How to Track Business Mileage for Tax Deductions is crucial for maximizing tax benefits. This guide delves into the intricacies of IRS guidelines, offering various methods for accurate mileage tracking, from manual logs to sophisticated apps. We’ll explore the best practices for record-keeping, calculation methods, and common pitfalls to avoid, ensuring you claim every eligible deduction. Understanding these processes will empower you to confidently navigate tax season and optimize your business finances.

We’ll cover everything from understanding IRS rules and choosing the right tracking method to accurately calculating your deduction and avoiding common mistakes. Whether you prefer a simple spreadsheet or a dedicated app, we’ll equip you with the knowledge to manage your business mileage effectively and legally.

Understanding Mileage Deduction Rules

Claiming a tax deduction for business mileage requires a thorough understanding of IRS guidelines. Accurate record-keeping is crucial for a successful deduction, and failing to meet these requirements can result in the rejection of your claim. This section clarifies the rules and provides practical examples to ensure compliance.

The Internal Revenue Service (IRS) allows self-employed individuals and some employees to deduct business-related vehicle expenses. Instead of itemizing individual expenses like gas, oil, repairs, and depreciation, taxpayers can use the standard mileage rate, a predetermined amount per mile, to simplify the process. This rate is adjusted annually and published by the IRS. Using the standard mileage rate requires meticulous record-keeping to substantiate the deduction.

IRS Guidelines for Deducting Business Mileage

The IRS mandates that only mileage driven for legitimate business purposes is deductible. This means the travel must directly relate to your business activities. Commuting between your home and your primary place of business is generally not deductible. However, if you have multiple business locations or work from various client sites, travel between these locations may qualify. The deduction is calculated by multiplying the total business miles driven by the current standard mileage rate. Remember to keep separate records for business and personal mileage.

Requirements for Maintaining Accurate Mileage Records

Maintaining accurate records is paramount. The IRS requires sufficient documentation to verify the legitimacy of your mileage deduction. Simply stating the number of miles driven is insufficient. Your records should clearly demonstrate the date, starting point, destination, business purpose of the trip, and the total mileage for each trip. This information can be recorded in a mileage log, a spreadsheet, or a dedicated mileage tracking app.

Consider these essential elements for your records:

- Date: The date of each trip.

- Starting Point: The address or location where the trip began.

- Destination: The address or location where the trip ended.

- Business Purpose: A brief description of the business reason for the trip (e.g., “Meeting with client X,” “Delivery of goods to Y,” “Site visit for project Z”).

- Total Mileage: The total number of miles driven for the trip (using an odometer reading is recommended).

Examples of Acceptable and Unacceptable Business Mileage

Understanding the difference between acceptable and unacceptable business mileage is crucial for avoiding potential audit issues. The following examples illustrate the key distinctions:

| Acceptable Business Mileage | Unacceptable Business Mileage |

|---|---|

| Driving to a client meeting | Commuting from home to your primary office |

| Traveling to a business conference | A personal shopping trip |

| Delivering goods to a customer | Driving to a social event |

| Visiting a job site | A weekend trip to visit family |

Best Practices for Documenting Business Trips

Proactive record-keeping minimizes potential problems during a tax audit. Consider these best practices:

- Use a Mileage Log: Maintain a detailed mileage log, either physical or digital, consistently recording all business trips.

- Record Odometer Readings: Note the beginning and ending odometer readings for each trip to accurately calculate mileage.

- Keep Supporting Documentation: Retain supporting documents like client invoices, meeting agendas, or delivery receipts that corroborate your business trips.

- Regularly Review and Update: Regularly review your mileage log to ensure accuracy and completeness.

- Use a Mileage Tracking App: Several apps automatically track mileage and categorize trips, simplifying the record-keeping process.

Methods for Tracking Mileage

Accurately tracking your business mileage is crucial for maximizing your tax deductions. Several methods exist, each with its own advantages and disadvantages. Choosing the right method depends on your individual needs and preferences, considering factors like the frequency of your business trips and your technological comfort level. Let’s explore the common options.

Manual Mileage Log

A manual mileage log involves meticulously recording your trips in a notebook or spreadsheet. This traditional method requires discipline and careful record-keeping. While simple, it’s prone to errors and omissions.

| Date | Starting Odometer | Ending Odometer | Business Purpose | Total Miles |

|---|---|---|---|---|

| 2024-10-26 | 12345 | 12400 | Client Meeting | 55 |

| 2024-10-27 | 12400 | 12510 | Office Supply Run | 110 |

| 2024-10-28 | 12510 | 12625 | Conference | 115 |

Mileage Tracking Apps

Numerous smartphone applications are designed specifically for mileage tracking. These apps automate many aspects of the process, often using GPS to automatically record trips, eliminating the need for manual odometer readings. Popular apps often include features such as categorizing trips by purpose, generating reports for tax purposes, and integrating with accounting software.

GPS Devices

Dedicated GPS devices, while less common now with the prevalence of smartphones, can also track mileage. These devices are typically installed in a vehicle and continuously record location and mileage data. They often offer more robust features than apps, but come with the added cost and inconvenience of purchasing and installing the device.

Comparison of Mileage Tracking Methods, How to Track Business Mileage for Tax Deductions

Each method has its strengths and weaknesses. Manual logs are inexpensive but require diligent record-keeping. Mileage tracking apps offer convenience and automation but rely on consistent smartphone usage and accurate GPS signals. GPS devices provide the most accurate data but are the most expensive option. Choosing the best method involves weighing the cost, convenience, and accuracy requirements against individual needs. For example, a self-employed individual with frequent business trips might benefit from a mileage tracking app, while someone with occasional business trips might find a manual log sufficient.

Maintaining Accurate Records

Maintaining meticulous records is crucial for successfully claiming your business mileage deduction. The IRS requires detailed and verifiable documentation to support your claim, preventing potential audits and ensuring a smooth tax filing process. Accurate record-keeping not only safeguards your tax benefits but also provides valuable insights into your business travel expenses.

Accurate mileage record-keeping involves a systematic approach to documenting every business-related trip. This ensures that you can easily substantiate your deductions when required by the tax authorities. Failing to maintain accurate records can result in the disallowance of your mileage deduction, leading to a significant financial setback.

Mileage Record-Keeping Steps

To ensure accuracy, follow these steps when recording your business mileage:

- Start a dedicated mileage log: Use a notebook, spreadsheet software (like Excel or Google Sheets), or a dedicated mileage tracking app. Consistency is key; choose one method and stick with it.

- Record each trip immediately: Note the date, starting odometer reading, ending odometer reading, total miles driven, purpose of the trip (e.g., client meeting, supply run), and the destination. Don’t rely on memory; record the information as soon as you complete your trip.

- Clearly identify business trips: Distinguish between personal and business travel. If a trip involves both, only record the business portion of the mileage. Maintain clear documentation to support this distinction.

- Regularly review and update your log: Check for any discrepancies or missing information. Regular review helps prevent errors from accumulating and makes year-end tax preparation significantly easier.

- Store your log securely: Keep your mileage log in a safe and organized place, readily accessible for tax preparation and potential audits. Consider both physical and digital backups.

Supporting Documentation

While the mileage log is the primary record, supporting documentation adds credibility to your claim. This might include:

- Client appointment confirmations: Emails, calendar entries, or invoices showing scheduled meetings with clients.

- Receipts for business-related expenses incurred during the trip: These can help substantiate the business purpose of the travel. While not directly related to mileage, they add context and strengthen your claim.

- Delivery receipts or invoices: For trips involving deliveries or pick-ups, these receipts provide evidence of the business purpose of the travel.

Organizing Mileage Records

Organize your mileage records for easy retrieval. A well-organized system simplifies tax preparation and reduces stress during audits.

- Chronological order: Arrange your records chronologically (by date) for easy tracking of travel expenses over time.

- Categorization: Group records by client, project, or type of business activity for clearer analysis of travel patterns and expense allocation.

- Digital backups: Create digital copies of your mileage logs and supporting documentation to protect against loss or damage.

Preventing Errors and Omissions

Careful planning and attention to detail minimize errors.

- Use a consistent method: Choose one method for tracking mileage (e.g., spreadsheet, app) and use it consistently throughout the year.

- Regularly reconcile your records: Compare your mileage log against your odometer readings to identify and correct any discrepancies.

- Double-check your entries: Before submitting your tax return, carefully review your mileage log for accuracy and completeness.

Calculating Deductible Mileage

Accurately calculating your deductible mileage is crucial for maximizing your tax benefits. This section will guide you through the two primary methods: using the standard mileage rate and calculating deductions based on your actual car expenses. Understanding the differences between these methods will help you choose the approach most advantageous to your specific situation.

Standard Mileage Rate Calculation

The IRS sets an annual standard mileage rate for business use. This rate covers the cost of gas, oil, repairs, insurance, and depreciation. To calculate your deduction using this method, simply multiply the total business miles driven by the current standard mileage rate. For example, if you drove 10,000 business miles and the standard mileage rate is $0.58 per mile (this is a hypothetical example, always check the current IRS rate), your deduction would be $5,800 (10,000 miles x $0.58/mile). Remember to keep meticulous records of your business mileage to support your claim. The standard mileage rate simplifies the process, eliminating the need for detailed expense tracking.

Actual Car Expense Calculation

Alternatively, you can deduct your actual car expenses. This method requires detailed record-keeping of all costs associated with your vehicle’s business use, including gas, oil changes, repairs, insurance, license fees, depreciation, and interest on car loans. You will need to determine the percentage of your vehicle’s total mileage that was used for business purposes. This percentage is then applied to each expense to determine the deductible portion. For instance, if 60% of your total mileage was for business and your total gas expense was $2,000, your deductible gas expense would be $1,200 ($2,000 x 0.60). This method offers potential for a larger deduction if your actual expenses exceed the deduction calculated using the standard mileage rate. However, it requires significantly more record-keeping.

Comparison of Standard Mileage Rate and Actual Expense Methods

Choosing between the standard mileage rate and the actual expense method depends on your individual circumstances. Here’s a comparison to help you decide:

- Simplicity: The standard mileage rate method is significantly simpler, requiring only the total business miles driven and the current IRS rate. The actual expense method necessitates detailed record-keeping of various expenses.

- Record-Keeping: The standard mileage rate method requires minimal record-keeping (mileage log). The actual expense method demands meticulous tracking of all car-related expenses and their allocation to business use.

- Deduction Amount: The standard mileage rate may result in a smaller deduction than the actual expense method, especially if you have high actual expenses or a vehicle that depreciates quickly. Conversely, the actual expense method might yield a larger deduction in such cases.

- Eligibility: Both methods are generally available, but certain limitations might apply based on vehicle type and business use. Consult the IRS guidelines for specifics.

Calculating Deductions for Different Scenarios

Let’s consider some scenarios to illustrate the calculation process:

Scenario 1: Multiple Vehicles

If you use multiple vehicles for business, you’ll need to track mileage and expenses separately for each. For example, if you drove 5,000 miles in Car A and 3,000 miles in Car B, you’ll calculate the deduction for each vehicle individually using either the standard mileage rate or the actual expense method.

Scenario 2: Partial Business Use

If your vehicle is used for both business and personal purposes, you must determine the percentage of business use. Let’s say you drove a total of 15,000 miles, with 8,000 miles for business. Your business use percentage is 53.33% (8,000/15,000). This percentage is then applied to your total expenses or mileage to calculate the deductible amount. For instance, if using the standard mileage rate of $0.58, your deduction would be $4,666 (8,000 miles * $0.58/mile). If using the actual expense method, this percentage would be applied to each individual expense category.

Remember to always consult the current IRS publications for the most up-to-date mileage rates and deduction rules. Proper record-keeping is essential to support your deductions.

Common Mistakes to Avoid

Claiming mileage deductions accurately requires careful record-keeping and a thorough understanding of IRS guidelines. Many taxpayers unintentionally make errors, leading to potential penalties or disallowed deductions. Understanding these common pitfalls and implementing preventative measures is crucial for maximizing your tax benefits while staying compliant.

Many common mistakes stem from a lack of detailed record-keeping or misunderstanding of the rules surrounding business versus personal use. Inaccurate reporting can lead to delays in processing your tax return, audits, and ultimately, a reduction in your refund or an increased tax liability. Avoiding these mistakes is achievable through diligent tracking and a commitment to accuracy.

Inconsistent or Incomplete Record Keeping

Maintaining meticulous records is paramount. Simply jotting down mileage sporadically in a notebook isn’t sufficient. The IRS requires detailed records, including the date, starting and ending odometer readings, purpose of the trip, and destination. Missing even one element can jeopardize your entire deduction. Using a dedicated mileage tracking app or a spreadsheet with clearly defined columns for each data point is recommended. For example, if you only record the total mileage for a week, without specifying individual trips and purposes, the IRS might question the legitimacy of your claim. Accurate records allow for easy verification and demonstrate compliance with IRS regulations.

Mixing Business and Personal Use

A significant error is failing to accurately distinguish between business and personal mileage. If you use your vehicle for both, you must only claim the mileage directly related to business activities. For instance, if you drive to work and then visit a client afterward, only the mileage from your workplace to the client’s location is deductible. Failing to separate these uses can result in a significant overstatement of your deduction. A reliable method for separating business and personal use is to keep separate logs for each purpose, ensuring that every trip is meticulously categorized.

Incorrect Calculation of Deductible Mileage

The IRS sets an annual standard mileage rate for business use. Using an outdated or incorrect rate will lead to an inaccurate deduction. It’s essential to refer to the official IRS website for the current rate, which is usually updated annually. Failing to use the correct rate can result in an under- or over-statement of your deduction. For example, using last year’s rate instead of the current year’s rate could lead to a significant discrepancy, depending on the mileage driven.

Failure to Correct Errors

Discovering an error in your mileage records after filing your tax return requires immediate action. Don’t ignore it; the IRS could identify the discrepancy during an audit. File an amended tax return (Form 1040-X) to correct the error and provide supporting documentation, such as revised mileage logs or explanations for any discrepancies. Proactive correction demonstrates your commitment to accuracy and helps avoid potential penalties. Ignoring errors can result in significant financial consequences.

Visual Representation of Mileage Tracking

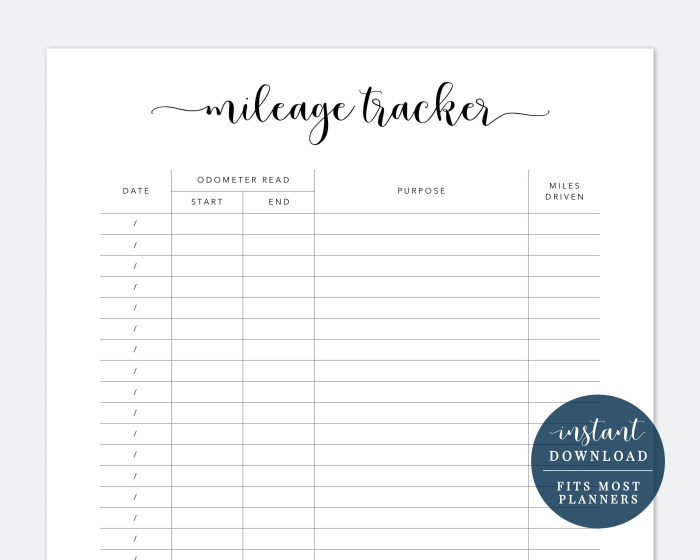

A clear visual representation of your mileage tracking is crucial for simplifying the tax deduction process and ensuring accuracy. Well-organized records minimize the chance of errors and make it easier for you to understand your business travel expenses at a glance. This section will illustrate how to create effective visual aids for your mileage logs and categorize your driving.

A well-maintained mileage log should resemble a simple spreadsheet or table. Each row represents a single trip, and each column contains essential information. Imagine a table with columns for the date of the trip, a brief description of the purpose (e.g., “Client meeting,” “Office supply run,” “Travel to conference”), the odometer reading at the start of the trip, the odometer reading at the end of the trip, and the calculated business miles for that trip. For example, a row might show: Date: October 26, 2023; Purpose: Client Meeting; Starting Mileage: 12,500; Ending Mileage: 12,550; Business Miles: 50.

Mileage Log Table Example

Consider a table with the following headers:

| Date | Purpose of Trip | Starting Odometer Reading | Ending Odometer Reading | Total Business Miles | Business/Personal Percentage (if applicable) |

|---|---|---|---|---|---|

| October 26, 2023 | Client Meeting – Acme Corp | 12500 | 12550 | 50 | 100% Business |

| October 27, 2023 | Office Supply Run | 12550 | 12575 | 25 | 100% Business |

| October 28, 2023 | Airport – Business Trip | 12575 | 12650 | 75 | 100% Business |

| October 29, 2023 | Grocery Shopping (Partial Business Use) | 12650 | 12700 | 50 | 50% Business |

This table clearly displays all necessary information for each trip, making it easy to calculate total business mileage at the end of the year.

Categorizing Business and Personal Mileage

Visually representing the distinction between business and personal mileage can be done effectively using a simple chart or graph. A pie chart, for example, could illustrate the percentage of total miles driven that were for business purposes versus personal use. Alternatively, a bar graph could visually compare the total business miles against the total personal miles for a given period (e.g., monthly or quarterly).

Investigate the pros of accepting How to Perform a Business Valuation in your business strategies.

For instance, a pie chart might show 70% of your total mileage was for business and 30% for personal use. A bar graph could directly show the number of business miles (e.g., 10,000 miles) versus the number of personal miles (e.g., 4,000 miles) for a specific time frame.

Conclusion

Mastering business mileage tracking is key to minimizing your tax burden and maximizing your financial health. By diligently maintaining accurate records and understanding the nuances of IRS regulations, you can confidently claim the deductions you deserve. Remember, consistent record-keeping is paramount; proactive tracking throughout the year simplifies the process significantly, making tax season less stressful and more financially rewarding.

FAQ Corner: How To Track Business Mileage For Tax Deductions

What if I use my car for both business and personal use?

You must accurately track both business and personal mileage. Only the business miles are deductible. Keep detailed records to support the percentage of business use.

Can I deduct mileage for commuting to my regular place of work?

No, commuting is generally not deductible. Mileage is deductible only for travel directly related to business activities beyond your usual workplace.

What happens if I make a mistake on my mileage log?

Amend your records as soon as possible. Correct the error and keep a record of the correction. If you’ve already filed, you may need to file an amended return.

Are there penalties for inaccurate mileage reporting?

Yes, inaccurate reporting can lead to penalties, including interest and back taxes. Accurate record-keeping is crucial to avoid these consequences.