How to Manage Accounts Payable and Accounts Receivable is crucial for any business’s financial health. Mastering these processes ensures smooth cash flow, prevents costly errors, and provides valuable insights into your company’s performance. This guide will walk you through the intricacies of managing both accounts payable and accounts receivable, from understanding the fundamental processes to leveraging technology for optimal efficiency and compliance.

We will explore best practices for invoice processing, timely payments, and effective collections. We’ll also delve into the importance of internal controls, data analysis, and the role of automation in streamlining these critical financial functions. By the end, you’ll have a comprehensive understanding of how to effectively manage your AP and AR, leading to improved financial management and stronger business outcomes.

Understanding Accounts Payable (AP)

Accounts Payable (AP) is the department responsible for tracking and paying all invoices from vendors and suppliers. Efficient AP management is crucial for maintaining strong supplier relationships, ensuring timely payments, and preventing financial penalties. Understanding the AP process, from invoice receipt to final payment, is key to optimizing cash flow and maintaining financial health.

Invoice Processing: From Receipt to Payment

The AP process begins with the receipt of an invoice. This can be in physical form, via email, or through an electronic data interchange (EDI) system. Once received, the invoice undergoes a verification process to ensure accuracy and completeness of information, including the vendor’s details, invoice number, date, items purchased, quantities, prices, and any applicable taxes or discounts. This verification step is critical for preventing errors and ensuring that payments are made only for legitimate goods or services received. Following verification, the invoice is coded to the appropriate general ledger accounts. Then, the invoice is approved based on the company’s established approval workflow, often involving multiple levels of authorization depending on the invoice amount. Finally, the invoice is scheduled for payment, and payment is made via check, electronic funds transfer (EFT), or other approved methods. The entire process is meticulously documented to provide an audit trail and ensure compliance with internal controls.

Accurate Invoice Data Entry and Matching

Accurate data entry is paramount in AP. Errors in data entry can lead to payment delays, incorrect accounting entries, and disputes with vendors. The process of matching involves comparing the invoice details with the purchase order and receiving report (three-way match) to ensure that the goods or services received match what was ordered and invoiced. This three-way matching process is a cornerstone of strong internal controls, minimizing the risk of fraudulent invoices or overpayments. Any discrepancies should be immediately investigated and resolved before processing the invoice for payment. Utilizing automated invoice processing systems can significantly improve accuracy and efficiency in data entry and matching.

Common AP Challenges and Solutions

Several challenges commonly arise in managing accounts payable. Late payments can damage vendor relationships and potentially lead to penalties or late fees. Solutions include implementing automated payment systems and establishing clear payment terms. Another challenge is invoice processing bottlenecks, which can result from manual processes and a lack of efficient workflows. Solutions involve streamlining workflows, automating data entry, and utilizing AP automation software. Finally, inaccurate data entry and a lack of proper controls can lead to payment errors and financial discrepancies. Solutions include implementing robust internal controls, data validation checks, and regular audits.

Typical AP Workflow

The following flowchart illustrates a typical AP workflow:

[Imagine a flowchart here. The flowchart would begin with “Invoice Received,” branching to “Invoice Verification,” then to “Three-Way Match (Purchase Order, Receiving Report, Invoice),” followed by “Approval Process,” then “Payment Processing,” and finally “Payment and Record Keeping.” Each stage would have a brief description of the actions taken.]

Sample AP Policy: Approval Processes and Payment Terms

This sample AP policy Artikels key aspects of the accounts payable process.

Approval Processes:

* Invoices under $500 require approval from the department manager.

* Invoices between $500 and $5000 require approval from the department manager and the finance manager.

* Invoices over $5000 require approval from the department manager, the finance manager, and the CFO.

Payment Terms:

* Net 30: Payment is due within 30 days of the invoice date.

* 2/10, Net 30: A 2% discount is offered if payment is made within 10 days of the invoice date; otherwise, the full amount is due within 30 days.

This policy ensures consistent and efficient processing of invoices, while also maintaining appropriate levels of authorization and promoting timely payments. The policy should be reviewed and updated periodically to reflect changes in business practices and regulatory requirements.

Understanding Accounts Receivable (AR)

Accounts Receivable (AR) represents the money owed to a business by its customers for goods or services sold on credit. Effective AR management is crucial for maintaining healthy cash flow and overall financial stability. Understanding the process, potential challenges, and best practices for managing AR is essential for any business.

Generating and Sending Invoices to Customers

The process of generating and sending invoices typically begins with creating a sales order or contract that details the goods or services provided, the agreed-upon price, and payment terms. Once the goods are delivered or services rendered, an invoice is generated. This invoice should clearly state the invoice number, date, customer information, a detailed description of the goods or services, the total amount due, payment terms (e.g., net 30, net 60), and contact information. Invoices can be sent via mail, email, or through online portals, depending on the customer’s preference and the business’s systems. Accurate and detailed invoicing is paramount to avoid disputes and delays in payment. Using invoicing software can streamline this process and improve accuracy.

Importance of Timely and Accurate Invoicing

Timely and accurate invoicing is critical for several reasons. Firstly, it ensures that the business receives payments promptly, improving cash flow. Secondly, it minimizes the risk of late payments or disputes. A well-structured invoice with clear and accurate information reduces confusion and misunderstandings. Thirdly, it contributes to a positive customer relationship by demonstrating professionalism and efficiency. Finally, timely invoicing simplifies the reconciliation process at the end of the accounting period, making financial reporting more efficient. Delays in invoicing can negatively impact a company’s credit rating and increase the likelihood of bad debt.

Common AR Challenges and Their Solutions

Several common challenges can arise in managing accounts receivable. One common issue is late payments. Solutions include implementing stricter credit policies, offering early payment discounts, and employing efficient collection procedures, such as sending timely reminders and escalating overdue accounts to collections agencies. Another challenge is inaccurate invoicing, leading to disputes and delays. Solutions include using invoicing software to minimize errors and implementing a robust review process before sending invoices. A third challenge is managing a high volume of invoices, which can become overwhelming. Solutions include using automated invoicing and payment systems, and potentially outsourcing AR management to a specialized firm. Finally, bad debt is a significant concern. Solutions include thorough credit checks before extending credit, setting clear credit limits, and employing aggressive collection strategies.

Typical AR Workflow

A flowchart illustrating a typical AR workflow would begin with the creation of a sales order. This leads to the delivery of goods or services, followed by invoice generation and sending. Next, the invoice is received by the customer. Upon payment receipt, the payment is recorded, and the invoice is marked as paid. If payment is not received by the due date, a series of reminders and follow-ups are initiated, potentially escalating to collection agencies for persistent non-payment. The entire process is monitored to ensure timely payment and accurate record-keeping. This process could be further enhanced by integrating with CRM and accounting software for automated workflows.

Sample AR Policy

This sample AR policy Artikels credit terms and collection procedures.

Credit Terms: Net 30 days from the invoice date. A 2% discount will be applied for payments received within 10 days. Credit limits will be determined based on creditworthiness.

Collection Procedures: A reminder notice will be sent 10 days after the due date. A second reminder, along with a late payment fee, will be sent 20 days after the due date. For accounts 30 days past due, a formal demand letter will be issued. Accounts 60 days past due will be referred to a collection agency.

This policy ensures consistent application of credit and collection practices, minimizing disputes and maximizing cash flow. Regular review and updates to this policy are essential to adapt to changing business conditions and customer relationships.

AP and AR Software and Technology: How To Manage Accounts Payable And Accounts Receivable

Automating accounts payable (AP) and accounts receivable (AR) processes is crucial for modern businesses seeking efficiency and accuracy. The right software can streamline workflows, reduce errors, and improve cash flow. Choosing and implementing the appropriate solution, however, requires careful consideration of various factors, including business size, industry, and specific needs.

Comparison of AP and AR Software Solutions

Various AP and AR software solutions cater to different business needs and sizes. Some are standalone applications, while others integrate with existing accounting systems or enterprise resource planning (ERP) software. Standalone solutions might offer basic functionalities like invoice processing and payment tracking, whereas integrated solutions provide a more comprehensive approach, often including features such as purchase order management, expense reporting, and financial reporting dashboards. The choice depends on the level of automation and integration required. Cloud-based solutions offer scalability and accessibility, while on-premise solutions provide greater control over data security. Open-source options offer flexibility and customization but might require more technical expertise.

Best Practices for Implementing and Integrating AP and AR Software

Successful implementation involves careful planning and execution. Begin by defining clear objectives and selecting software that aligns with those objectives. Thorough staff training is essential to ensure proper utilization of the software’s features. Data migration from existing systems should be carefully planned and executed to minimize disruptions. Regular monitoring and evaluation of the software’s performance are crucial to identify areas for improvement and optimization. Integration with other systems should be seamless to avoid data silos and ensure data consistency. Finally, establishing robust security protocols is paramount to protect sensitive financial data.

Benefits of Automation in AP and AR Processes

Automation significantly improves efficiency and accuracy in AP and AR. Automated invoice processing reduces manual data entry, minimizing errors and saving time. Automated payment processing streamlines payments and improves cash flow management. Automated reconciliation ensures accurate matching of invoices and payments, reducing discrepancies and improving financial reporting. Automated reporting provides real-time insights into AP and AR performance, enabling proactive management and informed decision-making. Ultimately, automation frees up staff time to focus on more strategic tasks.

The Role of Cloud-Based Solutions in Modern AP and AR Management

Cloud-based AP and AR solutions offer several advantages. They are accessible from anywhere with an internet connection, enhancing flexibility and collaboration. They are scalable, easily adapting to changing business needs. They often require less upfront investment compared to on-premise solutions, as they typically operate on a subscription basis. Regular software updates and maintenance are handled by the provider, reducing IT overhead. However, reliance on internet connectivity and data security concerns are important considerations.

Comparison of Popular AP/AR Software Packages

| Feature | Software A (e.g., QuickBooks Online) | Software B (e.g., Xero) | Software C (e.g., Zoho Invoice) |

|---|---|---|---|

| Invoice Processing | Automated invoice import, optical character recognition (OCR) | Automated invoice import, customizable invoice templates | Automated invoice creation and sending, mobile app integration |

| Payment Processing | Integration with various payment gateways | Supports multiple payment methods, automated payment reminders | Supports online payments, recurring billing |

| Reporting & Analytics | Real-time dashboards, customizable reports | Detailed financial reports, cash flow forecasting | Sales and expense tracking, customizable reports |

| Integration Capabilities | Integrates with various accounting and CRM systems | Integrates with various third-party apps | Integrates with other Zoho applications |

Managing Cash Flow with AP and AR

Effective management of accounts payable (AP) and accounts receivable (AR) is crucial for maintaining healthy cash flow. A well-managed AP/AR system ensures a steady stream of incoming payments while controlling outgoing payments, preventing cash shortages and maximizing financial flexibility. This section explores strategies for optimizing cash flow through efficient AP and AR management.

The Interplay of AP and AR on Cash Flow

Accounts payable and accounts receivable have a direct and reciprocal impact on a company’s cash flow. Accounts receivable represents money owed to the company by its customers, while accounts payable represents money the company owes to its suppliers. Efficiently managing AR accelerates cash inflows, while effectively managing AP optimizes cash outflows. A delay in collecting AR negatively impacts cash flow, whereas delaying AP payments can temporarily improve cash flow but risks damaging supplier relationships and potentially incurring late payment fees. The ideal scenario involves a balanced approach where the inflow from AR consistently exceeds the outflow from AP, resulting in a positive net cash flow.

Strategies for Optimizing Cash Flow Through AP and AR Management

Several strategies can significantly improve cash flow by optimizing both AP and AR processes. These strategies involve improving payment times for AR and payment terms for AP, and using data for cash flow forecasting.

Improving Payment Times for AR, How to Manage Accounts Payable and Accounts Receivable

Prompt invoice processing and efficient communication with customers are key to accelerating AR payments. Implementing online invoicing systems, offering early payment discounts, and proactively following up on overdue payments can significantly reduce Days Sales Outstanding (DSO). For example, a company that reduces its DSO from 60 days to 45 days frees up significant capital that can be reinvested in the business or used to cover operational expenses. Regularly reviewing customer payment history and identifying trends can help predict potential payment delays and allow for proactive intervention.

Improving Payment Terms for AP

Negotiating favorable payment terms with suppliers is crucial for managing cash outflows. Extending payment terms, even by a few days, can provide valuable breathing room. This could involve exploring options like early payment discounts (if financially beneficial) or establishing strong relationships with suppliers to negotiate flexible payment schedules. For instance, a company might negotiate a 30-day payment term instead of a 15-day term, giving them more time to manage their cash flow. Careful monitoring of AP aging reports helps identify potential payment issues and allows for proactive planning.

Cash Flow Forecasting Based on AP and AR Data

Accurate cash flow forecasting is essential for effective financial planning and decision-making. By analyzing historical AP and AR data, businesses can create realistic projections that account for expected inflows and outflows. This allows businesses to anticipate potential cash shortages and take proactive measures to address them. This forecasting process should consider factors such as seasonal variations in sales, typical payment cycles of customers and suppliers, and any planned large expenditures.

Sample Cash Flow Projection

Let’s assume a hypothetical scenario for a small business:

| Month | AR Inflow | AP Outflow | Net Cash Flow |

|---|---|---|---|

| January | $10,000 | $5,000 | $5,000 |

| February | $8,000 | $6,000 | $2,000 |

| March | $12,000 | $4,000 | $8,000 |

This simplified projection shows the monthly net cash flow based on estimated AR inflows and AP outflows. A more comprehensive projection would incorporate other factors like operating expenses, loan payments, and capital expenditures. This type of projection helps businesses anticipate potential cash flow deficits and make informed decisions about financing or resource allocation.

Internal Controls and Compliance for AP and AR

Robust internal controls are crucial for maintaining the accuracy and integrity of accounts payable (AP) and accounts receivable (AR) processes. Strong internal controls not only prevent fraud and errors but also ensure compliance with relevant regulations, ultimately protecting the financial health of the organization. Without these controls, businesses risk significant financial losses and reputational damage.

Importance of Internal Controls in Preventing Fraud and Errors

Internal controls act as a safeguard against both unintentional errors and deliberate fraudulent activities within AP and AR. Errors can arise from simple data entry mistakes to more complex miscalculations. Fraud, on the other hand, can involve a range of schemes, from fictitious invoices to unauthorized payments. Implementing effective controls minimizes these risks by establishing clear procedures, segregation of duties, and authorization levels. This reduces opportunities for manipulation and increases the likelihood of detecting discrepancies before they escalate into significant problems. For example, a lack of proper authorization for payments could lead to fraudulent payments being made to fake vendors.

Best Practices for Implementing Strong Internal Controls

Implementing strong internal controls requires a multi-faceted approach. This includes establishing clear roles and responsibilities, implementing segregation of duties (preventing a single person from controlling the entire process), and utilizing automated systems for invoice processing and payment approvals. Regular reconciliation of accounts is also critical to identify discrepancies early. Furthermore, establishing a robust approval workflow for invoices and payments ensures that all transactions are properly authorized before processing. A well-defined policy outlining procedures for handling exceptions and disputes is also vital. For instance, a company might implement a three-way match process (purchase order, invoice, and receiving report) to verify the accuracy of invoices before payment.

Examples of Common Internal Control Weaknesses and Their Remediation

A common weakness is a lack of segregation of duties, where one person handles all aspects of a transaction, from receiving invoices to processing payments. This creates an opportunity for fraud. The solution is to divide responsibilities among different individuals, ensuring that no single person has complete control over the process. Another common weakness is the absence of proper authorization procedures. This can be addressed by establishing clear approval workflows and assigning specific individuals or departments the authority to approve transactions. Finally, a lack of regular reconciliation can lead to undetected errors and fraud. Regular reconciliation, ideally performed by an independent party, helps identify and correct discrepancies promptly.

Compliance Requirements Related to AP and AR

Compliance with tax regulations is a crucial aspect of managing AP and AR. This involves accurate recording of sales tax, VAT, and other applicable taxes on invoices. Failure to comply can result in significant penalties and legal issues. Furthermore, companies must comply with relevant financial reporting standards (like GAAP or IFRS) when recording and reporting AP and AR data. Maintaining accurate records and adhering to established procedures is essential for demonstrating compliance during audits. Understanding and adhering to all relevant regulations, both at the local and national levels, is paramount.

Key Internal Controls for AP and AR

- Segregation of Duties: Different individuals should be responsible for receiving, processing, and approving invoices and payments to prevent fraud and errors.

- Authorization Procedures: Establish clear approval workflows with designated individuals or departments authorized to approve invoices and payments based on pre-defined thresholds.

- Three-Way Match: Match purchase orders, invoices, and receiving reports to verify the accuracy of invoices before payment.

- Regular Reconciliation: Regularly reconcile accounts payable and accounts receivable balances to identify discrepancies and prevent fraud.

- Automated Systems: Utilize technology to automate invoice processing, payment approvals, and reporting to improve efficiency and accuracy.

- Internal Audits: Conduct regular internal audits to assess the effectiveness of internal controls and identify areas for improvement.

- Vendor Management: Maintain a comprehensive vendor database and regularly review vendor information to ensure legitimacy.

- Document Retention: Maintain proper documentation of all AP and AR transactions, complying with legal requirements for record retention.

Analyzing AP and AR Data for Business Insights

Analyzing accounts payable (AP) and accounts receivable (AR) data offers invaluable insights into a company’s financial health and operational efficiency. By identifying trends and patterns within this data, businesses can make data-driven decisions to improve cash flow, optimize processes, and ultimately boost profitability. This analysis goes beyond simply tracking numbers; it’s about understanding the *why* behind the figures and using that understanding to improve business performance.

Key Performance Indicators (KPIs) for AP and AR Performance

Several key performance indicators (KPIs) provide a comprehensive overview of AP and AR performance. These metrics allow businesses to track progress, identify areas for improvement, and benchmark their performance against industry standards. Monitoring these KPIs regularly is crucial for maintaining financial health and operational efficiency.

| KPI | Description | Formula (if applicable) | Ideal Range/Target |

|---|---|---|---|

| Days Payable Outstanding (DPO) | Average number of days it takes to pay suppliers. | (Average Accounts Payable / Total Purchases) * Number of Days | Industry-specific, but generally lower is better (indicates efficient payment processes). |

| Days Sales Outstanding (DSO) | Average number of days it takes to collect payments from customers. | (Average Accounts Receivable / Total Credit Sales) * Number of Days | Industry-specific, but generally lower is better (indicates efficient collections). |

| AP Turnover | How efficiently a company pays its suppliers. | Total Purchases / Average Accounts Payable | Higher is generally better (indicates quicker payment cycles). |

| AR Turnover | How efficiently a company collects payments from customers. | Net Credit Sales / Average Accounts Receivable | Higher is generally better (indicates quicker collection cycles). |

Using Data Analysis to Improve AP and AR Processes

Data analysis reveals actionable insights for improving AP and AR processes. For example, consistently high DSO might indicate problems with invoicing, customer payment processes, or even credit policies. Analyzing the data can pinpoint the exact bottlenecks. Similarly, high DPO might signal strained cash flow or negotiations with suppliers. By identifying these issues through data analysis, targeted improvements can be implemented. A company might streamline its invoicing process to reduce DSO or negotiate extended payment terms with suppliers to reduce DPO.

Data Visualization Tools for Presenting AP and AR Insights

Data visualization tools are essential for effectively communicating AP and AR insights. Dashboards, charts, and graphs transform complex data into easily understandable visuals, allowing for quick identification of trends and anomalies. For example, a line graph showing DSO over time clearly illustrates payment collection trends, while a bar chart comparing DPO across different suppliers helps identify areas needing attention. These visualizations facilitate better decision-making and communication among stakeholders.

Sample AP and AR Dashboard

A well-designed dashboard provides a concise overview of key AP and AR metrics. The following is a sample dashboard illustrating key metrics:

| Metric | Current Value | Target Value | Trend |

|---|---|---|---|

| Days Sales Outstanding (DSO) | 45 days | 30 days | Increasing |

| Days Payable Outstanding (DPO) | 60 days | 45 days | Decreasing |

| AR Turnover | 6.0x | 7.0x | Stable |

| AP Turnover | 7.5x | 8.0x | Stable |

Improving AP and AR Processes Through Automation

Automating accounts payable (AP) and accounts receivable (AR) processes offers significant advantages for businesses of all sizes. By leveraging technology, companies can streamline operations, reduce manual effort, and improve accuracy, ultimately leading to enhanced efficiency and better financial management. This section explores the various aspects of automation in AP and AR, from the technologies involved to the challenges of implementation and examples of successful initiatives.

Automation Technologies Applicable to AP and AR

Several technologies are instrumental in automating AP and AR. Optical Character Recognition (OCR) software, for instance, automatically extracts data from invoices, eliminating the need for manual data entry. Robotic Process Automation (RPA) tools can automate repetitive tasks such as invoice processing, payment approvals, and customer invoice generation. Artificial Intelligence (AI) and machine learning (ML) algorithms can further enhance these processes by identifying anomalies, predicting cash flow, and improving the accuracy of automated tasks. Cloud-based platforms provide the infrastructure for seamless integration and accessibility of these tools.

Efficiency Improvements and Error Reduction Through Automation

Automation significantly reduces processing time for both AP and AR. OCR, for example, can process hundreds of invoices in a fraction of the time it would take a human. RPA can handle repetitive tasks 24/7, eliminating bottlenecks and improving turnaround times. By minimizing manual intervention, automation drastically reduces the risk of human error in data entry, calculations, and approvals. This leads to more accurate financial reporting and improved compliance. For example, automated invoice matching reduces discrepancies between purchase orders, invoices, and receipts.

Implementation Challenges and Considerations for Automation

Implementing AP and AR automation requires careful planning and consideration. Initial investment costs for software and infrastructure can be significant. Integration with existing systems can be complex, requiring expertise in system integration and data migration. Employee training is crucial to ensure smooth adoption and effective utilization of the new technologies. Change management strategies are essential to address potential resistance to change among employees accustomed to manual processes. Security concerns related to data privacy and access control should also be carefully addressed.

Examples of Successful Automation Initiatives in AP and AR

A large retail chain successfully implemented an AI-powered invoice processing system that reduced processing time by 70% and decreased errors by 85%. A manufacturing company leveraged RPA to automate payment approvals, resulting in a 50% reduction in processing time and improved cash flow management. A software company integrated OCR and cloud-based platforms to streamline its AR process, leading to faster invoice generation and improved customer satisfaction. These examples highlight the potential benefits of automation in achieving significant improvements in efficiency and accuracy.

Potential Automation Tools and Their Features

Choosing the right automation tools depends on specific business needs and budget constraints. Here are some examples:

- SAP Ariba: Provides comprehensive source-to-pay solutions, including invoice processing, payment automation, and supplier management.

- Coupa: Offers a cloud-based platform for procure-to-pay automation, encompassing invoice processing, expense management, and supplier collaboration.

- Oracle NetSuite: Integrates financial management and ERP capabilities with AP and AR automation features.

- Bill.com: Focuses on AP automation with features like invoice processing, payment automation, and supplier communication.

- Tipalti: Specializes in global payments automation, supporting multiple currencies and payment methods.

End of Discussion

Effectively managing accounts payable and accounts receivable is not merely about processing invoices; it’s about optimizing cash flow, mitigating risks, and gaining valuable business intelligence. By implementing the strategies and best practices Artikeld in this guide, businesses can significantly improve their financial health, enhance operational efficiency, and achieve sustainable growth. Remember, proactive management, technological adoption, and a focus on internal controls are key to success in this vital area of business operations.

FAQ Compilation

What is the difference between Accounts Payable and Accounts Receivable?

Accounts Payable (AP) represents money a company owes to its suppliers or vendors, while Accounts Receivable (AR) represents money owed to the company by its customers.

How often should I reconcile my AP and AR accounts?

Ideally, you should reconcile your AP and AR accounts monthly to ensure accuracy and identify any discrepancies promptly.

What are some common signs of AP or AR problems?

Common signs include late payments, high DSO (Days Sales Outstanding), increasing aging receivables, and disputes over invoices.

What is the role of technology in AP/AR management?

Technology streamlines processes, automates tasks, improves accuracy, and provides real-time visibility into AP and AR balances.

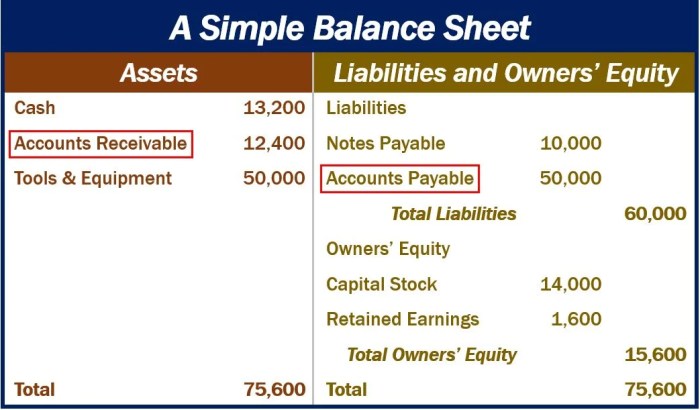

Discover how What is a Balance Sheet? A Simple Explanation has transformed methods in this topic.