Choosing the Right Accounting System for Your Company is crucial for business success. The right system streamlines financial management, improves accuracy, and offers valuable insights for informed decision-making. Selecting the wrong one, however, can lead to inefficiencies, errors, and ultimately, hinder growth. This guide navigates the complexities of choosing an accounting system, providing a framework for assessing your needs and exploring available options.

From understanding your specific business requirements to considering factors like scalability, security, and cost, we’ll explore the key aspects to ensure you make a well-informed choice. We’ll delve into different software types, comparing cloud-based and on-premise solutions, and examining the features essential for efficient financial management. By the end, you’ll be equipped to select the accounting system that best supports your company’s current and future needs.

Understanding Your Business Needs

Choosing the right accounting system hinges on a thorough understanding of your company’s unique financial requirements. A system that works flawlessly for a large corporation might be overly complex and expensive for a small startup, while a simple system might lack the features a growing business needs. Therefore, a careful assessment of your current and future needs is crucial before making a decision.

Before investing in any accounting software, it’s essential to clearly define your business’s financial processes and reporting needs. This involves identifying the specific tasks the system must handle and the types of reports you’ll need to generate for internal management, tax compliance, and other purposes. Failing to do this can lead to purchasing a system that is either inadequate or unnecessarily sophisticated.

Key Financial Processes and Reporting Requirements

Your company’s accounting system should manage core financial processes like accounts payable and receivable, general ledger management, bank reconciliation, and financial reporting. The specific requirements will vary greatly depending on your industry and business size. For example, a manufacturing company will require inventory management capabilities, while a service-based business might prioritize project tracking and billing. Similarly, a large corporation will need more sophisticated reporting capabilities than a sole proprietorship. Consider what financial information you need to access quickly and easily, and which reports are crucial for decision-making. Regulatory requirements also play a significant role. Public companies face stricter reporting standards than privately held businesses.

Challenges with Existing (or Lack of) Accounting System

Many businesses face significant challenges with their current accounting systems, whether those systems are outdated, inefficient, or entirely absent. Common issues include manual data entry leading to errors, lack of real-time financial data, difficulty generating accurate and timely reports, poor integration with other business software, and inadequate security measures. Identifying these pain points is crucial to selecting a system that addresses them effectively. For instance, if manual data entry is a major source of errors, a system with automated data entry features would be a significant improvement. If timely reporting is a challenge, a system with robust reporting capabilities and dashboards is essential.

Comparison of Current and Ideal System Capabilities

The following table compares the features of a hypothetical current system with the capabilities of an ideal system, highlighting the importance of each feature. Importance is rated as High, Medium, or Low based on its impact on business operations and efficiency.

| Feature | Current System | Ideal System | Importance Rating |

|---|---|---|---|

| Accounts Payable/Receivable Automation | Manual entry, prone to errors | Automated invoice processing, online payment options | High |

| Financial Reporting | Limited reporting options, slow generation | Real-time dashboards, customizable reports, forecasting tools | High |

| Inventory Management | Spreadsheet-based, lacks real-time tracking | Integrated inventory tracking, automated reordering | Medium |

| Bank Reconciliation | Manual process, time-consuming | Automated bank feeds, reconciliation tools | High |

| Payroll Processing | External payroll service, lack of integration | Integrated payroll processing, direct deposit | High |

| Data Security | Limited security measures | Robust security features, data encryption | High |

| Scalability | Limited capacity for growth | Scalable to accommodate future growth | Medium |

| Integration with other systems (CRM, ERP) | No integration | Seamless integration with other business systems | Medium |

Exploring Accounting Software Options: Choosing The Right Accounting System For Your Company

Choosing the right accounting software is crucial for efficient financial management. This section will explore various options, highlighting key differences and considerations to help you make an informed decision. We’ll examine the contrasting approaches of cloud-based and on-premise systems, review popular software choices, and discuss scalability and pricing models.

Cloud-Based vs. On-Premise Accounting Systems

Cloud-based and on-premise accounting systems represent fundamentally different approaches to software deployment and management. Cloud-based systems, also known as Software as a Service (SaaS), store data on remote servers accessible via the internet. This offers advantages such as accessibility from anywhere with an internet connection, automatic updates, and reduced IT infrastructure costs. On-premise systems, conversely, require installation and maintenance on your company’s own servers. This provides greater control over data security and customization but demands significant upfront investment in hardware, software licenses, and IT expertise for maintenance and support. The choice depends heavily on your company’s size, technical capabilities, and security priorities.

Popular Accounting Software Options

Several accounting software packages cater to businesses of various sizes and complexities. Understanding their key features is essential for selecting the best fit.

- Xero: A popular cloud-based option known for its user-friendly interface and robust features, including invoicing, expense tracking, bank reconciliation, and reporting. Xero integrates well with other business applications and offers excellent mobile accessibility.

- QuickBooks Online: Another leading cloud-based solution, QuickBooks Online provides a comprehensive suite of accounting tools, catering to small to medium-sized businesses. Its features include financial reporting, inventory management, and payroll processing. It offers various plans to accommodate different business needs and scales well with growth.

- Sage 50cloud: This cloud-based accounting software is suitable for businesses needing more advanced features than those offered by entry-level options. It includes robust inventory management, project accounting, and CRM integration capabilities.

- FreshBooks: Primarily designed for freelancers and small businesses, FreshBooks is a cloud-based option that focuses on ease of use and streamlined invoicing. It excels at managing client payments and generating professional invoices.

- Zoho Books: A comprehensive cloud-based accounting solution, Zoho Books offers a wide array of features, including inventory management, expense tracking, and time tracking. It also integrates well with other Zoho applications, creating a cohesive business management platform.

Scalability of Accounting Systems

The ability of an accounting system to adapt to your company’s growth is a critical factor. Cloud-based systems generally offer better scalability due to their flexible nature. As your business expands, you can easily upgrade to a higher-tier plan with increased storage, user access, and features. On-premise systems, however, require more significant investments in hardware and software upgrades to accommodate growth. For example, a small business using an on-premise system might find it cost-prohibitive to upgrade their server infrastructure when expanding operations, while a cloud-based system would simply require a plan upgrade.

Accounting Software Pricing Models

Different software providers offer various pricing models. Understanding these models is essential for budgeting effectively.

- Subscription-based pricing: This is the most common model for cloud-based systems, where you pay a recurring monthly or annual fee based on the features and number of users. Examples include Xero and QuickBooks Online, with pricing tiers ranging from basic to advanced plans.

- Per-user pricing: Some providers charge based on the number of users accessing the system. This model can be cost-effective for small businesses with limited staff but can become expensive as the company grows.

- One-time purchase: This model is typical for on-premise systems, where you pay a lump sum for the software license. However, ongoing maintenance and support costs need to be factored in.

- Tiered pricing: Many providers offer tiered plans with varying levels of features and functionalities at different price points. Choosing the right tier depends on your specific needs and budget.

- Custom pricing: For larger enterprises with complex requirements, some providers offer custom pricing solutions tailored to specific needs. This often involves negotiating a contract with the software vendor.

Key Features to Consider

Choosing the right accounting system hinges on selecting software that seamlessly integrates with your business operations and provides the tools necessary for efficient financial management. The features you prioritize will depend heavily on your company’s size, industry, and specific needs. However, certain functionalities are crucial for most businesses.

Accounts Payable and Receivable Management

Effective management of accounts payable (AP) and accounts receivable (AR) is vital for maintaining healthy cash flow. Key features to look for include automated invoice processing, online payment options for customers (AR), vendor payment scheduling and tracking (AP), and comprehensive reporting capabilities to monitor outstanding balances and payment trends. A system with strong AP/AR features minimizes manual data entry, reduces errors, and provides valuable insights into your company’s financial health. For example, automated invoice matching can significantly reduce the time spent reconciling invoices and payments, freeing up staff for other tasks. Furthermore, features like automated reminders for overdue payments can improve collection rates for accounts receivable.

Inventory Management Features

For businesses that handle inventory, robust inventory management is paramount. Essential features include real-time tracking of stock levels, automated ordering based on pre-set thresholds (reordering points), tracking of product costs, and integration with point-of-sale (POS) systems. The ability to forecast demand based on historical sales data is also highly beneficial. For instance, a bakery using an accounting system with integrated inventory management can accurately track flour usage, predict when to order more, and avoid stockouts that could disrupt production. This prevents lost sales and ensures smooth operations. Furthermore, accurate inventory tracking allows for better cost accounting and minimizes losses due to spoilage or theft.

Integrated Payroll Processing

Integrating payroll processing within your accounting system streamlines operations and improves accuracy. This integration eliminates the need for separate payroll software and reduces the risk of data entry errors. Key benefits include automated tax calculations, direct deposit capabilities, employee self-service portals, and generation of comprehensive payroll reports. For example, integrating payroll directly with the general ledger ensures that payroll expenses are accurately recorded, simplifying the financial reporting process. This integration also simplifies year-end tax reporting and reduces the potential for discrepancies. The time saved through automation allows for a more efficient and less error-prone payroll process.

Transaction Workflow

The following flowchart illustrates a typical transaction workflow within an integrated accounting system:

[Imagine a flowchart here. The flowchart would begin with a “Transaction Initiated” box (e.g., sale, purchase, payment). This would lead to a “Data Entry” box, followed by a “Validation” box (checking for errors). Next would be a “Posting to Ledger” box, updating the general ledger. Then, a “Report Generation” box, creating reports like balance sheets and income statements. Finally, an “Archive” box, storing the transaction data for future reference. Arrows would connect each box, showing the flow of the transaction.]

Implementation and Integration

Successfully implementing a new accounting system involves more than just purchasing the software. A smooth transition requires careful planning, efficient data migration, comprehensive user training, and proactive consideration of potential integration challenges with existing systems. Ignoring these crucial steps can lead to delays, errors, and ultimately, a failed implementation.

Data Migration

Migrating data from an older system to a new one is a critical step. This process involves extracting data from the old system, transforming it into a format compatible with the new system, and then loading it into the new system. Data cleansing—identifying and correcting inaccuracies and inconsistencies in the data—is essential before migration to ensure data integrity in the new system. A poorly executed data migration can lead to significant inaccuracies in financial reporting and operational inefficiencies. For example, a company might discover discrepancies in inventory counts or customer balances after a rushed migration. A phased approach, migrating data in stages, can minimize disruption and allow for thorough verification at each step. Automated data migration tools can significantly speed up the process and reduce the risk of manual errors.

User Training and Ongoing Support

Effective user training is paramount for a successful implementation. Training should be tailored to the specific roles and responsibilities of each user, covering everything from basic navigation to advanced features. Hands-on training sessions, coupled with comprehensive documentation and readily available support resources, are vital to ensure users are comfortable and confident in using the new system. Ongoing support, including access to help desk assistance and regular software updates, is also crucial to address any issues that may arise after the initial implementation. Consider providing refresher training sessions periodically to keep users updated on new features and best practices. For instance, a company could offer monthly webinars or create an internal knowledge base for users to access.

Integration Challenges

Integrating the new accounting system with existing CRM (Customer Relationship Management) or other business software systems can present significant challenges. Data synchronization issues, inconsistencies in data formats, and potential conflicts between systems are common problems. Careful planning and testing are crucial to ensure seamless data flow between systems. APIs (Application Programming Interfaces) are often used to facilitate integration, but choosing the right API and ensuring its proper configuration requires technical expertise. For example, a company might experience delays in order processing if the accounting system doesn’t integrate properly with its e-commerce platform. Prioritizing the integration of critical systems and addressing potential conflicts early on can minimize disruptions to business operations.

Implementation Checklist

A well-defined checklist can ensure a smooth transition. This checklist should include steps such as:

- Needs Assessment: Clearly define the business requirements and objectives for the new system.

- Software Selection: Evaluate and select the accounting software that best meets your needs.

- Data Migration Planning: Develop a comprehensive data migration plan, including data cleansing and validation steps.

- User Training: Create a training program that covers all aspects of the new system.

- System Testing: Conduct thorough testing of the new system before going live.

- Go-Live: Implement the new system in a controlled manner, minimizing disruption to business operations.

- Post-Implementation Review: Conduct a post-implementation review to identify areas for improvement.

Following a structured approach and meticulously addressing each step Artikeld in this checklist will significantly enhance the chances of a successful implementation and integration of the new accounting system.

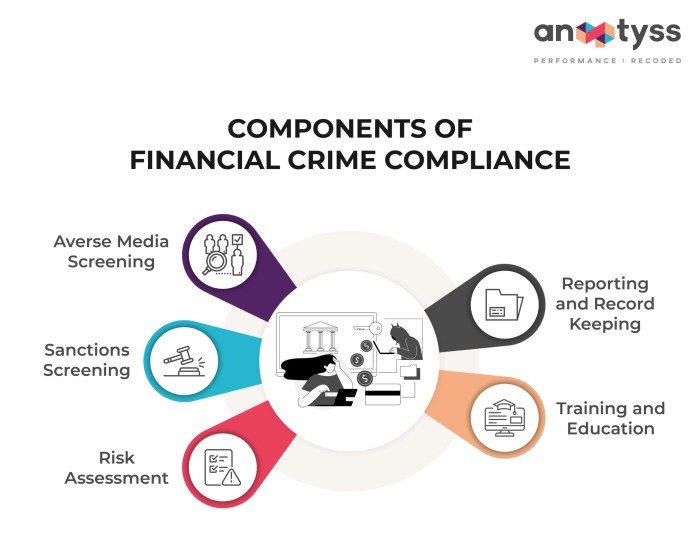

Security and Compliance

Choosing the right accounting system involves careful consideration of security and compliance aspects to safeguard your financial data and ensure adherence to relevant regulations. Robust security measures are crucial not only for protecting your business’s financial health but also for maintaining client trust and avoiding potential legal repercussions. Neglecting these aspects can lead to significant financial losses, reputational damage, and legal penalties.

Protecting sensitive financial data requires a multi-layered approach. The system you choose should offer a range of security features designed to mitigate various threats. This includes both technical safeguards and procedural controls that work together to create a secure environment for your financial information.

Data Encryption and Access Controls

Data encryption is a fundamental security feature. It transforms your sensitive data into an unreadable format, making it incomprehensible to unauthorized individuals even if intercepted. Strong encryption algorithms, such as AES-256, are essential for protecting data at rest and in transit. Access controls, implemented through user roles and permissions, ensure that only authorized personnel can access specific data and perform particular actions. For example, a system might allow accountants to view all financial records, while sales staff only have access to sales-related data. Different software options handle these features differently; some offer granular control over individual data fields, while others provide a more general approach. Cloud-based systems often leverage the provider’s infrastructure for encryption and access control, which can be advantageous in terms of security expertise and scalability, but requires careful consideration of the provider’s security practices and compliance certifications.

Compliance with Financial Reporting and Data Privacy Regulations

Accounting systems must comply with various financial reporting standards (e.g., GAAP, IFRS) and data privacy regulations (e.g., GDPR, CCPA). Compliance involves adhering to specific reporting formats, data retention policies, and audit trail requirements. The system should facilitate the generation of compliant financial reports and provide tools for managing data privacy, such as consent management and data subject access requests. Failure to comply can result in significant fines and legal action. For instance, a company failing to comply with GDPR could face substantial fines for unauthorized data processing. The chosen accounting system should provide features to help organizations meet these requirements, such as automated report generation, data masking capabilities, and audit logs.

Data Backups and Disaster Recovery Planning

Regular data backups and a comprehensive disaster recovery plan are critical for business continuity. Data loss can severely disrupt operations and cause irreparable damage. The accounting system should offer robust backup options, including both on-site and off-site backups, and a clear process for restoring data in case of a system failure or disaster. A disaster recovery plan should Artikel procedures for restoring data, systems, and operations in the event of a natural disaster, cyberattack, or other unforeseen circumstances. This plan should include details on data backup frequency, storage location, restoration procedures, and communication protocols. For example, a company might use a cloud-based backup service for off-site storage and have a detailed recovery plan that specifies the steps to be taken within specific timeframes following a system failure.

Cost and Return on Investment (ROI)

Choosing the right accounting system involves a careful consideration of not only its features and functionality but also its overall cost and the potential return on that investment. A well-chosen system can significantly improve efficiency and accuracy, leading to substantial cost savings and improved profitability in the long run. Conversely, a poorly chosen or implemented system can lead to increased costs and decreased productivity.

Cost Components of Accounting System Implementation and Maintenance, Choosing the Right Accounting System for Your Company

Implementing and maintaining an accounting system involves several cost components. These costs can vary significantly depending on the size and complexity of your business, the chosen software, and the level of customization required. Understanding these costs is crucial for budgeting and evaluating the overall ROI. Key cost elements include the initial software license fees, implementation and setup costs (which may involve professional services), ongoing maintenance and support fees (often annual subscriptions), training costs for employees, and any potential hardware upgrades needed to support the new system. Hidden costs, such as the time spent by employees on data migration and learning the new system, should also be factored in. For example, a small business might spend a few thousand dollars on software and training, while a large enterprise could easily invest tens of thousands, or even hundreds of thousands, depending on the scale and complexity of the project.

Calculating the Potential ROI of Upgrading to a New Accounting System

Calculating the ROI of a new accounting system involves comparing the total cost of ownership (TCO) with the anticipated benefits. The TCO encompasses all costs associated with acquiring, implementing, and maintaining the system over its lifespan. Benefits can include reduced labor costs due to increased efficiency, minimized errors leading to fewer financial discrepancies, improved reporting and decision-making capabilities, and enhanced compliance with regulations. A simple ROI calculation can be expressed as:

ROI = (Net Benefits – Total Costs) / Total Costs

. Net benefits represent the quantifiable improvements resulting from the new system, such as reduced labor hours, avoided penalties, or increased revenue due to better financial management. For instance, if a new system reduces manual data entry time by 10 hours per week at a cost of $25/hour, the annual benefit would be $13,000. This benefit would then be factored into the ROI calculation.

Total Cost of Ownership (TCO) Comparison

The following table compares the TCO for different accounting software options over a 3-year period. These figures are illustrative and can vary depending on the specific features, add-ons, and support levels chosen.

| Software Name | Initial Cost | Annual Maintenance | Total Cost (3 years) |

|---|---|---|---|

| Software A | $500 | $100 | $800 |

| Software B | $1500 | $250 | $2250 |

| Software C | $3000 | $500 | $4500 |

Improved Efficiency and Accuracy Contributing to Positive ROI

Improved efficiency and accuracy are key drivers of a positive ROI. A more efficient system reduces the time spent on manual tasks, freeing up employees to focus on more strategic activities. Reduced errors minimize the costs associated with correcting mistakes, such as reworking reports or dealing with audit issues. For example, a system that automates invoice processing can significantly reduce the time spent on this task, leading to substantial cost savings. Similarly, a system that improves the accuracy of financial reporting can help avoid costly errors and penalties. These improvements translate into tangible financial benefits that contribute significantly to a positive return on investment.

Final Wrap-Up

Ultimately, selecting the right accounting system is an investment in your company’s future. By carefully considering your business needs, exploring available options, and understanding the key features and implementation considerations, you can significantly improve your financial management capabilities. Remember to factor in cost, security, and scalability to ensure long-term success. A well-chosen system will not only streamline your financial processes but also provide valuable data-driven insights to inform strategic decisions and propel your business forward.

FAQ Insights

What is the difference between cloud-based and on-premise accounting software?

Cloud-based software is accessed via the internet, requiring no local installation. On-premise systems are installed and maintained on your company’s servers.

How much should I budget for accounting software?

Pricing varies greatly depending on features, number of users, and provider. Expect a range from free (often limited) to several hundred dollars per month.

What about data security in cloud-based accounting systems?

Reputable cloud providers employ robust security measures, often exceeding those of many small businesses. Look for systems with encryption, access controls, and regular security audits.

Can I integrate my accounting software with other business tools?

Many accounting systems offer integrations with CRM, payroll, and other business applications, streamlining workflows and data exchange.

Discover how How to Pay Estimated Taxes as a Small Business Owner has transformed methods in this topic.