance, mandates specific data protection measures for organizations handling personal data of EU citizens. SOC 2 reports, independently audited, verify a provider’s adherence to security best practices. Choosing a provider with these certifications provides assurance that they are taking the necessary steps to protect your data according to established standards. Checking for these certifications provides a tangible indicator of a provider’s commitment to security.

Cost and Pricing Models

Choosing the right cloud-based accounting software often hinges on understanding its cost. Pricing structures vary significantly, impacting your overall budget and potentially influencing your choice of features. A clear grasp of these models is crucial for making an informed decision.

Pricing models for cloud accounting software are generally subscription-based, offering varying levels of access and functionality depending on the chosen plan. Some providers offer per-user pricing, while others charge a flat monthly or annual fee irrespective of the number of users. Understanding these differences is critical for accurately estimating your long-term expenses.

Pricing Models Comparison, The Best Cloud-Based Accounting Tools for Entrepreneurs

Cloud accounting software providers typically offer a range of subscription plans, each tailored to different business needs and scales. Common models include monthly or annual subscriptions, often tiered by features and user access. Some platforms may also offer add-on modules or services at extra cost. For instance, Xero offers various plans ranging from a basic plan suitable for sole traders to more comprehensive plans for larger businesses with multiple users and advanced features. Similarly, QuickBooks Online presents a tiered system, starting with a simple plan for self-employed individuals and scaling up to plans designed for businesses requiring inventory management and advanced reporting. These plans frequently include varying numbers of users and differing levels of support.

Typical Cost Range

The following table Artikels the typical cost range for different cloud accounting software packages. These are estimates and actual prices can vary based on specific features, add-ons, and contract terms.

| Software | Basic Plan (Monthly) | Mid-Tier Plan (Monthly) | Premium Plan (Monthly) |

|---|---|---|---|

| Xero | $10 – $20 | $30 – $50 | $60 – $100+ |

| QuickBooks Online | $15 – $25 | $40 – $60 | $80 – $150+ |

| Zoho Books | $10 – $15 | $25 – $40 | $50 – $80+ |

Factors to Consider When Evaluating Pricing Plans

Before committing to a particular pricing plan, entrepreneurs should carefully weigh several key factors. This ensures that the chosen plan aligns with current business needs and anticipates future growth.

- Number of users: Consider how many individuals will require access to the accounting software. Per-user pricing can significantly impact the total cost.

- Required features: Assess your business’s specific accounting needs. A basic plan might suffice for simple bookkeeping, while a more comprehensive plan may be necessary for inventory management, advanced reporting, or project tracking.

- Scalability: Choose a plan that can accommodate your business’s anticipated growth. Upgrading to a higher-tier plan later can be costly and disruptive.

- Contract terms: Understand the terms of the subscription, including any cancellation fees or commitment periods. Annual subscriptions often offer discounts compared to monthly plans.

- Support and training: Evaluate the level of support offered by the provider. Comprehensive support can be invaluable, especially during the initial implementation phase.

- Integration capabilities: Consider the cost and implications of integrating the accounting software with other business tools. Some integrations may be included in the subscription, while others might incur additional charges.

Choosing the Right Tool for Specific Needs

Selecting the ideal cloud-based accounting software hinges on a careful consideration of your business’s unique requirements. Factors such as industry, size, and future growth projections significantly influence the best choice. A solution perfectly suited for a small freelance consultant might be insufficient for a rapidly expanding retail chain. This section explores how these factors impact software selection and provides guidance on ensuring long-term compatibility.

Different industries often have specific accounting needs. For example, a retail business will require inventory management capabilities, perhaps integrated with a point-of-sale (POS) system, while a consulting firm might prioritize time tracking and invoicing features. Similarly, a manufacturing company will need tools for cost accounting and production tracking, features less critical for a service-based business. Choosing software with functionalities aligned with your industry’s specific demands is paramount for efficiency and accuracy.

Browse the multiple elements of How to Conduct a Break-Even Analysis to gain a more broad understanding.

Industry-Specific Software Selection

Retail businesses typically need software that handles inventory tracking, purchase orders, sales tax calculations, and potentially integrates with POS systems for real-time sales data. Examples include Xero, QuickBooks Online, and Zoho Books, all of which offer robust inventory management modules. Consulting firms, on the other hand, may prioritize time tracking, project management integration, and sophisticated invoicing features. Software like FreshBooks or Toggl Track, known for their time-tracking capabilities, would be well-suited for this sector. Freelancers often benefit from simple, user-friendly software with streamlined invoicing and expense tracking, such as FreshBooks or Wave Accounting.

Business Size and Software Choice

The size of your business directly impacts your accounting software needs. Small businesses, with limited transactions and simpler accounting requirements, might find a basic, affordable solution like Wave Accounting sufficient. These platforms are often user-friendly and require minimal technical expertise. Mid-sized businesses, however, often require more advanced features, including multi-user access, more robust reporting capabilities, and potentially integrations with other business applications. Larger enterprises may need enterprise resource planning (ERP) systems that integrate accounting with other business functions like supply chain management and customer relationship management (CRM). QuickBooks Online offers various plans catering to different business sizes, scaling up features and user access as needed.

Assessing Long-Term Scalability

Choosing accounting software is a long-term commitment. Therefore, it’s crucial to assess the scalability of your chosen solution. Consider factors such as the software’s ability to handle increasing transaction volumes, the ease of adding users and integrating with new applications, and the availability of advanced features as your business grows. Cloud-based solutions generally offer better scalability than on-premise software, as they can be easily upgraded and adapted to changing needs without significant infrastructure changes. Before committing to a specific platform, investigate its capacity for future expansion and ensure it can accommodate your anticipated growth trajectory. For example, if you anticipate significant growth in the next few years, choosing a platform with flexible pricing plans and readily available upgrades would be beneficial. A solution that becomes restrictive as your business expands can lead to costly migrations and disruptions down the line.

Implementation and Onboarding

Successfully implementing a new cloud accounting system requires careful planning and execution. A smooth transition minimizes disruption to your business operations and ensures accurate data from the outset. This process involves several key steps, from initial setup to ongoing support utilization.

The transition to a new cloud accounting system can feel daunting, particularly if you’re migrating data from a legacy system. Careful planning and a phased approach are essential to minimize downtime and ensure data accuracy. Understanding the software provider’s support resources is crucial for addressing any challenges that may arise during and after implementation.

Setting Up a New Cloud Accounting System

Setting up a new cloud accounting system typically involves several straightforward steps. First, you’ll create an account with the chosen provider, often requiring basic business information and potentially verification steps. Next, you’ll configure your chart of accounts, ensuring it aligns with your business structure and accounting needs. This may involve importing data from existing spreadsheets or manually entering account details. Finally, you’ll customize settings to reflect your preferences, such as reporting frequencies and notification preferences. Many providers offer guided tours or tutorials to assist with this process. For example, Xero provides interactive setup guides that walk users through each step, minimizing the learning curve.

Data Migration from Existing Systems

Proper data migration is crucial for a seamless transition. Inaccurate or incomplete data migration can lead to errors in financial reporting and potentially significant business disruptions. Before starting the migration, thoroughly clean and validate your existing data. Identify and correct any inconsistencies or errors. Consider using a data migration tool provided by your software provider or a third-party specialist. This tool often helps ensure the data is correctly formatted and compatible with the new system. For example, QuickBooks Online offers various import tools and support documentation to assist with migrating data from different sources, such as spreadsheets and legacy accounting software. A phased approach, starting with a small sample of data, can help identify and resolve potential issues before migrating the entire dataset.

Utilizing Support Resources from Software Providers

Most cloud accounting software providers offer extensive support resources to assist with implementation and ongoing use. These resources typically include comprehensive documentation, online tutorials, and frequently asked questions (FAQs) sections. Many providers also offer phone or email support, often with tiered levels based on subscription plans. Proactive use of these resources can prevent many common implementation challenges. For example, Intuit offers a robust knowledge base, webinars, and community forums for QuickBooks Online users. Taking advantage of these resources, such as watching introductory videos or reviewing FAQs, can significantly expedite the setup and minimize potential issues. Understanding the different support channels available and how to access them is a key component of successful implementation and ongoing system management.

Ultimate Conclusion

Ultimately, selecting the best cloud-based accounting tool for your entrepreneurial venture hinges on a careful assessment of your specific needs and long-term goals. By understanding the features, pricing structures, and integrations available, you can make an informed choice that streamlines your financial processes, enhances efficiency, and empowers you to focus on what matters most: building and growing your business. Remember to prioritize security, scalability, and user-friendliness when making your selection.

FAQ Compilation

What is the average cost of cloud-based accounting software?

Costs vary widely depending on the software and features chosen, ranging from free plans with limited functionality to several hundred dollars per month for comprehensive packages. Many providers offer tiered pricing based on the number of users or features.

Can I switch from one cloud accounting software to another?

Yes, it’s possible to switch, but it often requires careful planning and data migration. Most providers offer support resources to assist with this process. Thorough data backup is essential before starting the transition.

What if my internet connection is down? Can I still access my data?

While cloud-based software requires an internet connection for optimal functionality, some offer offline capabilities for limited data access. However, relying solely on offline access is not recommended for consistent and accurate accounting.

How secure is my data in the cloud?

Reputable cloud accounting providers employ robust security measures, including encryption, data backups, and compliance with industry standards like GDPR and SOC 2. However, it’s crucial to choose a provider with a strong security reputation and thoroughly review their security policies.