Angel Investors vs Venture Capital Accounting Differences: Navigating the financial landscape of startup funding reveals significant discrepancies in how angel investors and venture capitalists approach accounting. Understanding these differences is crucial for both entrepreneurs seeking funding and investors managing their portfolios. This exploration delves into the intricacies of investment structures, valuation methods, and reporting requirements, highlighting the key distinctions that shape the financial realities of each investment type.

From the legal frameworks governing investment agreements to the diverse tax implications, this analysis provides a comprehensive overview. We will examine how investment size and stage influence accounting practices, offering a clear understanding of the nuances that set angel and venture capital accounting apart. This knowledge empowers informed decision-making for all stakeholders involved in the dynamic world of early-stage financing.

Investment Structures and Agreements

Angel investors and venture capitalists, while both providing crucial funding for startups, differ significantly in their investment approaches, reflected clearly in the structures and agreements they utilize. Understanding these differences is critical for entrepreneurs seeking funding. This section will delve into the nuances of these structures and agreements, highlighting key distinctions.

Legal Structures Used by Angel Investors and Venture Capitalists, Angel Investors vs Venture Capital Accounting Differences

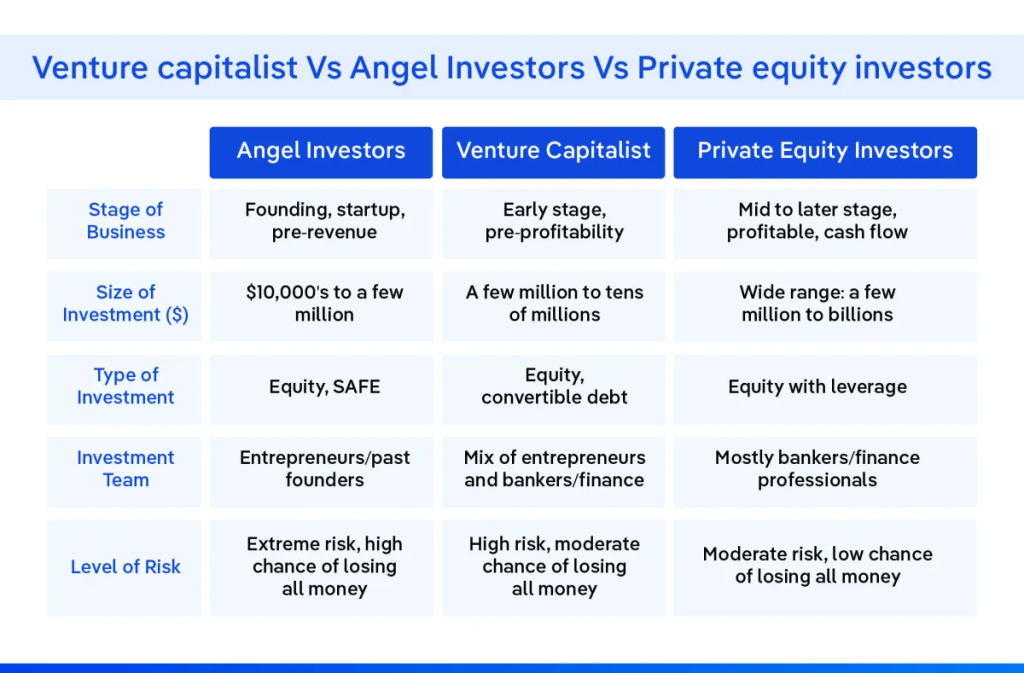

Angel investors often participate in simpler investment structures. They might use convertible notes, simple equity investments, or SAFE (Simple Agreement for Future Equity) agreements, particularly in early-stage funding rounds. These structures are less complex and require less legal negotiation than those used by venture capitalists. Venture capitalists, on the other hand, typically favor more sophisticated structures, primarily involving preferred stock with various rights and protections embedded within the investment agreements. This reflects their larger investment amounts and the higher level of due diligence they conduct. The complexity stems from the need to manage risk and ensure a favorable return on investment, often in later-stage companies.

Key Clauses in Investment Agreements: Angel vs. VC

Several key clauses distinguish angel and VC investment agreements. Valuation is a critical difference; angel investments often involve less rigorous valuations than VC deals, particularly in very early stages. Liquidation preferences, which dictate the order in which investors receive their capital back in the event of a sale or liquidation, are generally more favorable to VCs, often providing a multiple return on their investment before common shareholders receive anything. VCs also typically negotiate for greater control rights, including board seats and veto power over certain corporate decisions. Angels, due to their smaller investment size, usually have less influence over the company’s governance. Finally, anti-dilution protection, which protects investors from the dilution of their ownership stake through subsequent funding rounds, is a more common and robust feature in VC agreements.

Types of Preferred Stock and Accounting Implications

Preferred stock is a common instrument in VC deals, offering investors preferential treatment over common stockholders. Several types exist, each with unique accounting implications. Participating preferred stock allows investors to receive both their preferred return and participate in common stock distributions. Non-participating preferred stock only allows investors to receive their preferred return. These distinctions impact how the investment is accounted for on both the investor’s and the company’s balance sheets. For example, participating preferred stock might require a more complex accounting treatment to reflect the potential for double distribution. The accounting treatment also differs depending on whether the preferred stock is convertible into common stock. Convertible preferred stock, common in both angel and VC deals, is treated differently from non-convertible preferred stock, particularly in the event of conversion.

Comparison of Terms and Conditions in Angel and Venture Capital Agreements

| Term | Angel Investment Agreement | Venture Capital Term Sheet |

|---|---|---|

| Valuation | Often less formal, potentially based on simpler metrics | Rigorous valuation process, often involving professional appraisals |

| Liquidation Preference | May be absent or less favorable to the investor | Typically includes a multiple (e.g., 1x, 2x) on invested capital |

| Board Representation | Unlikely | Common, often with veto rights on significant decisions |

| Anti-Dilution Protection | Less common or less comprehensive | Usually includes robust provisions to protect against dilution |

Valuation Methods

Valuation is a critical aspect of both angel and venture capital investments, significantly impacting the accounting treatment of these investments. The methods employed, however, can differ based on the stage of the company, the investor’s risk tolerance, and the available information. Understanding these differences is crucial for accurate financial reporting and effective investment decision-making.

Valuation methodologies used by angel investors and venture capitalists often overlap but may emphasize different aspects depending on the investment stage and the investor’s strategy. Angel investors, often investing in earlier-stage companies with less historical data, may rely more on qualitative factors and less precise valuation methods. Venture capitalists, investing in later-stage companies with more established track records, may utilize more quantitative approaches. This divergence in approach directly influences how the investment is accounted for on both the investor’s and the company’s balance sheets.

Valuation Methodologies

Several valuation methodologies are commonly used. These include discounted cash flow (DCF) analysis, comparable company analysis, precedent transactions, and asset-based valuation. DCF analysis projects future cash flows and discounts them back to their present value, offering a theoretically robust valuation. Comparable company analysis compares the target company to similar publicly traded companies, using metrics like price-to-earnings (P/E) ratios or enterprise value-to-revenue (EV/R) multiples. Precedent transactions analyze the prices paid for similar companies in previous acquisitions. Finally, asset-based valuation assesses the net asset value of the company. The choice of method depends heavily on data availability and the specific circumstances of the investment.

Impact on Accounting Treatment

The chosen valuation method directly influences the accounting treatment of the investment. For example, if a DCF analysis is used, the resulting valuation becomes the initial carrying amount of the investment on the investor’s balance sheet. Subsequent accounting will depend on the classification of the investment (e.g., as available-for-sale or held-to-maturity securities). Using a comparable company analysis, the valuation is based on market multiples, and any subsequent changes in the market multiples may affect the fair value of the investment. This fair value is then reflected in the investor’s financial statements. Different valuation methods lead to different initial investment costs and subsequent adjustments based on fair value changes.

Key Factors Influencing Valuation in Early-Stage Companies

Several factors significantly influence valuation in early-stage companies, impacting accounting records. These include the size and experience of the management team, the strength of the intellectual property, the market opportunity, the competitive landscape, and the stage of product development. For example, a company with a strong management team and a large potential market may command a higher valuation than a company with a less experienced team and a smaller market opportunity. These qualitative factors are often difficult to quantify but significantly affect valuation and, consequently, the initial carrying amount of the investment on the investor’s books. A strong intellectual property portfolio can also justify a higher valuation.

Advantages and Disadvantages of Valuation Methods

| Valuation Method | Angel Investor Advantages | Angel Investor Disadvantages | VC Advantages | VC Disadvantages |

|---|---|---|---|---|

| Discounted Cash Flow (DCF) | Theoretically sound, considers future growth | Requires significant projections, sensitive to assumptions, less reliable for early-stage companies with limited historical data | More reliable with established cash flow history | Still requires significant projections, sensitive to assumptions |

| Comparable Company Analysis | Easy to understand and apply, readily available data for some sectors | Limited comparables for early-stage companies, may not accurately reflect unique characteristics | More reliable comparables available | May not fully capture company-specific factors |

| Precedent Transactions | Provides market-based valuation, useful for similar acquisitions | Finding truly comparable transactions can be difficult, especially for early-stage companies | More relevant transaction data available | Past transactions may not reflect current market conditions |

| Asset-Based Valuation | Simple to understand, uses readily available data | Ignores intangible assets, which are crucial for many early-stage companies | More relevant for mature companies with substantial tangible assets | Less relevant for early-stage companies with limited tangible assets |

Accounting for Equity Investments: Angel Investors Vs Venture Capital Accounting Differences

Angel investors and venture capitalists utilize distinct accounting methods when recording their investments in early-stage companies. The choice of method significantly impacts how investment performance is reflected in their financial statements, influencing decisions related to future investments and overall portfolio management. Understanding these accounting differences is crucial for both investors and the companies they fund.

Applicable Accounting Standards

Generally Accepted Accounting Principles (GAAP) in the US and International Financial Reporting Standards (IFRS) internationally govern the accounting treatment of equity investments. The specific standard applied depends on the investor’s level of influence over the investee company. For instance, if an investor holds a significant influence (typically 20% to 50% ownership), the equity method is generally used. Conversely, if the investor holds less influence, the cost method is typically employed. These standards ensure consistency and comparability in financial reporting. However, the practical application can be complex, particularly for investments in early-stage companies with volatile valuations.

Comparison of Cost Method and Equity Method

The cost method accounts for investments at their original cost, adjusting only for impairment losses. This method is simpler but may not accurately reflect the investment’s true value, especially in rapidly growing companies. In contrast, the equity method recognizes the investor’s share of the investee’s net income or loss, impacting the investor’s reported income. This approach provides a more comprehensive view of the investment’s performance, reflecting changes in the investee’s financial position. For example, if an angel investor uses the cost method, their financial statements would only show the initial investment cost unless the investment’s value drops significantly. If the equity method is used, the investor’s income statement would reflect a portion of the investee’s profits or losses, providing a more dynamic picture.

Recognizing Income and Losses from Equity Investments

Under the cost method, income or losses are only recognized when the investment is sold. The difference between the selling price and the original cost is recognized as a gain or loss. The equity method, however, reflects the investor’s share of the investee’s net income or loss in the investor’s income statement each reporting period. For example, if a venture capitalist owns 30% of a company that reports a $1 million net income, the venture capitalist would recognize $300,000 in income under the equity method. Dividends received from the investee are treated as a reduction of the investment’s carrying amount under the equity method, whereas under the cost method they are recorded as income.

Recording Angel and VC Investments in Financial Statements

A step-by-step guide to recording angel and VC investments involves several stages. First, the initial investment is recorded as an asset on the balance sheet at its cost. Subsequently, if the equity method is used, the investor’s share of the investee’s net income is added to the investment account, while losses are deducted. Dividends received reduce the investment account balance. At the end of each reporting period, the investment is reported on the balance sheet at its carrying amount (cost adjusted for equity method adjustments). Any unrealized gains or losses are not recognized on the income statement unless the investment is sold. For example, if an angel investor invests $100,000 and the investee company reports a $20,000 profit, and the angel investor holds 10%, then $2,000 is added to the investment account under the equity method. If the company issues a $5,000 dividend, the investment account balance is reduced by $500 (10% of $5,000).

Reporting and Disclosure Requirements

Angel investors and venture capitalists, while both providing equity financing, face different reporting and disclosure requirements stemming from the nature of their investments and their own financial structures. These differences are largely driven by the scale of their investments, the regulatory environment, and the level of formality in their investment arrangements.

Reporting requirements for angel investors are generally less stringent than those for venture capitalists. Angel investors, often individuals investing their own capital, are typically not subject to the same rigorous reporting standards as institutional venture capital firms. However, depending on the size and structure of the investment, certain tax reporting requirements might apply, particularly concerning capital gains or losses. Venture capitalists, on the other hand, are usually subject to more comprehensive reporting requirements, dictated by their status as either limited partnerships or corporations, and the regulatory frameworks governing their operations.

Reporting Requirements for Angel Investors and Venture Capitalists

Angel investors primarily report their investments through their personal income tax returns. Capital gains or losses from the sale of their equity stakes are reported according to prevailing tax laws. They may also need to provide information to the investee company for compliance purposes, such as details about their ownership stake. Venture capitalists, often operating as limited partnerships or investment funds, are subject to more extensive reporting, including filings with regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, depending on the size and structure of their fund. These filings provide transparency into the fund’s financial performance, investment activities, and management fees. They must also provide regular financial statements to their limited partners.

Implications of Different Accounting Treatments on Financial Reporting

The accounting treatment of equity investments significantly impacts the financial statements of both the investor and the investee. For the investor, the choice between the cost method and the equity method affects the reported value of the investment and the recognition of income or losses. The cost method reflects the investment at its original cost, while the equity method reflects changes in the investee’s net assets. For the investee, the issuance of equity affects its balance sheet by increasing equity and its income statement, potentially if certain performance-based milestones are met. Differences in accounting methods can lead to discrepancies in reported financial performance and valuation, influencing investor decisions and stakeholder perceptions. For instance, using the equity method may result in higher reported income for the investor if the investee company is profitable.

Key Disclosures in Financial Statements Related to Equity Investments

Financial statements must disclose essential information regarding equity investments. For investors, this includes the carrying amount of the investment, the method of accounting used (cost or equity method), any unrealized gains or losses, and the nature of any significant influence or control over the investee. For investee companies, the disclosures should detail the nature and terms of the equity financing, the number of shares issued, the amount of proceeds received, and any associated restrictions or covenants. The disclosures are crucial for transparency and allow stakeholders to assess the financial health and risk profile of both the investor and the investee.

Sample Financial Statement Excerpt

Let’s consider a simplified example. Imagine Angel Investor A invests $100,000 in Company X using the cost method, and Venture Capital Firm B invests $1 million in Company Y using the equity method.

| Investor | Investee | Accounting Method | Balance Sheet Excerpt |

|---|---|---|---|

| Angel Investor A | Company X | Cost Method | Investment in Company X: $100,000 |

| Venture Capital Firm B | Company Y | Equity Method | Investment in Company Y: $1,050,000 (initial investment + share of Y’s profits) |

Note: This is a simplified example. Actual financial statement excerpts would be significantly more detailed and complex, reflecting the specific terms of the investments and the accounting standards applied. The equity method investment value for Venture Capital Firm B reflects an assumed increase in Company Y’s net assets post-investment.

Tax Implications

Investing in startups, whether as an angel investor or a venture capitalist, carries significant tax implications. Understanding these implications is crucial for both investors and the companies they fund, as tax efficiency can significantly impact overall returns. The tax treatment of these investments varies depending on several factors, including the investor’s individual circumstances, the type of investment vehicle used, and the ultimate outcome of the investment.

Capital Gains and Losses

Angel investors and venture capitalists generally face similar tax treatments regarding capital gains and losses, although the specifics can differ based on the holding period and the type of investment. Both typically realize capital gains when their investment is sold at a profit, and these gains are taxed at the applicable capital gains tax rates. These rates vary depending on the investor’s income bracket and the length of time the investment was held. Long-term capital gains (generally investments held for more than one year) are typically taxed at lower rates than short-term capital gains. Similarly, losses are deductible against other capital gains, subject to limitations. However, the complexities of carried interest and other investment structures can lead to variations in the effective tax rates.

Tax Strategies for Angel Investors

Angel investors often utilize various tax strategies to minimize their tax burden. One common strategy involves leveraging tax-advantaged investment vehicles such as Qualified Opportunity Funds (QOFs). QOFs offer significant tax benefits, including potential deferral of capital gains taxes and reduced tax rates on subsequent gains if certain holding period requirements are met. Another strategy involves carefully structuring investments to maximize deductions and minimize tax liabilities. For instance, deductible expenses associated with the investment, such as travel costs for due diligence, might be claimed. However, it is crucial to consult with a tax professional to ensure compliance with all applicable regulations.

Tax Strategies for Venture Capitalists

Venture capitalists, often operating through partnerships or limited liability companies (LLCs), face a different set of tax considerations. A primary concern is the tax treatment of carried interest, which is a share of the profits earned by the fund manager. Carried interest is often taxed at lower capital gains rates, leading to significant tax advantages for fund managers. However, recent legislative proposals have aimed to alter the tax treatment of carried interest, potentially leading to higher tax rates in the future. Venture capital firms also utilize various tax planning strategies related to fund structuring, investment timing, and expense deductions to optimize tax efficiency. Similar to angel investors, they should consult tax professionals to ensure optimal tax planning within the complexities of their fund structures.

Comparison of Tax Implications

| Feature | Angel Investor | Venture Capitalist | Notes |

|---|---|---|---|

| Capital Gains Tax Rate | Based on holding period and income bracket | Based on holding period and income bracket (carried interest may be taxed differently) | Long-term capital gains are generally taxed at lower rates. |

| Capital Losses | Deductible against capital gains (subject to limitations) | Deductible against capital gains (subject to limitations) | Losses can offset gains, reducing overall tax liability. |

| Tax-Advantaged Vehicles | QOFs, potentially others depending on investment structure | Complex fund structures often utilize various tax optimization techniques | Strategic use of these vehicles can significantly reduce tax burden. |

| Tax Planning Complexity | Relatively simpler, but still requires careful consideration | Significantly more complex due to fund structures and carried interest | Professional tax advice is highly recommended for both. |

Impact of Investment Size and Stage

The size and stage of an investment significantly influence the accounting treatment for both angel and venture capital investments. Smaller, early-stage investments often involve simpler accounting methods, while larger, later-stage investments necessitate more complex approaches due to increased regulatory scrutiny and the potential for greater financial complexities. The choice of accounting method also directly relates to the investor’s level of influence over the investee company.

Early-stage investments, typically characterized by higher risk and uncertainty, often utilize the equity method of accounting. This is because, at this stage, the investor’s level of influence is often minimal. Later-stage investments, conversely, may lead to the use of more complex methods such as consolidation, especially when the investor holds a significant ownership stake. The investment size itself affects the accounting treatment by determining the materiality of the investment. Smaller investments might be recorded at fair value through profit or loss, while larger investments, due to their materiality, might necessitate a more detailed and rigorous accounting approach.

Equity Method vs. Fair Value Accounting

The equity method is commonly used for early-stage investments where the investor holds less than 20% ownership and exerts minimal influence over the investee’s operating and financial decisions. Under the equity method, the investment is initially recorded at cost and subsequently adjusted to reflect the investor’s share of the investee’s net income or loss. Conversely, the fair value method, often used for smaller investments or those where the investor lacks significant influence, requires the investment to be valued at its fair market value at each reporting period, with changes in fair value recognized in the income statement. For example, an angel investor making a small seed investment might use the fair value method, while a venture capital firm investing a larger sum in a later-stage company might opt for the equity method or even consolidation if their ownership surpasses a certain threshold.

Accounting for Different Investment Sizes

A small angel investment of $25,000 in a startup might be accounted for using the fair value method, reflecting fluctuations in the startup’s valuation. In contrast, a $5 million Series A investment from a venture capital firm might be accounted for using the equity method, as the investor might hold a significant ownership stake and influence the company’s operations. A later-stage investment of $50 million might necessitate consolidation if the venture capital firm holds a controlling interest.

Visual Representation of Accounting Practices

Imagine a two-dimensional graph. The X-axis represents the investment stage (early, mid, late), and the Y-axis represents the investment size (small, medium, large). The graph would be divided into nine sections, each representing a combination of stage and size. Each section would contain a brief description of the most likely accounting method used:

* Early-Stage, Small Investment: Fair Value through Profit or Loss.

* Early-Stage, Medium Investment: Equity Method.

* Early-Stage, Large Investment: Equity Method or potentially Consolidation (depending on ownership percentage).

* Mid-Stage, Small Investment: Fair Value through Profit or Loss.

* Mid-Stage, Medium Investment: Equity Method.

* Mid-Stage, Large Investment: Equity Method or Consolidation.

* Late-Stage, Small Investment: Less likely scenario; possibly Fair Value through Profit or Loss if a small, opportunistic investment.

* Late-Stage, Medium Investment: Equity Method or Consolidation.

* Late-Stage, Large Investment: Consolidation (highly probable).

This visual representation illustrates the general trend: larger and later-stage investments tend to involve more complex accounting methods, reflecting the increased influence and materiality of the investment. The specific accounting method ultimately depends on the facts and circumstances of each individual investment.

End of Discussion

Ultimately, the differences in accounting practices between angel investors and venture capitalists stem from the inherent variations in their investment strategies and risk profiles. Angel investors, often operating with smaller investments and a longer-term perspective, may employ simpler accounting methods. Venture capitalists, on the other hand, frequently manage larger, more complex investments requiring more sophisticated accounting and reporting. A thorough understanding of these differences is vital for ensuring transparency, compliance, and ultimately, successful navigation of the startup funding ecosystem.

User Queries

What are the common accounting methods used for angel investments?

Common methods include the cost method and equity method, depending on the investor’s level of influence over the investee company.

How does the Fair Value method impact accounting for VC investments?

The fair value method, often used for VC investments, requires regular valuation adjustments to reflect market changes, potentially leading to greater volatility in reported earnings.

What are the key tax considerations for angel investors compared to VCs?

Tax implications vary based on factors such as the investor’s tax bracket, investment structure, and the eventual disposition of the investment. Consult a tax professional for personalized advice.

How do convertible notes affect accounting treatment?

Convertible notes, often used in early-stage financing, are initially recorded as debt but are later converted to equity, requiring adjustments to the financial statements at the conversion date.

Do not overlook explore the latest data about How to Choose the Right Accounting Software.